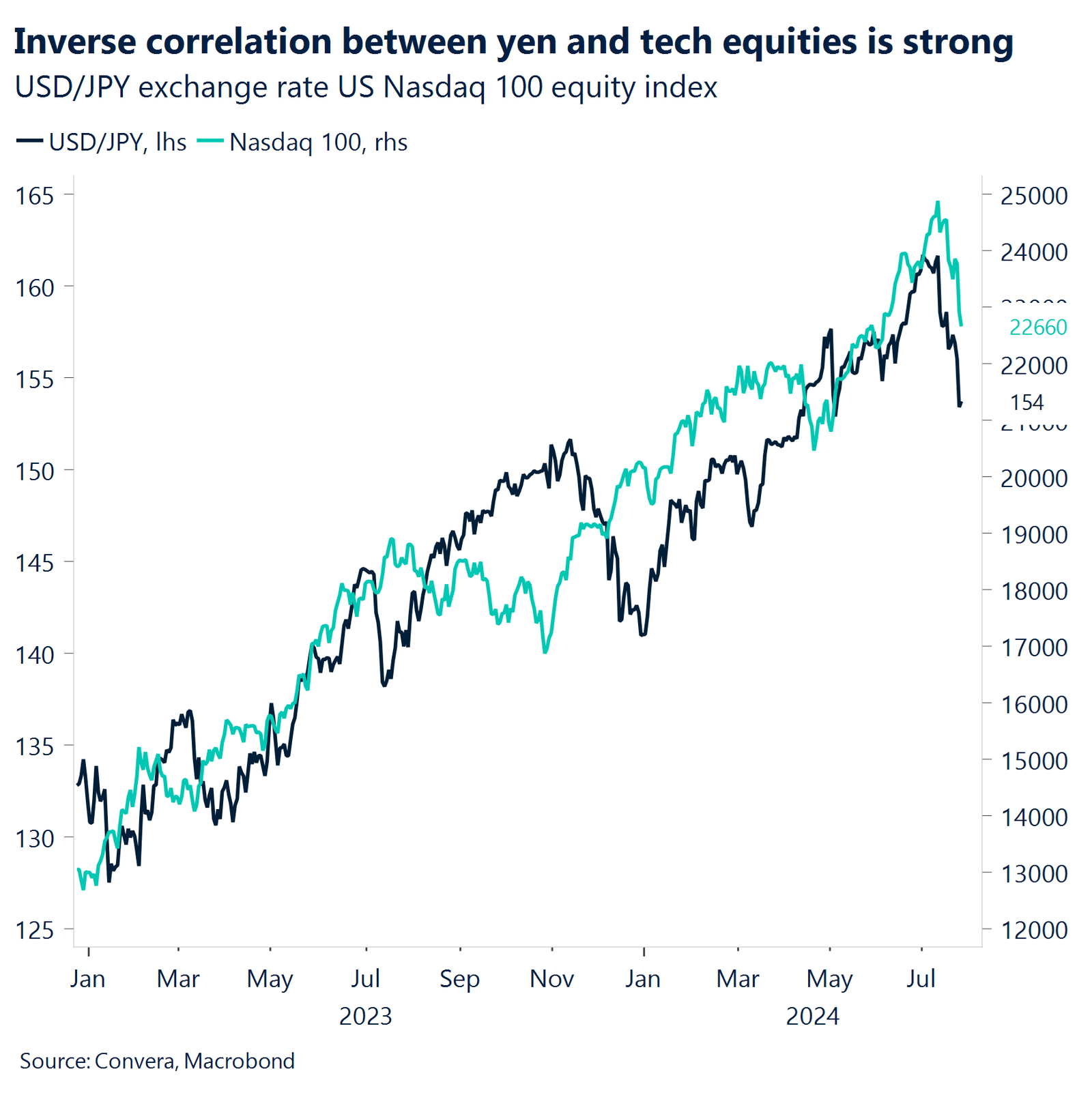

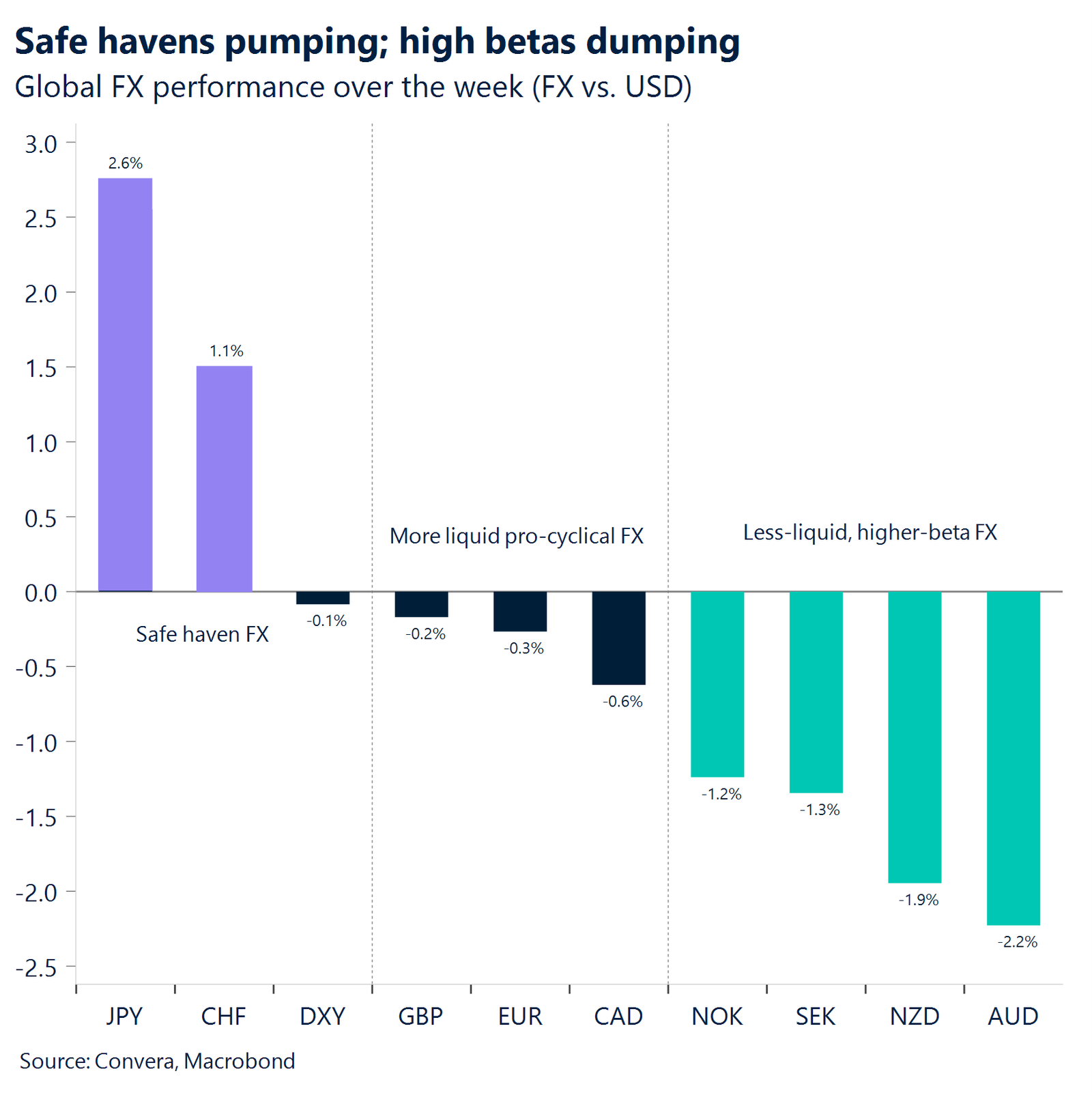

Global risk aversion has gripped markets this week as investors continued to sell some of this year’s top tech stocks amid yen outperformance. The Nasdaq and USD/JPY are down 9% and 4.5% from their peaks reached three weeks ago.

The US consumer is starting to feel the weight of high interest rates with excess savings now largely depleted and credit card delinquency on the rise. Concerns of an economic slowdown are growing, pushing up Fed rate cutting bets.

