Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

USD lower after Biden quits

The US dollar was moderately weaker in early Monday trade after US president Joe Biden announced he was dropping out of the 2024 presidential race.

President Biden endorsed vice president Kamala Harris to run in his place, but the final decision will be made at the Democratic National Convention, due to begin on 19 August. Other contenders might launch a campaign to attempt to win over the DNC’s delegates.

The reaction in FX markets was relatively muted with the USD slightly weaker.

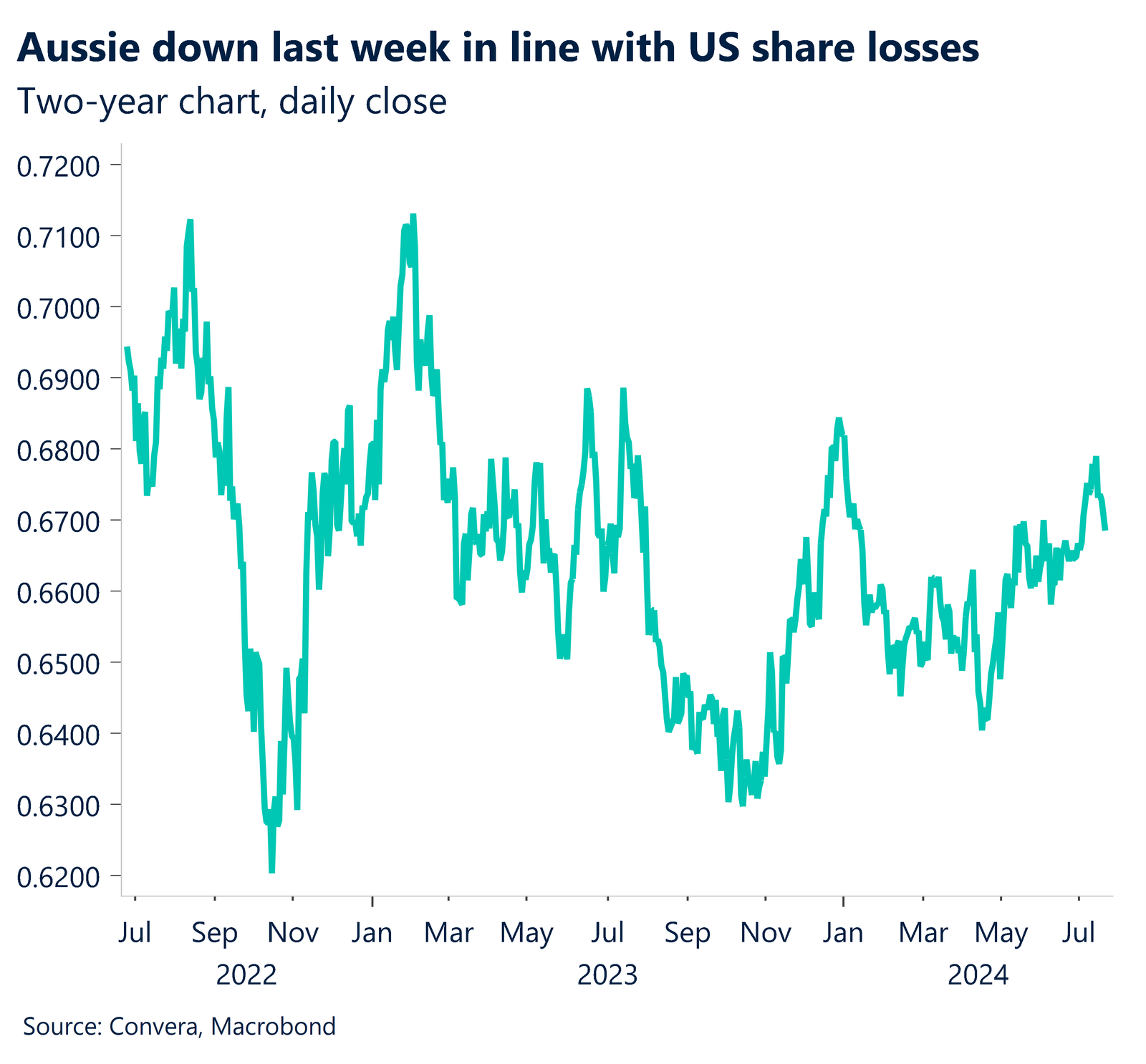

The AUD/USD gained around 0.1% as it climbed from the two-week lows seen on Friday. The AUD/USD was lower last week – down 1.1% last week – in line with losses in US sharemarkets with the Australian dollar traditionally seen as a “risk-sensitive” currency.

