Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

USD inches higher as markets turn cautious

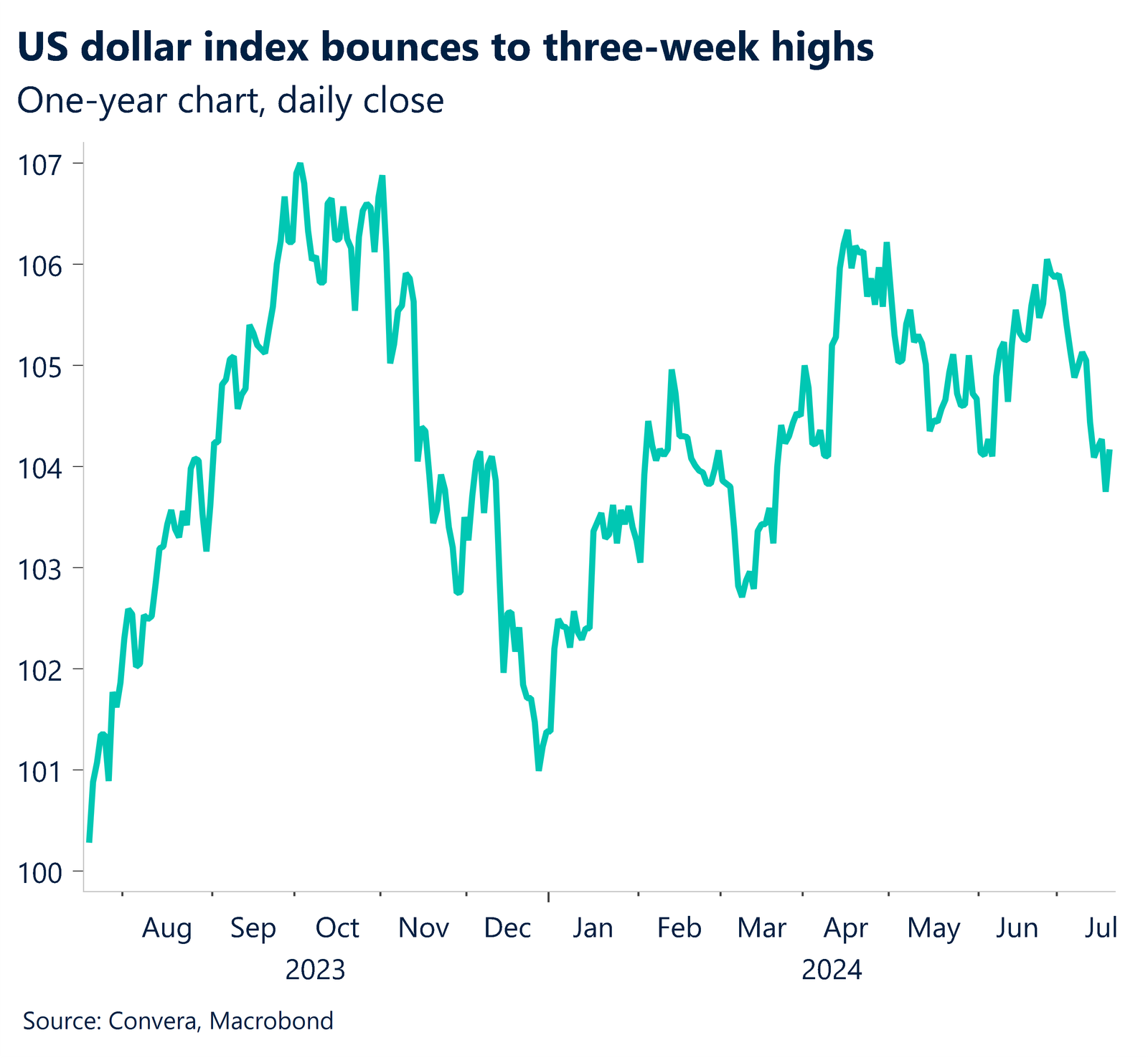

The US dollar was mostly higher overnight, with the US index at three-week highs, as markets turned more cautious ahead of Wednesday night’s all-important Federal Reserve meeting.

US sharemarkets were mostly flat as the volatility that defined last week eased.

While FX markets were also mostly quiet, the majority of key currencies eased versus the US dollar.