Political developments in the US remain in the spotlight after President Joe Biden’s decision to drop out of the election. As of now, former President Donald Trump is still the favourite to win, but Biden’s withdrawal adds considerable uncertainty.

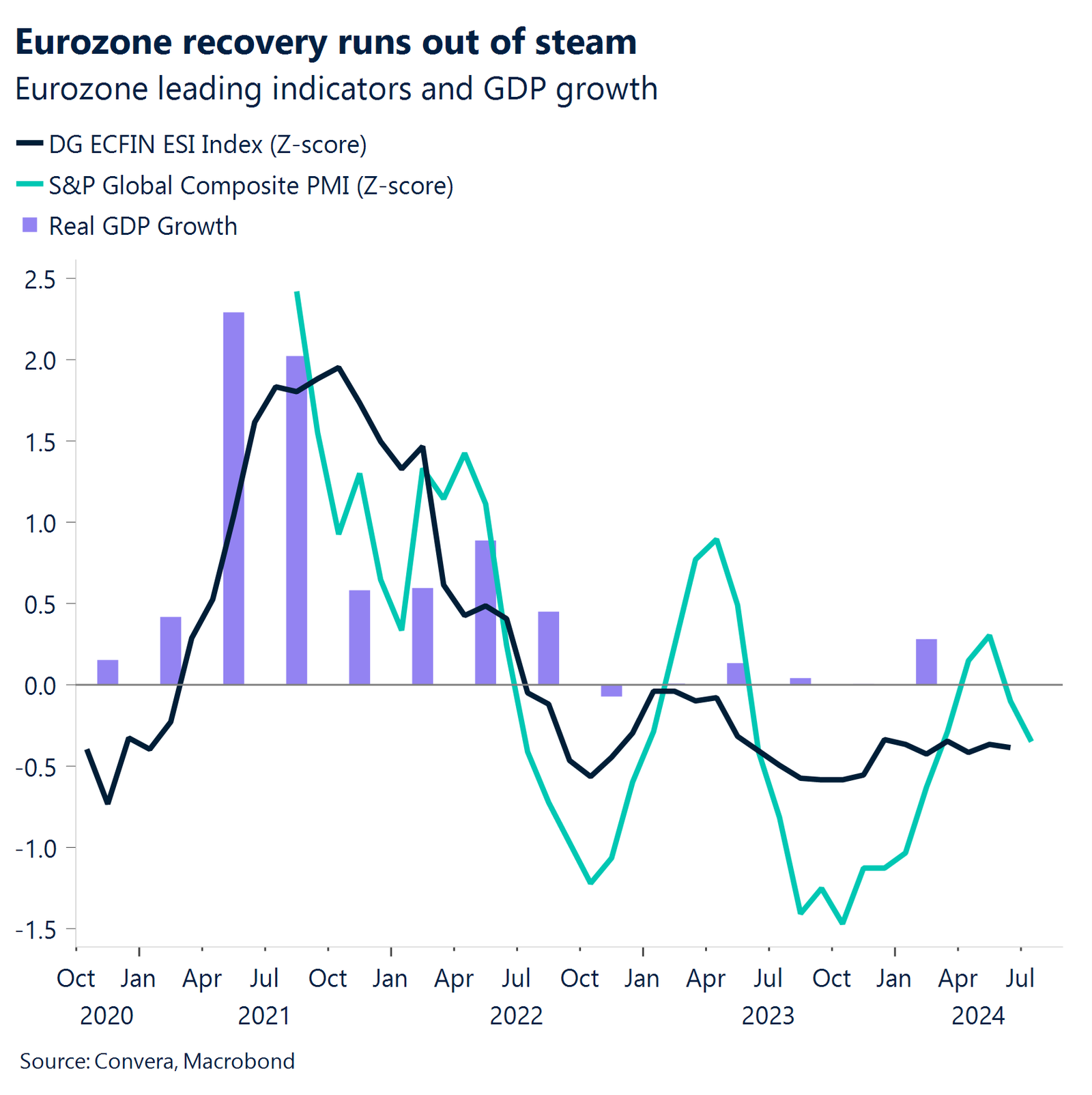

The flash HCOB Eurozone Composite PMI declined to a 5-month low in July, missing expectations. The reading signals a marked slowdown in economic momentum in Q2, driven by a deepening manufacturing downturn and a slowdown in services.

