Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

Chinese yuan leads losses as US shares turn

US shares ended their recent winning streak overnight after technology stocks fell following a profit warning from chipmaker ASML while worries about further US restrictions on the international sale of AI chips also hit the sector.

The tech-focused Nasdaq led losses, down 1.4%, while the Dow Jones and S&P 500 both fell 0.8%.

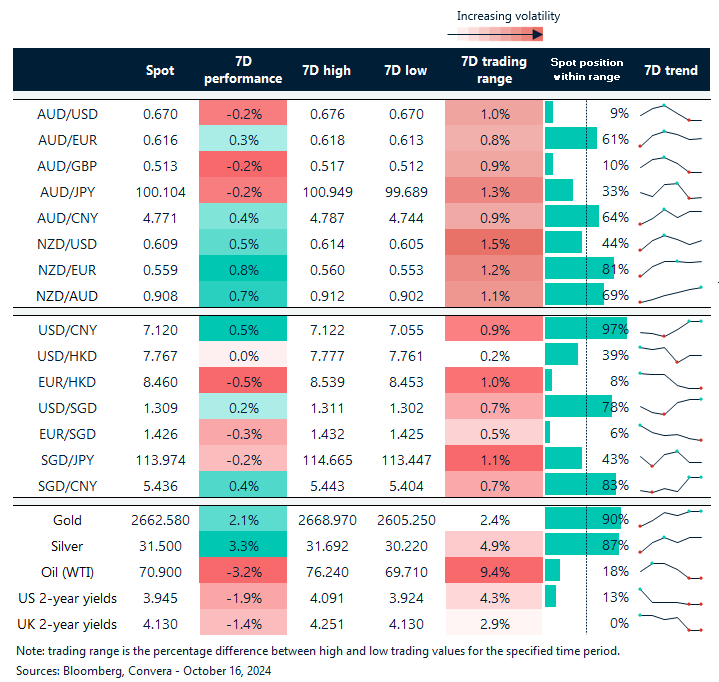

In FX markets, the sharemarket sell-off hit risk sensitive currencies like the Australian dollar, with the AUD/USD down 0.4% as it hit one-month lows. The Aussie’s biggest losses were in the AUD/JPY with the pair down 0.7%.

In other markets, the NZD/USD fell 0.2%, EUR/USD lost 0.2% while GBP/USD gained 0.1%.

In Asia, the USD/JPY fell 0.4% as the 150.00 level continued to provide resistance.