The kiwi also climbed, up moderately from Friday’s one-month lows.

In Asia, the USD/JPY was slightly lower, USD/SGD slightly higher while USD/CNH was flat.

China’s loan rate, BoC decision and US data in focus

FX markets will be influenced by important economic data releases and central bank decisions this week, with notable events from major economies including the United States, Germany, and Japan.

The week begins China’s key loan prime rate decision – the benchmark rate for the Chinese financial system – due at 9.15am HKT (11.15am AEST). No change is expected.

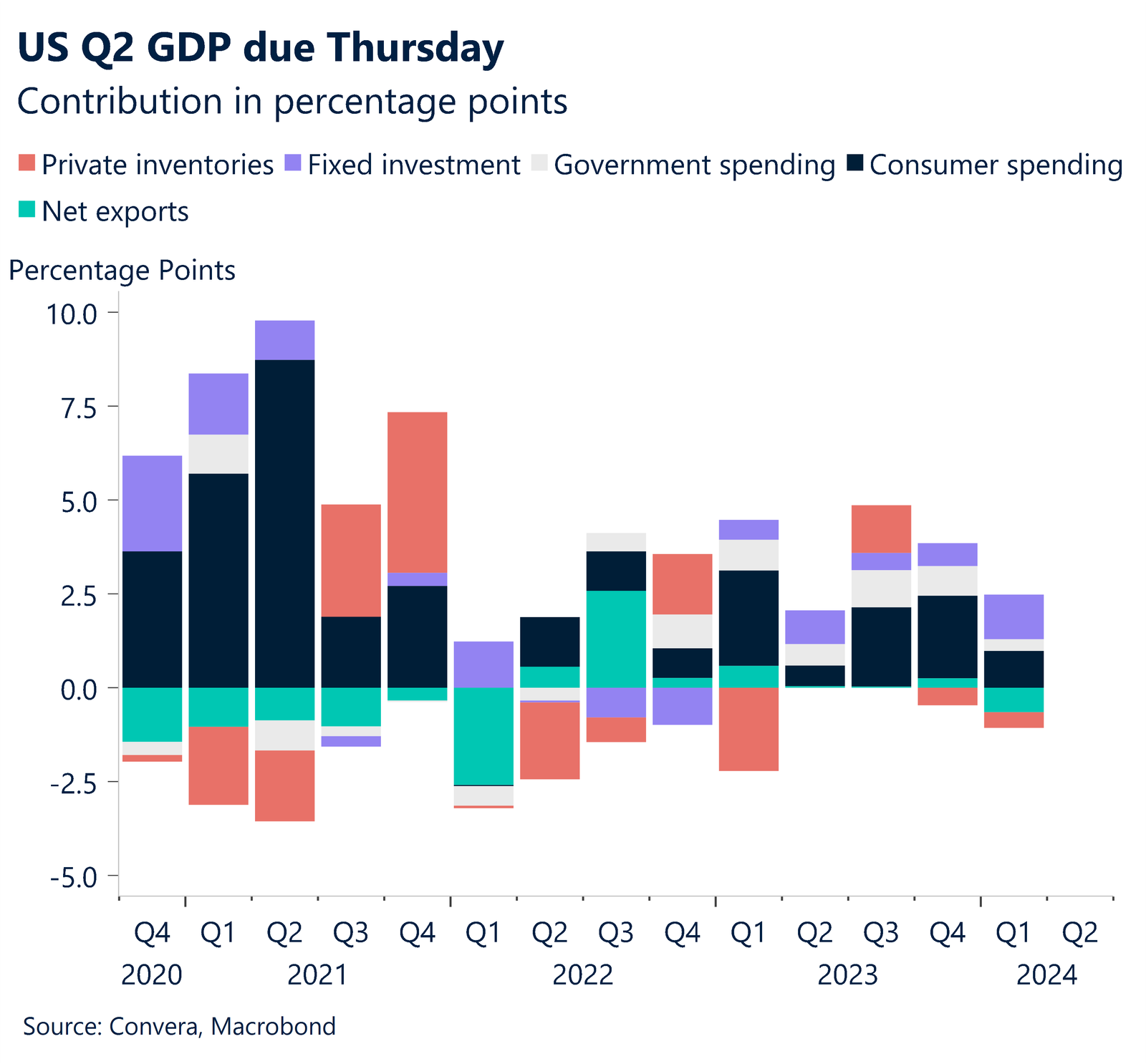

As the week progresses, attention will turn to preliminary PMI data from across the globe, consumer confidence figures from Germany and France, and GDP data from South Korea and the United States.

The Turkish central bank’s rate decision on Tuesday will be closely watched by emerging market investors while Bank of Canada meets on Wednesday night.

In the United States, existing home sales data on Tuesday and new home sales figures on Wednesday will provide insights into the health of the housing market. Thursday’s GDP and Friday’s personal consumption and expenditure numbers will be the week’s highlights.

