Item 1 of 2 Bull statues are placed in font of screens showing the Hang Seng stock index and stock prices outside Exchange Square, in Hong Kong, China, August 18, 2023. REUTERS/Tyrone Siu/File Photo

“We have seen further profit-taking pressure on Korea and Taiwan due to the shift in momentum on global AI/semiconductor investment theme,” said Jason Lui, head of APAC equity and derivative strategy at BNP Paribas.

“Some of the capital from East Asia (Japan, Korea, Taiwan) may have been reallocated back to HK/China as well.”

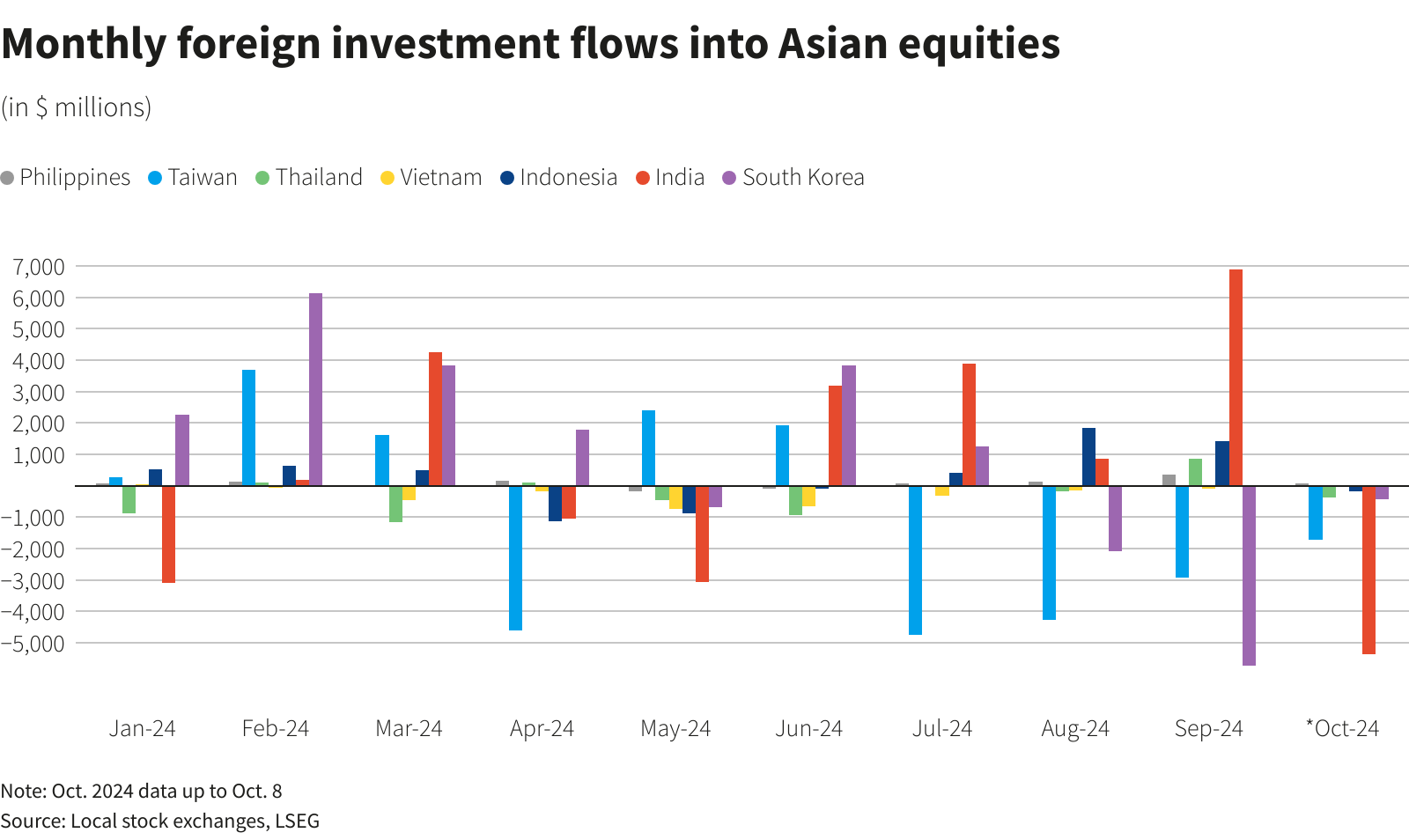

Taiwanese and South Korean stocks saw foreign net outflows of about $1.71 billion and $426 million, respectively, following $2.94 billion and $5.73 billion worth of net selling in September.

Overseas investors have, meanwhile, snapped up a net $5.81 billion worth of China-focused funds since the beginning of this month, LSEG Lipper data showed.

Indian equities trade at a price to 12-month forward earnings ratio (P/E) of 23.24 compared with a P/E of 12.63 for Asia. The P/E for Chinese shares is just 10.34.

According to Yeap Jun Rong, market strategist at IG: “The India story remains compelling for foreign investors despite softer growth momentum, as economic fundamentals are still strong.”

Thai and Indonesian stocks also saw $375 million and $176 million worth of net outflows, respectively, following $860 million and $1.42 billion worth of net inflows in September.

“We may expect a more cautious stream of inflows for the region as we head into the U.S. election, which adds a layer of uncertainty for global markets,” IG’s Rong said.

Sign up here.

Reporting by Gaurav Dogra in Bengaluru

Editing by Mark Potter

Our Standards: The Thomson Reuters Trust Principles.