Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

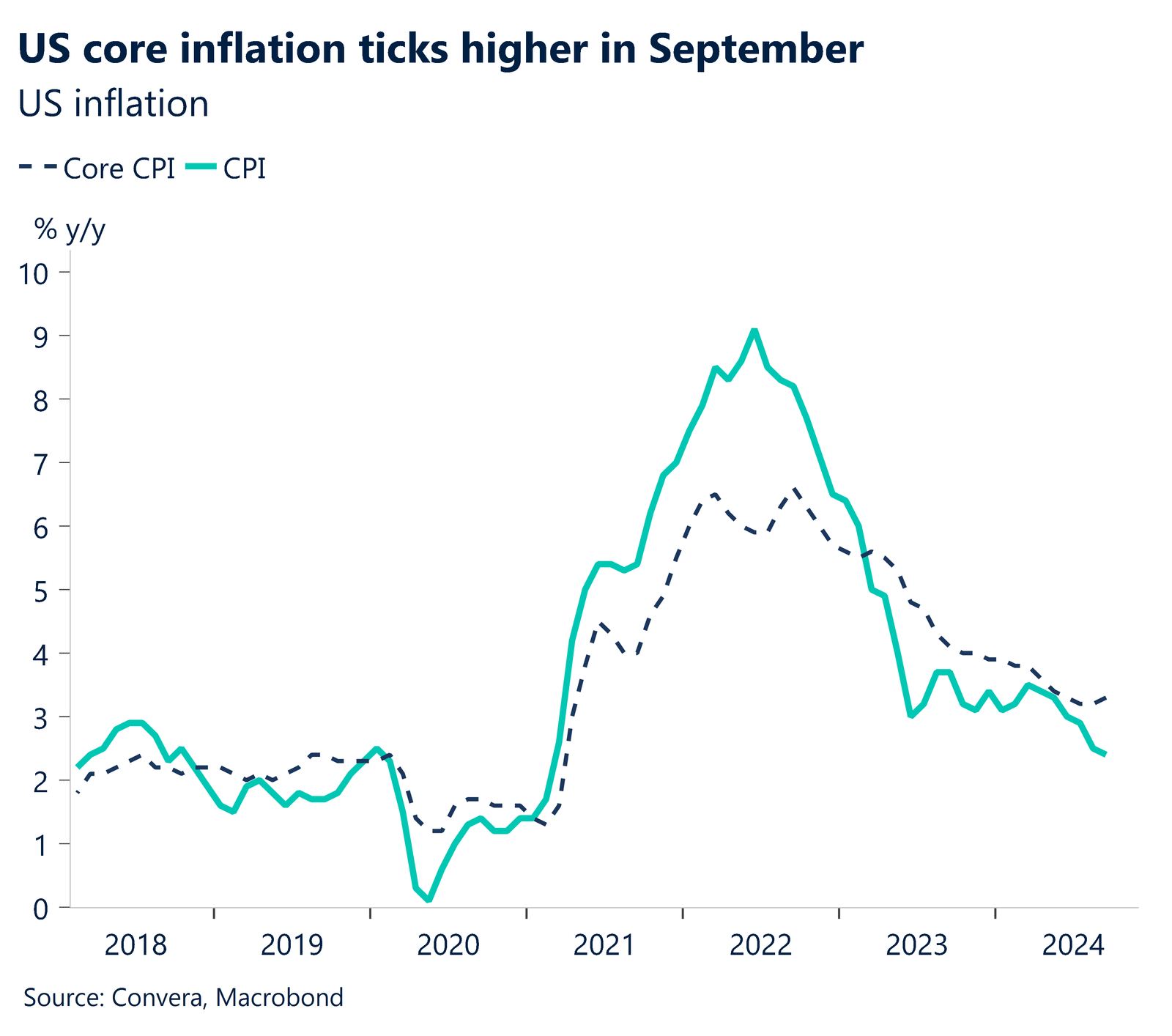

US inflation higher than expected

US shares were weaker and the US dollar also fell after a higher than expected reading from US CPI.

September headline annual CPI was reported at 2.4%, versus forecasts for 2.3%, while the core number was reported at 3.3%, versus the 3.2% forecast. The core number was also higher than the previous month’s reading.

The news caused further doubt on whether the Federal Reserve can cut by 50bps in November, causing US shares to fall. The greenback followed shares lower.

The AUD/USD climbed 0.3%, rising from six-week lows, while the NZD/USD gained 0.5%, as it rebounded from two-month lows.

The USD/SGD and USD/CNH were both lower.

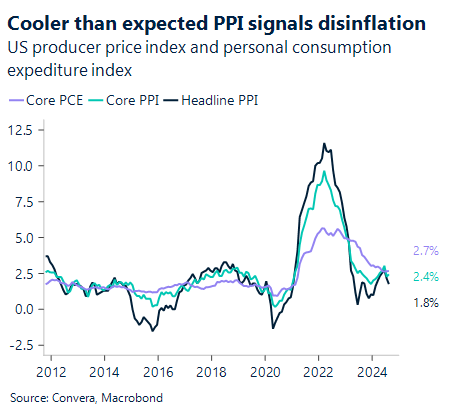

Greenback focus shifts to PPI

If one takes out the erratic prices for food, energy, and trade services, core PPI was probably muted in September.

