Written by Convera’s Market Insights team

US dollar in freefall

Boris Kovacevic – Global Macro Strategist

One more week in global macro this year has been dominated by developments in the United States, in particular the news flows regarding the Federal Reserve. Investors had been eagerly awaiting the scheduled speech by Fed Chair Jerome Powell at the last day of the Jackson Hole Symposium in Wyoming. The short speech confirming policy makers easing bias, acknowledging the recent cooling of the labor market, and preparing the groundwork for rate cuts over the coming months have given markets the green light they had been seeking for so long.

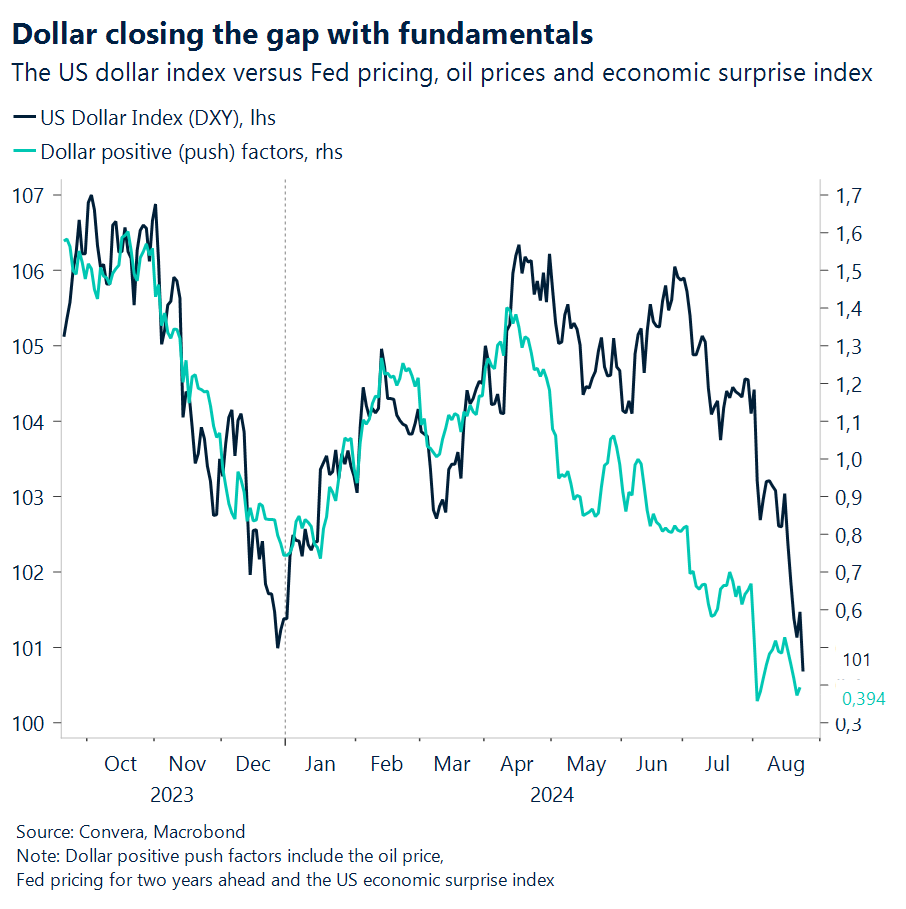

Investors on the futures market are pricing in around 100 basis points of cuts until the end of the year with three FOMC meetings left. This implies a larger-than-usual 50 basis point cut at one of the meetings. US equities rallied and secured their third consecutive weekly gain, while bond yields fell in anticipation of easier policy rates. However, the freefall of the US dollar stole other assets the show. It fell for a fifth week and it on track for its worst month in about a year (-1.7%).

The recent leg higher of important dollar pairs such as EUR/USD, GBP/USD and weakness of USD/JPY have led the US Dollar Index to its lowest level so far this year. The Greenback has reduced its post-pandemic gain to around 3%, while being down 12% from its peak reached in September 2022.

