Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

China’s RRR cut drives USD losses in Asia

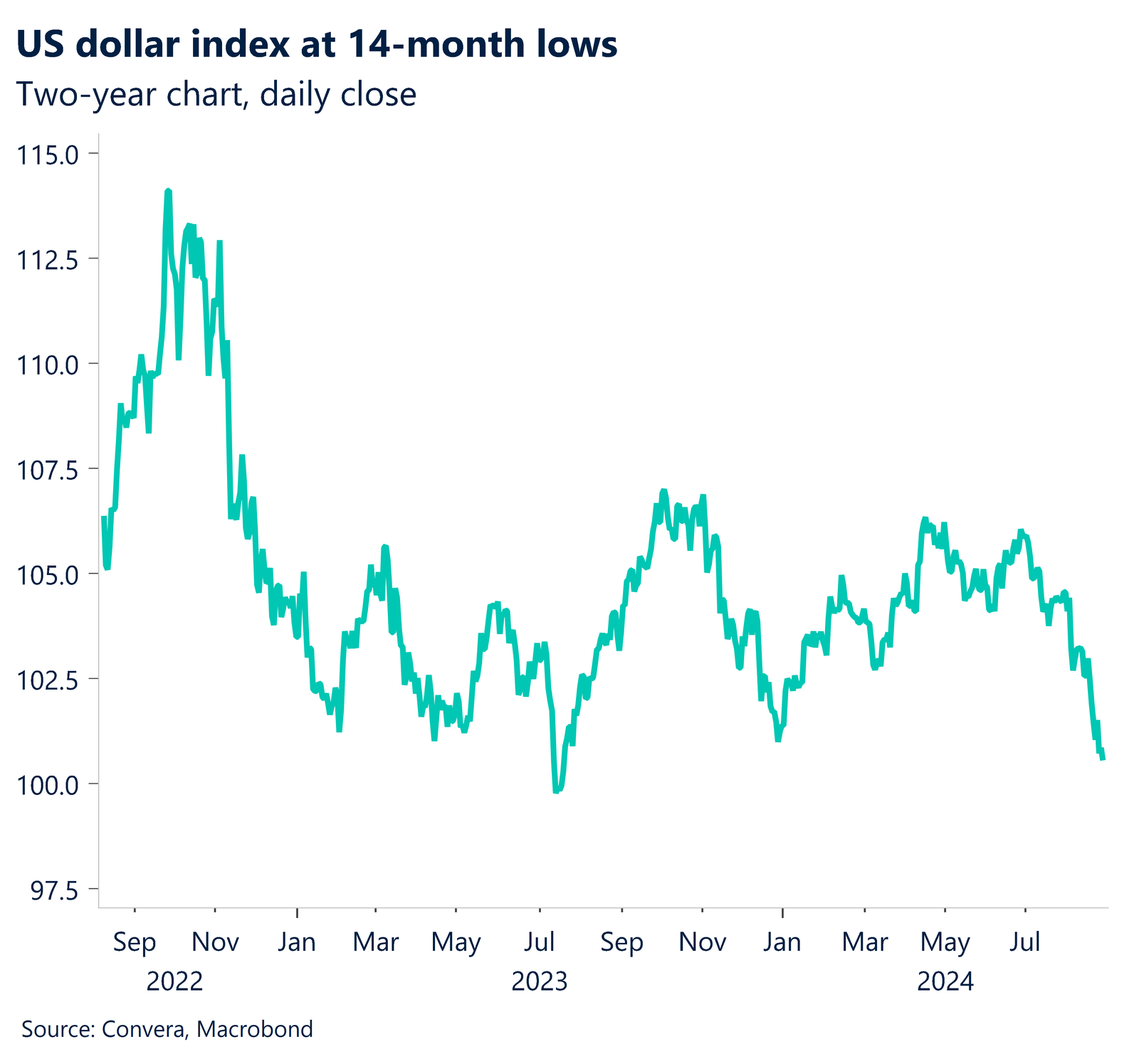

The US dollar’s September-quarter sell-off extended overnight with the US dollar index closing at the lowest level since July 2023.

Last week’s jumbo cut from the Federal Reserve continued to reverberate through markets with key global equity markets making new high.

Local sentiment was also boosted by news Chinese authorities had cut the reserve ratio requirement, a key measure that historically drives bank lending, and signaled further cuts in the benchmark loan prime rate.

Asian FX surged on the China news with the USD/CNH dropping 0.7% — its biggest one-day loss in two months. The USD/CNH hit the lowest level since May 2023.

The USD/SGD fell 0.6% as it hit the lowest level since 2014.

The Australian and NZ dollars were also higher.

The NZD/USD hit the highest level for 2024 with a 1.1% gain while the AUD/USD climbed 0.8%.

Aussie at 14-month highs after RBA

RBA left rates unchanged in line with market expectations. The RBA kept its hawkish stance while stressing that it is determined to get inflation back to target and pointing out how tight labour markets are.

Today at 11.30 AEST, Australian CPI indicator will be key to watch.

According to our estimates, base effects and a roughly 2% month-over-month drop in gasoline prices in August caused CPI inflation to moderate to 3.2% y-o-y in August from 3.5% y-o-y in July.

As in August, the mid-month estimate of the CPI indicator will probably be helpful in solidifying Q3 CPI projections and offering more details on pressures on service prices, many of which are recorded in the mid-month of every quarter.

The AUD/USD’s short-term momentum has turned more positive after closing above key resistance near 0.6825 with key moving average clusters now pointing higher. Longer-term resistance is located just over 0.7000.

The AUD/USD ended at 14-month highs whilst AUD/EUR is now at two-month highs.

Taiwan dollar navigates industrial production data

As the US dollar strengthened across Asia in 2024, some of the most significant losses were in the Taiwan dollar, with USD/TWD climbing to eight-year highs. USD/TWD posted 3.97% YTD gains.

As AI-related tech production is expected to stay robust, we anticipate that industrial production growth will increase to 14.6% y-o-y in August from 12.3% in July. Meanwhile, output growth in non-AI tech items may moderately rebound due to a pickup in seasonal demand.

We have a more positive stance on TWD in-line with gains in other Asian FX markets.

Aussie, kiwi at top of range

Table: seven-day rolling currency trends and trading ranges

Key global risk events

Calendar: 23 – 28 September

All times AEST

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Have a question? [email protected]