The Japanese Yen (JPY) enters today’s risk event with decent momentum, having appreciated over 2% in the past seven days, ING’s FX strategist Francesco Pesole notes.

Markets remain relatively hesitant about a BoJ move by year-end

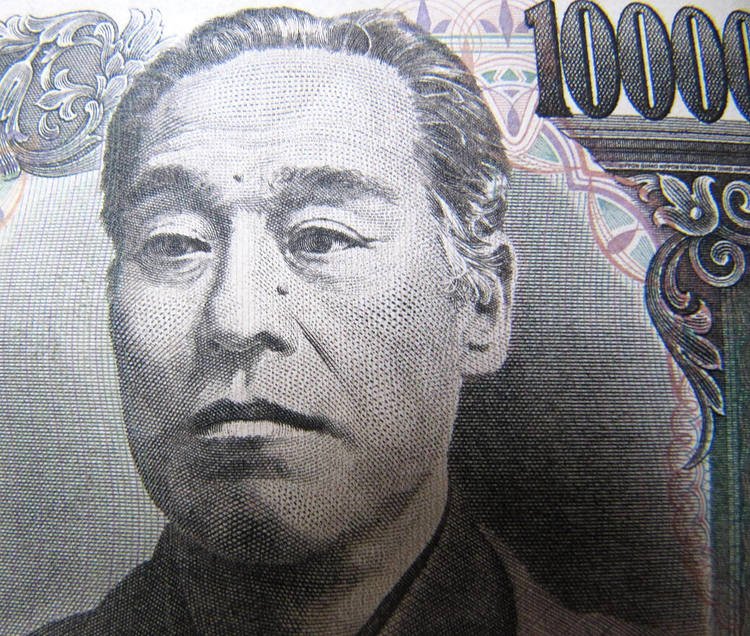

“Overnight, Bank of Japan Governor Kazuo Ueda maintained a generally hawkish tone in a likely attempt to show independence from the recent turmoil in the Japanese stock market.”

“Further rate hikes are on the table, and the marginal CPI surprise (2.8% vs 2.7% year-on-year) this morning is also helping the hawkish case. Markets remain relatively hesitant about a move by year-end though, with only 10bp priced in by December. We think the chance of a hike is – once again – underpriced.”

“Today, USD/JPY may trade higher on Powell’s cautious tone, but the path forward remains downward-sloping for the pair, in our view, as the pressure on the yen from carry trades looks unlikely to build up again into a Fed cut.”