Mumbai: The Indian rupee continued its weakening trend on Monday, depreciating by 8 paise to close at 86.96 (provisional) against the US dollar at the interbank foreign exchange market. The currency faced pressure due to persistent foreign institutional investor (FII) outflows, a strengthening US dollar index, and domestic trade data reflecting a widening deficit.

Rupee movement and market dynamics

Get Latest Mathrubhumi Updates in English

The rupee opened at 86.94 against the US dollar and showed some volatility during intraday trade, touching a high of 86.91 and a low of 86.98 before settling at 86.96. This marked a continued depreciation after falling by 17 paise in the previous session. The declining trend is largely attributed to foreign investors pulling out funds from Indian markets, coupled with limited support from the Reserve Bank of India (RBI), which has gradually reduced its intervention in the forex market.

Forex traders pointed out that sustained selling by foreign investors in domestic equities, combined with a firming US dollar, has maintained downward pressure on the rupee. The RBI’s intermittent interventions in the currency markets have slowed the fall but have not been able to reverse the depreciation trend.

Trade deficit weighs on Rupee

Another key factor dragging the rupee lower is India’s trade performance. According to the latest data from the Commerce Ministry, India’s exports declined for the third consecutive month in January 2025, falling by 2.38% year-on-year to USD 36.43 billion. In contrast, imports surged by 10.28% to USD 59.42 billion, primarily due to increased gold shipments. As a result, the trade deficit widened to USD 22.99 billion for the month, significantly higher than in previous months.

A widening trade deficit typically exerts downward pressure on the domestic currency as demand for foreign exchange increases to pay for imports. The surge in gold imports suggests higher demand ahead of the wedding season in India, but it also contributes to further strain on the country’s current account balance.

Impact of global market trends

The broader global currency market trends also influenced the rupee’s performance. The US dollar index, which measures the greenback against a basket of six major currencies, strengthened by 0.35% to 106.95. A stronger dollar reduces the attractiveness of emerging market currencies like the rupee, leading to further depreciation.

Additionally, crude oil prices edged higher, with Brent crude futures rising by 0.77% to USD 75.80 per barrel. Rising oil prices increase India’s import bill, adding further pressure on the rupee. Since India is a major oil-importing nation, any sustained increase in crude prices directly impacts the country’s trade balance and currency valuation.

Stock market and FII outflows

Domestic equity markets remained under pressure, reflecting cautious investor sentiment. The BSE Sensex slipped by 29.47 points to close at 75,967.39, while the NSE Nifty dropped 14.20 points to 22,945.30. Despite only marginal declines, the overall market mood remains cautious due to persistent foreign fund outflows.

Foreign Institutional Investors (FIIs) offloaded equities worth Rs 3,937.83 crore in the capital markets on Monday, continuing their trend of selling Indian assets. The ongoing FII exodus has been attributed to concerns over global economic conditions, tighter US monetary policy, and reduced risk appetite for emerging market assets.

RBI’s role and future outlook

Market analysts believe that the rupee’s depreciation could persist unless the RBI steps in with more aggressive intervention. While the central bank has been selling dollars intermittently to prevent excessive volatility, its support has been tapering off gradually. Analysts predict that the rupee may trade within a range of 86.75 to 87.20 in the near term, with the possibility of further weakening if global headwinds persist.

“The rupee remains under pressure due to a combination of factors, including weak domestic equities, FII outflows, and a recovery in the US dollar. Any further intervention by the RBI could provide some support, but the overall bias for the USD-INR pair remains negative,” said Anuj Choudhary, Research Analyst at a leading brokerage firm.

Global economic developments affecting the Rupee

Beyond domestic factors, geopolitical and economic developments in major global economies are also playing a role in influencing the rupee’s trajectory.

- China’s economic slowdown: Chinese President Xi Jinping recently met with top business leaders, including Alibaba founder Jack Ma, in an effort to restore investor confidence amid slowing economic growth. China’s GDP growth has hovered around 5% in recent years, raising concerns about a broader economic slowdown in Asia. A weak Chinese economy affects global trade flows and investor sentiment, indirectly impacting the rupee.

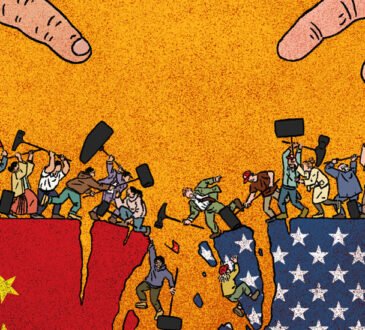

- US tariff policy: Concerns are rising over potential policy moves by former US President Donald Trump, who has signalled a possible increase in tariffs on Chinese exports. Any escalation in US-China trade tensions could lead to global market volatility, affecting risk sentiment and capital flows into emerging markets like India.

- US federal reserve policy: Traders are also keeping a close watch on upcoming speeches by members of the US Federal Open Market Committee (FOMC). Any hawkish signals regarding future interest rate hikes could strengthen the dollar further, leading to more pressure on the rupee.