Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

PBoC cut hits APAC FX

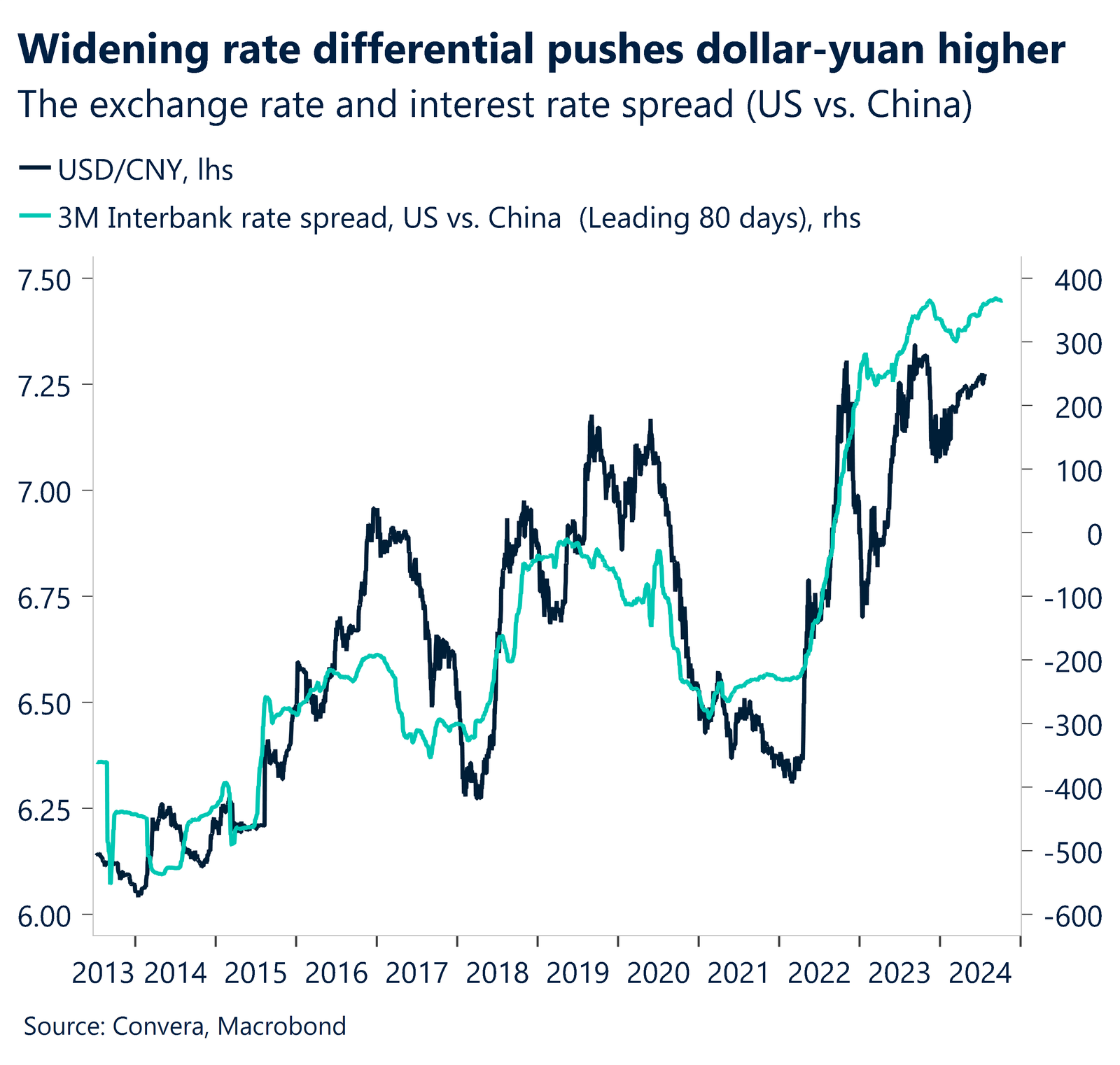

The Chinese yuan was lower on Monday after a move to cut key interest rates from the People’s Bank of China.

The USD/CNH gained 0.2% as it climbed to three-week highs and neared the highest level in 18 months. The Chinese yuan was lower versus other key currencies.

The PBoC cut the key 7-day repo rate and also moved on the one-year loan prime rate, from 3.45% to 3.35%, and five-year loan prime rate, from 3.95% to 3.85%.

