Written by Convera’s Market Insights team

Dollar bounces amid mixed data dump

George Vessey – Lead FX Strategist

US Treasury yields fell after US jobless claims came in higher than expected yesterday, pointing to further weakness in the labour market and firming up the case for two or more interest rate cuts by the Federal Reserve (Fed) this year. However, the move in yields was tepid and the US dollar in fact rebounded from a near-4-month low.

The market is seemingly more and more sensitive to further signs of a labour-market softening, and so another upside surprise in jobless claims was noteworthy. While the level of initial filings is only back to early-June levels, continuing claims are now at their highest level since November 2021. The impact on the bond and currency markets may have been soothed a bit by the Philly Fed survey, which pointed to expansion in July after months of contraction, with many sub-indexes reaching their highest levels since 2022. Notably, new orders surged from -2.2 to 20.7 (the highest since March 2022) and employment from -2.5 to 15.2 (the highest since October 2022). Although strong figures, the Philly survey is known to be volatile, so the data should be taken with a pinch of salt when assessing the manufacturing outlook.

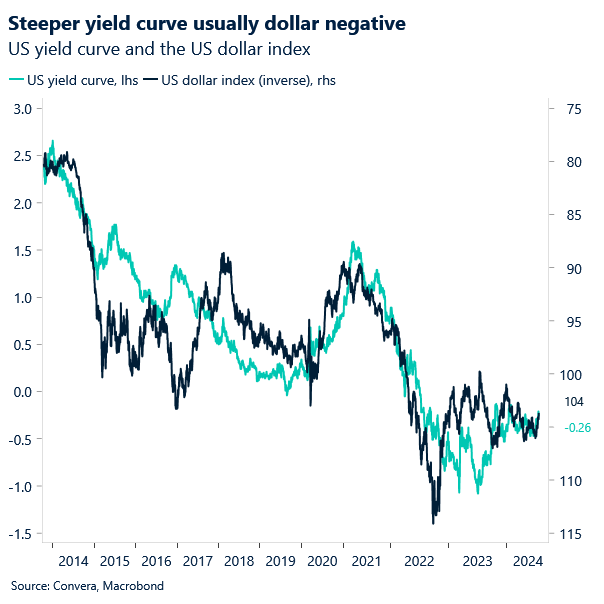

Investors have interpreted the recent news and data flow as dovish enough for the Fed to start its easing cycle in September. Markets are pricing in six rate cuts over the course of the next nine policy meetings with the benchmark policy rate settling at around 4% in exactly one year from now. This is dollar bearish. On the political front, however, speculation is swirling around what a potential Trump presidency will mean for markets. It does appear that Trump’s fiscal rhetoric (higher long-end yields) coupled with rising Fed easing bets (lower short-end yields) are leading to a steepening of the yield curve. This could lead to a weaker dollar in the future.

Pound looks toppy after retail sales miss

George Vessey – Lead FX Strategist

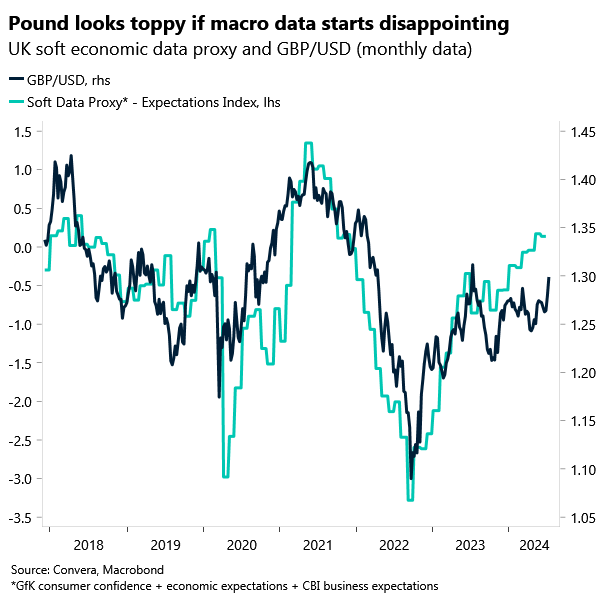

Sterling has surrendered a chunk of its weekly gains, particularly against the stronger US dollar, which has seen GBP/USD slide south of the psychologically important $1.30 handle. Adding insult to injury was this morning’s UK retail sales data for June, which came in worse than expected.

