Written by Convera’s Market Insights team

Strong spending, careful cuts

George Vessey – Lead FX Strategist

US exceptionalism has been a dominant narrative for most of 2024, boosting the US dollar, yields and equities. Yesterday, the dollar marched to fresh 11-week highs, stocks rose and bonds fell after a solid US retail sales report. Jobless claims also fell 19k to 241k after a big jump due to storms the week prior. Bottom line, the US economy is looking strong, so the Federal Reserve (Fed) is likely to cautiously cut rates.

Retail sales in the US increased 0.4% m/m in September, well above a 0.1% gain in August and beating market expectations of a 0.3% rise. The figure caps another likely quarter of solid economic growth and consumer demand fuelled by solid income growth, access to credit and a sturdy labour market. While the retail sales report won’t deter the Fed from cutting interest rates by 25 basis points next month, it is yet more evidence that consumer spending remains robust, boosting the no landing thesis.

As a result, looking further ahead, swaps market now reflects about 125 basis points of rate cuts through the seven Fed meetings through July 2025, implying two skips in that time frame.

Pound rebounds after retail sales beat

George Vessey – Lead FX Strategist

Retail sales in the UK unexpectedly increased 0.3% m/m in September 2024, following a 1% surge in August and beating forecasts of a 0.3% fall. Sales at non-food stores jumped 2.5%, following a 0.6% rise in August, mostly led by computers and telecommunications retailers. The pound is staging a strong end to the week as a result.

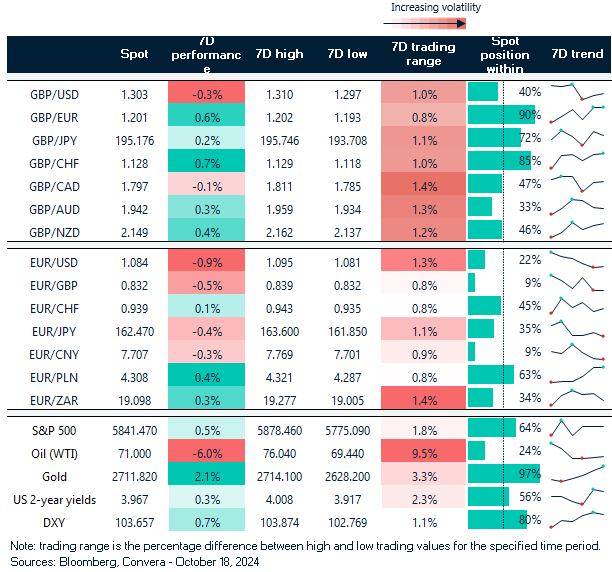

The British pound has jumped back towards $1.31 against the US dollar as result of the promising UK data. GBP/EUR is also scaling multi-month peaks thanks to widening economic growth and yield differentials favouring the pound. However, with looming risk events, the options market is pointing to growing downside risk for sterling. With 1-week and 1-month risk reversals for GBP/USD in negative territory once again, there is a bias towards protecting against further GBP declines, or USD strength.

Despite the slight pullback from 2024 peaks in 1-month implied volatility for GBP/USD, it remains above 8%, thus two standard deviations above its year-to-date average of 6.6%.

