US President Donald Trump has clubbed India among the most-tariffed nations with tariffs of 26%

read more

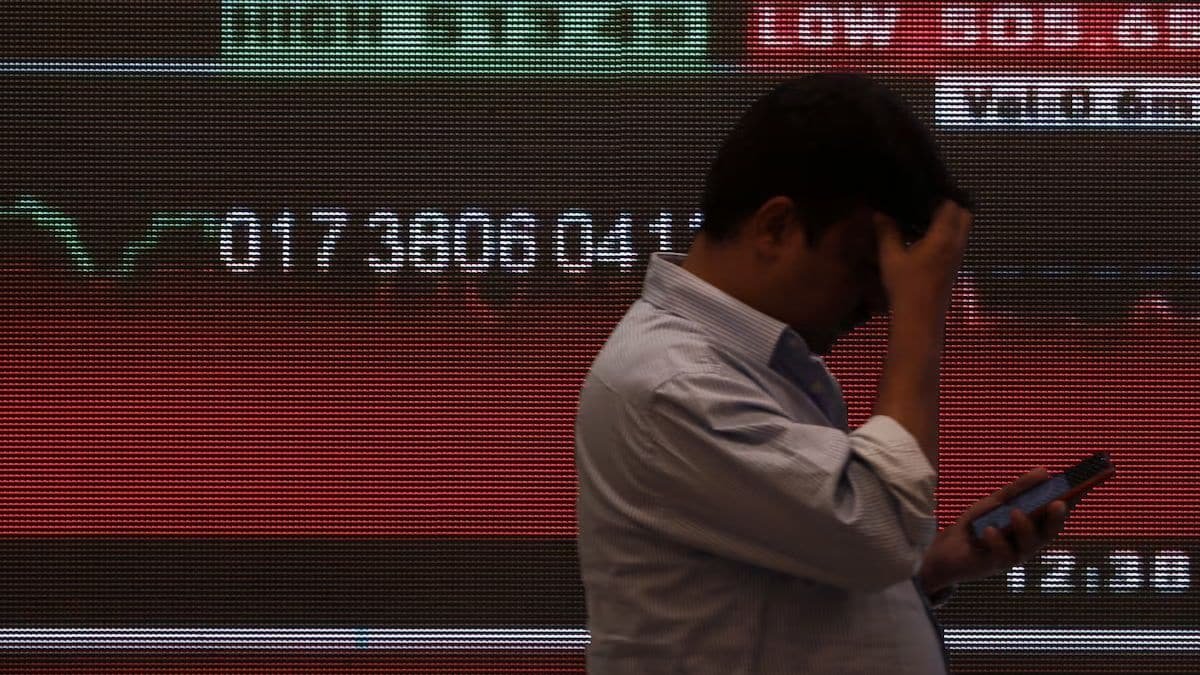

Indian shares are set to open lower on Thursday and remain under pressure after US President Donald Trump imposed a 26 per cent reciprocal tariff on imports from the South Asian nation, a level that caught some analysts by surprise.

The GIFT Nifty futures were trading down 0.22 per cent at 23,178.5 as of 8:30 am IST, indicating that the blue-chip Nifty 50 index will open below Wednesday’s close of 23,332.35.

The Indian rupee is also poised to fall, driven by the decline in Asian equity and currency markets.

Trump’s tariff announcement on India on Wednesday was part of his plan to impose a 10 per cent baseline tariff on all trade partners from April 5, with higher duties on dozens of other countries, including 34 per cent on China from April 9.

Macquarie analysts said the 26 per cent reciprocal tariffs on India are “much worse than what we had anticipated”.

It seems likely that US effective tariffs, even after negotiations, are likely to rise to about 20-25 per cent, a far worse outcome than anticipated, Macquarie estimated.

Other Asian markets plunged on the day, with MSCI Asia ex Japan down 1 per cent, as investors fled to the safety of bonds, gold and the yen as the unexpectedly steep tariffs threatened to upend trade and supply chains.

“There were some expectations that India would have some concessions. But the silver lining is that tariffs (for India) are lower than China, Taiwan, Vietnam and several other ASEAN countries,” said Ambareesh Baliga, an independent market analyst.

That could make some Indian exports relatively more competitive.

The other silver lining is that pharmaceutical products, among a few others, have been exempted, although analysts and investors await more clarity. For now, this could benefit Indian pharma companies, which count the US as a key market.

On the flip side, IT companies, which also rely heavily on the US, could suffer as clients lower spending with the tariffs expected to drive up domestic inflation.

(This is an agency copy. Except for the headline, the copy has not been edited by Firstpost staff.)