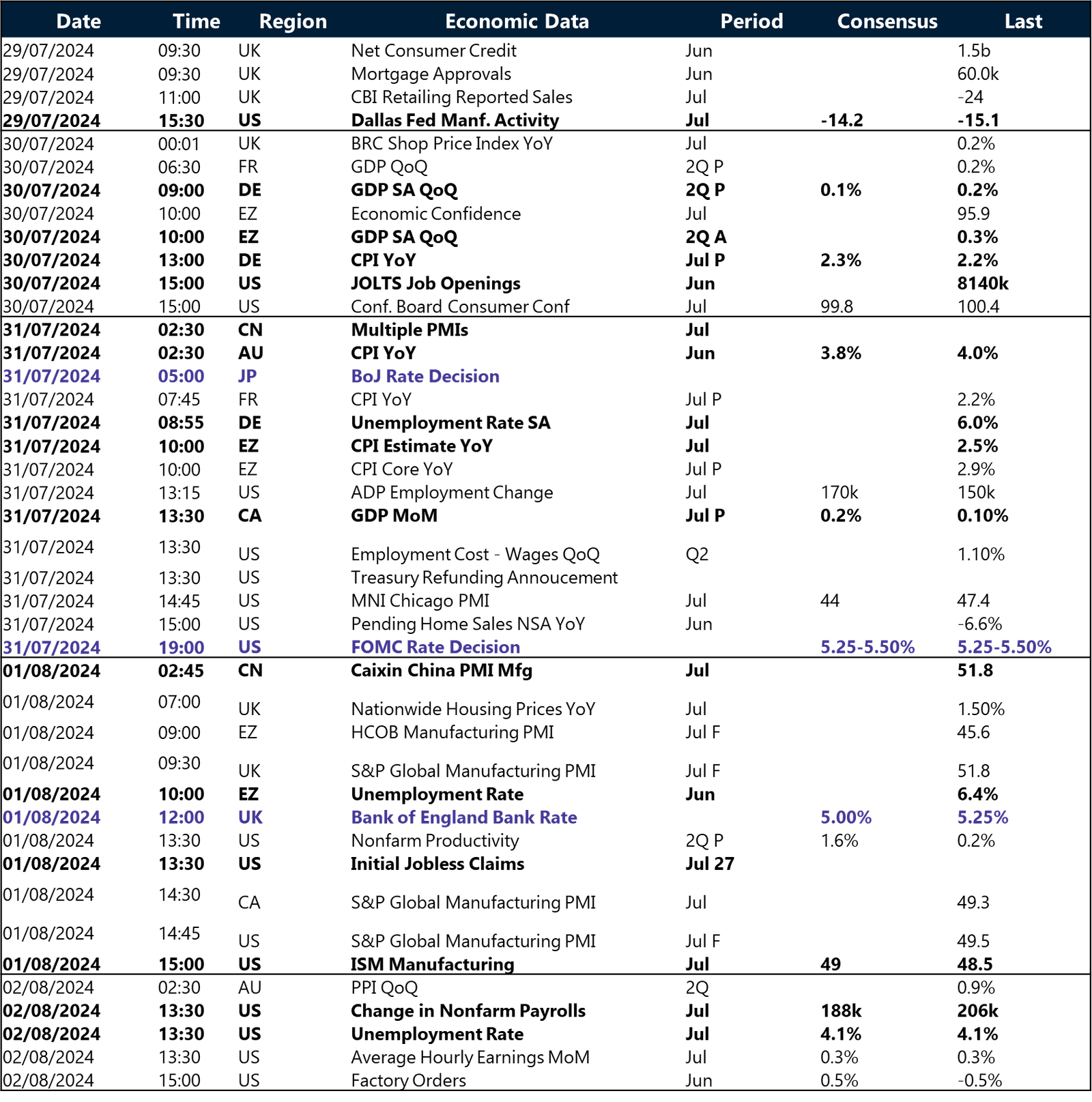

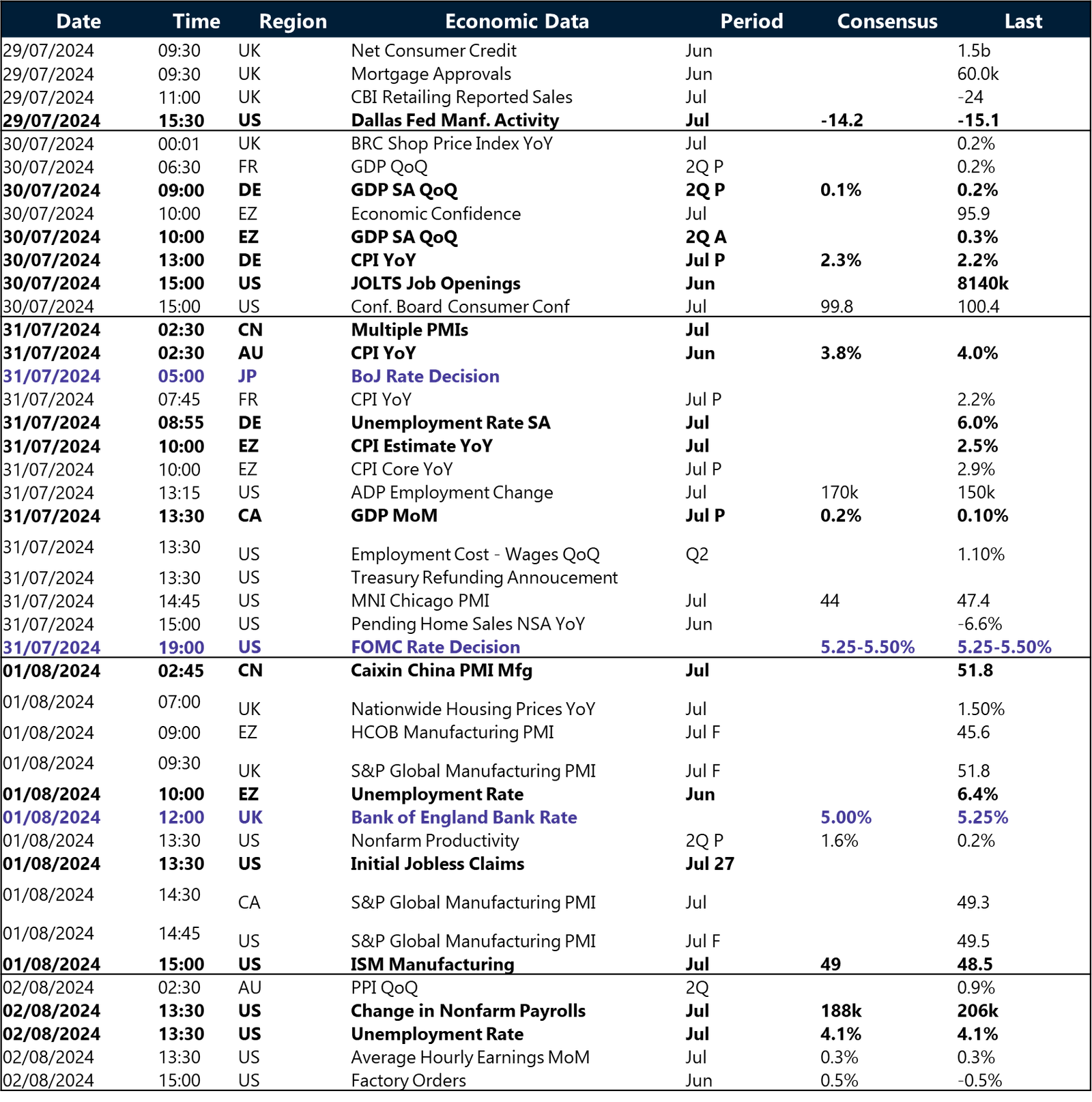

A macro packed week including a Fed rate decision, PMIs and US labor market report could add fuel to the uncertainty. China will come into focus following the rate cut from the PboC with the BoE decision and Eurozone CPI coming up in Europe.

The Euro Index closed the penultimate week of July lower for the first time in a month, shedding approximately 0.45% week-on-week.

