The yen fell about 2.5% to a session low of 147.94 per dollar following the comments from BOJ Deputy Governor Shinichi Uchida. The dollar was last up 1.74% at 146.850 yen.

“As we are seeing sharp volatility in domestic and overseas financial markets, it’s necessary to maintain current levels of monetary easing for the time being,” Uchida said.

“I think we’re still going through a little bit of an unwind from what was, at least thematically from a market perspective, a little bit of an overreaction,” said Marvin Loh, senior global macro strategist at State Street in Boston.

The U.S. dollar index , which measures the currency against six rivals, rose 0.214% to 103.2, inching further above the seven-month low of 102.15 it touched on Monday.

“The drama – the sturm und drang – of these kind of moves in equities are great stories, but they don’t necessarily… signal a greater economic catastrophe. I just don’t see it,” said Joseph Trevisani, senior analyst at FX Street in New York.

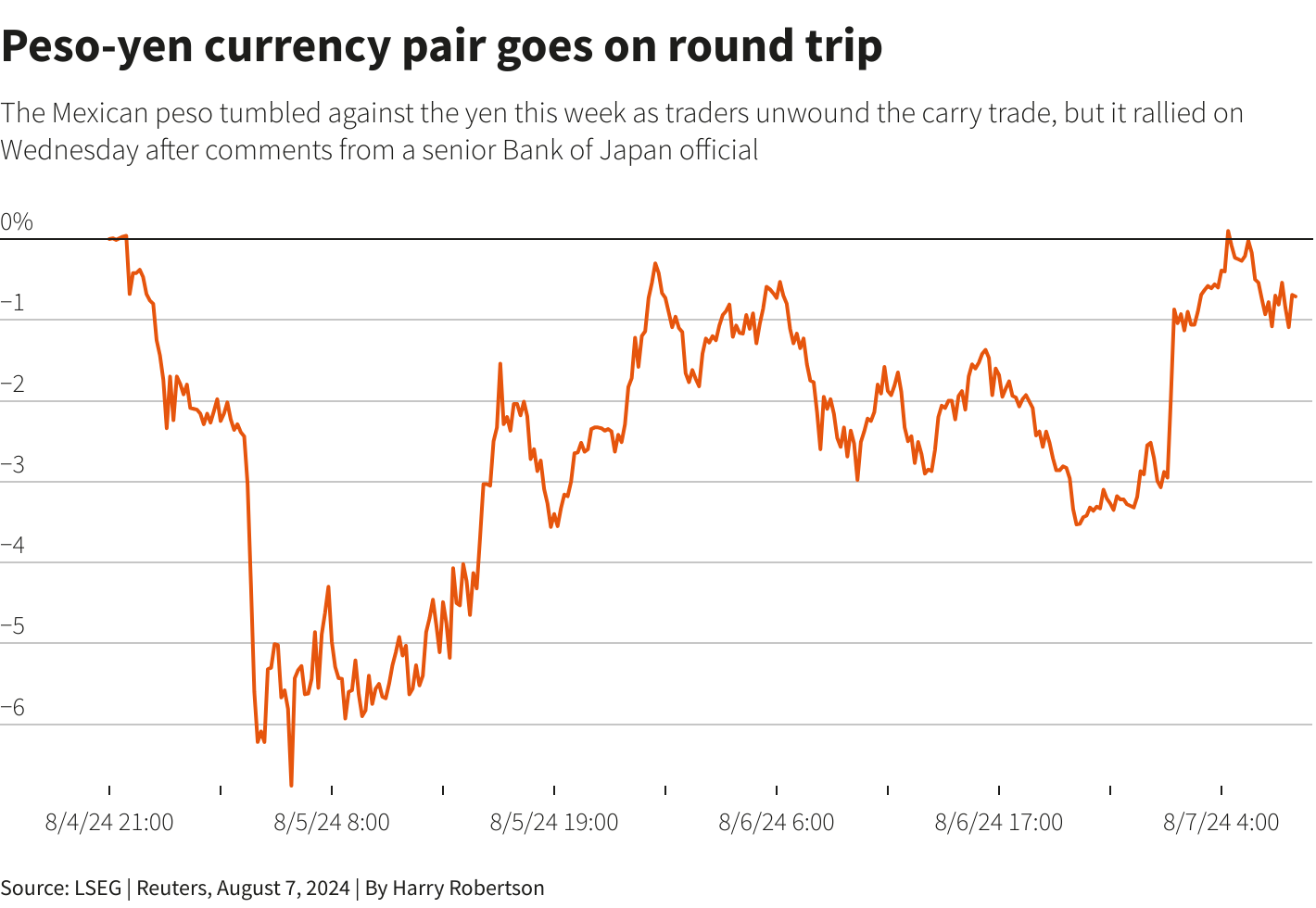

CARRY TRADES

The yen’s decline was broad based, with the Mexican peso, New Zealand dollar and Australian dollar – all carry trade investment candidates – surging against the currency.

The Swiss franc , another currency that was used to fund carry trades, like the yen, was down around 1.18% to 0.862 per dollar.

The euro was down 0.09% at $1.092, below an eight-month high of $1.101 hit on Monday as the dollar dropped. Sterling was 0.06% lower at $1.268.

Traders ramped up their bets on Federal Reserve rate cuts on Monday following an unexpected jump in the unemployment rate on Friday, at one point pricing in more than 125 basis points of reductions this year.

Those bets have gradually come down, and traders on Wednesday were expecting 100 bps of easing this year and a 62% chance of a 50 basis point cut in September, having priced it as a near certainty on Monday.

“I think you start to see people saying, hey, let’s go more and more through the details of what’s going on in the labor market, and really come to the conclusion that things are really not falling apart lightning quick in the United States,” said Stephen Miran, senior strategist at Hudson Bay Capital.

The Aussie has struggled in recent days, sinking to an eight-month low on Monday in the wake of the global market meltdown, but perked up on the day following the BOJ comments.

Sign up here.

Reporting by Hannah Lang in New York; additional reporting by Harry Robertson in London and Ankur Banerjee and Vidya Ranganathan in Singapore; Editing by Peter Graff, David Holmes and Aurora Ellis

Our Standards: The Thomson Reuters Trust Principles.