Overall, prices paid index decreased across national and regional polls. We anticipate that since crude oil prices fell throughout the month, the headline PPI was similarly reduced.

We shall keep a careful eye on the PPI components that are important to the core PCE price index, such as airline tickets, financial services, and health care services.

Given the need to re-inject some tariff premium into the currency, the sharp build-up of USD shorts over the last two months may reverse, albeit we do not expect the size of the adjustment to be significant.

The USD index has been on a positive two-week streak, but further correction may be on the cards given RSI is in overbought territory.

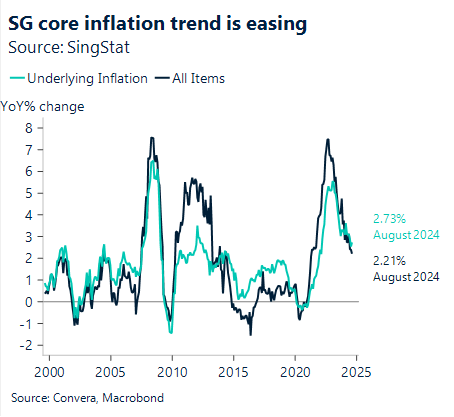

SGD subdued ahead of MAS FX policy announcement

The upcoming Monetary Authority of Singapore (MAS) FX policy announcement, expected no later than 14 October, is a key event to watch.

Following the upside surprise in Singapore’s August core CPI and China’s policy stimulus, the probability of MAS easing FX policy at this meeting has declined.

Despite this, there are several reasons to maintain a tactical bearish position on SGD, potentially causing the USD/SGD to rise.

First, the core inflation trend in Singapore is easing, with expectations for year-on-year growth to fall below 2% at the start of 2025.

Second, the MAS continues to anticipate core inflation to “step down further in Q4 2024.” This trajectory raises the possibility of a more dovish tone in the MAS policy statement.

And finally, while US data have shown some stability and China’s stimulus is emerging, there’s still uncertainty over whether these factors will translate into sustained economic rebounds.

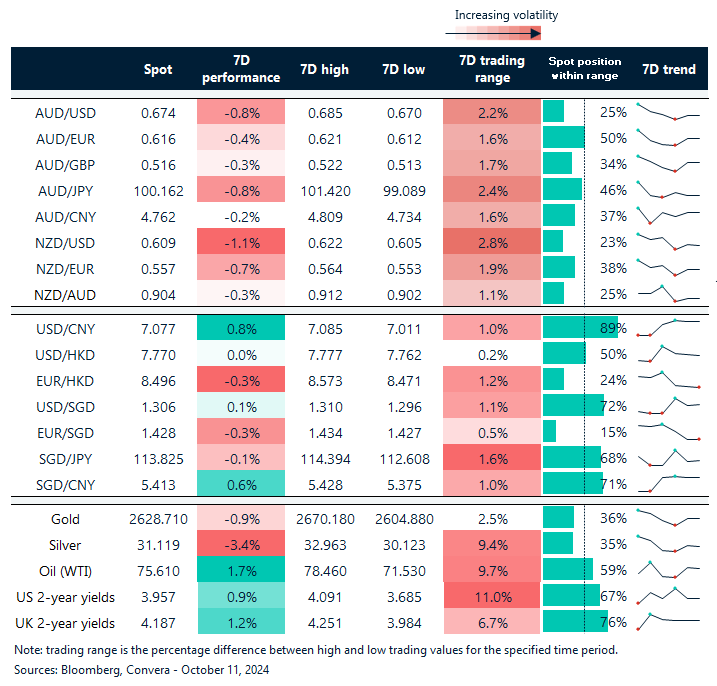

Greenback’s run halted

Table: seven-day rolling currency trends and trading ranges

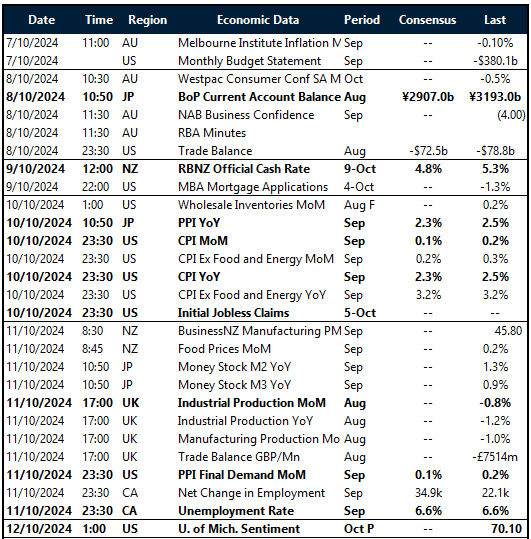

Key global risk events

Calendar: 7 – 12 October

All times AEST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.