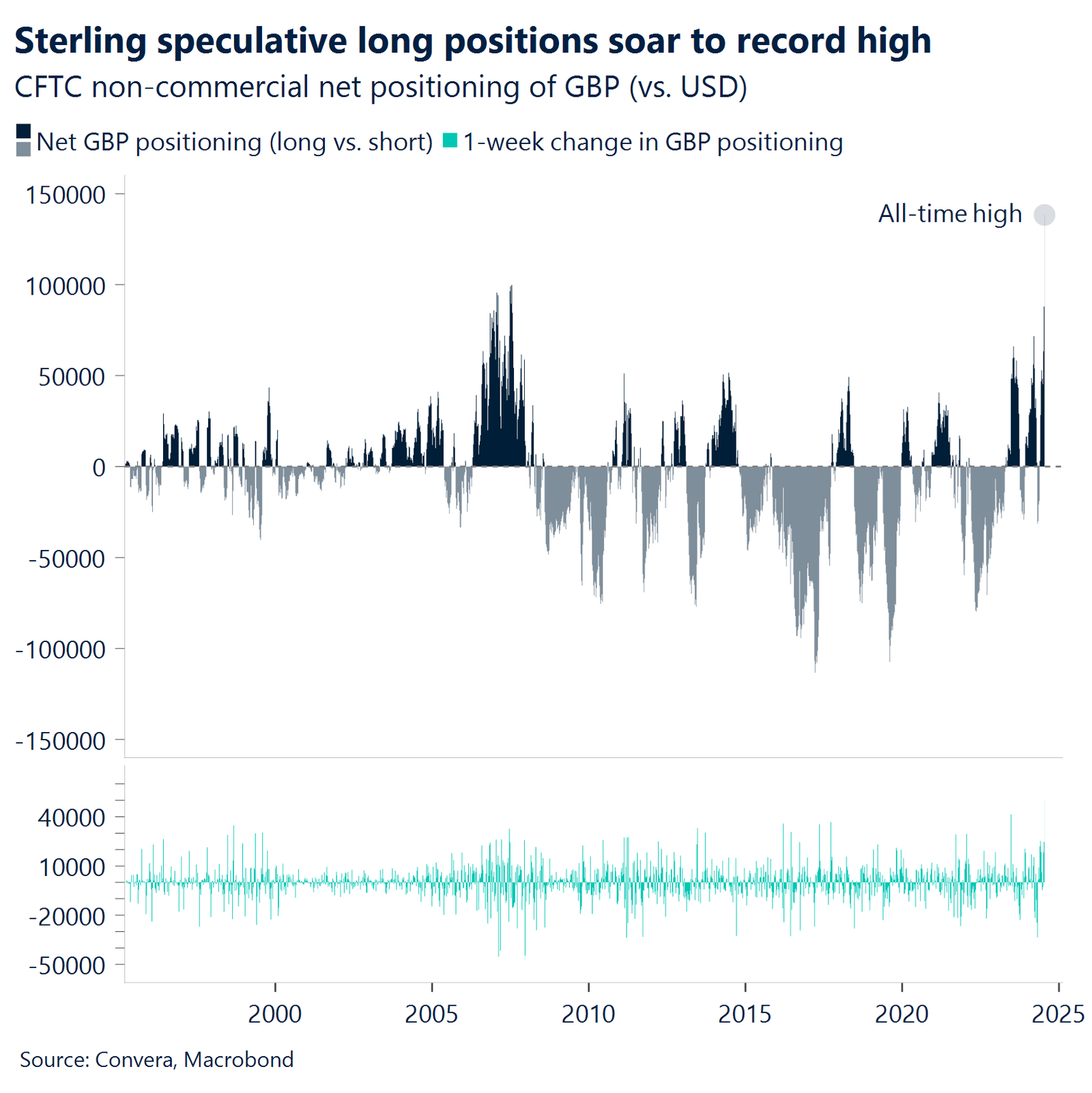

In parallel with GBP/USD stretching to a fresh 1-year high above $1.30 earlier this month, bullish bets in the British currency climbed to a record high.

Global Macro

Making sense of the market

The US consumer is starting to feel the weight of high interest rates with excess savings now largely depleted and credit card delinquency on the rise. The recent macro data has softened, and company earnings have so far somewhat disappointed. Former New York Fed President Dudley unexpectedly came out backing a Fed rate cut as early as next week. The change of tune came amid growing concern of a steeper yield curve in a sign that cracks in the economy are potentially growing.

Political uncertainty surrounding the upcoming election has added to the sour risk sentiment with President Joe Biden stepping aside for Kamala Harris. Donald Trump’s hawkish rhetoric on trade is expected to be dollar positive. However, his recent suggestion on weakening the Greenback have made the FX reaction function surrounding Trump more ambiguous.