British retail sales volumes fell by 1.2% in June following a 2.9% rise in May. All the sub-sectors were weaker, with the sharpest downward contributions from department stores, clothing and footwear retailers. Despite the GfK Consumer Confidence indicator for the UK rising to -13 in July from -14 in June, improving for the fourth consecutive month to the highest level since September 202, retailers blamed election uncertainty, poor weather and low footfall for the weaker sales. The British pound had been enjoying a healthy appreciation against its peers following the sticky services inflation print earlier this week leading to a scaling back of Bank of England (BoE) rate cut bets. But with private sector wage growth decelerating and consumer spending cooling, the BoE’s August meeting looks set to be a coin toss. Given markets have moved to somewhat price out an August cut, if the BoE were to start easing next month, this would make for a very negative event for the pound.

Sterling is also on the backfoot against the euro somewhat after stretching to near 2-year highs earlier in the week. GBP/EUR’s grip on the €1.19 handle has loosened as it flirts precariously with its 200-month moving average, which has been a tough resistance level over the past eight years.

ECB fails to inject excitement

Ruta Prieskienyte – Lead FX Strategist

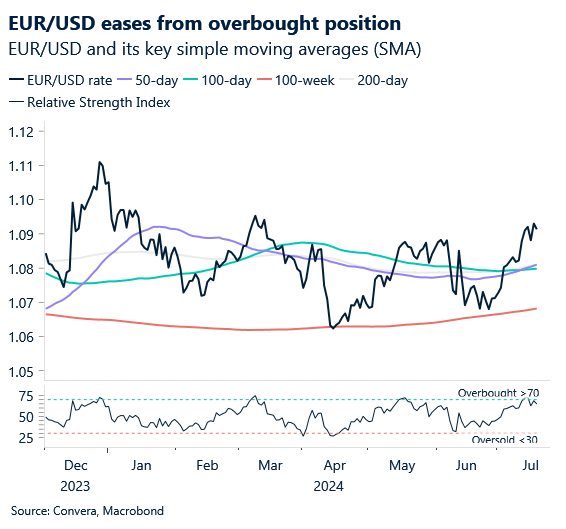

The euro retreated from a four-month high to $1.091 as the latest ECB monetary policy meeting offered very little guidance on the extent of rate cuts later in the year. European bonds remained largely unchanged and continue to underperform Treasuries, with the DE-US 2-year bond yield spread widening to a one-week high of 170bps.

As expected, the ECB held its key interest rates unchanged in their July meeting, reflecting policymakers’ uncertainty on whether inflation in the Eurozone is moderating quickly enough to warrant looser monetary policy. President Lagarde refrained from pre-committing to a specific rate cut trajectory, noting that September’s decision is wide open. Although arguably the most influential Governing Council member, Lagarde is not usually the one to signal a turning point in the Council’s sentiment, a role historically assumed by ECB members Lane and Schnabel. With the need for more evidence of easing inflation pressures growing, especially on the services and wage growth front, we view rate cuts as more likely at meetings accompanied by updated staff forecasts, namely in September and December. Markets continued to expect that the ECB would resume cutting interest rates in its upcoming meeting in September, pricing in 20bps of cuts. Year-end expectations remained largely unchanged at 46bps.

From a technical standpoint, the current euro pullback results from overbought conditions, as indicated by the RSI metric. With the economic calendar largely absent of market-moving data releases, attention shifts back to the US, which will continue to drive the EUR/USD trajectory.

CAD vulnerable as BoC rate cut bets rise

Table: 7-day currency trends and trading ranges

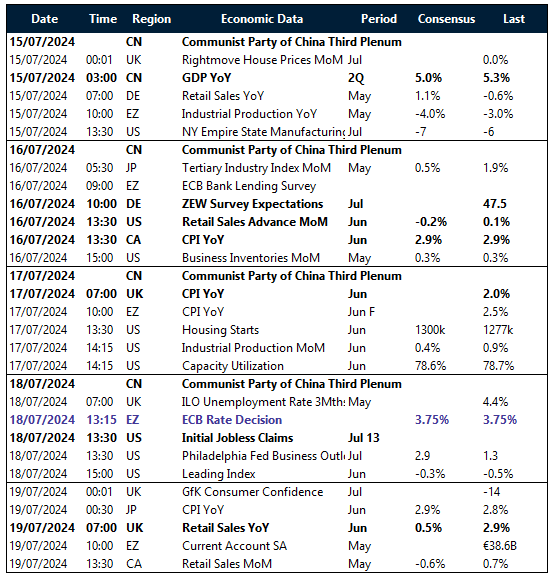

Key global risk events

Calendar: July 15-19

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.