Item 1 of 2 Chinese Yuan banknotes are seen in this illustration picture taken June 14, 2022. REUTERS/Florence Lo/Illustration/File Photo

NEW YORK, Sept 24 (Reuters) – China’s yuan hit a 16-month high against the U.S. dollar on Tuesday, after the central bank of the world’s second-largest economy revealed new stimulus measures, while the greenback extended declines against other major currencies after soft data on the consumer.

The Chinese yuan strengthened 0.65% against the greenback to 7.017 per dollar after reaching 7.0156 on the session.

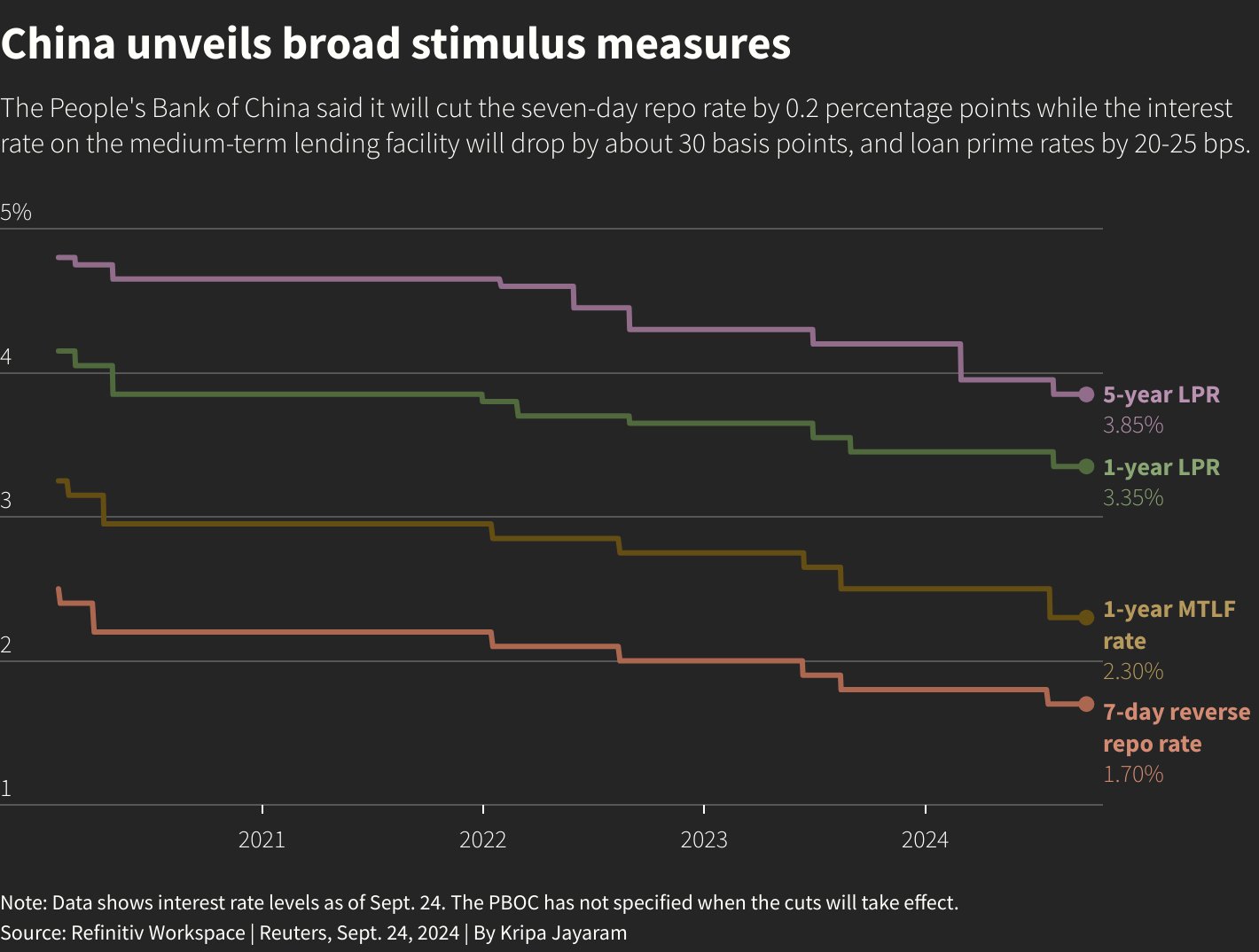

“It hit all the things that people wanted to see – more support for the housing market, lower interest rates, reserve rate cut and that support for the stock market,” said Marc Chandler, chief market strategist at Bannockburn Global Forex in New York.

“At least initially the market is giving Beijing the benefit of the doubt … I’m not convinced that the underlying problems, the underlying challenges are really being addressed.”