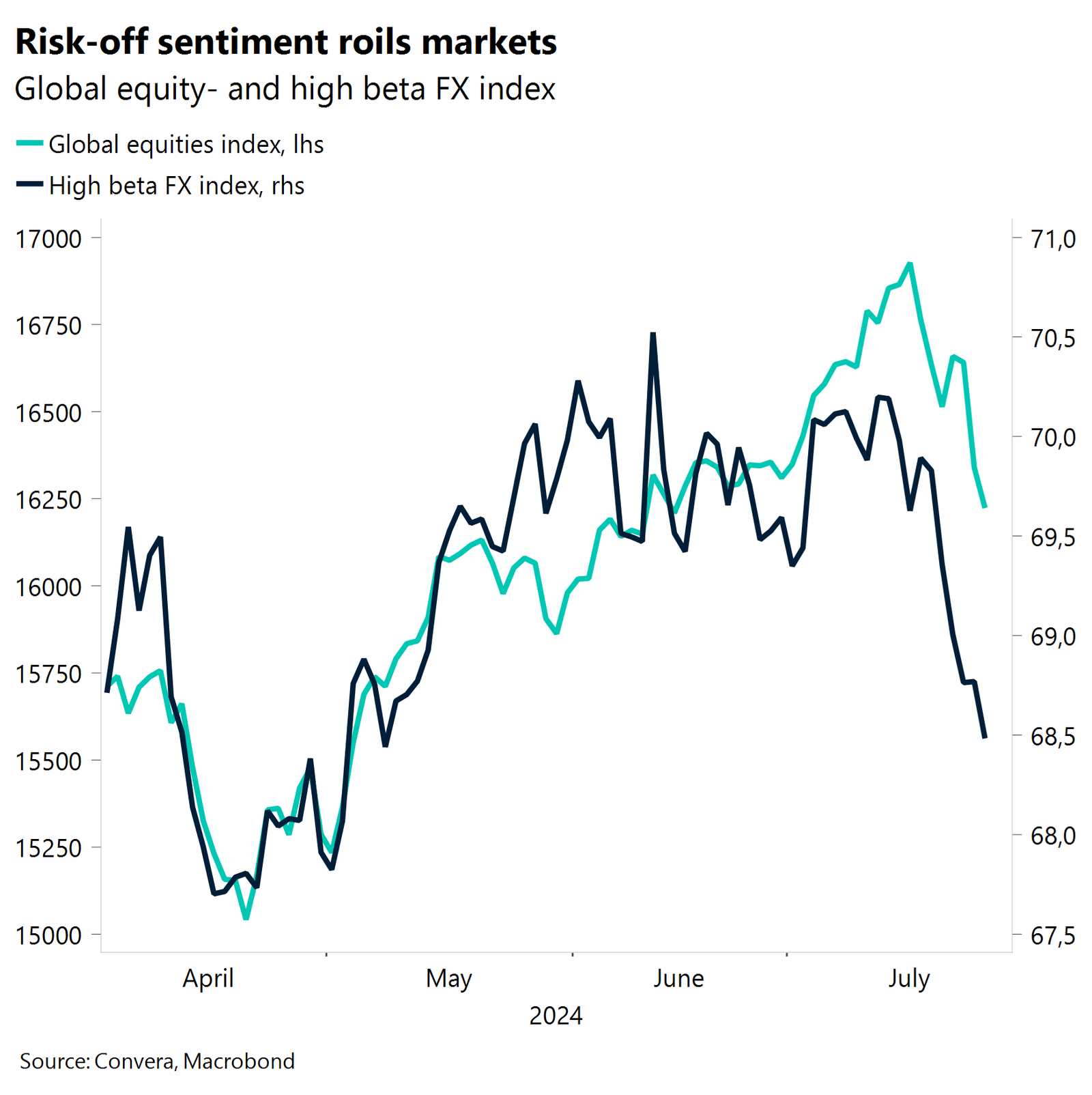

Markets have been working overtime to reflect those two monumental shifts on macro and politics. The global risk off flow has led to lower yields and equities, higher volatility and a stronger Japanese yen.

Nasdaq down 9% since peak. USD/JPY down 4.5% since peak. VIX rises for second consecutive week. US 2-year yield down to lowest since January.

Particularly the development on FX markets and the short squeeze of the yen have been major volatility drivers this week. The Japanese currency is currently profiting from all three of its historic drivers. 1. Weak macro data and falling US yields. 2. Political risk-off sentiment. 3. Unwinding of the carry trade.

Regional outlook: United States

Politics overshadowed by liquidation risks

Position liquidation. Global risk aversion has gripped markets this week as investors continued to sell some of this year’s top tech stocks, following the worst sessions for the S&P500 and Nasdaq 100 since 2022. “Position liquidation” is perhaps at play, as recent price action in tech stocks and the yen suggest that consensus positions have come under the cosh. Despite safe haven demand, the US dollar index has struggled for three days straight and is primed for a marginal weekly loss amidst a surging Japanese yen.

Trump still leading the polls. Political developments in the US remain in the spotlight after President Joe Biden’s decision to drop out of the election. It appears Vice President Kamala Harris has enough pledged delegates to secure the Democratic presidential nomination, although delegate support will not be official until August. As of now, former President Donald Trump is still the favourite to win, but Biden’s withdrawal adds considerable uncertainty and arguably makes it a closer competition

GDP surprise. Meanwhile, on the economic data front, the better-than-expected 2.8% expansion in Q2 US GDP, up from 1.4% in Q1, reinforces the view that the Federal Reserve (Fed) can curb inflation without hurting the economy. In addition, the PCE inflation indicator, that accompanied the GDP data, surprised to the upside.

Strong services. The S&P Purchasing Manager Index for July surprised to the upside as well, coming in at 55 vs. 54.8 in the previous month. The manufacturing sector slipped into contraction after six consecutive months of expansion. However, the strength of the services sector now at 56 has more than compensated for that. The ISM PMIs, which are coming out next week, are more important as a gauge for the US economy than their S&P counterparts and will be closely watched.

Regional outlook: Eurozone

Recovery momentum stalls in H2

Consumer confidence holding strong. The flash Eurozone consumer confidence indicator surprised to the upside, marking its highest level since February 2022. The uptick in optimism can be attributed to the recent ECB interest rate cut in June as well as buoyant optimism about a further cut in September. Additionally, the GfK Consumer Climate Indicator for Germany climbed to an over 2-year high, amid easing cost pressures and rising wages.

Business confidence? Not so much. The Ifo Business Climate indicator for Germany declined for a third consecutive month to touch the lowest since February 2024. Sentiment has declined considerably at companies in Germany, with both current conditions (87.1 vs 88.3) and expectations (86.9 vs 88.8) worsening. Business climate declined in manufacturing, services, trade and construction as Germany remains stuck in crisis mode.

PMIs disappoint. The flash HCOB Eurozone Composite PMI declined to a 5-month low in July, missing expectations. The reading signals a marked slowdown in economic momentum in Q2, driven by a deepening manufacturing downturn and a slowdown in services. New orders fell for the second month running and business confidence dropped to a six-month low, leading firms to halt a spell of hiring which began at the start of 2024. The two largest euro area economies continued to underperform the wider region. Output in Germany decreased for the first time in four months, despite hosting the Euros, while France posted a third consecutive monthly reduction in business activity.

Week ahead (1/2)

Risk events to add fuel to tensions

Investors are tense due to the rapid unwind of short positions on the Japanese yen and falling equity markets. A macro packed week including three major rate decisions, PMIs and the US labor market report could add fuel to already heightened uncertainty. China will come into focus as well following the surprise rate cut from the PboC this week with the BoE decision and Eurozone inflation coming up in Europe.

