Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

Asian FX pressured

US equities were lower on Friday but remained higher for the week with global sentiment still mostly robust. Investors appear cheered by central bank rate cuts, economies that have mostly avoided recessions, and strong earnings growth.

The S&P500 and Nasdaq both touched new all-time highs last week.

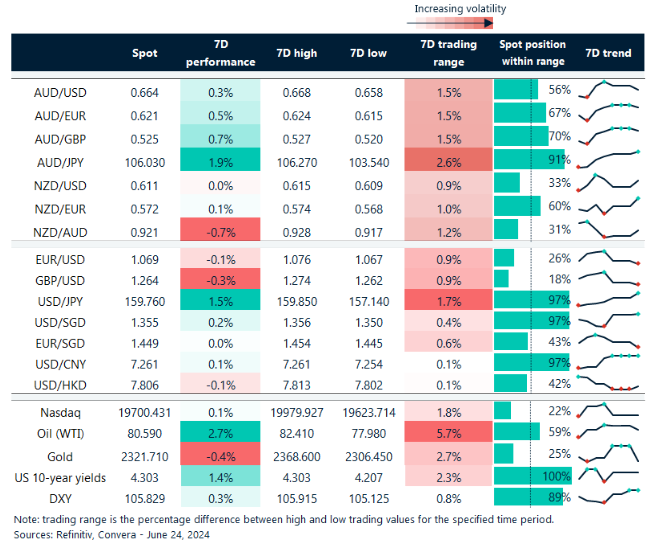

In FX markets, the US dollar remains dominant, with the USD index up 0.3% last week as it hit the highest level since 1 May.

The Aussie was also higher last week, with AUD/USD up 0.4%, after the Reserve Bank of Australia said it was still considering rate hikes. The Aussie was higher in most other markets.

The kiwi eased, with the NZD/USD down 0.4%, with a better-than-expected result from March-quarter GDP (up 0.2% for the quarter) not providing much benefit.

In Asia, the USD dollar continues to gain strongly. The USD/JPY gained 1.5% last week and is now back at the previous intervention level at 160.00.

