(Bloomberg) — Shares in Asia opened higher Monday as markets shifted focus to key US data prints this week for further insight into the health of the world’s biggest economy. The yen pulled further off the seven-month high it touched last week.

Most Read from Bloomberg

Equity benchmarks for Australia and South Korea both gained, while stock futures for Hong Kong slipped. Contracts for US equities were little changed in early Asian trading, after the S&P 500 climbed 0.5% on Friday. Japan was closed for a public holiday.

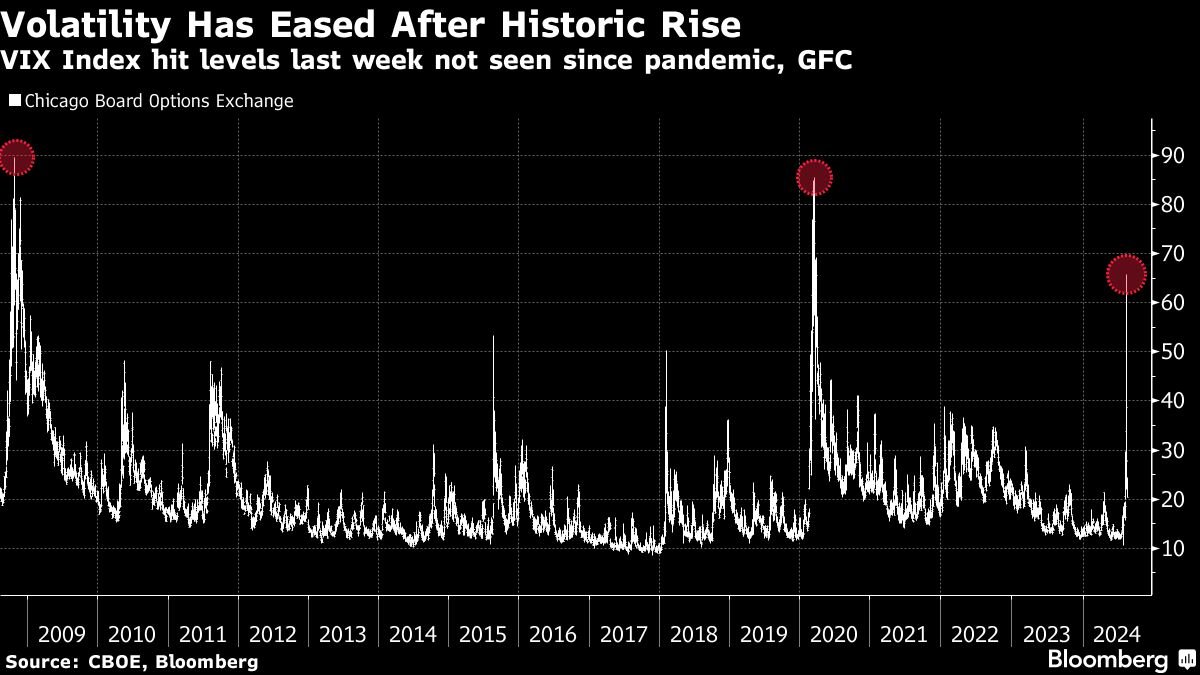

A semblance of calm is returning after markets were ravaged early last week from fears the Federal Reserve would make quick, sharp rate cuts to stave off a deep recession. The Cboe Volatility Index – Wall Street’s fear gauge – has reversed off its highest since the early days of the Covid-19 pandemic. The yen was 0.2% weaker against the greenback on Monday, after surging a week ago as traders slashed bearish bets following the Bank of Japan’s rate hike.

Given investors are focused on the chance of a US recession, markets will be sensitive to data that shows weakness in consumer prices, producer prices and retail sales, said Chris Weston, head of research at Pepperstone Group in Melbourne. “The market is still on edge and would look to reengage with recession trades, with cries that the Fed are ‘behind the curve’ if the data shows further softening.”

