Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

USD index hits three-month lows

The US dollar was mostly weaker overnight as the USD index fell to three-month lows.

Most notably, the US dollar crumbled in Asia, with the USD/JPY leading losses as it fell 1.3%.

The US dollar’s move lower followed comments by former US president Donald Trump who said he was concerned about the strength of the US dollar hurting exports in an interview with Bloomberg. “We have a big currency problem,” said Trump.

The AUD/USD fell 0.1%, but the NZD/USD bucked the trend as gained 0.5% after yesterday’s inflation reading.

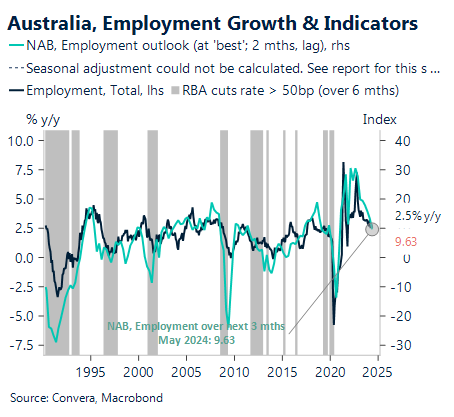

Aussie dollar awaits employment data

In June, we project a 25k increase in jobs. Although this would be a good outcome, there has been rapid population growth, and assuming a stable participation rate, this should cause the unemployment rate to increase by 0.1 percentage points to 4.1%.

Separate payroll figures point to weaknesses in the employment of males and young people, with job growth concentrated in the public sector, health care, and education sectors and weaker in the retail, construction, and lodging and food services sectors.

Since the RBA is among the final DM central banks to cut, the AUD should benefit from this as we have long anticipated.

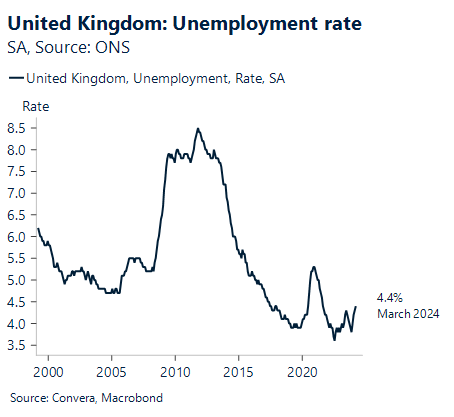

GBP at highs ahead of UK jobs

The upcoming UK employment data release on Thursday is a crucial indicator for Bank of England policy decisions.

Recent months have shown remarkably robust growth in private sector regular wages, with figures surpassing 0.7% month-on-month or 9% on an annualized basis over a three-month period. This unusual surge may be partly attributed to minimum wage adjustments.

For May, we anticipate a more moderate increase, projecting a 0.5% month-on-month rise.

The pound sterling has clear upward momentum and might maintain its upward trajectory, building on gains made following the recent election.

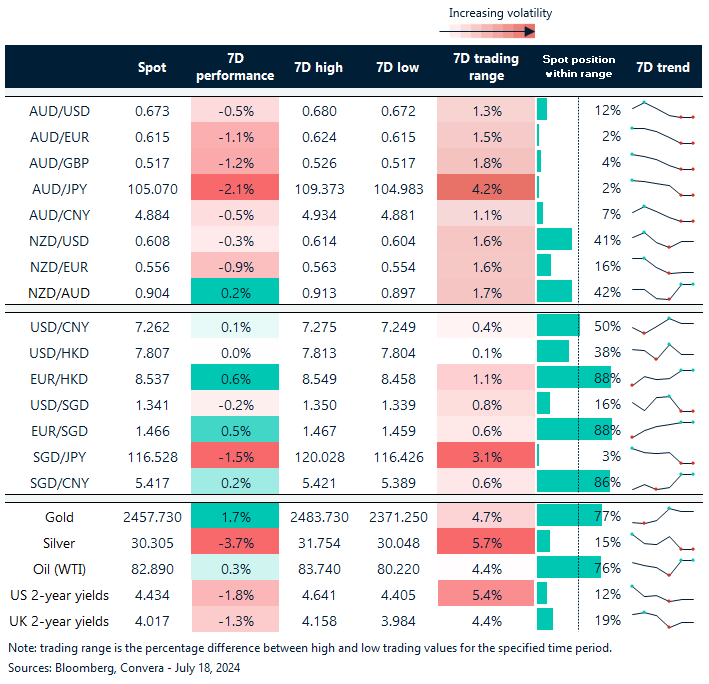

USD index hits three-month lows

Table: seven-day rolling currency trends and trading ranges

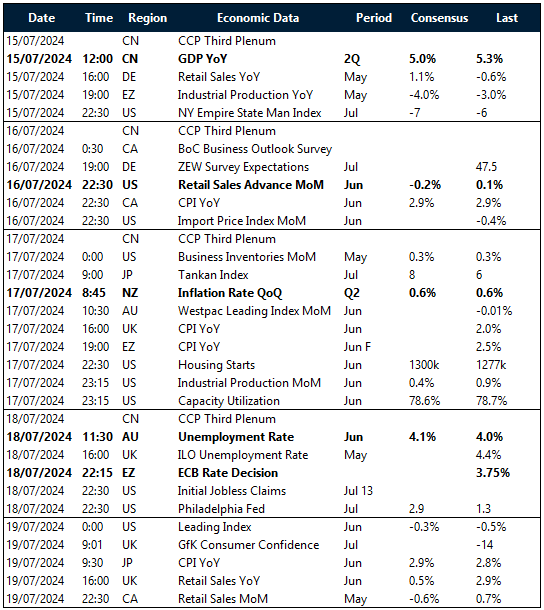

Key global risk events

Calendar: 15 – 19 July

All times AEST

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Have a question? [email protected]