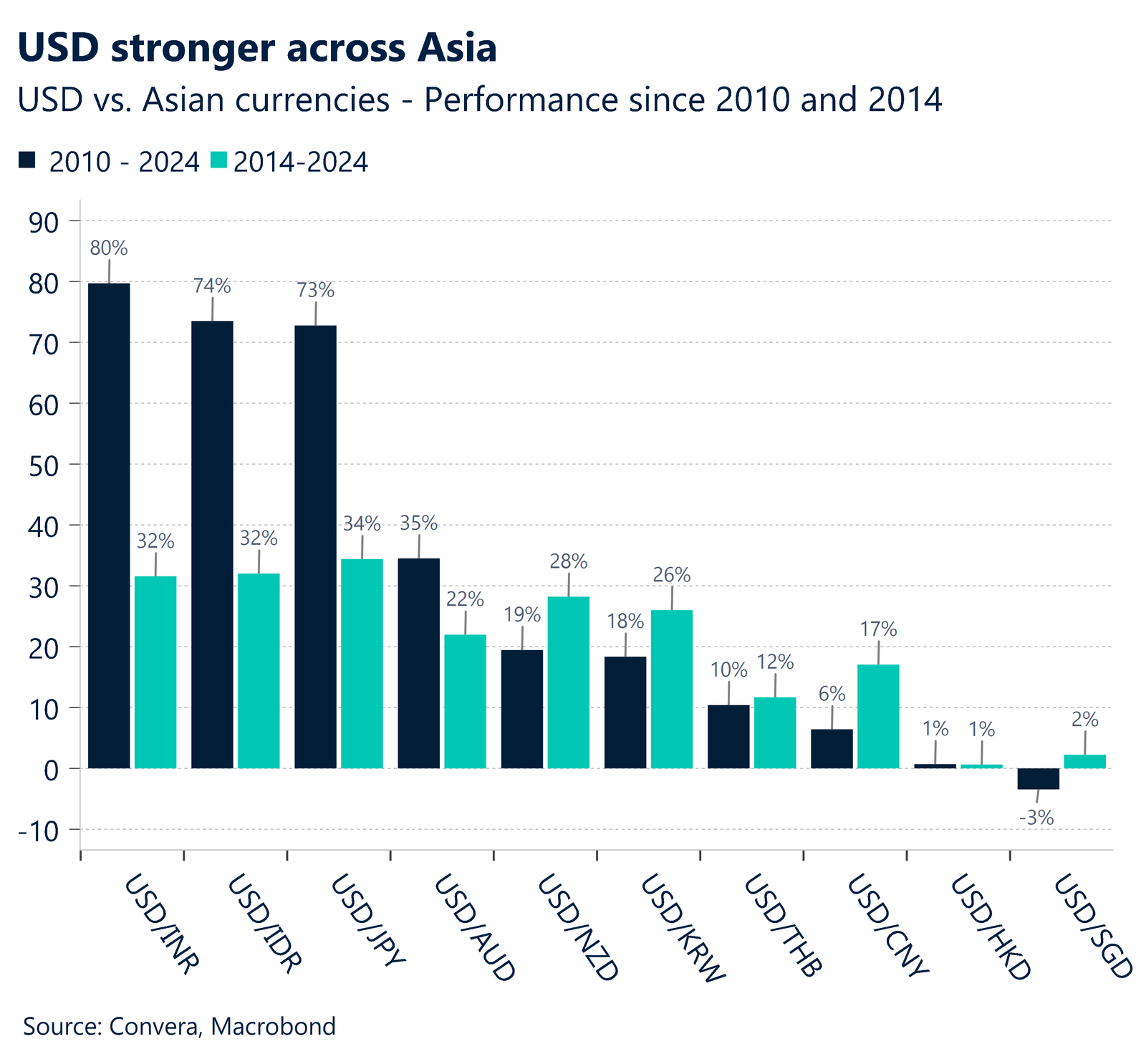

Korean won eases despite strong export growth and tech demand

The Korean won has been recently weaker with the USD/KRW and AUD/KRW both near two-year highs.

Looking to upcoming trade data, due to increased working days, we anticipate that export growth during the first 20 days of the month will increase from 8.5% y-o-y in June to 20.8% y-o-y in July.

Due in large part to the robust demand for chips, daily average export growth probably increased to 13.5% y-o-y in June from 8.5% in May after accounting for working days.