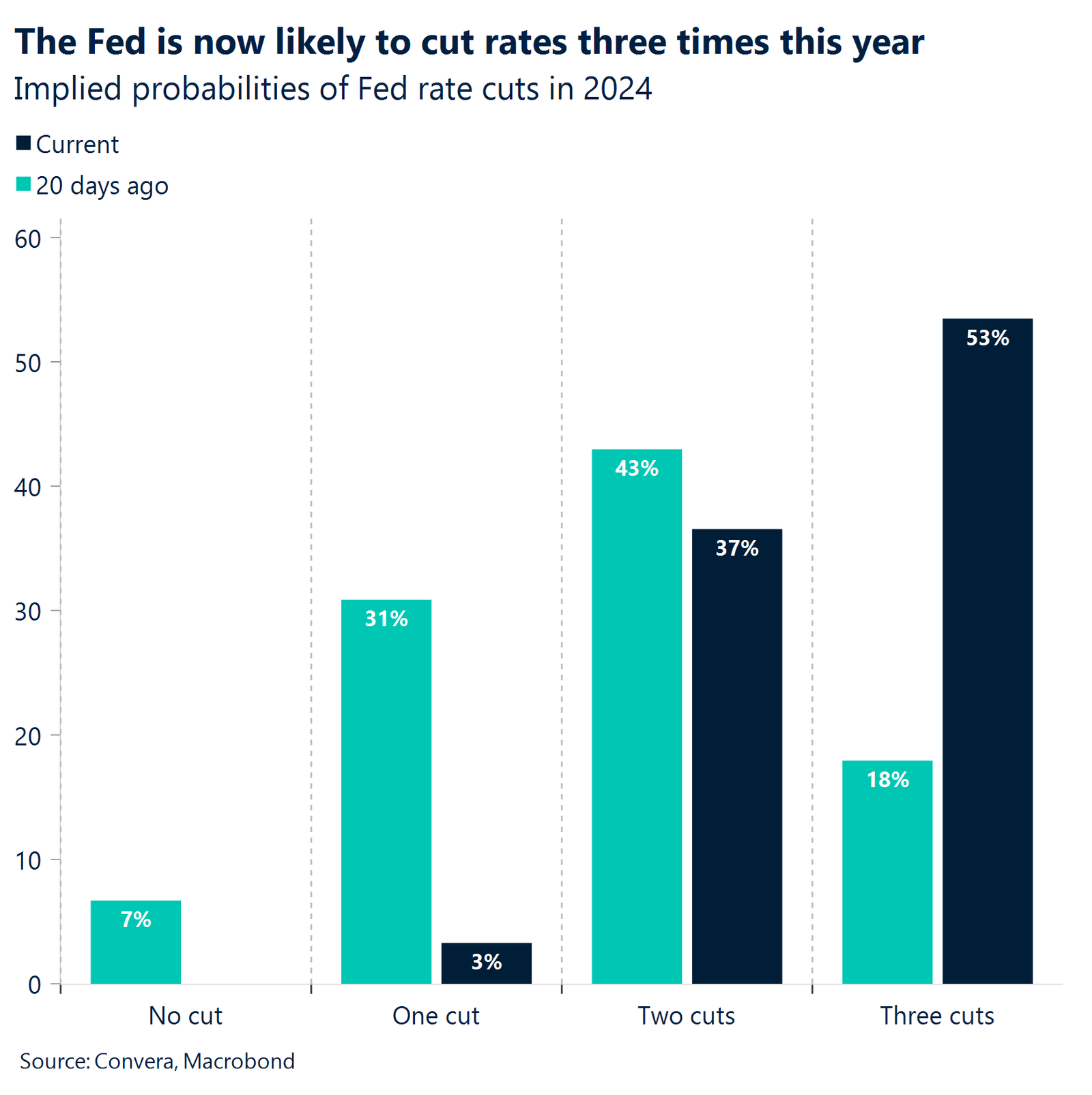

Signal now or in August? The Federal Reserve is expected to leave policy rates unchanged at 5.25% – 5.50% next Wednesday. The labor market is coming into balance and growth has weakened despite the upside GDP surprise for Q2 on Thursday. This will likely lead the FOMC to pave the way for a September cut. However, the committee could also opt for not going as far as indicating imminent easing given that policy makers will have another opportunity at the Jackson Hole meeting in August with two more jobs reports coming out before that.

Job growth to move markets, again. The unemployment rate has likely held stagnant at 4.1% in July. Job growth is expected to weaken slightly to sub 200k from the 206k recorded last month. There is a lively debate about the new post-pandemic neutral job growth rate, which is needed to hold the unemployment rate constant under consideration of population growth. While believed to be around 100k in the decade before 2020, this is now believed to have come up to around 200k. This explains why the relatively strong job growth as of late still coincided with a rising unemployment rate.

European CPI. Inflation is expected to have stagnated at 2.5% in July. We have flagged the risks of a reflation in summer that is starting to play out. The ECB should look past the next CPI print and focus on the medium-term inflation projection. Between now and September, inflation should fall close to the central banks 2% target.

Week ahead (2/2)

Risk events to add fuel to tensions

Hard call to make. The bets on a potential rate cut by the Bank of England next week have fluctuated with the incoming data over the past few months. The decision will not be a straightforward one, but the recent inflation miss could have turned the needle towards a policy easing. The split will be important here to gauge how much easing is in the pipeline over the next 6-12 months.

Weak China. The Chinese recovery continues to disappoint expectations as the consumer suffers from falling equity and property prices. The purchasing manager indicators for July are not expected to change that. We will get both the official and Caixin PMIs next week with both likely to show stagnation in the services sector.

BoJ to hike? Staying in Asia, the Bank of Japan could raise interest rates for the second time this year on Wednesday, taking more steps to normalizing its monetary policy. This would put the policy rate at 0.15% – 0.25%. As with the Bank of England, the decision will be contested and is not set in stone. The recent pickup in wage growth and inflation is helping the hawks make a case for tightening, but July’s strength of the yen is elevating pressures to act swiftly.

Fine line in Australia. Another risk event in Asia will come in the form of the Australian CPI print. Inflation is expected to have fallen from 3.6% to 3.5%. This will be enough for the RBA to not engage in changing its monetary policy direction. However, nowhere in the world is the line between cutting and hiking rates as close as in Australia. Investors will carefully dissect the CPI report to gauge inflation momentum and the likelihood of changes to policy.

FX Views

Yen steals the show

USD Clobbered by yen; supported by risk aversion. The US presidential race has become less clear with the withdrawal of Joe Biden, injecting a degree of uncertainty to the dollar’s outlook. But equity selloffs and carry trade unwinding have been most influential this week. Indeed, since rising to a 4-decade high earlier this month, the dollar has plunged around 6% versus the Japanese yen, half of that move occurring over the past few days. Nevertheless, the dollar’s safe haven allure in the current risk off climate has curtailed the depreciation of the dollar index, reflected by its over 2% gains against less-liquid, higher-beta currencies like NOK, SEK, AUD and NZD over the past week. Meanwhile, US yields on the short-end are at 5-month troughs and showing a distinct path lower, as markets shift to pricing almost three rate cuts by the Fed this year. Going forward, if the macro backdrop continues to point towards a US economic slowdown and Fed easing, the US dollar’s high growth and yield appeal should naturally diminish. That said, the dollar exhibits seasonal strength in Q3, and with market volatility on the rise and geopolitical and trade risks lurking in the shadows, the dollar’s safe haven status could limit losses.

EUR Have euro bulls run their course? The Euro Index closed the penultimate week of July lower for the first time in a month, shedding approximately 0.4% week-on-week. The losses were exclusively driven by a flight to safe-haven currencies. Specifically, EUR/USD pulled back for the second consecutive week as the domestic macro backdrop became increasingly less supportive, while the US economy continued to outperform expectations. On aggregate, EUR/USD is still up 1.3% month-to-date, but that may be the cap of near-term gains. Previously supportive seasonality trends weaken in August and are set to turn negative in September, leading to an overall negative Q3 performance. On the policy side, the few voices emerging from the GC endorse the current ECB pricing, meaning attention and control of the trajectory firmly rest with the Fed. The rate differential should be a tailwind for the euro, which seems to hold true during serene periods. In the near term, the market has arguably priced in too much near-term Fed easing (around 28bps in September), an unwind of which would be dollar positive.

