Written by Convera’s Market Insights team

Dollar rebounds after US PMIs

George Vessey – Lead FX Strategist

The US dollar rebounded across the board yesterday to stage its best day of August, along with the US 10-year Treasury yield bouncing sharply higher from 14-month lows in the prior session. Supporting US assets was PMI data from S&P Global showing US private sector growth slowed less than expected in August. Markets continue to assess the magnitude of rate cuts that the Federal Reserve (Fed) may deliver this year as Fed Chair Powell takes centre stage today.

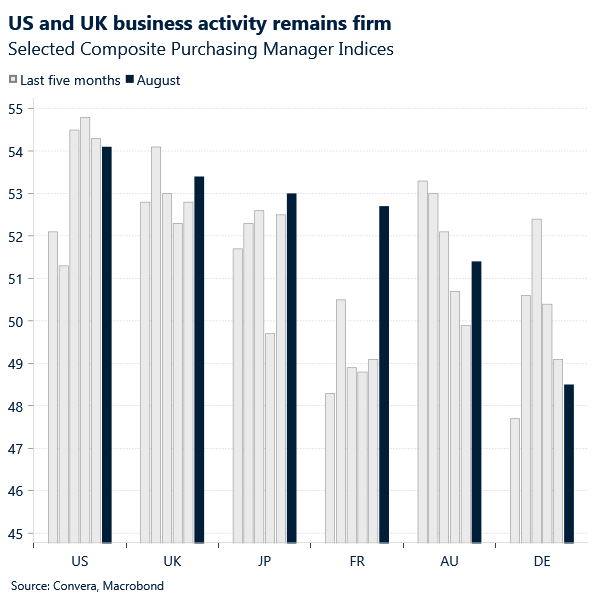

The PMIs showed some solid economic resilience in the US on the services side. However, manufacturing fell from 49.6 to 48, the lowest reading of the year, which dragged the composite reading down to a 4-month low. In terms of the composite details, employment sagged from 51.6 to 48.9, though new orders were largely unchanged at 52.3. Input and output prices were also little changed. Overall, the figures don’t alter the US economic narrative too much, but the resilience does cast doubt over some of the easing embedded in market pricing. Four rate cuts by the Fed are still almost fully priced in, although the odds of a jumbo cut in September have been slashed.

Fed Chairman Jerome Powell is due to speak at the Jackson Hole Economic Symposium today to deliver insights on how the central bank may react to increasing signs of a moderating job market. This could be a pivotal momentum for market participants and determine whether the current scale of expected easing baked into markets is justified and whether the dollar’s downtrend will gather steam or not.

Sterling’s support could fade

George Vessey – Lead FX Strategist

As the technical backdrop indicated via overbought signals, the pound has pulled back slightly from over 1-year highs against the US dollar as US yields rebounded following the strong PMI figures. However, GBP/USD did extend beyond $1.31, helped by the UK PMI data beat across the board, which suggests Britain’s economic recovery has further room to run.

Preliminary August services data picked up to 53.3, exceeding a 52.8 forecast. The measure has now been in growth territory for a tenth successive month. Manufacturing was also in expansion at 52.5 and beat estimates, pointing to a more balanced recovery. Digging deeper into the surveys revealed rising business activity and resilient demand helped drive the fastest employment growth since June 2023. At the same time, inflationary pressures moderated across the private sector, with input costs rising at the slowest pace since January 2021. This might give the Bank of England (BoE) more confidence in cutting interest rates again in November. A September rate cut looks highly unlikely at this stage, whereas markets are pricing both the Fed and ECB to cut. This has helped keep demand for the pound strong.

The short-term risk to the pound is a potentially less-dovish Powell speech today boosting the dollar and keeping the risk rally in check. Against the euro though, the convincing break above its 100-day moving average this week, coupled with an uplift in UK-German yield spreads, points to a potential retest of the €1.18 handle soon.

Euro’s momentum softens going into Jackson Hole

Ruta Prieskienyte – Lead FX Strategist

Thursday’s macro calendar provided market participants with a lot to digest, but the overall message was clear: the case for ECB rate cuts in September is strong, and the probability of further cuts is rising—both euro-negative outcomes.

Firstly, the widely anticipated negotiated wages came in at 3.6% year-on-year in Q2 2024, down from the 4.7% year-on-year observed in the previous quarter. This reduction eases concerns over a wage-price inflation spiral. However, the picture is not entirely straightforward, as wage growth slowed in France, the Netherlands, and Austria but accelerated in Belgium, Italy, and Spain. Nonetheless, the overall trend points towards easing price pressures, signalling a green light for monetary easing.

Secondly, the composite PMI increased from 50.2 in July to 51.2 in August, largely driven by a surge in French services activity. Despite this, the underlying data remains weak. The boost to the headline Eurozone number, spurred by the Olympic spirit, is unlikely to persist in France beyond the summer. Meanwhile, output in Germany, Europe’s largest economy, continues to decline faster than expected. The rising risks to Eurozone economic growth further strengthen the argument for rate cuts in September and beyond.

The final piece of the puzzle, as highlighted by Christine Lagarde, involves whether corporate profit margins can absorb some of the rise in labour costs and whether productivity improves. However, recent disappointments in productivity raise concerns that the ECB may be too optimistic. ECB officials won’t have to wait long to assess a broader measure of workers’ pay, with crucial data due on 6 September, less than a week before the next rate decision.

Aggressive US easing bets have recently overshadowed the economic weakness in the Eurozone. The euro’s 3% rally in August has been relentless, pushing it to a one-year high against the dollar on Wednesday. However, this momentum is showing signs of fatigue. We maintain a three-month bearish outlook for EUR/USD due to lingering political risks in both the Eurozone and the US, but we acknowledge that the euro’s ascent may continue leading up to the first Fed rate cut in September, potentially testing the 30-month range ceiling around mid-$1.12 (the July 2023 high). As it stands, momentum has slowed ahead of Jackson Hole, with the RSI indicator firmly in overbought territory. The bar for Powell to sound dovish is very high, making it likely that the symposium will result in a hawkish outcome for the dollar.

Oil slumps almost 5% in a week

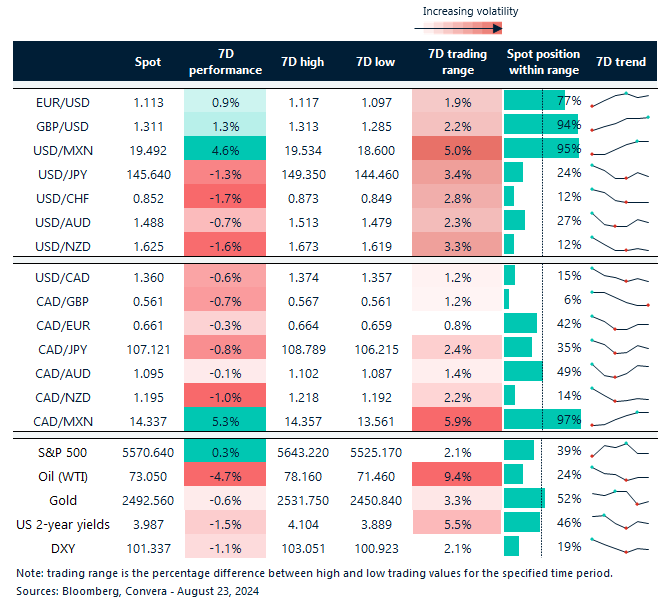

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: August 19-23

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.