The strengthening of the Thai Baht against the U.S. dollar is no good news and is raising concerns in Thailand. For the uninitiated, the Thai Baht has hit a five-year high against the U.S. dollar, and the rise is having a major impact on the country’s manufacturing, imports, and export sectors. In addition, tourism is also being hit as significant revenue comes from foreigners visiting the country for vacations.

Also Read: China’s Belt and Road Initiative Reaches European Borders

The Economic Impact of Thai Baht’s Strengthening Against the U.S. Dollar

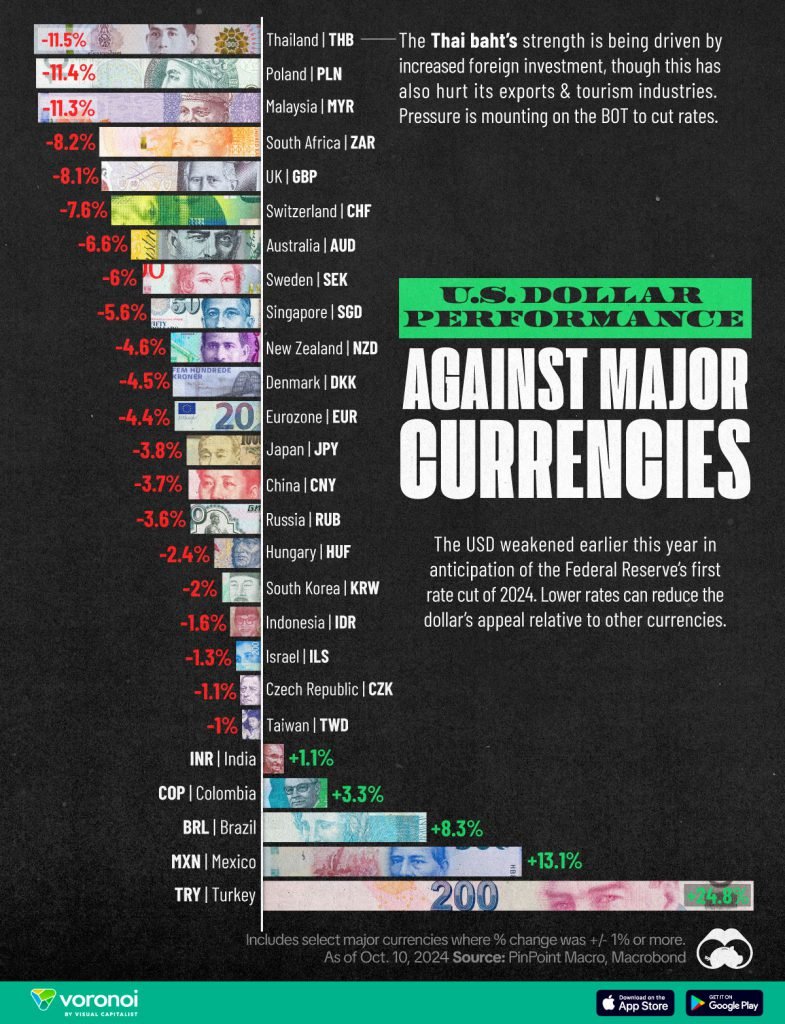

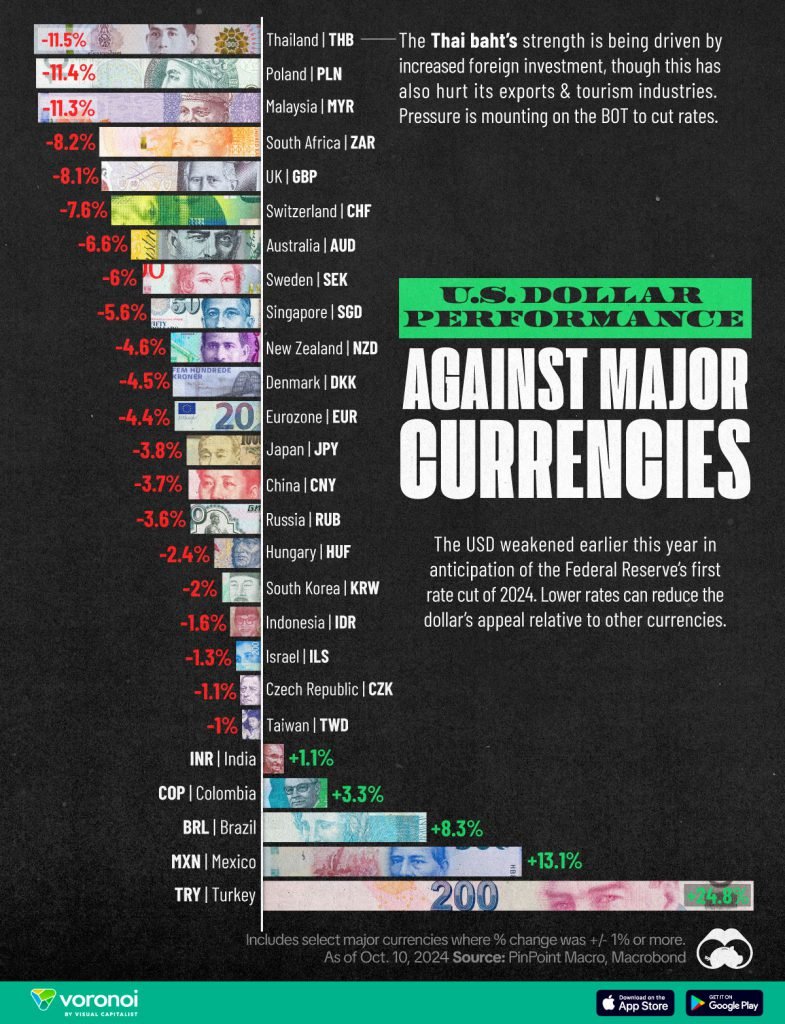

The U.S. dollar had dipped 11.5% against the Thai Baht during mid-2024. However, it briefly recovered and is now down 8.5% year-to-date. While local currencies gaining against the U.S. dollar is a win for other countries, the case is not the same for Thailand. A strong Thai Baht is hitting exporters and tourism, confirmed the Central Bank of Thailand.

The Central Bank of Thailand said that exports in August rose 11.4% compared to last year, while imports were up 8.5%. This has resulted in a trade account surplus of $2.4 billion. Manufacturing companies in the country have expressed worries about their exports as the Thai Baht appreciated to 33.50 against the U.S. dollar.

Also Read: Can Uber Stock Cruise to $100 After Q3 Earnings?

“Amid increased uncertainties driven mainly by external factors, the Thai Baht is likely to fluctuate against the U.S. dollar. However, we expect it to follow a strengthening trend, ending the year at 33.40-33.50 to the dollar,” said Poon Panitchpibun, a market strategist from Krungthai Bank.

What Next For the U.S. Dollar?

A recent report from Bloomberg indicates that the Thai Baht could remain steady against the U.S. dollar. This could force the Central Bank officials to consider interest rate cuts to cool down the currency. “The topic of strong baht is already on the agenda of policymakers,” said Christopher Wong, a currency strategist to Reuters.

Also Read: Goldman Strategists Declare End to Decade of US Stock Market Gains

The strategist revealed that policymakers will wait and watch how the currency unfolds before deciding. “At this point, it is likely they may wait and watch but we cannot rule out any responses,” he said.