The sudden appreciation of the yen in the wake of the Bank of Japan’s surprise interest rate hike and hawkish stance is largely seen as the main reason the Nikkei stock index’s recent plunge eclipsed those of global markets.

With the yen apparently beginning to stabilize, the equities market will likely return to calm. But whether the Nikkei index rebounds toward the 40,000 level remains to be seen due to the unclear prospects of the U.S. economy, analysts say.

The “BOJ shock” was behind the crash that led the benchmark to shed some 7,600 points during a three-day losing streak through Monday, said Chihiro Ota, assistant general manager of investment research at SMBC Nikko Securities Inc.

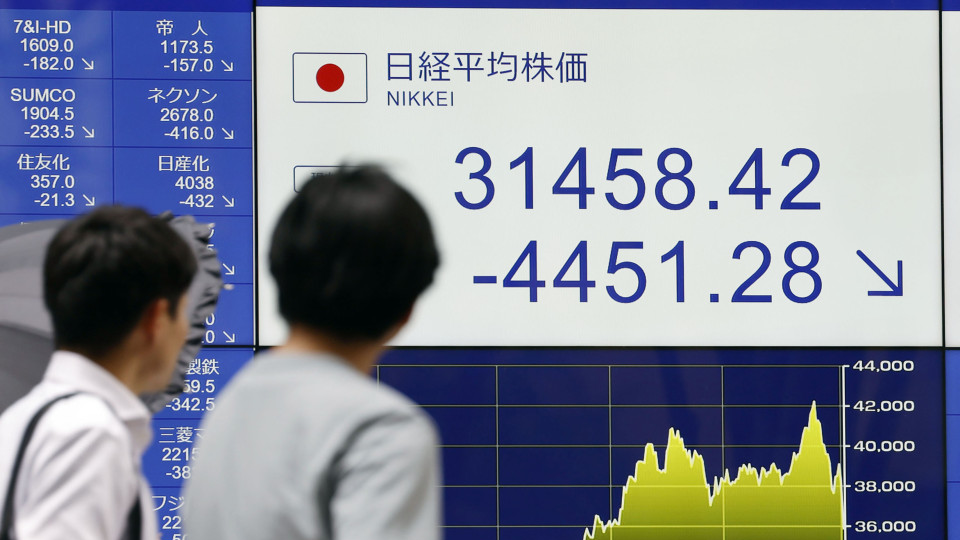

The Nikkei suffered its largest single-day point drop of 4,451.28 points and lost 12.4 percent Monday, after the central bank raised its policy interest rate to around 0.25 percent on July 31.

Pedestrians look at a financial monitor in Tokyo’s Marunouchi business district on Aug. 5, 2024, showing the Nikkei Stock Average ending over 4,400 points lower from the previous day’s close for its largest single-day point drop. (Kyodo) ==Kyodo

The yen, which had dropped to its lowest level in 37 years, toward 162 against the dollar in early July, soared to the 141 zone on Monday after Governor Kazuo Ueda signaled further interest rate hikes could be on the table.

Selling of stocks was further fueled by fears of a potential U.S. recession after employment data from the country came in weaker-than-expected, triggering a worldwide rout amid global risk-off sentiment, with some concerned that the Federal Reserve, seen on course to cut interest rates in September, had waited too long to take monetary easing steps.

“About 70 percent to 80 percent of the decline in Japanese stocks is attributable to the strong yen, while concerns about the U.S. economy account for about 20 percent to 30 percent,” said Ota.

The strengthening of the yen directly affects stocks as it erodes the value of foreign earnings for Japanese exporters, leading to fears of a substantial hit to corporate profits.

“The earnings structure of Japanese listed firms is very (prone to be) negatively impacted by a strong yen, as even companies once considered domestic, like retail, now earn a significant portion of their revenue from overseas,” he said.

Another factor contributing to the Nikkei’s tumble is the unwinding of a popular investment strategy known as the carry trade, which involves borrowing in a low-interest-rate currency to make investments in a higher-rate currency, analysts said.

Japan’s ultra-low interest rates have made the yen the favored funding currency in recent years, but the BOJ’s surprise rate hike meant it was no longer so cheap to borrow.

Investors that borrowed faced margin calls as the yen appreciated, forcing them to sell their assets in global markets to buy yen and cover their positions, pushing the currency even higher, analysts said.

But James Malcolm, a Japan macro strategist at UBS, was wary of putting too much blame on the BOJ for the recent Japanese stock market crash, saying instead that the timing was simply unfortunate.

A financial data screen in the western Japan city of Osaka shows the 225-issue Nikkei Stock Average plunging more than 4,700 points in afternoon trading on Aug. 5, 2024. (Kyodo) ==Kyodo

“This is not just about Japan and this is definitely not about Mr. Ueda having given a hawkish surprise,” said Malcolm. “The carry trade was already unwinding and then the big push came from the (U.S.) nonfarm payrolls report being weak.”

Meanwhile, some pointed out that the Nikkei’s historic one-day loss appeared excessive, as it was further compounded by algorithmic trading mainly used by institutional investors and hedge funds to swiftly place buy or sell orders via a computer program.

Such practices led to “a chain reaction of trades,” said Seiichi Suzuki, chief equity market analyst at Tokai Tokyo Intelligence Laboratory Co., caused by stop-loss sell orders by financial institutions and forced selling by individual investors due to insufficient margins.

“While the record drop was shocking, it was an overreaction. If it were solely due to the yen’s strength and the carry trade, the market wouldn’t have rebounded so much,” he said, referring to the Nikkei bouncing back with the biggest-ever point rise the following day.

“The fact that it did suggests that the trading itself had become extremely technical, reaching prices that were not justified by fundamentals,” Suzuki added.

After a few days of turbulence, the Japanese stock market appears to have somewhat stabilized, with the yen retreating to the 147 range versus the dollar on Friday after BOJ Deputy Governor Shinichi Uchida expressed a cautious stance over further interest rate hikes.

While there is a general consensus that the worst of the volatility has run its course, uncertainties linger on whether the Nikkei will move toward the record closing high of 42,224.02 registered on July 11 from the 35,000 level as of Friday.

“If the BOJ adopts a dovish stance, it may lead to a slight weakening of the yen,” said Shinichiro Kadota, director of Research at Barclays Securities Japan Limited.

“However, the global risk-off trend and the state of the U.S. economy are more critical factors. Unless those areas stabilize, a full recovery might take some time,” he added.

Related coverage:

BOJ won’t raise rates when financial markets unstable: deputy chief

Japan spent record 5.92 tril. yen a day to boost yen in April

Japanese government, BOJ on alert amid market volatility, to work closely