Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

Higher inflation looks to end jumbo-cut hopes

A slight bump higher in US inflation in August drove overnight volatility with the US dollar lower in Asia but higher in other markets.

The annual US inflation rates were in line with forecasts – with headline at 2.5% and core at 3.2% – but the monthly core number was above expectations at 0.3% versus 0.2% forecast. The August result was also an increase on the 0.2% reading in July.

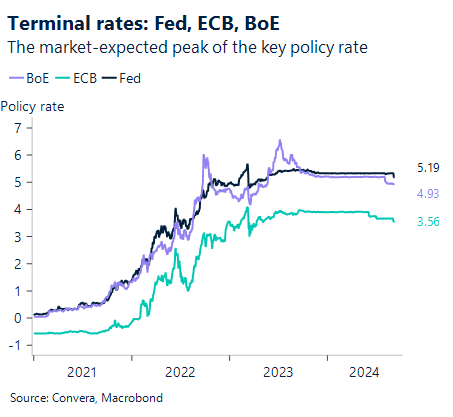

As a result, hopes diminished for a 50bps cut when the Federal Reserve meet next week – markets see only a 17% chance of a larger-than-usual cut. A 25bps cut is fully priced in.

The US dollar was mixed, gaining in Europe, but weaker in Asia.

The AUD/USD gained 0.4% while NZD/USD fell 0.1%.

The USD/SGD and USD/CNH both fell 0.1%.

The USD/JPY ended flat but had earlier neared one-year lows just above 140.00.

Euro eases into ECB

The euro was mostly weaker overnight. Looking forward, the big announcement is from the European Central Bank, with a decision due at 10.15pm AEST.

At its September meeting, the ECB is expected to lower the deposit rate by 25 basis points, to 3.50% from 3.75%.

Also, due to weaker GDP growth outturns and lower wage growth assumptions, the ECB will likely cut its estimates for core inflation and GDP growth in 2026.

Lagarde is probably going to stress the importance of data reliance, adopt a meeting-by-meeting strategy, and stress the independence of the ECB from the Fed.

Despite the recent pullback in EUR/USD, momentum remains positive, with the pair sitting above its 50- and 200-day EMA heading into the meeting.

INR stuck at lows

In August, we anticipate CPI inflation to drop from 3.5% in July to 3.1% year over year, partially due to an improving but diminishing base impact.

Core inflation is projected to stay constant at 3.3% year over year, with sequential pace expected to decelerate from July’s 0.38% to 0.34% m-o-m.

With the exception of the personal care category, which we anticipate seeing an acceleration in momentum due to rising gold prices, the majority of categories should continue to exhibit modest inflationary pressures.

On USD/INR, we are neutral on the pair, with the market stuck under long-term resistance at 84.00.

Aussie rebounds as euro, GBP ease

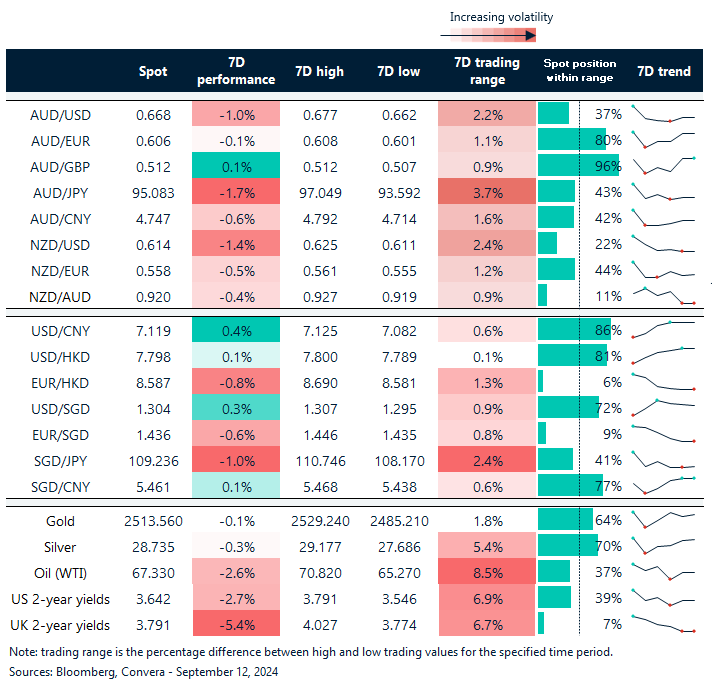

Table: seven-day rolling currency trends and trading ranges

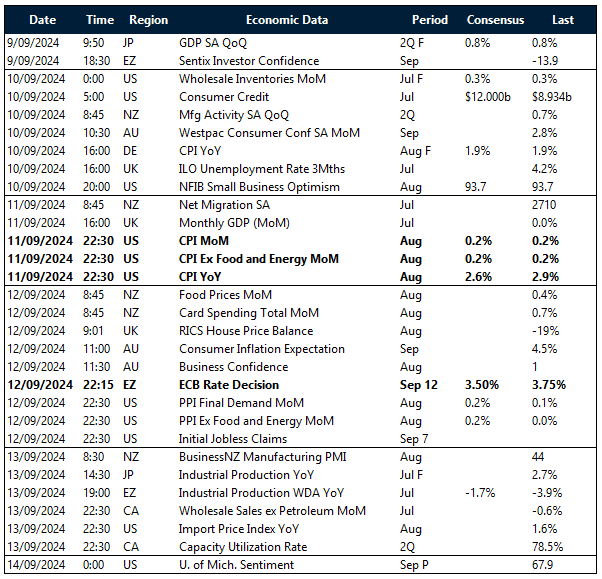

Key global risk events

Calendar: 9 – 14 September

All times AEST

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Have a question? [email protected]