Bitcoin’s status as a hedge against monetary debasement could be bolstered by China’s growing national debt.

China is considering the approval of more than 10 trillion yuan of debt, worth about $1.4 trillion, as part of a fiscal package that could increase with the potential reelection of Republican Party Presidential candidate Donald Trump, anonymous sources familiar with the matter told Reuters.

If approved, the yuan debt would be raised over the following three years, with the proceeds used to help local governments address debt risks.

Reports of the potential debt could increase interest in Bitcoin’s BTCUSD status as a hedge against monetary debasement among traders in mainland China, according to Arthur Hayes, the co-founder of BitMEX.

The potential debt raise could present a “great buying opportunity,” Hayes wrote in an Oct. 28 blog post:

“The fact economists are bearish on the size and scale of the stimulus so far presents a great buying opportunity. Because when the average wealthy coastal living Zhou decides they must have Bitcoin at any yuan price, the upside price volatility will harken back to August 2015.”

Hayes’ prediction comes shortly after Bitcoin surpassed $70,000 for the first time since June 10, bolstered by growing anticipation of the US presidential elections on Nov. 5.

Bitcoin price saw a 5x last time China raised debt

Hayes’ predictions are partly based on Bitcoin’s historic performance after periods of large national debt increases and currency devaluations.

Bitcoin price saw an over five-fold increase in 2015 when the People’s Bank of China (PBOC) executed three consecutive devaluations of the Chinese yuan, which lost over 3% of its value, Hayes added:

“[In August 2015] when, after a shock yuan devaluation by the PBOC, Bitcoin went from $135 to $600 — an almost 5x pump in under 3 months.”

Investors like MicroStrategy’s Michael Saylor have described Bitcoin as the best hedge against inflation and fiat currency devaluation.

Asian buyers are driving Bitcoin’s breakout toward new highs: Nansen

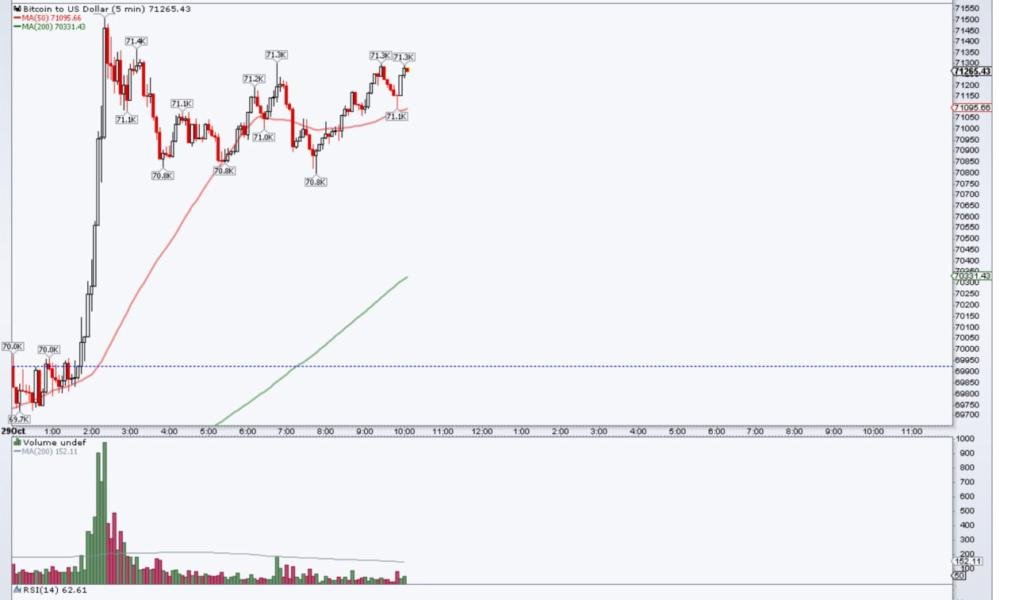

The Bitcoin price is setting up for a breakout to a new all-time high on the five-minute chart.

Asian buyers have been a significant driver of this price momentum, according to Aurelie Barthere, the principal research analyst at Nansen.

Barthere told Cointelegraph:

“BTC broke higher to tackle the all-time highs at 1:30 a.m. CET, so it was clearly driven by Asian buyers. It is not possible to say whether the price break is related to the fiscal/ debt announcement from China, to pre-US-election excitement, or even just price reflexivity, with BTC showing a positive trend. It might be a combination of different factors.”

Bitfinex analysts also predict a Bitcoin rally to $80,000 before the end of 2024, driven by the options market structure and the prospect of a Republican presidential victory.

A victory by Trump in the Nov. 5 US presidential election is widely seen as a bullish development for risk assets like Bitcoin, which has correlated with Trump’s rising election odds.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.