The next risk event comes in the form of the PCE report. Underlying inflation in the US is expected to have increased by 0.2% in July to 2.7%. While this constitutes an acceleration from the annual growth rate seen in June at 2.6%, it is likely not enough to move the needle when it comes to the expected Fed rate cut in September. The job report the week after will therefore be the decider of the magnitude (25 vs. 50bp) of easing at the next meeting.

Proud pound pounces to 2-year peak

George Vessey – Lead FX Strategist

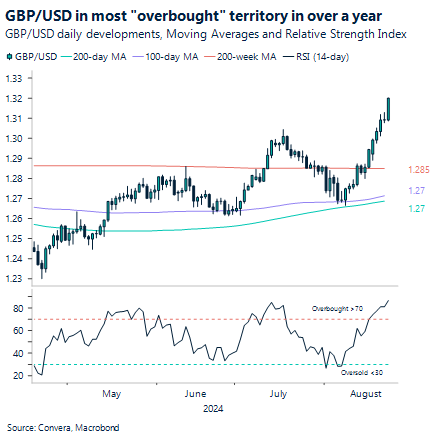

GBP/USD jumped to its highest level in over two years following the dovish tone struck by Fed Chair Powell at Jackson Hole last week. The pound is now up 4% from August lows but the relative strength index (RSI) is flashing severely overbought conditions. The last time the RSI was this high, GBP/USD dropped over three cents in a couple of weeks.

It’s not just US-centric factors, weakening the dollar, that’s driving GBP/USD higher though. The UK PMI data beat across the board last week also suggests Britain’s economic recovery has further room to run following its strongest growth in the G7 over the first half of 2024. The latest PMI surveys also showed a welcome combination of improved job creation and lower inflation. Input costs rose at the slowest pace since January 2021 in August and inflationary pressures moderated sharply in the services sector – an area of concern for the Bank of England (BoE). Thus, the BoE is likely to keep cutting rates, albeit at a slow pace, hence markets pricing in less than two cuts for the remainder of the year, which is supporting the pound via favourable rate differentials.

Nevertheless, this is also a risk to sterling. The UK currency is more vulnerable to a dovish repricing of UK interest rates, especially if the BoE takes cues from the Fed, which is expected to cut at least three times this year.

Euro rallies on dovish Powell

Ruta Prieskienyte, Lead FX and Macro Strategist

The euro has appreciated for the past three consecutive weeks against the US dollar, with domestic developments again overshadowed by events across the Atlantic. EUR/USD climbed to a fresh one-year high above $1.118 but is now running the risk of losing momentum due to overbought conditions, as indicated by several technical indicators.

European equities trended upwards, with the Stoxx 50 gaining over 1% last week. The index has more than recouped its August losses and is now trading in positive territory on a monthly basis. However, buyer fatigue may soon set in. The index peaked in mid-May, well before the August equities selloff. While there is still an argument for further upside amid the global monetary easing cycle, technical analysis suggests that 5000 could serve as a ceiling for potential gains. Additionally, we are entering a period that has historically seen sharp downturns in equity performance, which could start acting as a headwind as we approach the final week of August and move into September.

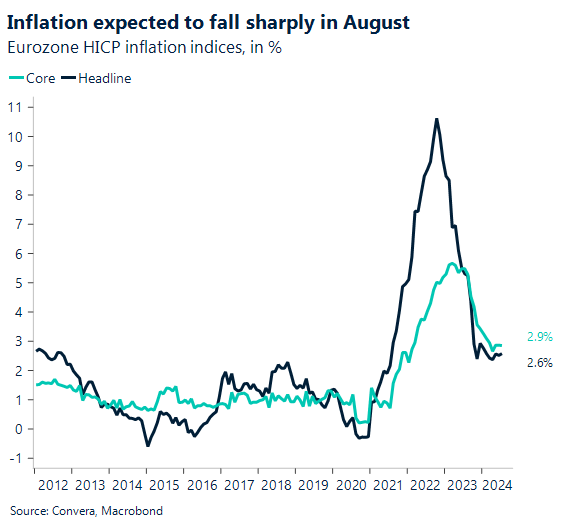

On the rates front, the Bund yield curve has mostly shifted downwards compared to the previous week, with the heaviest buying observed around the two-year tenure. The 10-year Bund yields appear to be finding resistance at 2.2%, well below the July high of 2.6%. This decline in rates is partially influenced by concerns over US economic growth. Closer to home, last week’s slowdown in negotiated wage growth data strengthens the case for rate cuts in September and beyond, as this was one of the factors keeping the ECB cautious. This week’s Eurozone CPI for August will be closely watched to confirm the continuation of the disinflation trend into Q3. Markets continue to price in 65-70 basis points of further ECB cuts in 2024, which is just shy of three 25 basis point cuts, with a September cut fully priced in.

