By Swann Collins, investor, writer and consultant in international affairs – Eurasia Business News, July 29, 2024. Article no 1121

The use of ZiG (short for the Zimbabwe Gold currency), which replaced the Zimbabwean dollar after it actually depreciated, has doubled since its launch in April 2024, Bloomberg reports, citing Zimbabwean Central Bank Governor John Mushayawanha.

According to the Bloomberg agency, ZiG is currently used in 30% of all transactions in the country. On July 15, Mushayavanhu reported in an interview with Bloomberg that the use rate of ZiG in the country had reached 20%.

Zimbabwe has launched the world’s newest currency – the ZiG. The new gold-backed currency called the ZiG, or Zimbabwe Gold, has come into effect from April 5, 2024 and will co-circulate with other foreign currencies in the economy.

In May Zimbabwe’s central bank said the country is “recalibrating its monetary policy framework”.

This is Zimbabwe’s sixth attempt to create a functioning local currency in the last 15 years, and it is backed by foreign exchange reserves, as well as precious metals. Last week, Finance Minister Mthuli Ncube announced measures to stimulate demand for ZiG, and also ordered government departments to accept payments in local currency instead of US dollars.

Read also : Gold : Build Your Wealth and Freedom

The Zimbabwe’s authorities revealed that by 2030 the ZiG will become the only legal tender, while President Emmmerson Mnangagwa has said that the goal could be achieved as early as 2026.

Zimbabwe decided to leave its currency in 2009 amid its complete depreciation and switched to the US dollar. The Zibabwean dollar was reintroduced in 2019 – in this way the authorities tried to revive the stagnating economy, but a couple of years later the country again allowed to pay in US dollars due to a strong acceleration in inflation. Last year, Zimbabwe’s president extended the use of the U.S. dollar for five years, until 2030.

Plagued with hyperinflation since 2007, the government of Zimbabwe decided to strengthen the Zimbabwean dollar starting the sale of gold coins in July 2022, as we reported then.

By mid-July 2019, inflation had increased to 175%, sparking concerns that the country was entering another period of hyperinflation. In March 2020, with inflation above 500% annually, a new task force was created to assess the currency problems.

By July 2020, annual inflation was estimated to be 737%. In 2022, the country experienced another period of high inflation, which jumped to 131.7% in May from 96.4% in April. The government was struggling to pull Zimbabwe from the grips of an economic crisis characterized by high inflation, a rapidly devaluing local currency, 90 percent unemployment, and declining manufacturing output.

To save the national economy and currency, the central bank of Zimbabwe decided in 2021 to buy gold bars from a private company in order to issue gold coins in 2022.

In February 2023 the Reserve Bank of Zimbabwe reported that some 25,188 of its gold coins were sold between July 2022 and January 13, 2023. According to the central bank governor, John Mangudya, the gold coins “have proved to be an effective open market instrument for mopping up excess liquidity in the economy.”

Hyperinflation in Zimbabwe began in February 2007. During the height of inflation from 2008 to 2009, it was difficult to measure Zimbabwe’s hyperinflation because the government stopped filing official inflation statistics.

Initially launched to act as “an alternative retail investment product for value preservation,”, the central bank said lower denomination gold coins introduced in November 2022 “accounted for 38% of all sales.”

Commenting on the gold coins’ impact since their introduction, Reserve Bank of Zimbabwe (RBZ) governor John Mangudya said: “The coins have proved to be an effective open market instrument for mopping up excess liquidity in the economy and a retail investment product for preserving value for investable funds.”

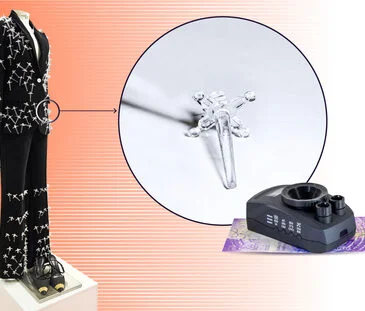

The gold coins are minted by Fidelity Gold Refineries (Private) Limited. Founded in 1978 and fully owned by the Reserve Bank of Zimbabwe, the company is the sole gold buying entity and refining entity in the country.

The new gold coins weigh one troy ounce and are made of 22-carat gold. Each coin costs the price of one gold troy ounce. The coin was called “Mosi-oa-Tunya”, which means “rumbling smoke” – this is how Victoria Falls is called in the language of the local Lozi people.

The value of each coin is equal to the price of an ounce of gold plus 5% to cover the cost of minting.

The RBZ governor added that the coins, which have a 180-day vesting period, along with the bank’s high-interest rate policy, played a part in stabilizing inflation and the local currency’s exchange rate versus the greenback.

According to the local statistical office, Zimstats, the African country’s month-on-month inflation fell from a high of 30.74% in June 2022 to 1.1% in Jan. 2023. Thanks to the gold coins released by the Zimbabwe’s central bank since July 2022, the month-on-month inflation rate in February 2023 was – 1.6 percent shedding 2.3 percentage points on the January rate of 0.7 percent, reported the Zimbabwe National Statistics Agency (ZIMSTAT). Annual inflation for February 2023 also declined to 92.3 percent from 101.5 percent the previous month.

One year and a half later, consumer prices unchanged in June 2024 after falling 2.4% in May.

The issue of gold coins started in 2023 to remove pressure on the national currency, cooling inflation and allowing citizens to hope for easier daily expenses. This work goes ahead in 2024.

Our community already has nearly 135,000 readers!

Subscribe to our Telegram channel

Notify me when a new article is published:

Follow us on Telegram, Facebook and Twitter

© Copyright 2024 – Eurasia Business News. Article No. 1120.