Euro bears welcome dovish ECB

Boris Kovacevic – Global Macro Strategist

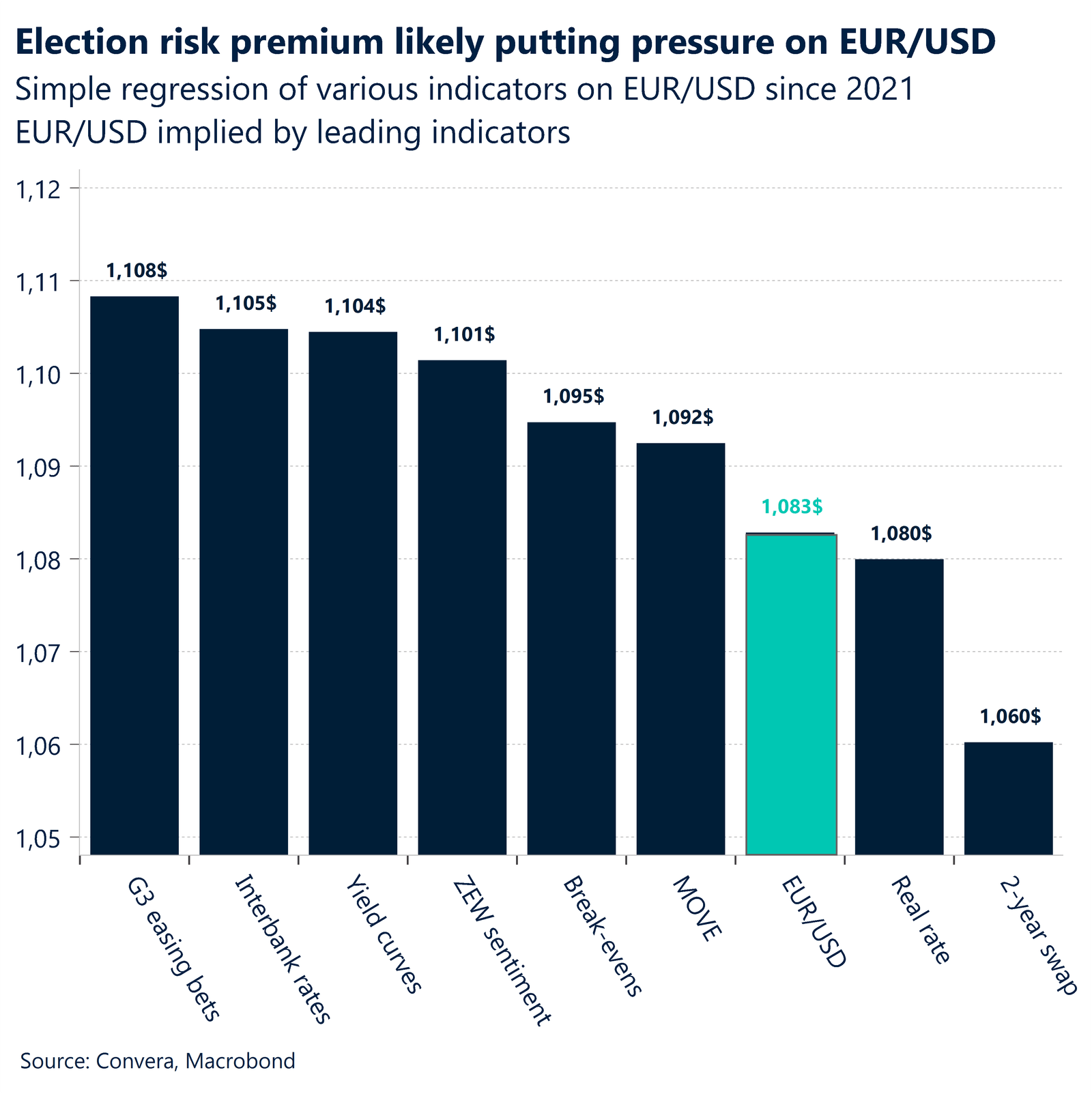

The euro continued its three-week descent following hotter than expected US data and a slightly dovish ECB meeting. Both events can be seen as prime examples of two narratives that have recently shifted in the euros disadvantage. The initial rise of EUR/USD from $1.07 to $1.12 between May and September was all about the US economy losing steam and the expectation that the European Central Bank would not cut interest rates as aggressively as the Federal Reserve. Both theses have lost their supporters in recent weeks as economic activity in the US seems to gather pace, while the macro disappointments in Europe favor another policy easing in December. This would bring the deposit rate to 3% by year end.

Yesterday’s 25 basis point cut was highly anticipated and well telegraphed. The central bank under Christine Lagarde continues to be data dependent and sets policy by a meeting-by-meeting approach. However, the downside risks to inflation are mounting and have opened the door to more policy easing ahead. Markets now imply a 20% chance of a half-point cut in December. While a possibility, we don’t think that the upcoming developments will justify going big. The first arguments rests on the case that the easing cycle is already well underway. Cutting by more than the usual 25 basis points would imply that policy makers have made an error before. Secondly, while not great, economic data as of late has experienced somewhat of an uptick. German sentiment and Eurozone industrial production surprised to the downside this week.

Such a view still sees the euro trending lower going into the US election as signs of a Trump victory mount. The resistance at around $1.0750 will be key to watch. However, we have to also be mindful about the euro has now fallen on 13 out of the last 15 days. We still think that EUR/USD would trade somewhere around $1.10 absent the US election. A Harris victory would lead us there, but markets seem to continue moving in Trump’s favor.

Dollar and gold push higher

Table: 7-day currency trends and trading ranges

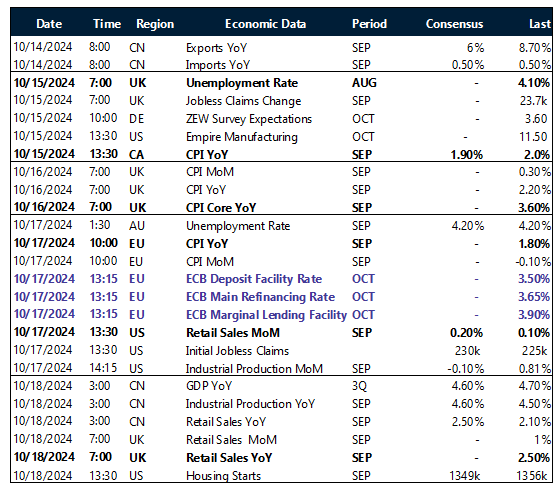

Key global risk events

Calendar: October 14-18

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.