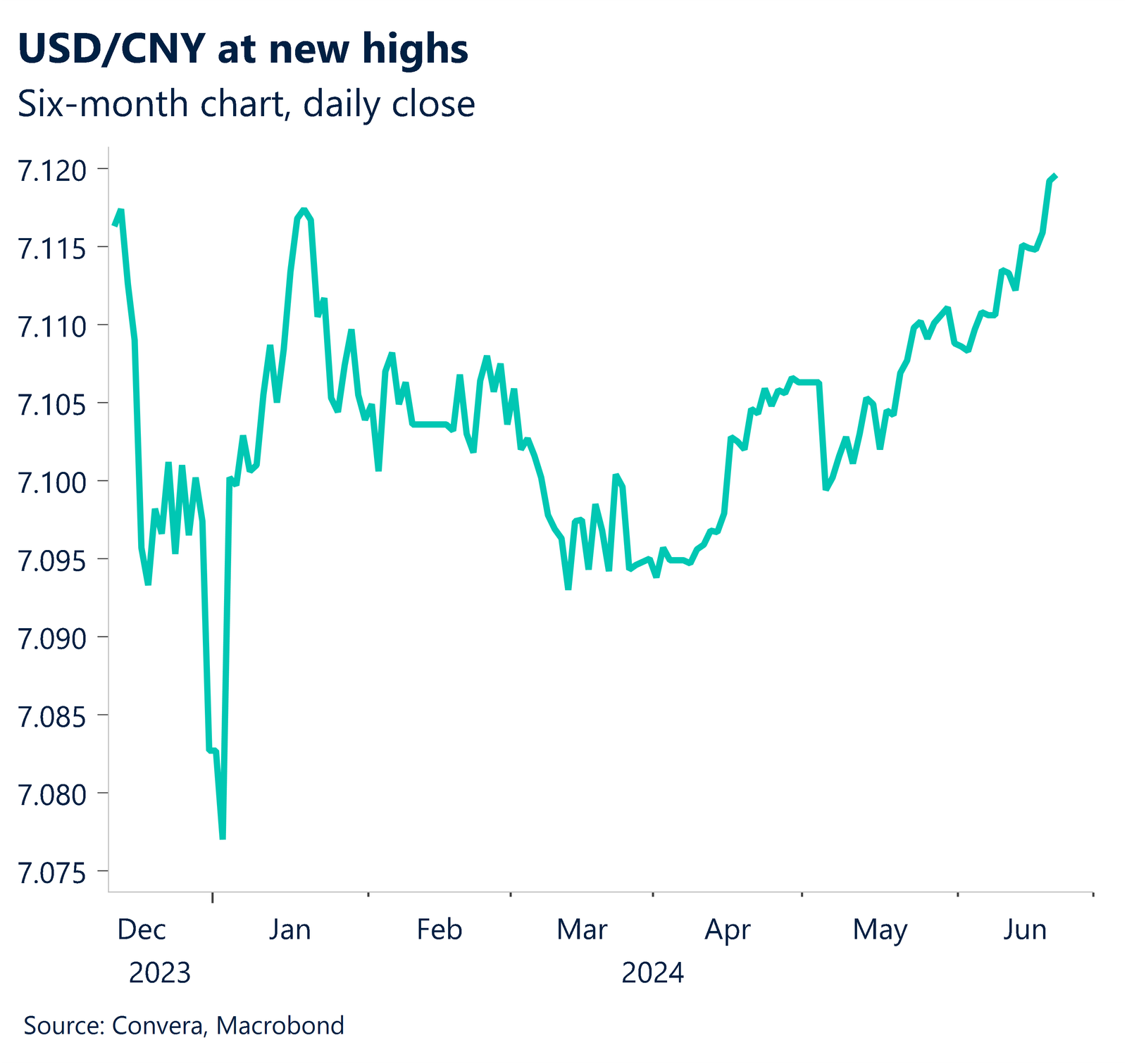

The Chinese yuan has also been notably weaker as the People’s Bank of China allowed the daily CNY fix to drift lower. The USD/CNH finished last week at 7.2900 – the lowest level since 14 November.

USD at highs as Fed aftershocks linger

The Federal Reserve decision on 13 June looks to have some medium-term impact with USD index ending last week at seven-week highs.

The hawkish surprise was in the so-called “dot-plot projections” but bond markets appear to being taking this in their stride – the US ten-year bond yield has been broadly steady around 4.25% since the Fed’s announcement.

Also, stocks shrugged off any perceived negativity as essentially the projections support a view of delayed but not necessarily shallower easing cycle.

