Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

USD lower on CPI drop

US markets are now convinced the Federal Reserve will cut interest rates in September after last night’s all-important US inflation numbers came in below expectations.

Headline annual CPI fell from 3.0% in June to 2.9% in July while core inflation dropped from 3.3% in June to 3.2% in July.

US money markets now have 35bps worth of cuts priced in suggesting the possibility of a 50bps rate cut when the Fed next meets on 19 September (APAC time).

The US dollar was initially lower on the news but later recovered in a mixed session that saw the euro mostly higher but the British pound weaker after the UK also received some lower-than-expected inflation numbers.

The USD/JPY gained 0.2% while the USD/SGD and USD/CNH both fell 0.2%.

Kiwi hit after RBNZ rate cut, Aussie also lower

The Australian and New Zealand dollars also bucked the USD’s weakening trend after the Reserve Bank of New Zealand cut interest rates by 25bps to 5.25%.

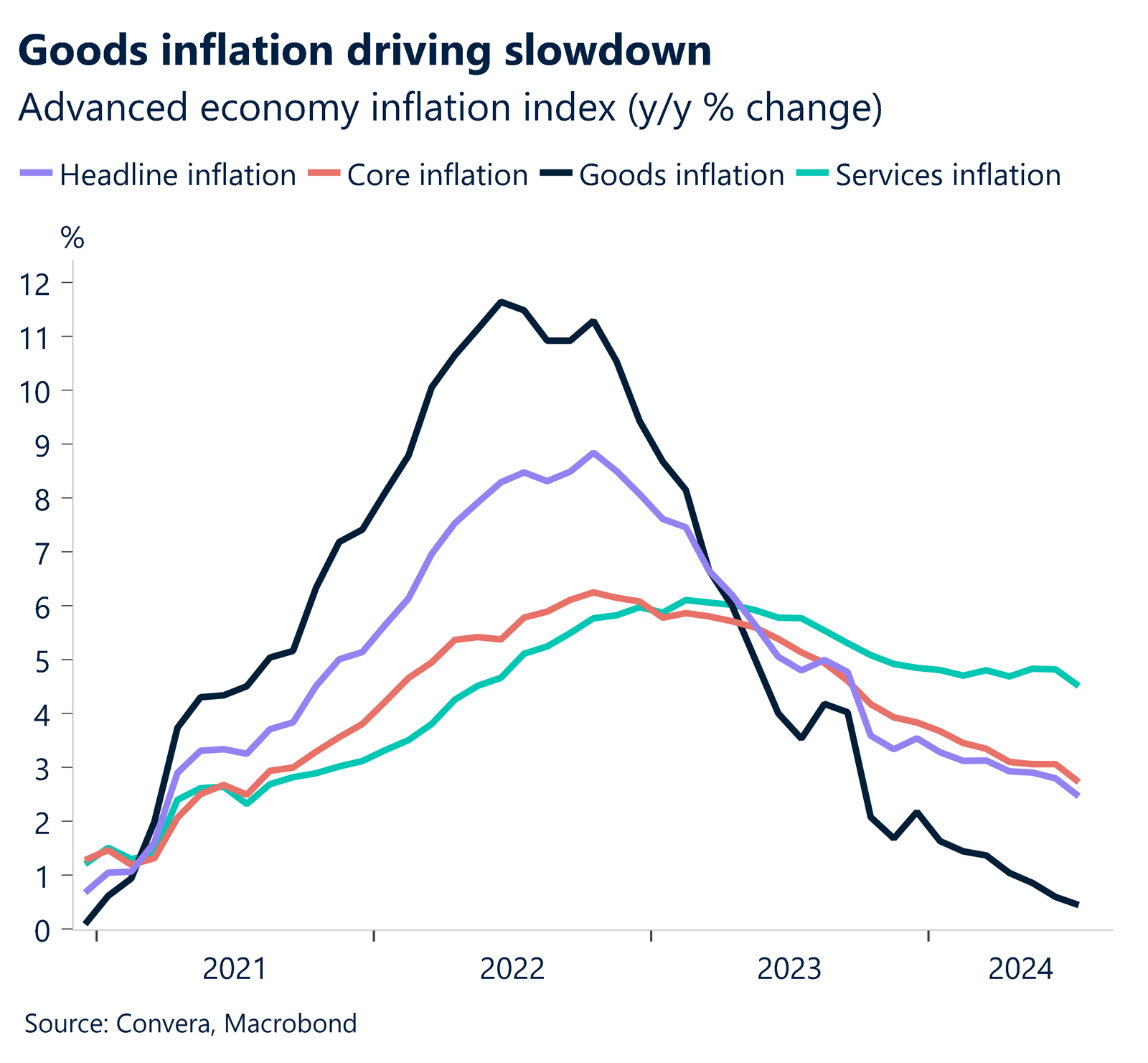

The RBNZ’s main reasons for cutting were because “economic growth remains below trend and inflation is declining across advanced economies.”

The NZD/USD tumbled 1.2% in its largest one-day loss since 7 June.

The kiwi was lower in all major markets with the NZD/EUR leading the losses, down 1.4%. The NZD/AUD fell 0.6% to two-week lows.

The Aussie fell in sympathy – especially as overseas markets opened – with traders deciding the RBNZ’s move might provide some clues around the Reserve Bank of Australia’s thinking.

The AUD/USD fell 0.6%. The Aussie will be in focus today with Australian jobs due at 11.30am AEST. The market’s looking for a drop from 50.2k in June to 20k new jobs in July. The unemployment rate is forecast remain steady at 4.1%.

China data drop due

The data deluge continues from China today with major monthly numbers due at 10.00am local time (12.00pm AEST).

Industrial production, retail sales, fixed asset investment and unemployment will all be released with a particular focus on what industrial production means for global demand and what retail sales means for the local consumer.

The Chinese yuan has been mostly weaker in 2024 as economic growth remained sluggish, but the Chinese currency has seen a revival in August as the USD eased. The USD/CNH ended yesterday’s session at the yuan’s second-best closing level for 2024.

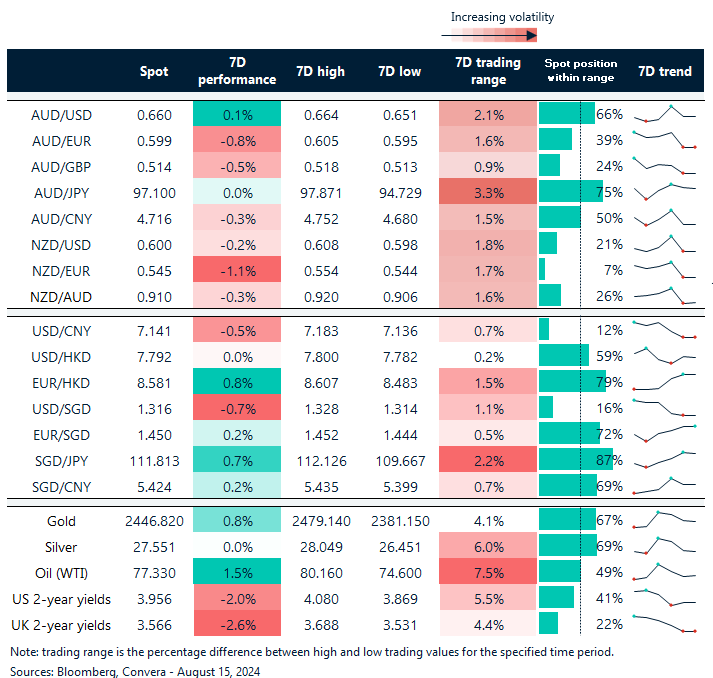

NZD leads losses after RBNZ

Table: seven-day rolling currency trends and trading ranges

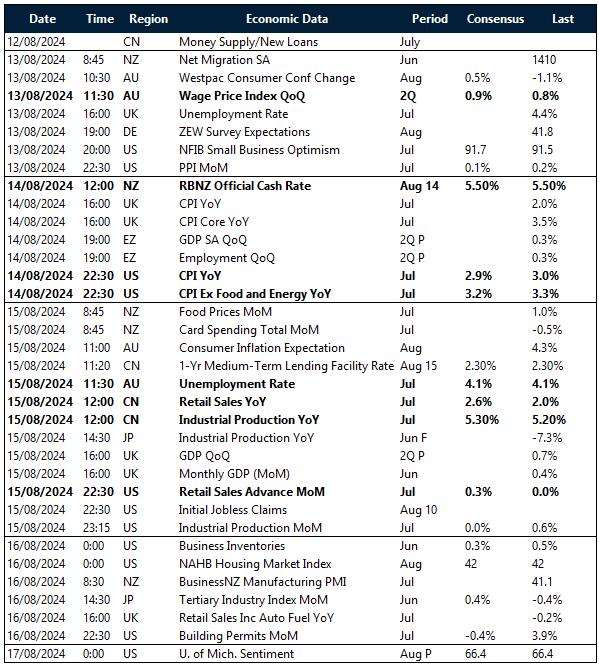

Key global risk events

Calendar: 12 – 17 August

All times AEST

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Have a question? [email protected]