The

financial world is on edge as a massive unwinding of the carry trade continues

to reverberate through global markets. This popular trading strategy, which

involves borrowing in low-interest currencies like the Japanese yen and

investing in higher-yielding assets, is experiencing a significant reversal

that has caught many investors off guard.

The

Japanese yen has surged against major currencies in recent weeks, appreciating

nearly 7% against the US dollar since mid-July. This rapid move has forced many

traders to liquidate their carry trade positions, leading to increased

volatility across various asset classes.

At the

beginning of last month, one dollar was worth more than 160 yen, the highest

value in several decades. However, a month later, the same dollar was exchanged

for only 142 yen, the lowest since the beginning of the year.

Market

experts are closely monitoring the situation, with some suggesting that the

unwinding process may only be halfway complete. Historically, Japan’s negative

interest rates and a weakening yen made it an attractive proposition for

investors seeking higher returns. By borrowing yen at low rates and investing

in higher-yielding assets, traders could profit from both interest rate differentials

and potential currency appreciation.

Michał Stajniak, the Deputy Director of the XTB Analysis Department

“However,

this dynamic has shifted dramatically in recent months,” explained Michał

Stajniak, the Deputy Director of the XTB Analysis Department. “Speculation is

rife that the Bank of Japan (BoJ) could raise interest rates as high as 1% in

the coming months, while according to the market, the Federal Reserve is expected to

cut rates by 100 basis points this year.”

Central

banks are now facing a challenging balancing act. The Federal Reserve, in

particular, finds itself in a precarious position. While economic data might

suggest the need for interest rate cuts, such moves could potentially

exacerbate the carry trade unwind and lead to further market instability.

Moreover, the persistence of carry trade unwinding is supported by the behavior of

yen futures contracts. “The extreme short positioning in yen futures, which had

ballooned to around 240,000 contracts, has contracted to 140,000. In contrast,

long positions have surged to 65,000 from a mere few thousand in 2020,” continued

Stajniak.

🇯🇵 How Big Is the Yen Carry Trade, Really? – Bloomberghttps://t.co/JuozkWGNPZ pic.twitter.com/4NT39vY0gG

— Christophe Barraud🛢🐳 (@C_Barraud) August 7, 2024

Swiss Franc Tests Decade

High

Meanwhile,

the Swiss franc has also seen significant gains as investors seek safe-haven

assets. This surge has prompted concerns from Swiss exporters, who fear that an

overly strong currency could harm their competitiveness in global markets.

“Although

the largest number of carry trades took place on the USDJPY pair, it is also

worth remembering that investors also used the franc and Chinese yuan in such

transactions, so the current trend of reversal of the situation on the yen may

also affect these currencies,” Stajniak added.

At a time

when the market fears a recession in the United States, geopolitical tensions

have been as high as a tightrope for over two years, and significant volatility

in the Japanese financial markets has scared investors, everyone is again

looking at the Swiss franc as a potential safe haven in difficult times.

Furthermore,

analysts from State Street and Citigroup are convinced that the franc may

become the new choice for investors specializing in carry trade, replacing the

Japanese yen in the leading position. Although the CHF/JPY currency pair

reached levels of 180.0 this year, testing multi-year highs, it has since

corrected significantly and is currently testing this year’s lows at the level

of 170.0.

Global Carry Trades See

Massive Unwinding, JPMorgan Reports

A

significant portion of global carry trades have been dismantled in recent

months, according to a new analysis by JPMorgan Chase & Co. The bank’s

quantitative strategists estimate that approximately three-quarters of these

trades have been unwound, marking a substantial shift in the financial

landscape.

JPMorgan’s

data reveals that returns across Group-of-10, emerging market, and global carry

trade baskets have plummeted by roughly 10% since May, effectively erasing

gains made earlier in the year. The pace of the selloff has been notably swift,

occurring at twice the usual rate observed during carry trade drawdowns.

The sharp rise in the JPY/USD is causing a massive unwind of Yen carry trade positions and contributing to the sharp decline in US stocks. For those who do not understand how this works, a brief explanation

1) Many traders were borrowing Jap Yen (JPY) at low interest rates,… pic.twitter.com/sfi0Hva56M

— Adam Khoo (@adamkhootrader) August 5, 2024

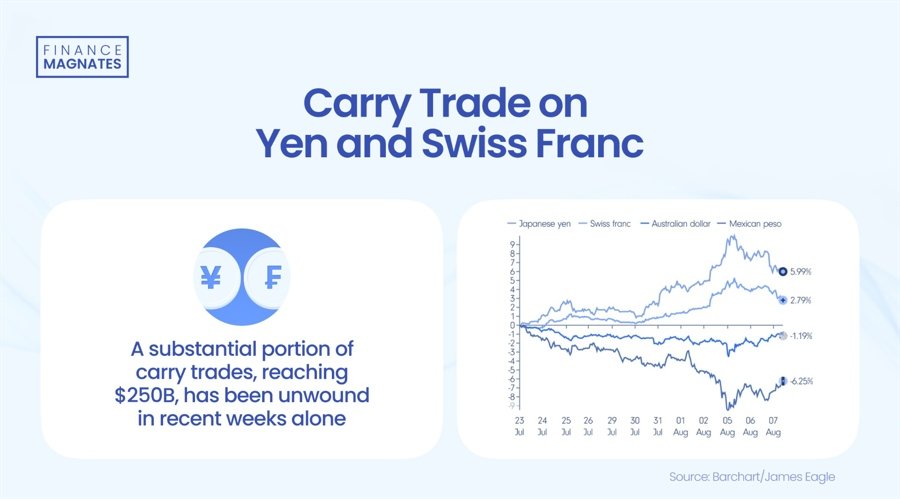

“A

substantial portion of these trades, estimated at $200–250 billion, has been

unwound in recent weeks alone,” added Stajniak. “JPMorgan estimates that as

much as three-quarters of carry trade positions have been closed, wiping out

gains accumulated from the first half of this year.”

Despite the

significant unwinding, JPMorgan strategists caution that the global carry trade

strategy currently offers limited appeal. “The yield on the basket has

plummeted since the highs of 2023 and is not a sufficient compensation for

holding EM high betas through US elections and the risk of further repricing of

low yielders if US yields fall,” explained Meera Chandan, analyst at

JPMorgan Chase & Co.

The

implications of this unwinding extend beyond the carry trade itself. Value

strategies have seen appreciation, while foreign exchange rates’ momentum has

regained ground as currencies realign with interest rate directions.

Carry Trade 101

Imagine an

investor borrows Japanese yen at a 0.1% interest rate and uses it to buy

Australian dollars, which offer a 3% interest rate. If the exchange rate stays

constant, the investor could potentially earn a 2.9% profit from the interest

rate difference alone.

While

carry trades can be profitable, they come with significant risks:

- Currency

fluctuations can quickly erase profits or lead to losses - Changes in

interest rates can affect the trade’s profitability - Economic

and political factors can impact currency values

Many

traders use leverage to amplify potential returns from carry trades. While this

can increase profits, it also magnifies risks. For example, using 20:1 leverage

could turn a 3% interest rate differential into a 60% annual return—but

losses would be equally amplified.

Carry

trades tend to perform well in stable economic environments with clear interest

rate differentials between countries, low market volatility and strong risk

appetite among investors.

The

financial world is on edge as a massive unwinding of the carry trade continues

to reverberate through global markets. This popular trading strategy, which

involves borrowing in low-interest currencies like the Japanese yen and

investing in higher-yielding assets, is experiencing a significant reversal

that has caught many investors off guard.

The

Japanese yen has surged against major currencies in recent weeks, appreciating

nearly 7% against the US dollar since mid-July. This rapid move has forced many

traders to liquidate their carry trade positions, leading to increased

volatility across various asset classes.

At the

beginning of last month, one dollar was worth more than 160 yen, the highest

value in several decades. However, a month later, the same dollar was exchanged

for only 142 yen, the lowest since the beginning of the year.

Market

experts are closely monitoring the situation, with some suggesting that the

unwinding process may only be halfway complete. Historically, Japan’s negative

interest rates and a weakening yen made it an attractive proposition for

investors seeking higher returns. By borrowing yen at low rates and investing

in higher-yielding assets, traders could profit from both interest rate differentials

and potential currency appreciation.

Michał Stajniak, the Deputy Director of the XTB Analysis Department

“However,

this dynamic has shifted dramatically in recent months,” explained Michał

Stajniak, the Deputy Director of the XTB Analysis Department. “Speculation is

rife that the Bank of Japan (BoJ) could raise interest rates as high as 1% in

the coming months, while according to the market, the Federal Reserve is expected to

cut rates by 100 basis points this year.”