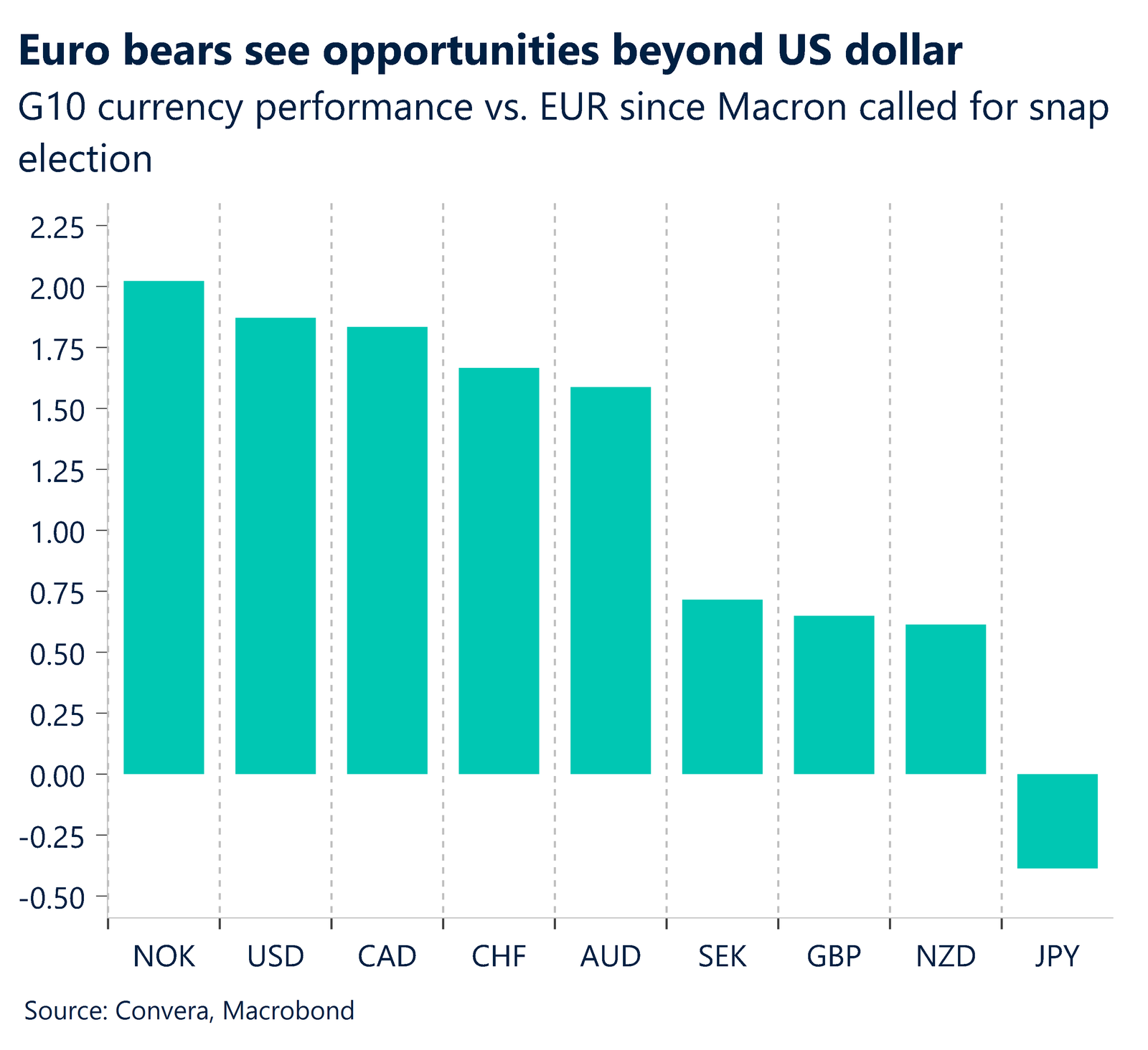

However, the US dollar has been stronger, up 1.2% since the Fed decision, helped by cuts from other major central banks this month, including the Bank of Canada, European Central Bank and Swiss National Bank.

Australian CPI key this week

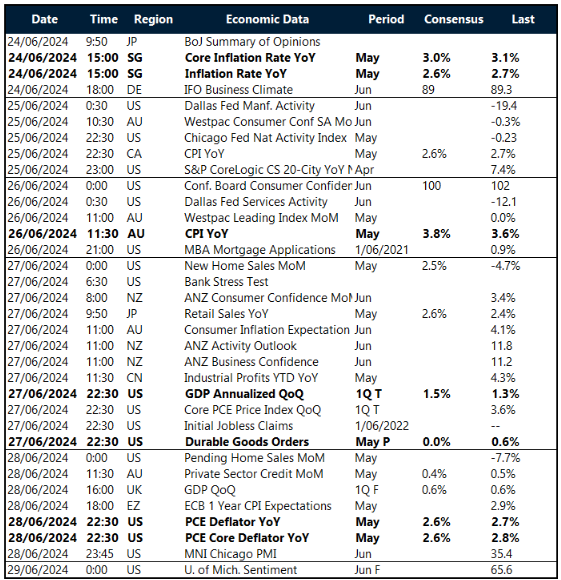

The Australian monthly CPI reading, due Wednesday, looks likely to be the major event this week.

The Reserve Bank of Philippines will hold its monetary policy meeting on Thursday, June 27, where the central bank will announce its interest rate decision. The same day, the Riksbank, Sweden’s central bank, will reveal its rate announcement and Monetary Policy Report.

In Europe, the focus is on upcoming elections, with the first round of French parliamentary elections due 30 June, and the UK general election on 4 July.

Other notable events include the release of German IFO business survey and Taiwan’s industrial production data, as well as the final reading of the US first-quarter GDP and durable goods orders for May.

Asian FX hits top of the range

Table: seven-day rolling currency trends and trading ranges

Key global risk events

Calendar: 24 – 29 June

All times AEST

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Have a question? [email protected]