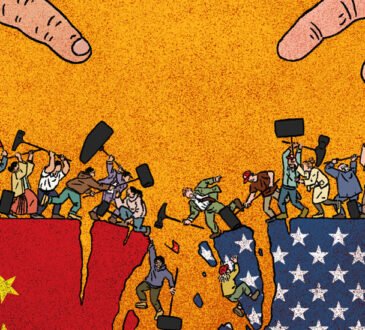

Illustration: Xia Qing/GT

Shanghai-based Hudong-Zhonghua Shipbuilding Co, a subsidiary of China State Shipbuilding Corp, and China Shipbuilding Trading Co, signed a new shipbuilding deal denominated in yuan with Canadian tonnage supplier Seaspan Corp on Friday for six container ships, according to China Media Group. This marks the largest single container shipbuilding deal to be settled in yuan in China this year.

The application of the yuan in a large cross-border container shipbuilding deal expands the scope of the Chinese currency’s use in cross-border trade, further raising the international recognition of the currency, which has significance in promoting the internationalization of the yuan.

In recent years, with the steady growth of China’s economy and the continuous enhancement of its position in international trade, the status of the yuan in the international market has become increasingly prominent.

According to the People’s Bank of China, from January to August 2024, the total amount of yuan cross-border payments reached 41.6 trillion yuan ($5.85 trillion), a year-on-year increase of 21.1 percent, indicating steady growth in the scale of yuan cross-border usage.

The yuan saw its share in global payments rise in August. The yuan’s global share was up from 3.06 percent in July to 3.47 percent in August, according to the Society for Worldwide Interbank Financial Telecommunication, a global provider of financial messaging services. The yuan remained the fifth most active currency.

The progress of the internationalization of the yuan has adapted to the increasing demands of the international market. As China’s economic strength and its role in the international economic and trade system have grown, the demand from market participants in more countries to use the yuan for payments and to allocate yuan-denominated assets has been steadily increasing.

With the continuous growth of economic and trade cooperation among developing countries, the demand for the use of the yuan is expected to continue to strengthen, which will further enhance the stability of global payment mechanisms and reduce volatility. Geopolitical risks and financial volatility risks are intensifying, and countries are inclined to choose relatively safer currencies.

The internationalization of the yuan has been proved to help to provide a stable and reliable public good in terms of currency value, which not only benefits China in achieving a currency status that matches its economic and trade position but also gives a wide range of developing countries the opportunity to choose a safer international reserve currency.

For instance, the Belt and Road Initiative partner countries have significant advantages in choosing the yuan for economic and trade activities. It can help avoid losses to economic entities caused by severe exchange rate fluctuations resulting from irresponsible domestic monetary policies in some countries. It can also alleviate currency mismatches and mitigate exchange rate risks.

The report of the 20th National Congress of the Communist Party of China noted that China will promote the internationalization of the yuan in an orderly way, in an important component of high-quality development and high-level opening-up. The future orderly advancement of the internationalization of the yuan offers a significant opportunity.

First, in increasingly volatile international financial markets, yuan-denominated assets remain underestimated compared with assets in other currencies, which means that the attractiveness of yuan assets to foreign investors remains strong.

Second, in the face of the wave of de-globalization and protectionism, China is committed to high-standard opening-up, which provides broad scope for yuan settlement in increasing trade and investment cooperation.

Third, China has ample capacity and policy space to maintain the stability of the yuan’s exchange rate. For international trading companies, a resilient and stable yuan can help them effectively mitigate risks.

As China continues to expand the scope of currency swaps, to achieve bilateral currency regional transactions, to advance the establishment of yuan-clearing arrangements with relevant countries, and further improve the functions of the Cross-Border Interbank Payment System while reducing fees, there will be more enterprises choosing to use the yuan for settlement in cross-border trade.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn