Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

Powell’s slight dovish remarks drive market sentiment

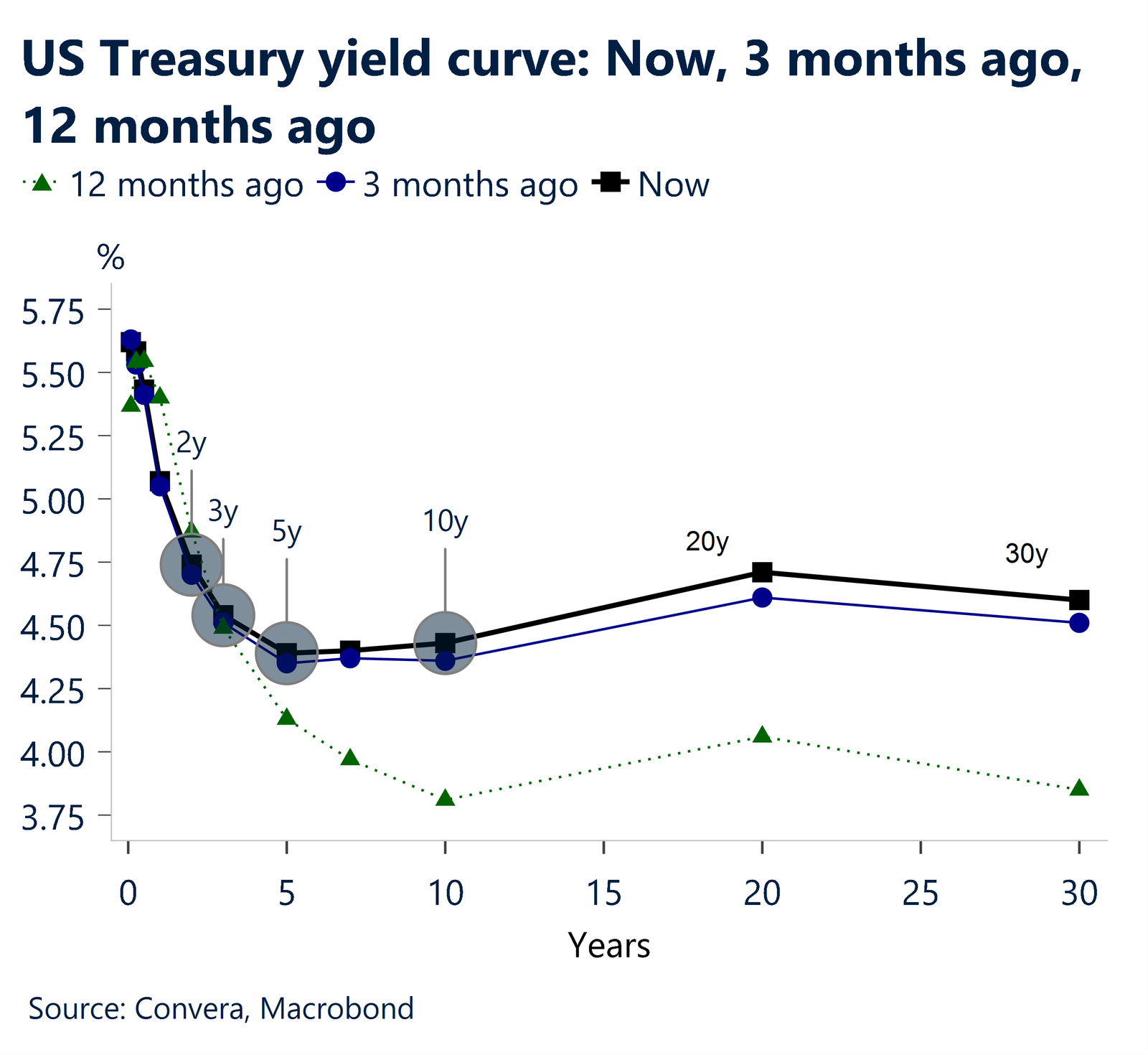

US Federal Reserve Chair Jerome Powell’s slightly dovish delivery at Sintra influenced markets overnight. Treasury yields experienced a slower-tempo bull-steepening on diminished volumes, with US fixed income marginally underperforming European counterparts.

