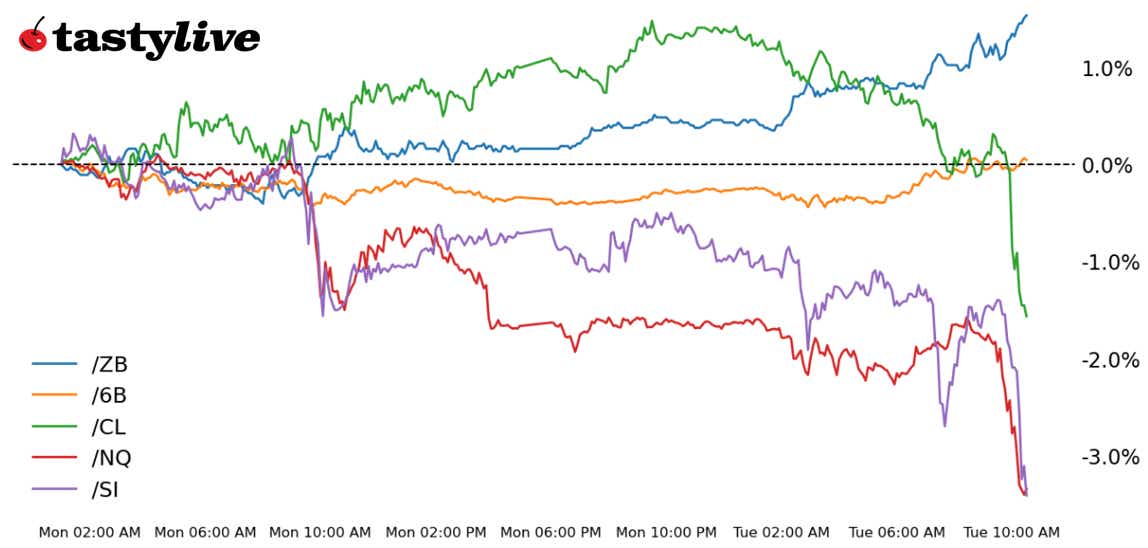

Also, 30-year T-bond, silver, crude oil and British pound futures

- Nasdaq 100 E-mini futures (/NQ): -1.54%

- 30-year T-bond futures (/ZB): +1.15%

- Silver futures (/SI): -1.96%

- Crude oil futures (/CL): -2.01%

- British pound futures (/6B): +0.34%

A week devoid of significant data releases is proving highly sensitive to any news that confirms the emerging narrative: The U.S. economy is slowing down. Three consecutive days of U.S. data releases, however major or minor, pointing to stagflationary conditions rising (higher inflation, higher unemployment and lower growth) are spooking equity traders. With concern about U.S. growth in focus, Treasuries have rallied across the curve. The shift to risk-aversion is evident as the year’s top performers are being sold off alongside growth-centric commodities.

|

Symbol: Equities |

Daily Change |

|

/ESH5 |

-0.92% |

|

/NQH5 |

-1.54% |

|

/RTYH5 |

-0.78% |

|

/YMH5 |

-0.24% |

U.S. equity futures continued to decline today, extending a move from previous days as economic concerns drag on sentiment. Nasdaq futures (/NQH5) shed 1.5% in early trading, with recent tariff announcements from the White House offering no help to dip buyers. President Trump said earlier this week that tariffs on Canada and Mexico will move forward. The uncertainty is being reflected in the spot VIX, which rose above the 21 level this morning. One bright spot in the equity market came from the Home Depot (HD) earnings report this morning. The home improvement retailer rose 4% in early trading after reporting a beat vs. street estimates.

|

Strategy: (64DTE, ATM) |

Strikes |

POP |

Max Profit |

Max Loss |

|

Iron Condor |

Long 20900 p Short 21000 p Short 21800 c Long 21900 c |

21% |

+1600 |

-400 |

|

Short Strangle |

Short 21000 p Short 21800 c |

57% |

+20740 |

x |

|

Short Put Vertical |

Long 20900 p Short 21000 p |

61% |

+640 |

-1360 |

|

Symbol: Bonds |

Daily Change |

|

/ZTH5 |

+0.14% |

|

/ZFH5 |

+0.38% |

|

/ZNH5 |

+0.6% |

|

/ZBH5 |

+1.15% |

|

/UBH5 |

+1.44% |

Bonds are rallying but for all the wrong reasons after this morning’s consumer sentiment data weakened significantly from the previous month. The consumer market’s strength is now in question, which is also being reflected in financial stocks this morning. The 30-year T-bond futures (/ZBH5) rose over 1% this morning, with the underlying yield falling to 4.556%, its lowest mark since early December. Concern over economic growth and the ability to remove inflation pressures in the economy sent yields lower across the curve. Meanwhile, trade tensions with China are ramping up, as the U.S. considers stronger use of the Committee on Foreign Investment in the United States (CFIUS).

