Written by Convera’s Market Insights team

CPI not moving the needle

Boris Kovacevic – Global Macro Strategist

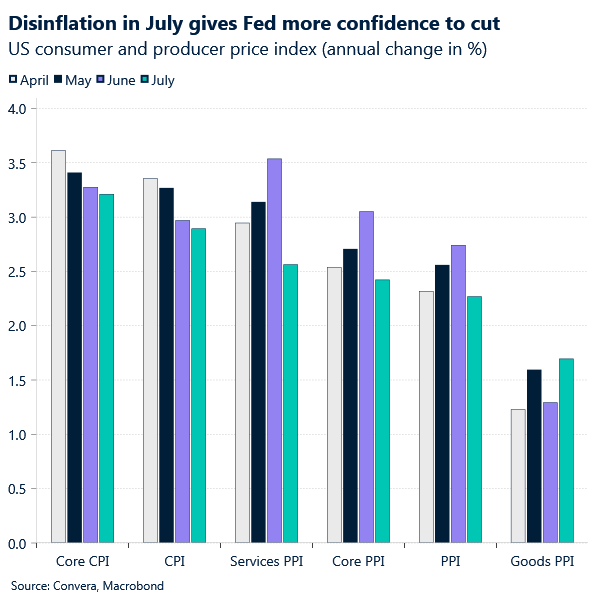

Global markets welcomed yesterday’s news about US inflation easing for a fourth consecutive month and falling to the lowest level since early 2021. Headline inflation surprised the consensus to the downside, coming in at 2.9% on an annual and 1.6% on a 3-month annualized basis in July. The CPI reports only caveat was the unexpected 0.4% monthly rise in shelter costs – the biggest component of the headline index – as rents are coming down slower than initially thought.

While the details of the CPI and PPI readings that flow into the Fed’s preferred inflation gauge (PCE) coming up later this month could see the index move higher, it is unlikely to deter the expected beginning of the easing cycle. Broadly speaking, price pressures are continuing to slow and will give the Federal Reserve (Fed) more confidence to ease policy over the coming meetings. The question has changed from asking if the Fed will cut in September to how much easing is feasible. The answer is likely to depend on the next job report, which has replaced inflation data – that had been the dominant force during the first six months of the year – as the main determinant of policy pricing in the second half of 2024.

Overall, this week’s inflation readings did not move the needle for markets, or the Fed. US equity benchmarks were trading slightly lower following the CPI report, while the US dollar and Treasury yields declined. Falling inflation rates will probably remain a net-negative development for the dollar over the next 2-3 months. It is therefore up to the macro data to move the tide into one direction. Today’s retail sales report will be the last important release this week. Any signs of recessionary risks mounting would see the dollar weaken. Robust spending would question if 200 basis points of cuts over the next seven meetings are really justified.

Sterling softens after UK CPI

George Vessey – Lead FX Strategist

A smaller-than-expected rise in UK inflation in July has traders confident that more Bank of England (BoE) cuts are coming. Markets are almost fully pricing in two more 25-basis point rate reductions this year compared to 44 basis points before the inflation report. Sterling has come under some modest selling pressure, slumping over 50 pips versus the euro as €1.17 proves to be a key short-term resistance level.

UK CPI advanced 2.2% in July and is expected to creep higher still because the impact of lower household energy prices is dropping out of the annual comparison. However, this comes as no surprise and was forecast by the BoE. Instead, more attention is on services inflation to guide policy and that posted its lowest reading in more than two years, sitting at 5.2% down from 5.7% in June and crucially, well below the BoE’s 5.6% forecast. Survey data also show firms are raising prices much less aggressively than they were and with wage growth also cooling, these conditions should help unlock at least one rate cut, possibly two more before year-end.

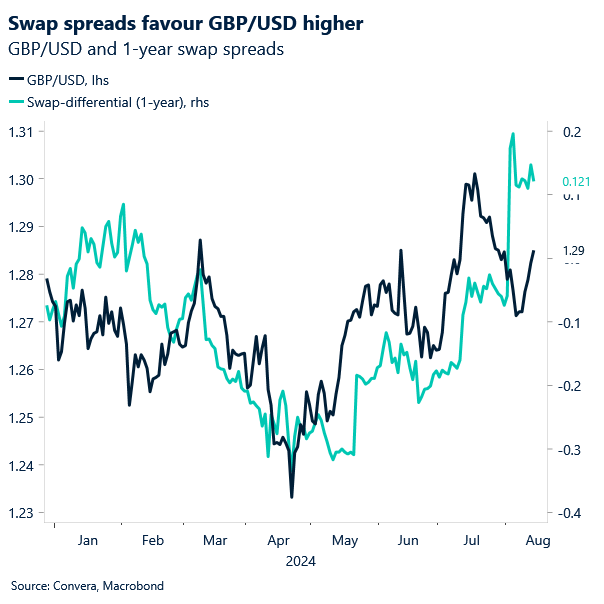

Why didn’t GBP/USD fall further yesterday? Despite UK yields falling in line with rising rate cut bets, US yields also tumbled after headline US CPI printed its lowest since 2021, allowing GBP/USD to steady above its 5-year average of $1.28. Attention now turns to UK Q2 GDP, which came in line with expectations this morning, barely budging the pound, but retail sales data out tomorrow will provide further evidence into the strength of the consumer and economy in Q3.

