Remittance flows to the Europe and Central Asia region have grown steadily for nearly a decade, reaching a record high of $79 billion in 2022, which is a 19 percent increase from the previous year. The strong performance was mainly due to record high amounts of money transfers from Russia to neighboring countries, especially to the Commonwealth of Independent States (CIS). The surging inflows of remittances from Russia were driven by capital migration through the relocation of Russian companies and citizens, the strong Russian exchange rate, and the increased demand for migrant workers in Russia.

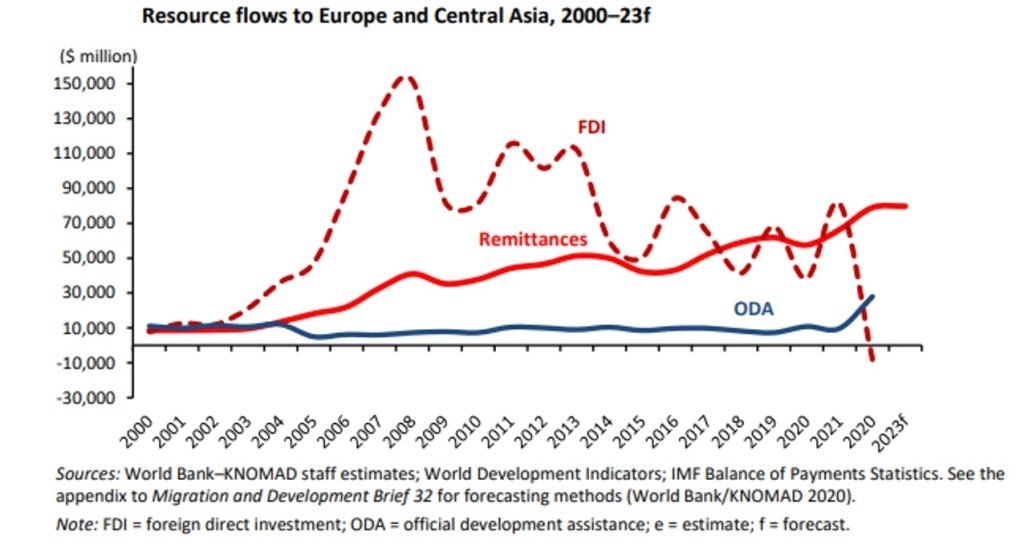

Remittances represented the largest source of external financing for the region in 2022, providing an important buffer for current account deficits across a number of regional economies. FDI, which has been an important resource to the region, fell sharply last year after more than doubling in 2021, turning to negative flows. The drop in FDI was mainly due to the large-scale divestment of foreign capital from Russia, and FDI inflows into the EU-CIS countries also somewhat suffered. In Armenia, Georgia, and Uzbekistan, the influx of Russian money transfers was met by a boost in foreign reserves and increased foreign investments (in the form of buying foreign bonds or cross-border bank lending). For Kazakhstan and Moldova, Russian remittances were less impactful compared to other countries, but they attracted FDI and boosted their reserves with the proceeds from closing out overseas positions and greater oil revenues.

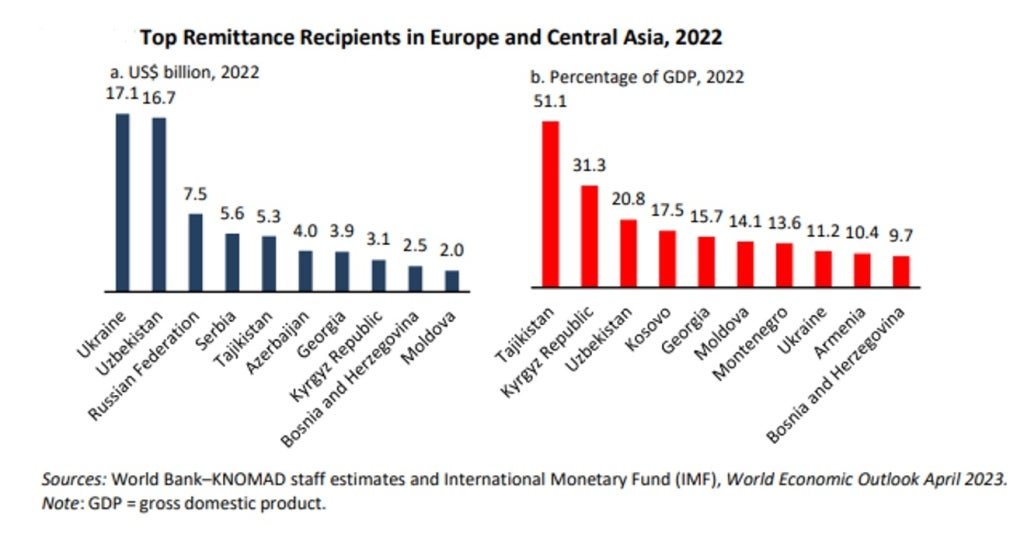

Ukraine remained the region’s largest recipient of remittances, receiving less-than-expected inflows of $17.1 billion in 2022 on negative growth of 5.4 percent. This interrupted an upward trend, which had begun after the first Russian invasion back in 2014 and following the EU decision to allow visa free entry for Ukrainians. This outturn is tied to lower-than-predicted remittances from the European Union, especially from Poland, which is the largest remittance-sending country for Ukraine (accounting for 30 percent on average).

As a share of GDP, remittance receipts in Tajikistan and the Kyrgyz Republic led among regional economies, at 51 percent and 31 percent, respectively; remittances remain by far the largest source of hard currency earnings for these countries. For Uzbekistan, the second-largest recipient, remittances surged by 80 percent in 2022 with money transfers from Russia nearly tripling from a year previous. Remittances equalled about 21 percent of GDP in 2022, up sharply from 13 percent in 2021. And in the first four months of 2023, money transfers to Uzbekistan increased by 21 percent (to $3.1 billion) from the same period of 2022, of which about 87 percent came from Russia. Money transfers from Russia, Azerbaijan, Armenia, and Georgia were reported at record-high levels in 2022, several times the figures for 2021. As a result, total remittances to Azerbaijan amounted to 6 percent of GDP, to Armenia 10 percent of GDP, and to Georgia 16 percent of GDP.

The average cost of sending $200 to the Europe and Central Asia region climbed to 6.4 percent in 2022Q4 from 6.1 percent a year earlier, in large part reflecting a sharp increase of costs in the Türkiye to Bulgaria corridor. Amid the ongoing Russia’s invasion of Ukraine, the average cost for the Europe and Central Asia region excludes data on corridors originating in Russia, which used to be one of the lowest-cost senders of remittances globally.

Read the latest Migration and Development Brief here.