|

Strategy (59DTE, ATM) |

Strikes |

POP |

Max Profit |

Max Loss |

|

Iron Condor |

Long 115 p Short 116 p Short 119 c Long 120 c |

32% |

+703.13 |

-296.88 |

|

Short Strangle |

Short 116 p Short 119 c |

60% |

+3015.63 |

x |

|

Short Put Vertical |

Long 115 p Short 116 p |

69% |

+375 |

-625 |

|

Symbol: Metals |

Daily Change |

|

/GCJ5 |

-1.32% |

|

/SIH5 |

-1.96% |

|

/HGH5 |

-0.45% |

If you looked at the dollar and Treasury yields you would assume precious metals would be moving higher today, but that isn’t the case. Silver futures (/SIH5) were down nearly 2% in early trading today, and gold prices were down over 1%. Silver is breaking below a level of support that kept prices afloat through early February, although previous resistance from January may turn to support if the selling eases over the short term. That said, a break below 31.5 for silver could spell more trouble for the metal, but if we manage to consolidate near this level, it could offer a base for traders to get on the long side again.

|

Strategy (58DTE, ATM) |

Strikes |

POP |

Max Profit |

Max Loss |

|

Iron Condor |

Long 31.25 p Short 31.5 p Short 33.5 c Long 33.75 c |

23% |

+945 |

-310 |

|

Short Strangle |

Short 31.5 p Short 33.5 c |

55% |

+10140 |

x |

|

Short Put Vertical |

Long 31.25 p Short 31.5 p |

59% |

+570 |

-680 |

|

Symbol: Energy |

Daily Change |

|

/CLH5 |

-2.01% |

|

/HOH5 |

-1.51% |

|

/NGH5 |

+0.38% |

|

/RBH5 |

-1.29% |

Crude oil futures (/CLH5) are being hit on multiple fronts today, with concern over tariffs and a potential peace deal between Russia and Ukraine both dragging on the commodity. Tariffs are introducing more uncertainty into the global economic outlook, and the peace deal between Russia and Ukraine could introduce more supply back onto the market, albeit a limited amount because Russia needs to adhere to OPEC limits. Still, the removal of geopolitical uncertainty is proving to be a negative for oil prices. With a clean break below 70, there could be more selling in the cards and traders may be wary of taking long positions given the strength of the sell-off. The American Petroleum Institute (API) will report inventory data later today.

|

Strategy (50DTE, ATM) |

Strikes |

POP |

Max Profit |

Max Loss |

|

Iron Condor |

Long 67 p Short 67.5 p Short 71 c Long 71.5 c |

23% |

+370 |

-130 |

|

Short Strangle |

Short 67.5 p Short 71 c |

59% |

+4270 |

x |

|

Short Put Vertical |

Long 67 p Short 67.5 p |

59% |

+190 |

-310 |

|

Symbol: FX |

Daily Change |

|

/6AH5 |

-0.4% |

|

/6BH5 |

+0.34% |

|

/6CH5 |

-0.36% |

|

/6EH5 |

+0.41% |

|

/6JH5 |

+0.63% |

British pound futures (/6BH5) hovered near the highest levels traded since mid-December as the dollar takes a hit against its major peers on economic concerns. Traders are hoping an accelerated rate cut scheme by the Bank of England (BoE) could revive the economy in the United Kingdom, and policymakers have sent signals recently that they may step up the pace of rate cuts. However, the currency’s direction may rely on the strength of the dollar as traders look ahead to the inflation report due on Friday.

|

Strategy (38DTE, ATM) |

Strikes |

POP |

Max Profit |

Max Loss |

|

Iron Condor |

Long 1.255 p Short 1.26 p Short 1.275 c Long 1.28 c |

24% |

+225 |

-87.50 |

|

Short Strangle |

Short 1.26 p Short 1.275 c |

50% |

+1075 |

x |

|

Short Put Vertical |

Long 1.255 p Short 1.26 p |

65% |

+112.50 |

-200 |

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.