The dollar index , which measures the greenback against a basket of currencies including the yen and the euro, fell 0.44%, on track for its biggest daily percentage drop in two weeks, to 100.49. The dollar had fallen for three straight weeks on expectations for a rate cut from the Federal Reserve, which delivered an upsized 50 basis point cut last week.

The euro climbed 0.46% at $1.1163.

Multiple Fed officials are scheduled to speak this week including Fed Chair Jerome Powell as well as Governors Lisa Cook and Adriana Kugler.

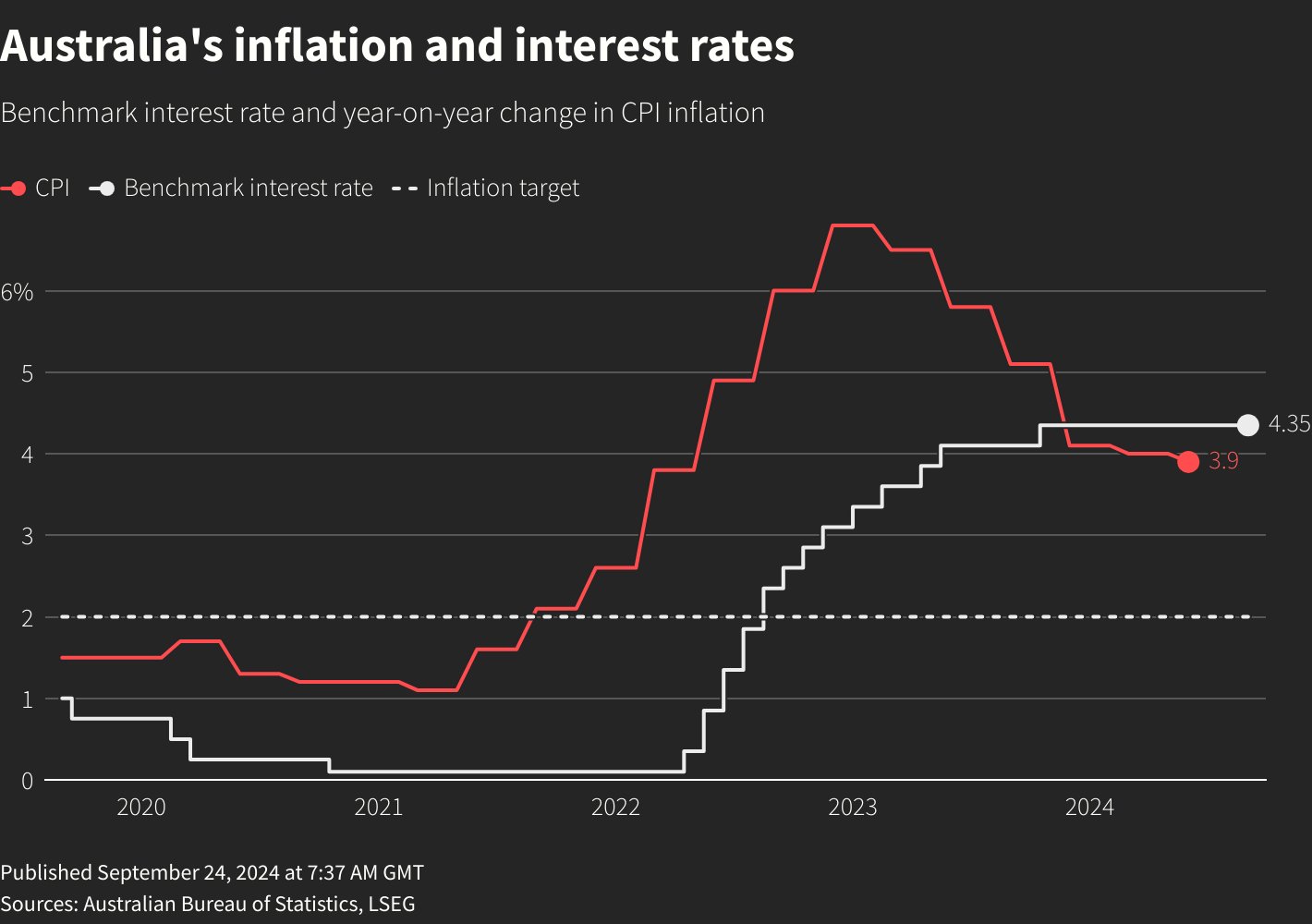

Analysts at Goldman Sachs said that they consider the RBA’s decision not to explicitly consider a rate cut “as a mini pivot in the dovish direction.”

Policy announcements are also expected from the Swiss National Bank, which is expected to cut by 25 bps, and Riksbank, which is also seen cutting by 25 bps, this week.

Sterling strengthened 0.37% to $1.3395.

Sign up here.

Reporting by Chuck Mikolajczak, Editing by Nick Zieminski and Deepa Babington

Our Standards: The Thomson Reuters Trust Principles.