FX markets show mixed results

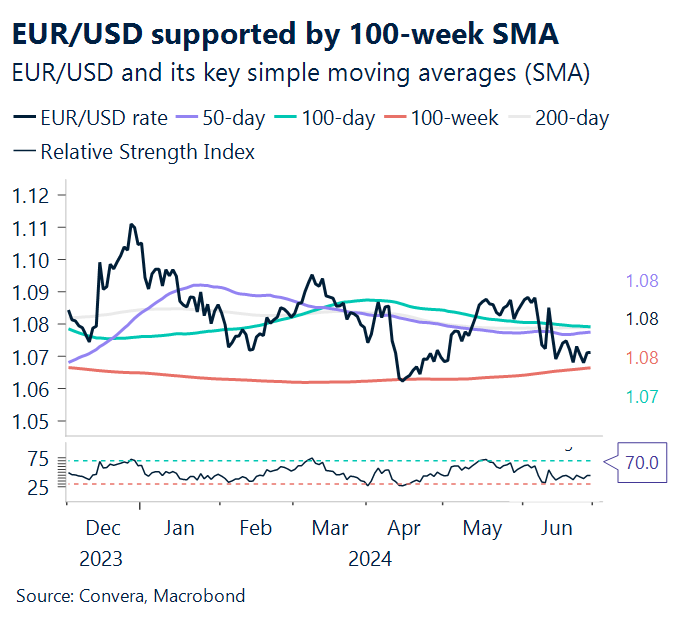

The US dollar traded mixed, with notable moves in select local markets like ZAR at NY close. JPY still hovering above 160 handle, while EURUSD found support at 1.0700.

Asia-Pacific focus

Australian retail sales data, expected to show acceleration, could support the AUD. The People’s Bank of China’s fix may overshadow Caixin China PMIs, with an elevated USDCNY fix potentially keeping USDCNH stuck at 7.30.

Key events to watch (SGT times)

Australian retail sales data (9:30 AM SGT)

Caixin China PMIs (9:45 AM SGT)

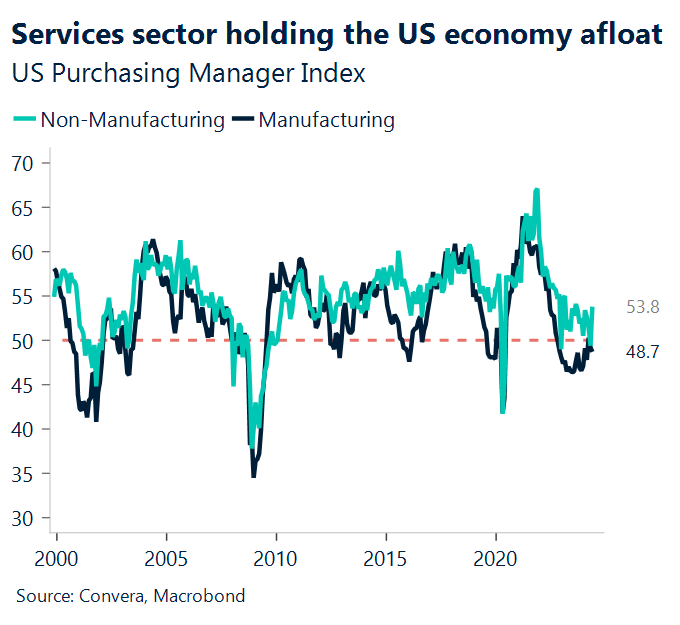

Dollar firm as ISM Services data unlikely to alter Fed outlook

We anticipate a small decline in ISM services from 53.8 in May to 53.0 in June. The results of the month’s national and local Fed service surveys have been inconsistent. Survey responses point to pessimism because of the uncertainties around interest rates. A large spike in the supplier delivery index in May, which indicated slower deliveries, contributed to some of the rise. In June, this is probably going to normalize.

The rate market finds it difficult to factor in more Fed cuts in the face of conflicting economic data, particularly in light of the Fed’s aggressive June forward guidance. We remain positive on DXY.

Euro struggles as US exceptionalism overshadows regional developments

We anticipate an m-o-m increase in producer prices of 0.1%. With a 0.8% month-over-month increase in May, Spain makes up the greatest portion of the contribution, with PPI growth remaining constant in Germany, the largest nation.