The move helped the US dollar mostly gain in Asia with the AUD/USD and NZD/USD both down 0.5%. The USD/JPY fell 0.3%.

In Europe, the euro and British pound gained versus the US dollar.

USD can stage comeback despite housing market weakness

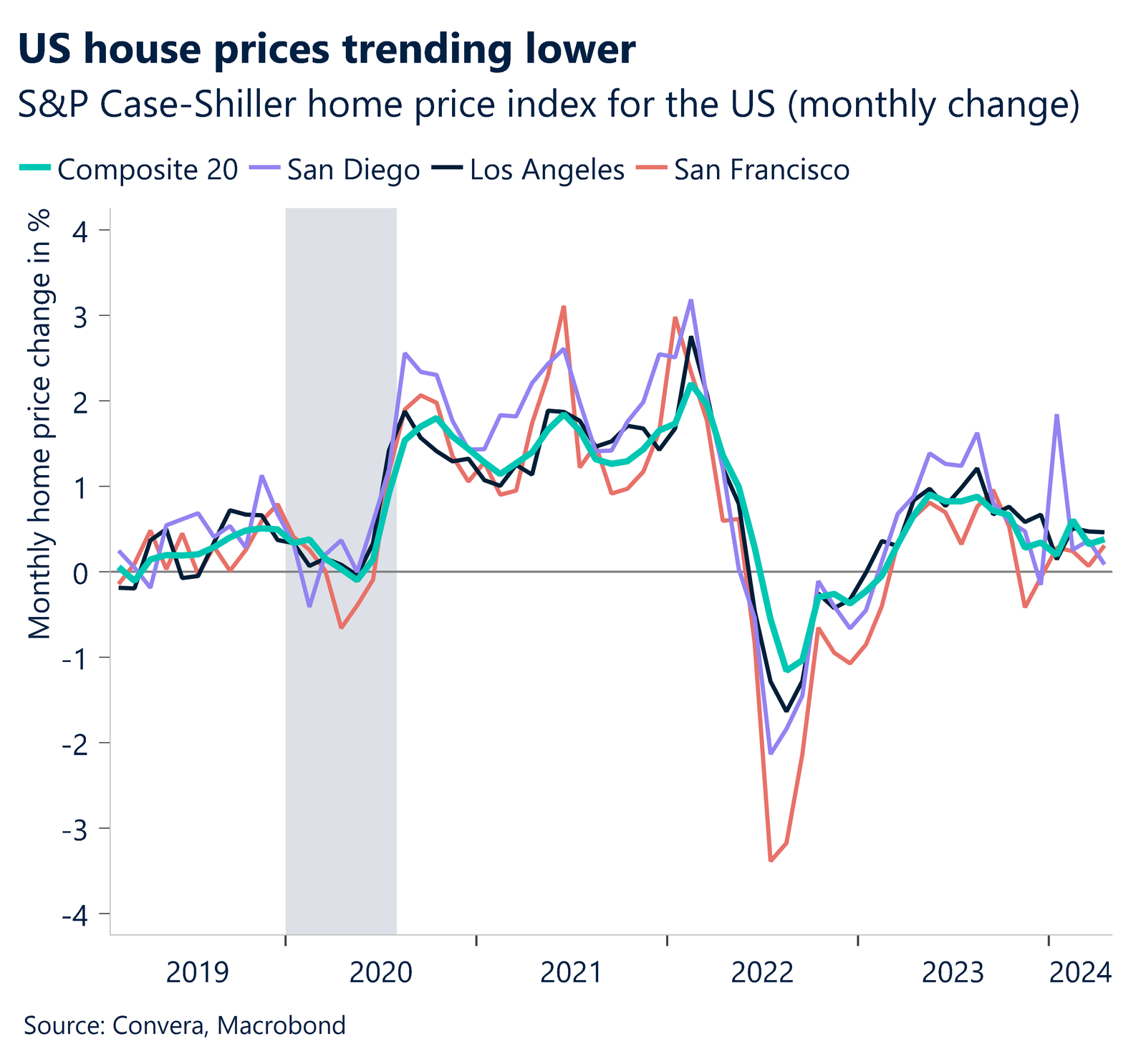

The US dollar index recently fell to four-month lows but a recent rebound signals the world’s most traded currency could stage a comeback.

Looking forward, we have key housing data. Existing house sales probably fell 3.9% month over month in June, from 4.11 million in May to 3.95 million.