Central

banks are now facing a challenging balancing act. The Federal Reserve, in

particular, finds itself in a precarious position. While economic data might

suggest the need for interest rate cuts, such moves could potentially

exacerbate the carry trade unwind and lead to further market instability.

Moreover, the persistence of carry trade unwinding is supported by the behavior of

yen futures contracts. “The extreme short positioning in yen futures, which had

ballooned to around 240,000 contracts, has contracted to 140,000. In contrast,

long positions have surged to 65,000 from a mere few thousand in 2020,” continued

Stajniak.

🇯🇵 How Big Is the Yen Carry Trade, Really? – Bloomberghttps://t.co/JuozkWGNPZ pic.twitter.com/4NT39vY0gG

— Christophe Barraud🛢🐳 (@C_Barraud) August 7, 2024

Swiss Franc Tests Decade

High

Meanwhile,

the Swiss franc has also seen significant gains as investors seek safe-haven

assets. This surge has prompted concerns from Swiss exporters, who fear that an

overly strong currency could harm their competitiveness in global markets.

“Although

the largest number of carry trades took place on the USDJPY pair, it is also

worth remembering that investors also used the franc and Chinese yuan in such

transactions, so the current trend of reversal of the situation on the yen may

also affect these currencies,” Stajniak added.

At a time

when the market fears a recession in the United States, geopolitical tensions

have been as high as a tightrope for over two years, and significant volatility

in the Japanese financial markets has scared investors, everyone is again

looking at the Swiss franc as a potential safe haven in difficult times.

Furthermore,

analysts from State Street and Citigroup are convinced that the franc may

become the new choice for investors specializing in carry trade, replacing the

Japanese yen in the leading position. Although the CHF/JPY currency pair

reached levels of 180.0 this year, testing multi-year highs, it has since

corrected significantly and is currently testing this year’s lows at the level

of 170.0.

Global Carry Trades See

Massive Unwinding, JPMorgan Reports

A

significant portion of global carry trades have been dismantled in recent

months, according to a new analysis by JPMorgan Chase & Co. The bank’s

quantitative strategists estimate that approximately three-quarters of these

trades have been unwound, marking a substantial shift in the financial

landscape.

JPMorgan’s

data reveals that returns across Group-of-10, emerging market, and global carry

trade baskets have plummeted by roughly 10% since May, effectively erasing

gains made earlier in the year. The pace of the selloff has been notably swift,

occurring at twice the usual rate observed during carry trade drawdowns.

The sharp rise in the JPY/USD is causing a massive unwind of Yen carry trade positions and contributing to the sharp decline in US stocks. For those who do not understand how this works, a brief explanation

1) Many traders were borrowing Jap Yen (JPY) at low interest rates,… pic.twitter.com/sfi0Hva56M

— Adam Khoo (@adamkhootrader) August 5, 2024

“A

substantial portion of these trades, estimated at $200–250 billion, has been

unwound in recent weeks alone,” added Stajniak. “JPMorgan estimates that as

much as three-quarters of carry trade positions have been closed, wiping out

gains accumulated from the first half of this year.”

Despite the

significant unwinding, JPMorgan strategists caution that the global carry trade

strategy currently offers limited appeal. “The yield on the basket has

plummeted since the highs of 2023 and is not a sufficient compensation for

holding EM high betas through US elections and the risk of further repricing of

low yielders if US yields fall,” explained Meera Chandan, analyst at

JPMorgan Chase & Co.

The

implications of this unwinding extend beyond the carry trade itself. Value

strategies have seen appreciation, while foreign exchange rates’ momentum has

regained ground as currencies realign with interest rate directions.

Carry Trade 101

Imagine an

investor borrows Japanese yen at a 0.1% interest rate and uses it to buy

Australian dollars, which offer a 3% interest rate. If the exchange rate stays

constant, the investor could potentially earn a 2.9% profit from the interest

rate difference alone.

While

carry trades can be profitable, they come with significant risks:

- Currency

fluctuations can quickly erase profits or lead to losses - Changes in

interest rates can affect the trade’s profitability - Economic

and political factors can impact currency values

Many

traders use leverage to amplify potential returns from carry trades. While this

can increase profits, it also magnifies risks. For example, using 20:1 leverage

could turn a 3% interest rate differential into a 60% annual return—but

losses would be equally amplified.

Carry

trades tend to perform well in stable economic environments with clear interest

rate differentials between countries, low market volatility and strong risk

appetite among investors.