Motivated more by US exceptionalism than by recent political developments, we are less enthusiastic about EUR.

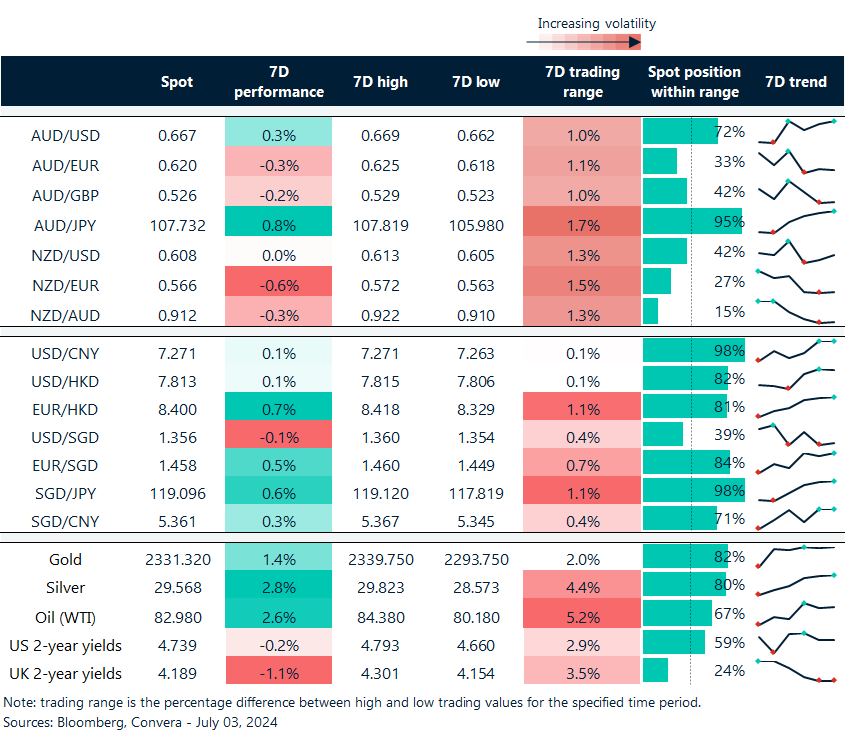

AUD/JPY at highest since 1992

Table: seven-day rolling currency trends and trading ranges

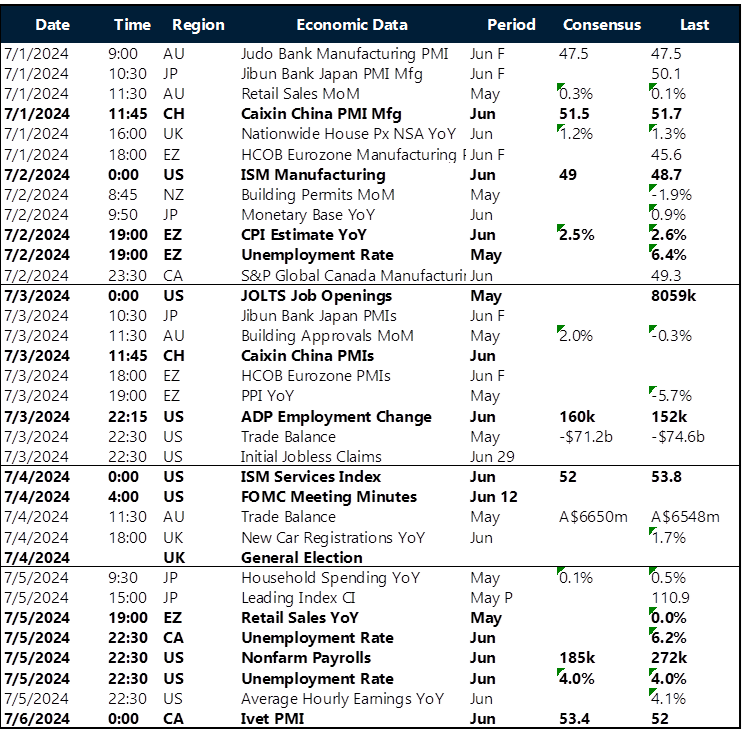

Key global risk events

Calendar: 1 – 6 July

All times AEST

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Have a question? [email protected]