April and May saw a decline in pending home sales. The supply of existing homes has been constrained, as has the demand, by elevated mortgage rates.

The dollar’s recent decline might not be long-lasting due to the weakening cyclical environment outside of the US.

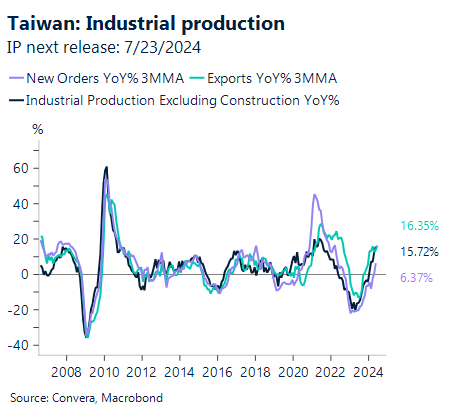

Taiwan dollar hits eight-year lows

As the US dollar surged across Asia this year, some of the most significant losses were in the Taiwan dollar, with USD/TWD climbing to eight-year highs.

The TWD has fallen despite better trade data. As a result of higher tech output, we forecast that industrial production growth will accelerate to 22% y-o-y in June from 16.1% in May. Strong activity in the IT industry may have resulted from a comeback in smartphone sales led by Apple and higher-than-expected demand for Nvidia’s new AI servers.

Thus, we believe that robust manufacturing activity will contribute to even more robust economic growth in Q2, which will reinforce our belief that rates will rise once again in September.

We are still negative towards TWD since there is no indication that the government will take steps against the TWD’s vulnerability.

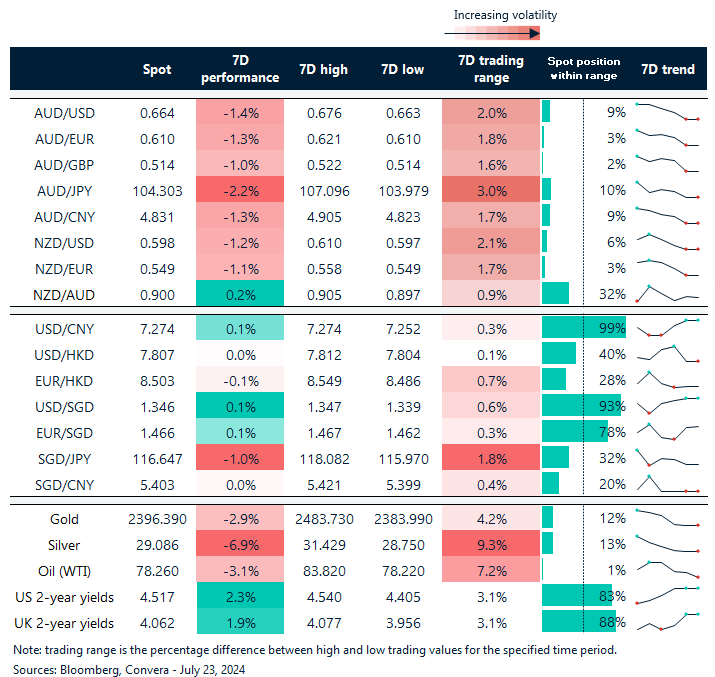

USD strength dominates APAC

Table: seven-day rolling currency trends and trading ranges

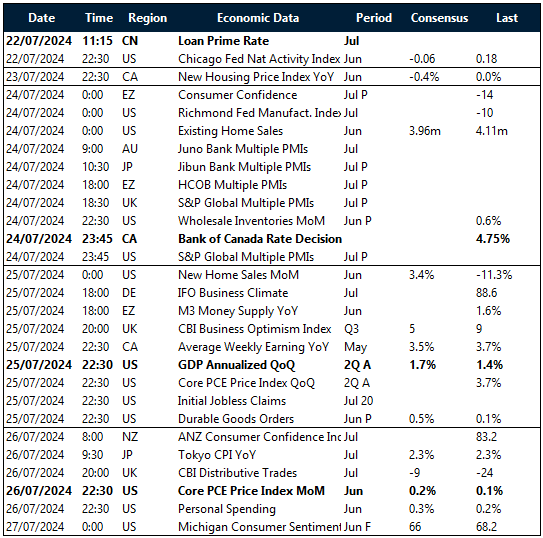

Key global risk events

Calendar: 22 – 27 July

All times AEST

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Have a question? [email protected]