Recovered sentiment propels euro above $1.10

Ruta Prieskienyte – Lead FX Strategist

EUR/USD rose to its strongest level in 2024 as US CPI came in lower than expected, bolstering hopes for a Fed cut in September. However, traders anticipating an even softer print were left disappointed, as the prospect of a jumbo 50 basis points Fed rate cut in September is becoming increasingly difficult to justify. Despite a rise in US Treasury front-end rates, the euro remained strong, supported by recovering sentiment that favoured the pro-cyclical currency.

Domestic macroeconomic data was mixed and largely overlooked by market participants. Final estimates revealed that France’s annual inflation rate in July rose to 2.3% year-on-year, less than the preliminary estimate had suggested. The second estimate of Eurozone GDP came in line with expectations, but employment growth was weaker than anticipated, signalling potential trouble ahead. Additionally, June industrial production fell by 3.9% year-on-year, exceeding expectations of a 2.9% decline. In fact, Eurozone industrial production has contracted every single month in 2024 on a year-on-year basis. With the manufacturing sector remaining weak and showing little sign of recovery, it is likely to weigh on growth in Q3 2024. Consequently, Eurozone growth is likely to depend more on the services sector for now.

The Euro index advanced over 0.3% on Wednesday, supported by a modest gain against NZD. EUR/GBP rose by as much as 0.3% to £0.858 as UK inflation increased less than expected, boosting near-term Bank of England rate cut bets. Meanwhile, EUR/JPY approached a two-week high following news that Japanese Prime Minister Fumio Kishida will not be running for a second term.

CHF and JPY nursing heavy losses this week

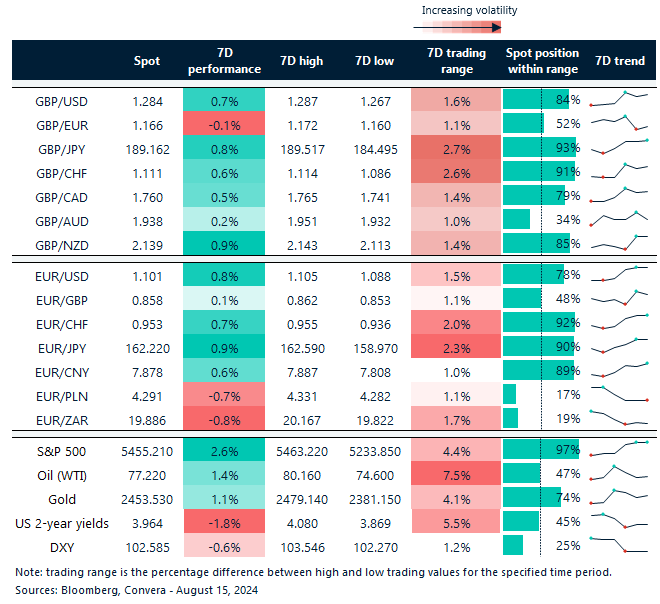

Table: 7-day currency trends and trading ranges

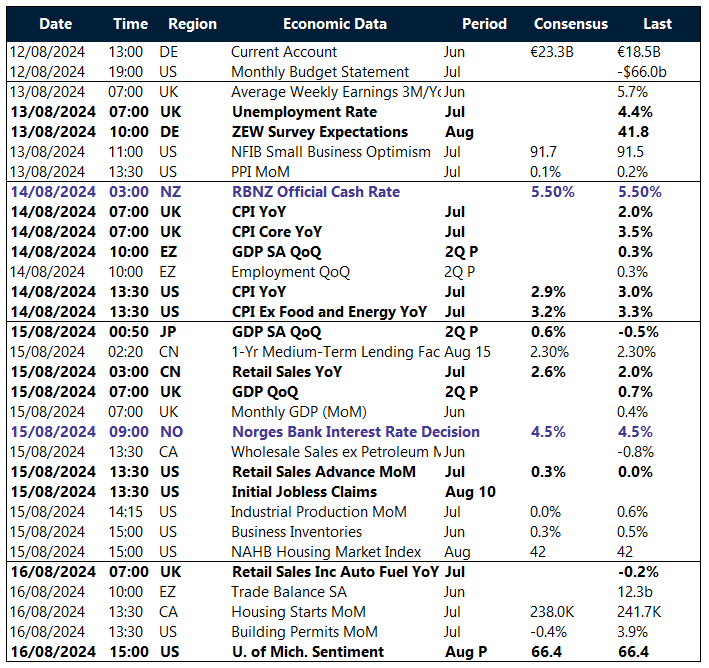

Key global risk events

Calendar: August 12-16

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.