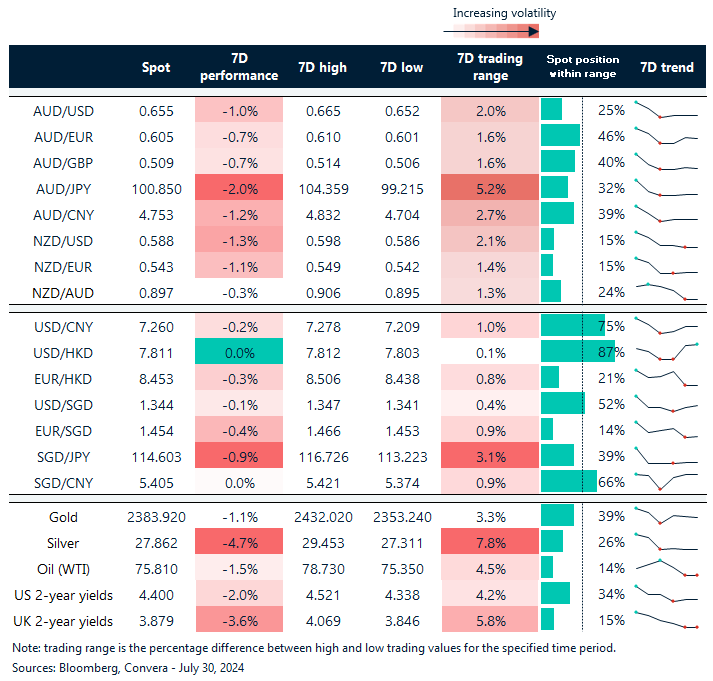

The GBP/USD fell 0.1%, EUR/USD lost 0.3% while USD/JPY gained 0.3%.

Locally, the AUD/USD bucked the trend as it gained 0.1%, while the NZD/USD lost 0.1%.

The USD/CNH and USD/SGD both gained 0.1%.

The next few days will see a sequence of key events that could drive major moves. On Wednesday, Australian CPI and the Bank of Japan meet. Thursday morning sees the US Federal Reserve while the Bank of England decision is due Thursday night. Friday night sees the US non-farm employment report.

US consumer mood signals US slowdown

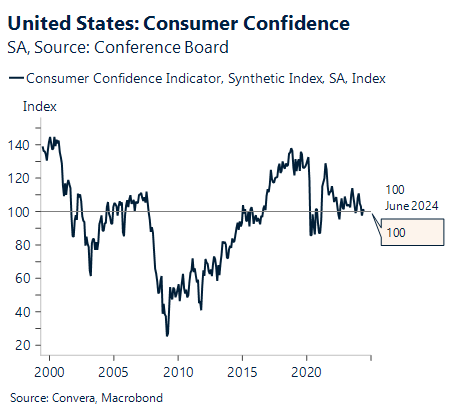

The expectations for Fed cuts have grown as more mixed signals have been seen in the economy. Preliminary University of Michigan consumer sentiment index declined, despite early July improvements in equity prices that have since retreated and recent inflation data showing moderating prices.

Moreover, the cost of gas increased at the beginning of the month. We think the labor markets remained cool in July, which probably had an impact on the Conference Board’s confidence index because the majority of the survey’s questions are about the labor market. Consumer confidence looks likely to decrease slightly from 100.4 in June to 99.0 in July.

The US dollar might regain recent losses due to the uncertainty surrounding the US economy’s cyclical backlash as well as the potential for trade conflicts resulting from the US elections.

Euro finally cracks ahead of sentiment data

The euro has recently been one of the stronger FX markets but finally cracked overnight as the EUR/USD fell to four-week lows.

The euro fell in other markets. The AUD/EUR bounced from key support at 0.6000 while NZD/EUR similarly rebounded from 0.5400.

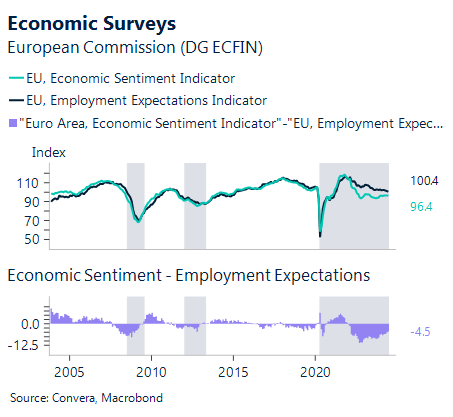

According to the July results of the most recent Sentix, ZEW, and PMI surveys, we think the July economic confidence indicator from the European Commission may also decline.

Pricing balances, however, will be of greater significance to the ECB.

We will have a clearer picture of the degree of pricing power retained by services firms and the persistence of labor shortages thanks to this most recent quarterly survey.

Aussie rare winner overnight

Table: seven-day rolling currency trends and trading ranges

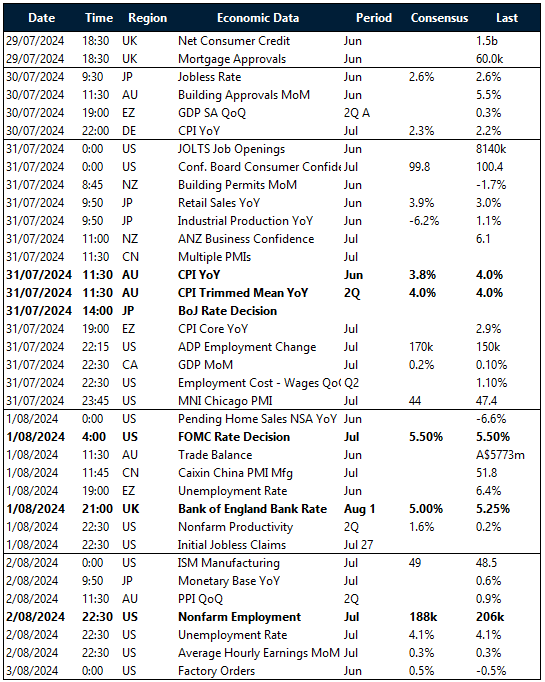

Key global risk events

Calendar: 29 July – 3 August

All times AEST

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Have a question? [email protected]