GBP Gains looked stretched. In parallel with GBP/USD stretching to a fresh 1-year high above $1.30 earlier this month, bullish bets in the British currency climbed to a record high. With speculative positioning so stretched, we cautioned the risk of a rapid unwind of this overcrowded bet. In fact, we’ve already witnessed a modest correction lower in the risk sensitive pound, driven by the reversal of carry trades and the global equity market rout. Indeed, the risk off mood has also seen the probability of a BoE rate cut in August jump back above 50% and has dragged the 2-year gilt yield below 4%, to a new 1-year low. Markets might be underestimating the prospects of UK rate cuts this year and we think GBP is more exposed to greater downside bias in the short-term given there’s more scope for dovish BoE repricing. Whether the first move comes in August or September is a very close call and with 1-week GBP/USD implied vols at a 1-month high, markets are gearing up for the upcoming knife edge BoE meeting. That said, we caution that if the BoE delivers a hawkish cut, or even keeps rates unchanged, underscoring upside risks to inflation persistence, we could see GBP/USD and GBP/EUR move back towards $1.30 and €1.20 respectively, but this also depends on the broader global market dynamics as evidenced this week.

CHF Safe haven allure. The Swiss franc has made sizable gains against all G10 peers bar the Japanese yen recently, in a sign of safe haven demand and the unwinding of carry trades. Although the Swiss National Bank remains dovish, it’s the risk off climate, and the closing out of short bets against low yielders like the swissy prompted EUR/CHF to fall circa 2.5% in seven trading sessions to fresh 1-month lows. USD/CHF has also slipped to its lowest (0.878) in four months, with losses gaining speed amid heightened political uncertainty around the US elections in a repeat of price action seen around the French elections. Higher realised and implied volatility in the Swiss franc are helping lift broader measures of currency volatility, which could potentially elicit a doom loop, keeping the safe haven franc in high demand. Indeed, the one-month risk reversal in the Swiss franc jumped to a 4-year high in a sign that options traders are buying the franc to protect against equity market turmoil and as a pre-Fed-meeting hedge against franc short positions.

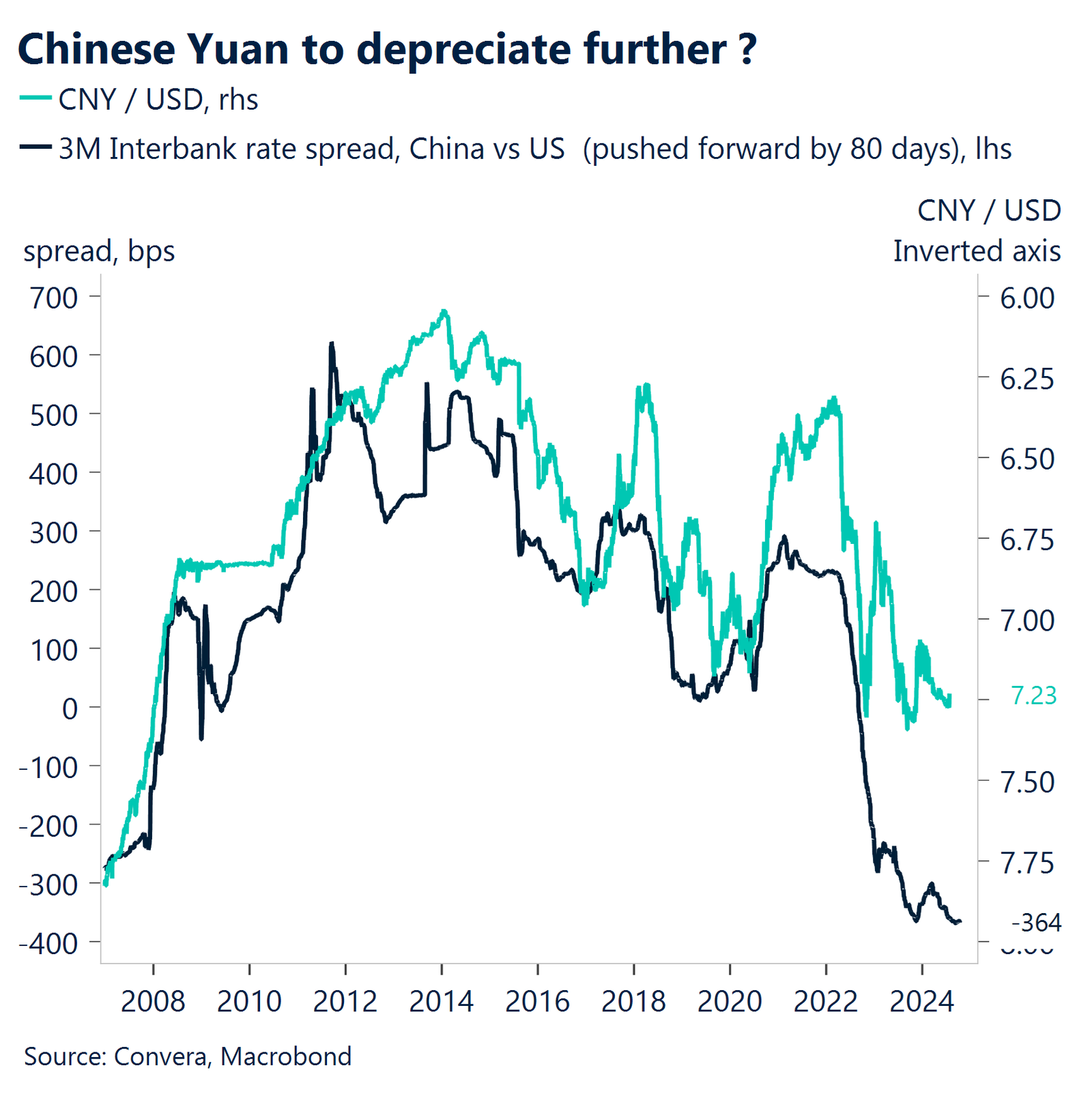

CNY Under pressure as PBoC eases policy. China’s monetary landscape is evolving rapidly as policymakers respond to economic headwinds. The PBOC’s recent cut to the medium-term lending facility rate signals a shift towards more accommodative monetary policy. This move, lowering the rate from 2.5% to 2.3%, aims to inject liquidity and stimulate economic activity. Concurrently, Beijing has unveiled a comprehensive reform agenda targeting various sectors. These initiatives include deepening tax and fiscal reforms to alleviate regional debt burdens, revamping the housing system to balance renting and purchasing, and bolstering technological self-reliance. The government’s focus on ‘high-quality development’ and support for private enterprises underscores its commitment to sustainable economic growth. From a technical standpoint, USDCNH is testing a critical support level at the 200-day moving average of 7.228. A breach below this level could open the door to further yuan strength, while resistance looms at the psychologically significant 7.3 handle. Chart shows possibility of Yuan to depreciate further given the strong correlation between FX and rate differentials. The pair’s near-term trajectory may be influenced by upcoming Chinese economic indicators, particularly the composite PMI and manufacturing data.

