Written by Convera’s Market Insights team

Trump sounds alarm on strong dollar

George Vessey – Lead FX Strategist

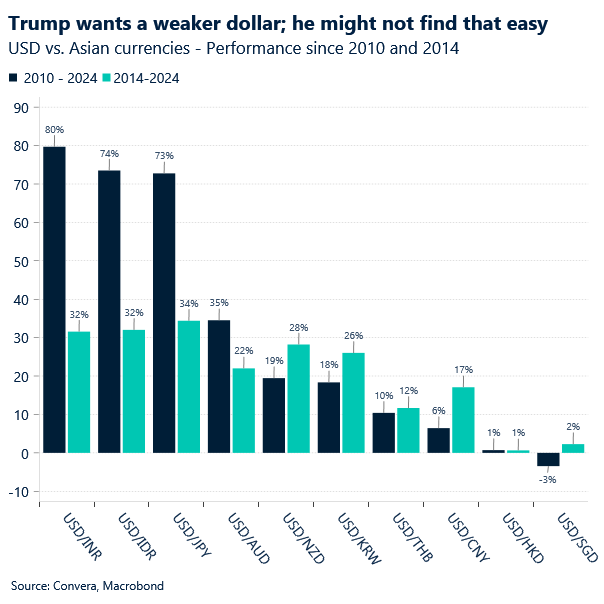

The US dollar tumbled to its weakest level in about four months as traders fully price in the Federal Reserve (Fed) to deliver an interest rate cut in September. But the extended decline in the dollar was amplified by a sharp rally in the Japanese yen that reverberated across global currency markets after comments made by Donald Trump regarding FX.

The Republican presidential nominee, Mr Trump, said the strength of the US dollar has been hurting the competitiveness of US exports while also pointing to the weakness of the Japanese yen and Chinese yuan giving a trading advantage for Japan and China. This triggered a shockwave through FX markets, with the dollar under pressure and the yen catapulting higher. USD/JPY slipped over 1% to hit a fresh 5-week low as broader anxiety grows around whether yen short positioning is stretched in the face of Japanese officials’ willingness to intervene and the expected interest rate hike by the Bank of Japan at the end of July.

The bottom line though is that despite what Trump says, high tariffs, tax cuts, a weak dollar and low inflation don’t mix. We are reluctant to call excessive dollar weakness in the second half of this year, due to Trump’s inflationary policies being dollar supportive. That said, the dollar index is now below its 200-day moving average and testing 4-month lows.

Will pound hold $1.30 this time?

George Vessey – Lead FX Strategist

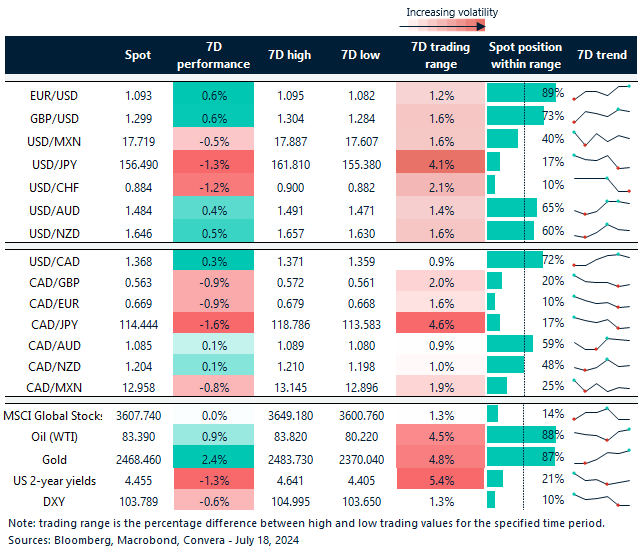

GBP/USD spiked above $1.30 yesterday for the first time in a year, boosted by sticky UK inflation data resulting in a scaling back of UK rate cut bets. Money markets are now pricing a 36% (down from 60%) chance of a cut by the Bank of England (BoE) in August. This morning’s UK jobs data has done little change this narrative.

UK wage growth decelerated to 5.7% from 5.9% y/y as estimated, the unemployment rate in the three months through May stayed steady at 4.4%, also in line with forecasts. Sterling is grappling with the $1.30 handle against the US dollar and has slipped slightly under €1.19 versus the euro. The pound retains its status as the best performing G10 currency this year though as investors question whether the BoE will deliver as many rate cuts as its G3 peers. Although headline UK inflation is below that of the Eurozone and US, services sector inflation at 5.7% was stronger-than-expected, and above the 5.1% that the BoE’s most recent forecasts had anticipated by now. Moreover, the new Labour government wants to raise the minimum wage and lower the age limit, which again may make it harder for the BoE to cut interest rates.

