Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

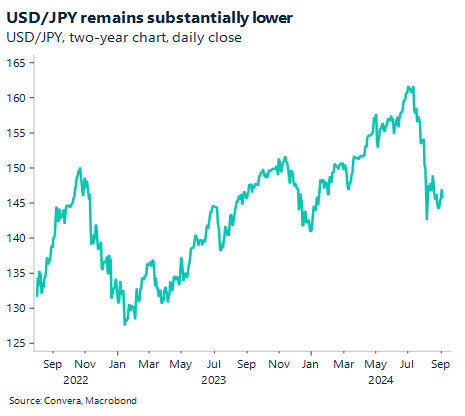

USD/JPY leads losses in Asia

The US dollar was lower across Asia overnight after the key Job Openings and Labor Turnover Series (JOLTS) fell to the lowest level since January 2021.

The JOLTS series is a critical read of the US labour market and fell from 7.91m to 7.67m — well below the 8.1m expected. The result was another sign of weakening in the US employment market.

The USD/JPY led losses with the pair down 1.2% and back near one-month lows.

The USD/SGD fell 0.3%, also back near key lows, while USD/CNH fell 0.1%.

The AUD/USD and NZD/USD both gained 0.2%.

Cable approaching key resistance levels

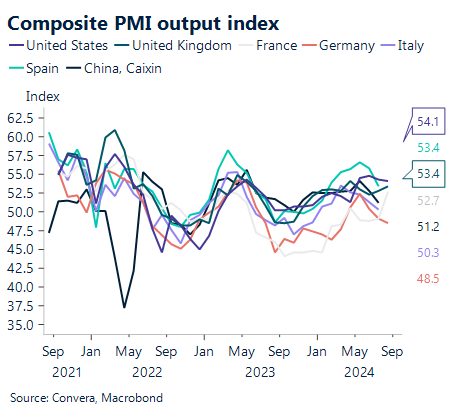

The GBP has been well support with GBP/USD near two-year highs.

In July, the composite PMI headline index increased significantly to its highest level since the spring of 2022. The activity indices for housing and civil engineering activities showed the biggest increases, and new orders increased significantly in all subsectors as well.

Housing construction activity may increase if the government’s intentions to build houses at a significantly faster rate in the upcoming years come to pass. However, we think any increase in building may take some time to realize.

The 1.3000 zone remains GPB/USD key support level.

Ringgit stable ahead of BNM decision

We anticipate that the Malaysian central banks will retain a neutral, somewhat comparable tone to past meetings and keep its policy rate at 3%, noting that the economy is still supported by the existing monetary policy. We believe that despite the global cutting cycle, BNM will continue to see monetary accommodation as unnecessary because the GDP outlook is still favorable and inflation is following its projections.

The Q2 GDP figures indicated a widening impetus for growth, and although the fuel subsidy reduction has kept inflation steady, BNM is aware of the potential dangers associated with more subsidy rationalization.

Additionally, we anticipate that BNM will state that the recent FX outperformance is a reflection of both the Fed’s recent actions and the policy’s influence in encouraging GLCs to repatriate FX earnings by coordinating with the government, implying that the policy will continue for the time being.

Greenback resumes losses

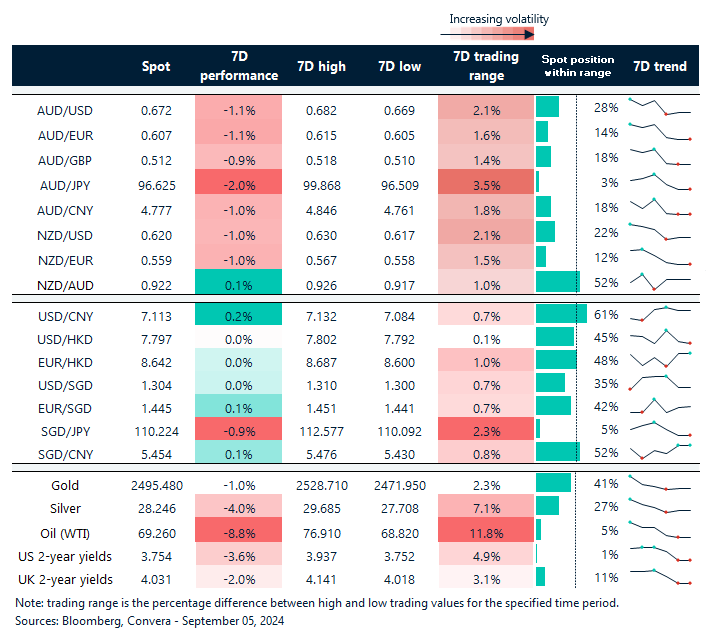

Table: seven-day rolling currency trends and trading ranges

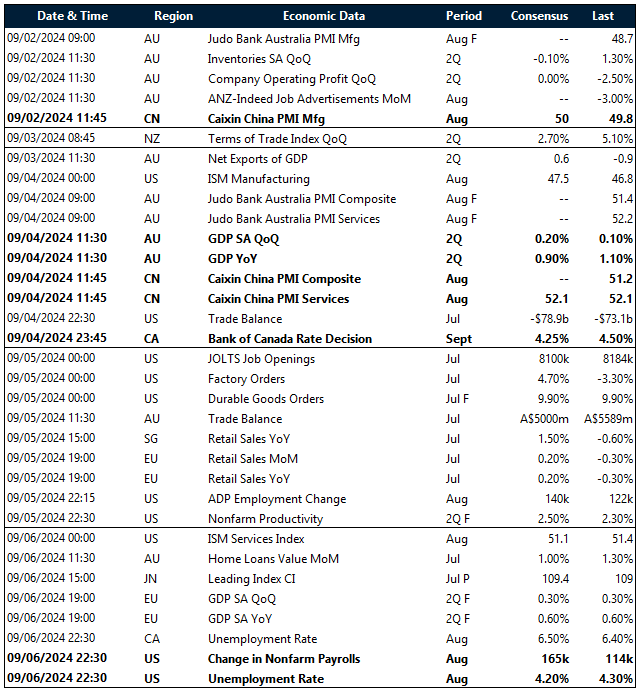

Key global risk events

Calendar: 2 – 6 September

All times AEST

Have a question? [email protected]