Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

US dollar weaker across Asia

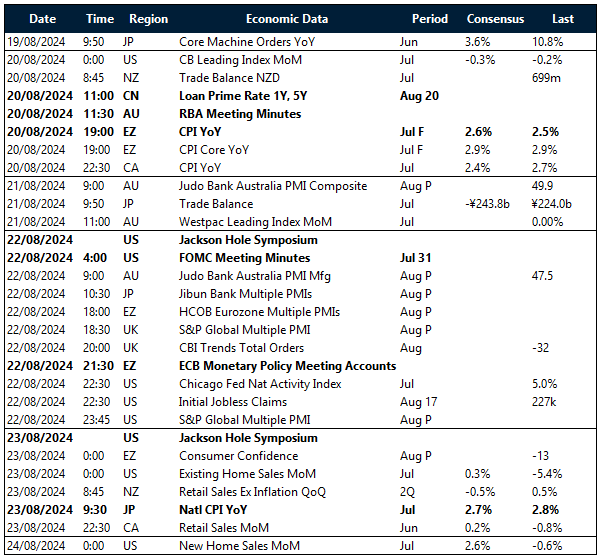

The US dollar extended losses overnight as markets braced for a series of major Federal Reserve statements with the Fed minutes due at Thursday morning, the Jackson Hole symposium starting on Thursday night, and the all-important Jackon Hole speech from Fed chair Jerome Powell due on Friday night.

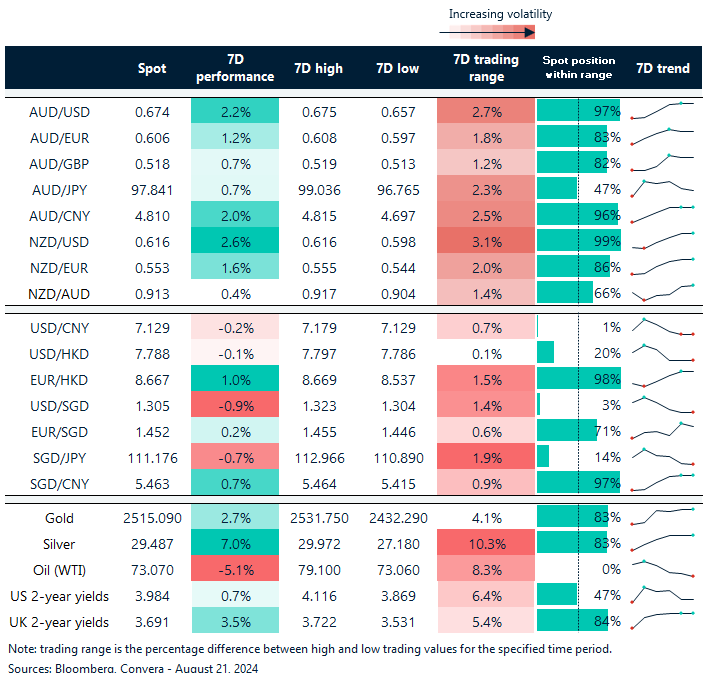

The USD index fell 0.4% overnight and is now down 3.0% for August so far.

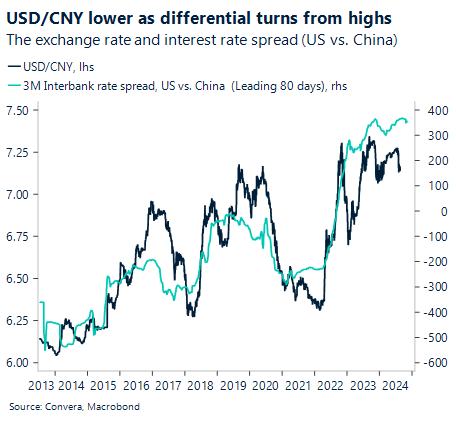

The most notable move across APAC was in USD/CNH with the pair down 0.2% as it ended at the lowest closing level for the year. Yesterday’s decision from the People’s Bank of China, which kept the one-year loan prime rate on hold at 3.35%, helped boost the Chinese yuan.

In other markets, the USD was mostly weaker.

The AUD/USD gained 0.2% as it reached one-month highs.

The NZD/USD continued to outperform as it gained 0.7% and hit two-month highs.

Focus on Fed minutes

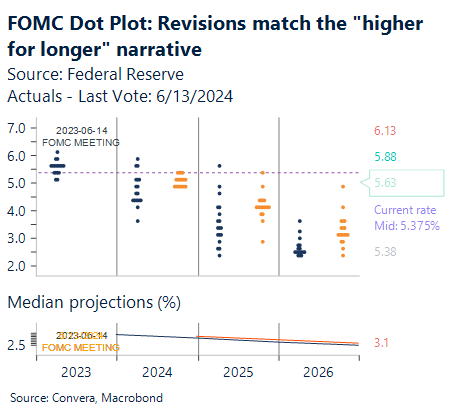

As we mentioned above, the minutes of the July FOMC meeting will be made public two days prior to Chair Powell’s Jackson Hole address, which will restrict their use as a window into the Fed’s thinking. Powell stressed the importance of downside risks to the job market in his July press conference.

However, as this meeting occurred prior to the employment report’s July surprise, the discussion in the minutes is probably outdated.

The fact that “many” or “most” participants agreed that it may be appropriate to relax rates at a future meeting suggests to us that a September rate decrease is probable.

The FOMC should be ready to relax more swiftly if the labor market deteriorates, but we do not anticipate a detailed discussion of the potential of a 50bp rate decrease.

Thai baht at one-year highs ahead of BoT

With the US dollar weaker across Aisa, one major beneficiary has been the Thai baht, trading close to one-year highs versus the US dollar.

As stated in the last meeting, the policy rate is “consistent with the economy converging to its potential, as well as conducive to safeguarding macro-financial stability,” thus we predict the Bank of Thailand (BOT) to maintain its 2.5% policy rate.

The tone of the policy statement is probably going to be the same as it was at the last meeting in June, although we think the BOT will probably highlight the risks from growing political instability on the growth forecast. We also anticipate that the vote split will stay at 6-1.

In our opinion, the BOT will stick with its statement that it “will take into account growth and inflation outlook in deliberating monetary policy going forward,” which, in the event that growth declines significantly, opens the door to policy easing.

Yet, considering the most recent economic activity indices and the swift PM vote on Friday helping to reduce the likelihood of another FY25 budget delay, we do not anticipate a definite dovish turn at this meeting.

THB has benefited from rising gold prices and the weaker US dollar, both of which are driven by Fed rate-cut speculative activity.

Aussie, kiwi reach highs as USD weakens before Fed minutes

Table: seven-day rolling currency trends and trading ranges

Key global risk events

Calendar: 19 – 24 August

All times AEST

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Have a question? [email protected]