However, the last BoE meeting was “finely balanced” and policymakers will be wary of making a policy mistake by keeping rates too high for too long. We think markets may be underestimating the prospects of UK rate cuts this year, so we are sceptical about how much more upside potential there is for GBP/USD. The last time the currency pair breached $1.30 last year, it lasted a week before tumbling almost ten cents over a couple of months.

Euro holds gains ahead of the ECB decision

Ruta Prieskienyte – Lead FX Strategist

The euro advanced to a fresh 4-month high amid dovish Fed fuelling expectations for a Fed cut in September. The broad European equities index Stoxx50 extended losses for the third consecutive day, impacted by news that the US administration more severe trade restrictions against China. Government bond yields trended lower amid solid demand, tracking a decline in US Treasury yields, on the back of a number of dovish Fed speaker remarks.

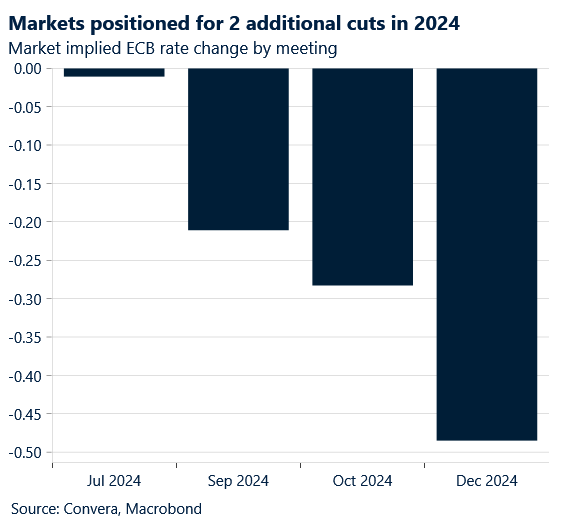

The attention turns to the main event of the week – the ECB rate decision later this afternoon, which is expected to be non-market moving. With only marginal macroeconomic changes since the last meeting, we are not anticipating any policy adjustments ahead of the summer break. A back-to-back rate cut following June’s 25bps reduction would be a major surprise to us and the markets. In terms of signalling, we expect the council to reiterate the statement from its last meeting, emphasising the data-dependent nature of the central bank’s decision-making process. At most, we would expect a cautious signal that rate cuts are more likely at meetings accompanied by updated staff forecasts, as hinted by ECB Vice President Guindos in late June.

Provided no changes in the official communication, we expect a minimal FX reaction. The one-week implied options volatility in euro crosses is marginally above the two-week tenure, which is likely to be residual market jitters from the French parliamentary elections concluded just over a week ago and not a reflection of the approaching rate decision. Unless we observe a revision in the official communication, EUR/USD will continue to be more influenced by UST-Bund spreads. With several GC members implicitly endorsing the current ECB money market pricing (48bps by year end), these expectations are likely to remain stable throughout the coming weeks, suggesting that the Fed’s actions will be a major driver for EUR/USD. If we hear any hawkish comments warning markets about upside inflationary risks, we are sceptical about the longevity of the support for the euro.

JPY on the attack after Trump’s comments

Table: 7-day currency trends and trading ranges

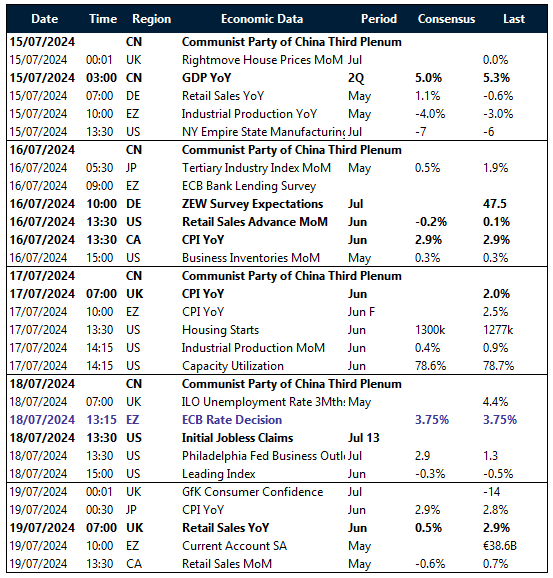

Key global risk events

Calendar: July 15-19

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.