It was another quiet session in Europe with no significant market action although the Yen to USD rate ticked above 145 briefly. The only notable news came from the Australian CPI inflation figures released overnight, which didn’t cause any major market shifts, although AUD/USD ticked above 0.68 briefly after the data, before pulling back down.

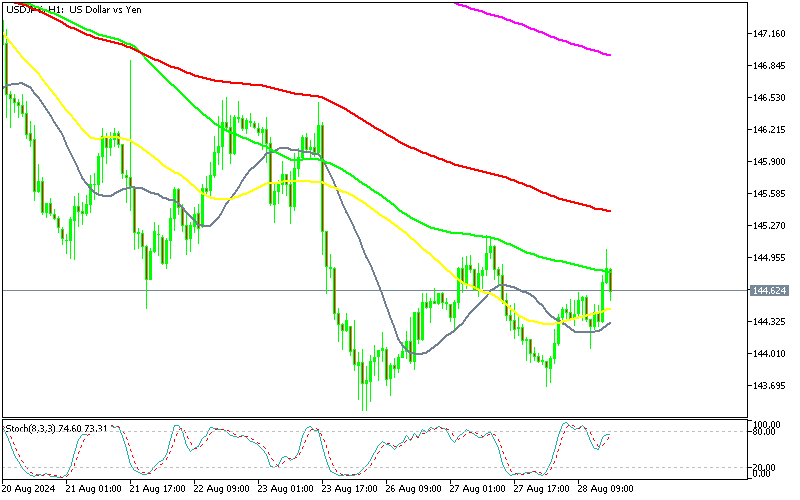

USD/JPY Chart H1 – MAs Continue to Push the Highs Lower

Forex and Gold Price Action

The USD has been leading higher, recovering some of this month’s losses. Meanwhile, the EUR has been the weakest currency of the day, even as European markets moved higher and US 10-year yields dropped by more than 2 basis points to 3.80%. Gold dropped more than 1% below $2,500 but has since been pulled back above this level. Earlier, gold briefly reached a high of $2,529 during the Asian session, but then retreated below $2,500 due to market noise. It is currently trading in a range between the $2,530 resistance and the $2,470-80 support zone.

Safe havens such as the JPY and the CHF were retreating lower, with USD/JPY gaining around 140 pips since the lows yesterday. However, moving averages continue to provide resistance on the H1 chart, and the climb has stopped at the 100 SMA (green). The picture is similar in USD/CHF , which peaked above 0.8450 where it found resistance on the H1 chart and has now reversed lower.

Crude Oil and Market Movements

Crude oil has been the main mover, extending its decline below Monday’s low before news of a halt in the surge of Libyan oil production provided some relief. Looking ahead, the economic calendar is largely empty until late in the evening when Nvidia is set to disclose its earnings after the US markets close. Investors are now focusing on the upcoming US PCE inflation report, which is a key indicator for the Federal Reserve and is expected later this week.

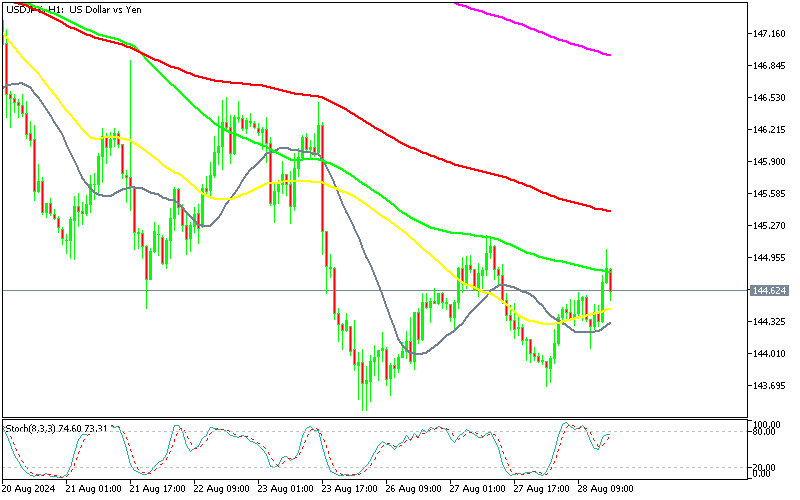

USD/JPY Live Chart

USD/JPY