JPY Gains ground on wage hikes and BoJ speculation. Japan has agreed to a substantial increase in the national average minimum hourly wage, the largest hike on record. This move aims to alleviate cost-of-living pressures, particularly for lower-income households. Meanwhile, market speculation is intensifying around the upcoming Bank of Japan decision on July 31. Some sources suggest the BoJ may consider adjusting its key rate, depending on the board’s assessment of consumption trends and inflation stability. USDJPY has experienced a downward movement, touching the 151.93 level last week, primarily driven by unwinding of carry trades as markets price in the possibility of a more hawkish BoJ stance. Key events to monitor include the BoJ interest rate decision, outlook report, industrial production data, and retail sales figures.

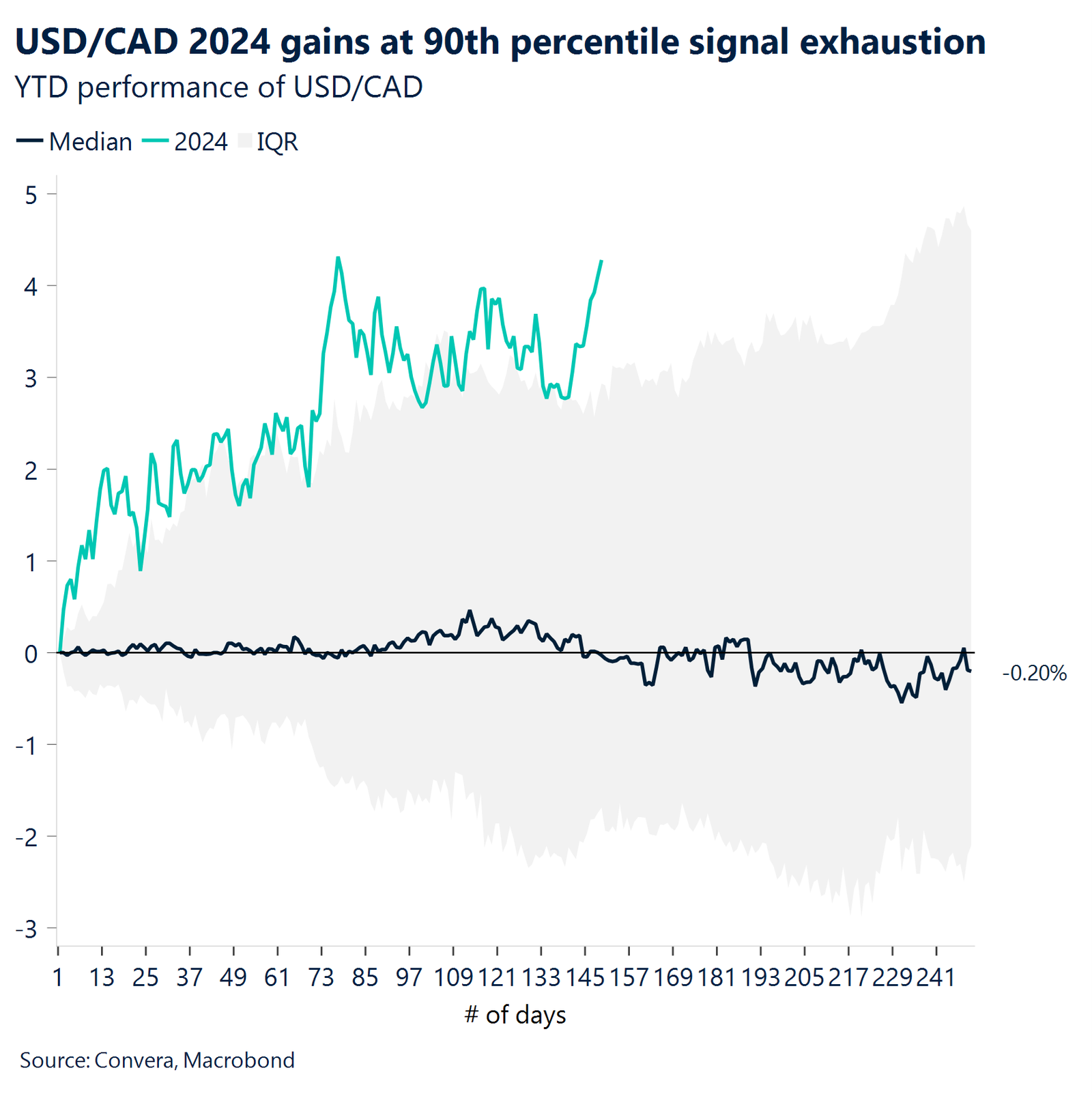

CAD Approaching the limit. The BoC reduced its policy rate by 25bps for the second consecutive time in its July meeting, signalling further easing to come. However, the loonie sustained minimal damage for several reasons: (1) the cut was largely priced in; (2) overstretched positioning limited the impact; and (3) favourable July seasonality trend cushioned the demise. Despite this, the Canadian dollar sustained much larger broad-based losses, caught in a crossfire of global cross-asset sell-off at the end of the week. The loonie registered sizable weekly losses against the safe-haven currencies of USD (-0.6%), CHF (-1.5%), and JPY (-2.9%). Looking ahead, momentum indicators, such as the RSI, are flashing oversold conditions. EUR/CAD has appreciated for the fifth consecutive week to climb to an 8-month high, but may soon face resistance at C$1.50, a psychological barrier that the pair has been unable to sustain above since Oct ‘21. We expect USD/CAD to pull back from the current 3-month highs amid overstretched positioning and maintain that the area around C$1.38 is the short-term ceiling. This does not indicate a bullish turn for the loonie. On the contrary, the favourable seasonality effect that helped mitigate CAD losses in July is soon to benefit the US dollar. On the US side, markets have fully priced in the Fed’s September cut, with futures pricing in 28bps of easing. Thus, the primary channel to express dollar weakness appears exhausted. USD/CAD year-to-date gains amount to approximately 4.4%, its best performance since 2018, and in the 90th percentile of gains since 1950. Consequently, room for further gains appears to be limited.

AUD Aussie stumbles as economic indicators soften. Recent data suggests a slowdown in Australia’s private sector activity. The composite PMI edged down, reflecting challenges in both manufacturing and services sectors. Notably, export orders declined significantly, while input costs surged. Economic experts are closely watching whether government support measures will boost consumer spending and business activity. Business sentiment has dipped to levels not seen since the pandemic’s onset, excluding its initial wave. Employment trends are also showing signs of weakness. From a technical perspective, AUDUSD has broken below the 50 and 200-day moving average at 0.6655 and 0.6609 respectively, finding some support near key handle at 0.65. This week’s economic releases, including retail sales, CPI, trade data, and PPI, could provide further direction for the pair.