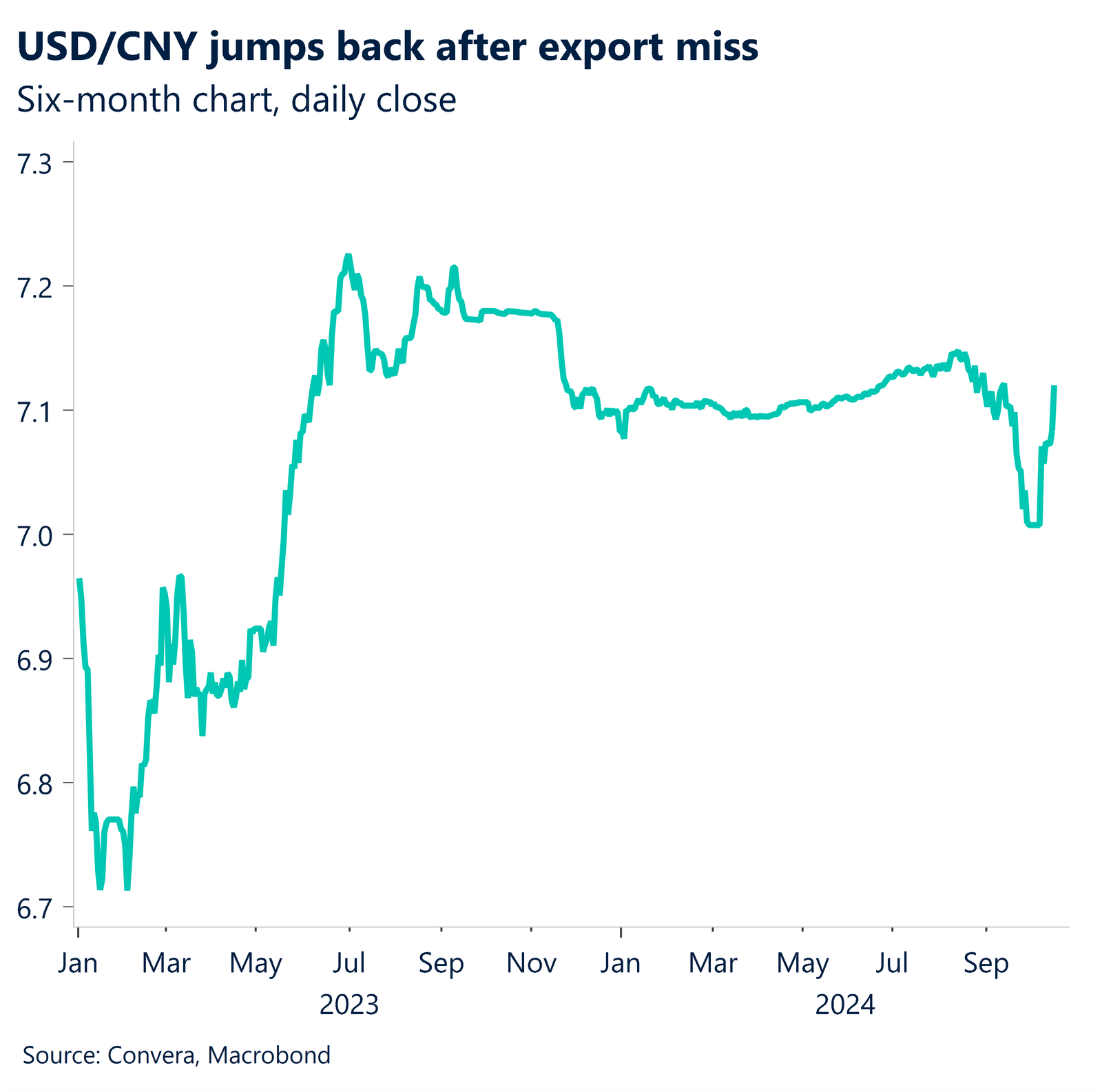

The USD/CNH jumped higher, up 0.5%, as the pair climbed to the highest level in six weeks, following Monday’s weaker export numbers. The Chinese yuan was weaker in other markets.

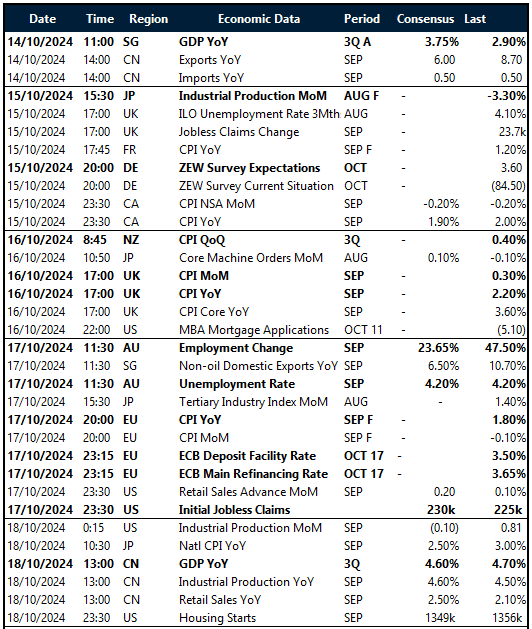

New Zealand CPI key for RBNZ

The New Zealand CPI will be announced at 10.45 NZDT (8.45am AEDT) today. According to our estimates, the headline CPI inflation rate significantly decreased in Q3 from 3.3% y-o-y in Q2 to around 0.5% m-o-m and 2.0% y-o-y.

Certain pricing data indicates that although alcohol and tobacco prices most likely saw only slight decreases in Q3, fuel and lodging costs dropped dramatically.

A symptom of weak demand is likely the moderation of rental inflation and the cost of restaurant meals and ready-to-eat food. Our prediction is much lower than the 2.3% y-o-y RBNZ projection.

NZD/USD might rise in the near term if local data beats expectations since it has already lagged the improvement in local business optimism.

However, risks are growing that the NZD/USD will head lower as the 50-day EMA is likely to cut the 200-day EMA from above – usually seen as a sign of bearish momentum.

Bank of Thailand caution drives THB gains

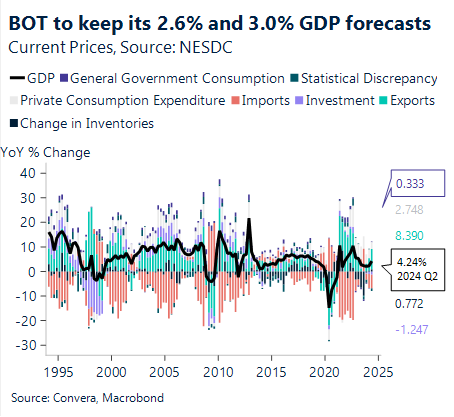

In line with the Bank of Thailand’s (BOT) most recent hawkish direction, we anticipate that the policy rate will remain at 2.50%.

On September 20, BOT Governor Sethaput said that the bank still follows its outlook-dependent strategy and that data-dependence may “create a lot of noise” after the Fed’s 50bp rate decrease that kicked off its rate-cutting cycle.

Furthermore, according to the BOT governor, lowering the policy rate could not have much of an effect on lowering household debt levels.

We believe that the threshold for a reduction is still high, given BOT’s ongoing focus on household debt deleveraging, and we anticipate that BOT will continue to examine the poor economic activity statistics and below-target inflation for the time being.

Additionally, we anticipate that the policy statement’s tone will mostly not change from the previous meetings and that the vote will remain divided 6-1, with the lone dissenter continuing to support a 25bp reduction.

We do anticipate BOT to modestly decrease its headline inflation predictions for 2024—to 0.4% from 0.5% and 1.2% from 1.3%—but to maintain its core inflation forecasts intact at 0.5% and 0.9%, respectively, after highlighting negative risks during the August meeting.

The Thai baht has been remarkably resilient in recent weeks – hitting two-year highs versus the US dollar and four-year highs versus the Australian dollar. In USD/THB, topside targets for THB buyers are at the 21-day EMA at 33.80.

USD/CNY hits top of the range on trade worries

Table: seven-day rolling currency trends and trading ranges

Key global risk events

Calendar: 14 – 18 October

All times AEST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.