NEW YORK, Aug 12 (Reuters) – The yen fell against the dollar on Monday in calmer currency market trading as investors weighed the odds of a deep Fed interest rate cut next month ahead of a slew of U.S. economic data after volatile moves last week.

The respite follows a tumultuous week that began with a massive sell-off across currencies and stock markets, driven by worries over the U.S. economy and the Bank of Japan’s hawkishness.

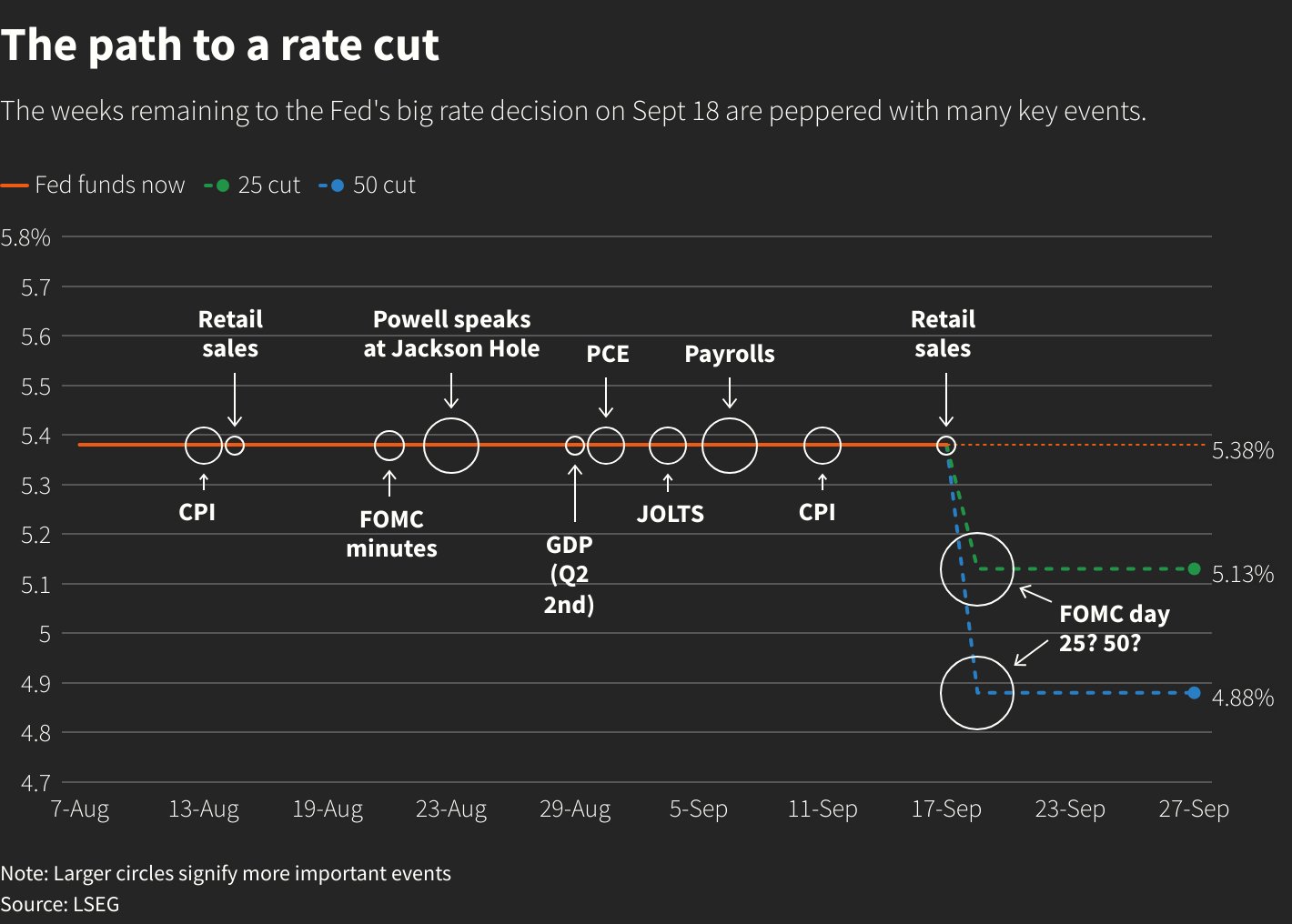

“All they’re really looking at is to see whether the inflation narrative is going to revive with this week’s (consumer price index), or we’re going to continue with the new narrative of is the economy headed for a recession, typified by what’s going on with the labor market in nonfarm payroll,” said Joseph Trevisani, senior analyst at FXStreet.com in New York.

“We’re looking at which way the Fed’s attention is going to go. Right now, it’s back on the labor market. That could switch if you get something unexpected in the inflation, CPI numbers, especially if those numbers tick up,” Trevisani said.

The dollar was trading at 147.10 yen , up 0.33%, and was flat on the Swiss franc, at 0.8661.

The euro eased up 0.16% to $1.0933 , while the dollar index fell to 103.10. Sterling stayed flat at $1.2763.

A week ago, the euro rose as far as $1.1009 for the first time since Jan. 2.

CARRY TRADES UNWIND

The violent sell-off in the dollar-yen pair between July 3 and Aug. 5, sparked by Japan’s intervention, a Bank of Japan rate rise and then the unwinding of yen-funded carry trades, caused it to fall 20 yen.

Leveraged funds’ position on the Japanese yen shrank to the smallest net short stance since February 2023 in the latest week, U.S. Commodity Futures Trading Commission and LSEG data released on Friday showed.

The yen reached its strongest level since Jan. 2 at 141.675 per dollar last Monday. It is still down around 4% versus the dollar so far this year.

“Comments this morning from an ex-BoJ official summarizing why the BoJ is unlikely to be in a rush to hike rates again has undermined the JPY,” said Jane Foley, head of FX strategy at Rabobank in London.

“That said, with volatility likely to be higher into the end of the year in view of the U.S. election and the likelihood of Fed rate cuts, the market is unlikely to plow back into carry trades.”

Sign up here.

Reporting by Laura Matthews; additional reporting by Iain Withers in London, Vidya Ranganathan in Singapore; Editing by Alex Richardson, Kirsten Donovan and Jonathan Oatis

Our Standards: The Thomson Reuters Trust Principles.