Elsewhere in Asia, traders will be focused on China’s one-year medium term lending rate as well as retail sales and industrial production data this week to gauge whether the nation’s economy is finding traction.

China is still battling bond market speculators, with state banks selling bonds to buoy yields. Sovereign yields rebounded last week after authorities intensified their fight against bond bulls. The economy needs more stimulus as the latest leading indicators point to a loss of recovery momentum around mid-year, according to Bloomberg Economics.

New Zealand’s central bank will also decide on policy this week, with the economy showing signs of entering its third recession in less than two years. Australian and New Zealand government bonds were little changed on Monday while Treasuries are closed for trading in Asia due to the holiday in Japan.

Economic Downturn

A tumultuous week for global bond markets headed toward calm on Friday as angst over the potential US economic downturn — which spurred a Treasury rally and brief market meltdown — faded.

The US consumer price index on Wednesday is expected to have risen 0.2% from June for both the headline figure and the so-called core gauge that excludes food and energy. The modest moves, however, may not be enough to derail the Fed from a widely anticipated interest-rate cut next month.

At the weekend, Fed Governor Michelle Bowman said she still sees upside risks for inflation and continued strength in the labor market, signaling she may not be ready to support an interest-rate decrease when US central bankers next meet in September. Money markets have fully priced a rate cut in September and about 100 basis points of easing for the year, according to swaps data compiled by Bloomberg.

“If you kind of forget the noise early in the week, this seems like the right place to settle in,” Bryan Whalen, chief investment officer and a generalist portfolio manager at TCW Group, said on Bloomberg Radio. “It’s a nervous market.”

In commodities, oil was steady on Monday following a 4.5% gain last week. Some of the top US oil refiners are throttling back operations at their facilities this quarter, adding to concerns that a global glut of crude is forming. Gold was also little changed.

Some key events this week:

-

RBA Deputy Governor Andrew Hauser speaks, Monday

-

India CPI, industrial production, Monday

-

Australia consumer confidence, Tuesday

-

Japan PPI, Tuesday

-

South Africa unemployment, Tuesday

-

UK jobless claims, unemployment, Tuesday

-

Home Depot earnings, Tuesday

-

US PPI, Tuesday

-

Atlanta Fed President Raphael Bostic speaks, Tuesday

-

Eurozone GDP, industrial production, Wednesday

-

New Zealand rate decision, Wednesday

-

South Korea jobless rate, Wednesday

-

Poland CPI, Wednesday

-

UK CPI, Wednesday

-

US CPI, Wednesday

-

Australia unemployment, Thursday

-

Japan GDP, industrial production, Thursday

-

Philippines rate decision, Thursday

-

China home prices, retail sales, industrial production, Thursday

-

Norway rate decision, Thursday

-

UK industrial production, GDP, Thursday

-

US initial jobless claims, retail sales, industrial production, Thursday

-

St. Louis Fed President Alberto Musalem, Philadelphia Fed President Patrick Harker speak, Thursday

-

Alibaba Group, Walmart earnings, Thursday

-

Hong Kong jobless rate, GDP, Friday

-

Taiwan GDP, Friday

-

US housing starts, University of Michigan consumer sentiment, Friday

-

Chicago Fed President Austan Goolsbee speaks, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures were little changed as of 9:27 a.m. Tokyo time

-

Hang Seng futures were little changed

-

Australia’s S&P/ASX 200 rose 0.7%

-

Euro Stoxx 50 futures were little changed

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was unchanged at $1.0917

-

The Japanese yen fell 0.2% to 146.93 per dollar

-

The offshore yuan was little changed at 7.1768 per dollar

-

The Australian dollar was little changed at $0.6576

Cryptocurrencies

-

Bitcoin rose 0.3% to $58,689.31

-

Ether fell 0.1% to $2,555.2

Bonds

Commodities

-

West Texas Intermediate crude was little changed

-

Spot gold fell 0.2% to $2,427.61 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Richard Henderson.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.