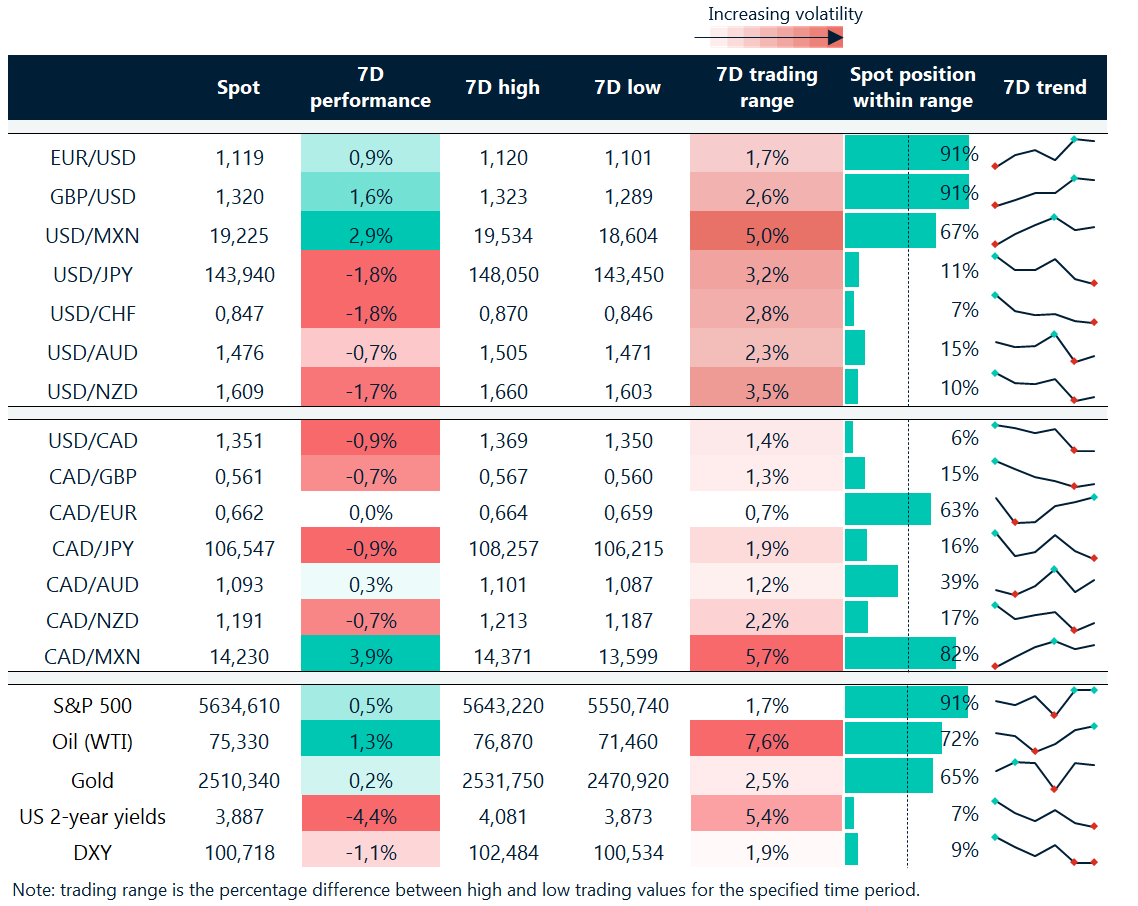

Euro, pound, yen extend gains on dollar weakness

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: August 26-30

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.