With Nvidia scheduled to debut its new AI servers in H2, we continue to witness tailwinds for semiconductor exports as chip prices rise.

Furthermore, non-chip exports like autos probably contributed to the rise of exports as well, confirming our theory of a broader revival in the export industry.

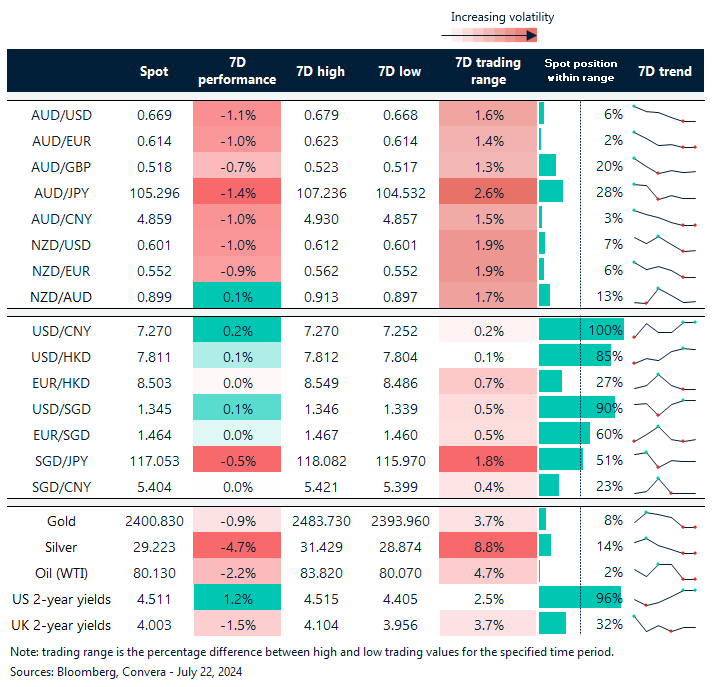

USD lower on Biden news, but most APAC FX remain weak

Table: seven-day rolling currency trends and trading ranges

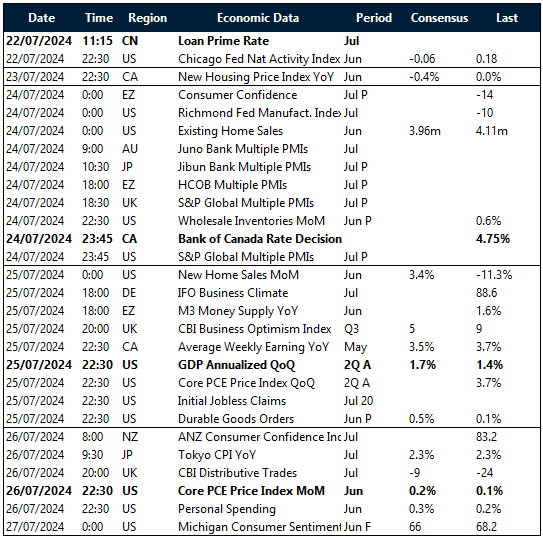

Key global risk events

Calendar: 22 – 27 July

All times AEST

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Have a question? [email protected]