Remittance flows to South Asia in 2022 surpassed expectations to reach $176 billion, nearly $13 billion higher than forecasted in Nov 2022. This was also largely due to remittance flows to India overshooting the $100 billion milestone by $11 billion. Remittances to South Asia grew at 12.2 percent in 2022, nearly twice the rate in 2021 in all but three countries (Bangladesh, Pakistan, and Sri Lanka). All South Asian countries benefited from strong labor market conditions and wage hikes in the region’s high-income destination economies, and higher energy prices in the GCC countries, a key destination for its less-skilled migrants.

Remittances continued to remain a critical financial inflow, and an important source of foreign exchange for several countries in South Asia. Remittances measured almost 326 percent of FDI inflows in 2022, up from 247 percent in 2019; and 1,036 percent of ODA relative to 935 percent in 2019. Although remittances amounted to only 4 percent of South Asia’s GDP in 2022, the variation across countries was large. In Nepal, which also features in the list of the top 10 countries with the largest shares, remittances stood at 23.1 percent of GDP in 2022, compared with 7.9 percent in Pakistan, 5.1 percent in Sri Lanka, and 4.7 percent in Bangladesh. In India, the largest global recipient, remittances represented only 3.3 percent of GDP in 2022 (Figure 1).

Figure 1: Top Remittance Recipients in South Asia, 2022

In India, the 8 percent increase in remittances in 2021 and the historic 24.4 percent rise in 2022 led remittances to peak at $111 billion, representing 63 percent of South Asia’s total remittance flows. Two factors contributed to this unprecedented level. Almost 36 percent of India’s remittances are attributable to the high-skilled and predominantly high-tech Indian migrants in three high-income destinations (United States, United Kingdom, and Singapore), where the post-pandemic recovery led to a tight labor market and wage hikes that boosted remittances. In addition, India’s other high-income destinations also enjoyed favorable economic conditions. High energy prices favored the employment and incomes of the less-skilled Indian migrants in the GCC countries, while the GCC governments’ special measures to curb food price inflation shielded migrants’ remitting potential. As a result, remittance inflows from the GCC countries, which today account for about 28 percent of India’s total remittance inflows, also soared in 2022.

South Asia’s remittances’ boom in 2022 may not have registered large inflows in the central banks’ official statistics in Bangladesh, Pakistan, and Sri Lanka. Growth in remittances was negative in all three countries, reflecting turbulent domestic economic conditions. Weak global demand for their exports, rising interest rates that inflated the cost of debt servicing, and high global fuel and food prices exacerbated balance of payments pressures, leading to currency depreciations. In Bangladesh and Pakistan, the latter created a widening parallel exchange rate gap between the official and the market exchange rate, which ranged between 12 and 18 percent in Bangladesh, and stood at 4 percent by January 2023 in Pakistan. The widening of the exchange rate gaps and the lingering uncertainty diverted remittance inflows away from official to unofficial informal channels since September 2022.

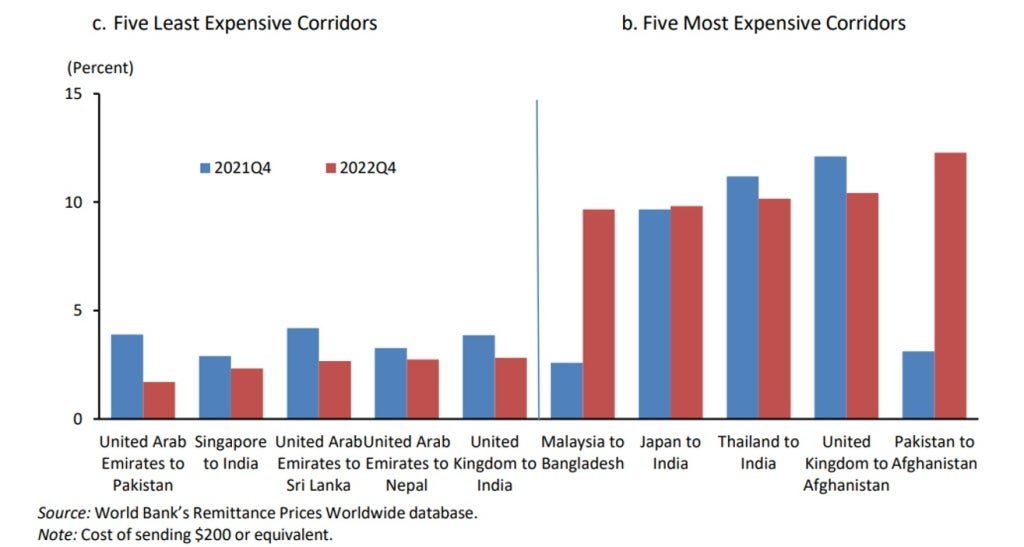

South Asia continued to enjoy the lowest remittance costs of all regions in the world in 2022. The five least costly corridors achieved the SDG target of 3 percent or lower. While the cost of sending $200 in 2022Q4 remained around 10 percent in the five most expensive corridors, the change in cost relative to 2021Q4 varied substantially. The Thailand to India and United Kingdom to Afghanistan corridors revealed a reduction in remitting costs, bringing remitting costs for both corridors under 11 percent for every $200 remitted. In contrast, the cost of remitting $200 from Pakistan to Afghanistan jumped 9.2 percentage points, and from Malaysia to Bangladesh escalated 7.1 percentage points (Figure 2). The cost increase for the Malaysia to Bangladesh corridor compounded the sharp rise in remittance costs from the previous year. During the same period, meanwhile, there was a consistent drop in remitting costs in the least cost corridors. The cost of remitting $200 dropped between 0.5 percentage points along the United Arab Emirates to Nepal corridor, and more than 2 percentage points along the United Arab Emirates to Pakistan corridor.

Figure 2: The costs of sending remittances to South Asia varies across corridors

After achieving remarkable growth in 2022, the growth of remittance flows to South Asia is projected to taper off in 2023, largely due to India, where projections suggest a flat trend in 2023 and 2024, and Pakistan, where more remittances are projected to flow through informal than formal channels. Despite moderating inflationary pressures, the global economic outlook for 2023 is expected to remain anaemic in South Asian migrants’ high-income host economies.

Read the Migration and Development Brief 38 here.