Written by Convera’s Market Insights team

Dollar gains on Trump trade after tough week

George Vessey – Lead FX Strategist

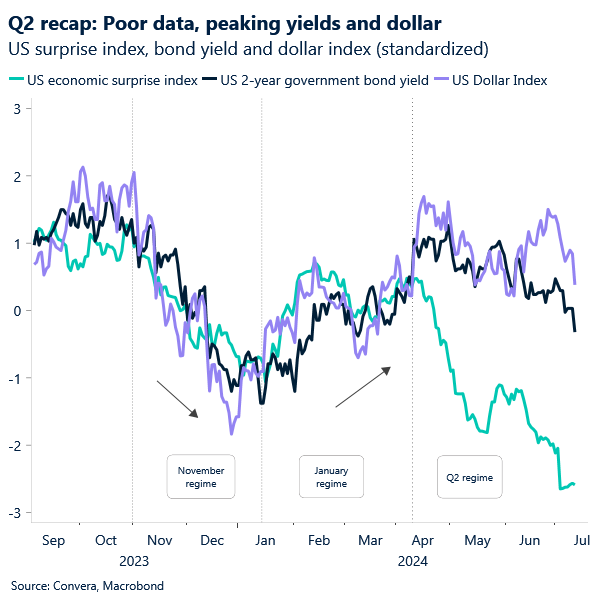

The week has started with a stronger US dollar amid the resurgent “Trump trade” following Saturday’s assassination attempt on the former president. The bottom line is that the chance of an eventual Trump victory is greater now, and due to his proposed tax cuts and trade tariffs seen as inflationary, this might force the Federal Reserve (Fed) to keep US rates high for longer.

The US dollar index suffered its worst 2-week drop since December 2023 last week, but it was the losses endured against the Japanese yen, which did much of the damage. The 2.6% plunge in one day suggests Japan likely stepped into currency markets for a third time this year. But the overall dollar-negative story was a result of softer economic data and a Fed-friendly inflation report. Another interesting week beckons, and on net, we think it could be a dollar negative macro flow, though the political backdrop looks supportive.

We have recently proposed two macro theses that are starting to unfold, and which might complicate the picture for the Fed going into the second half of the year. First, the global inflationary impulse and the goods side of inflation have bottomed and are on the rise again. Second, the US labour market and economic growth are more likely to surprise to the downside. This poses a conundrum for the Fed, that is complicated by the upcoming presidential election in November. Q2 inflation misses and further moderation in job and wage growth might sway policy makers to cut. This might anchor headline inflation above the 2% target.

Triggering the recent slide in US yields and the dollar was the US CPI report, which revealed US inflation declined on a monthly basis for the first time since May 2020. Next up, focus will be on the appetite of the US consumer as US retail sales data looms. The consensus expects retail sales to have fallen by 0.2% in June as leading indicators on consumption continue to weaken.

UK macro in focus

George Vessey – Lead FX Strategist

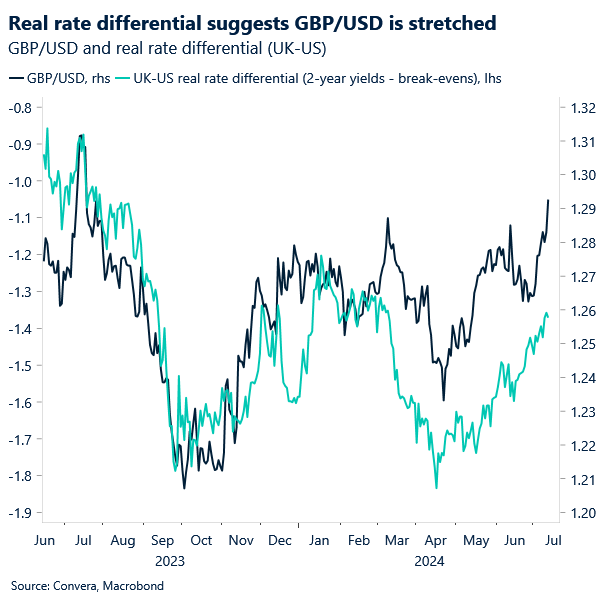

The pound is the best performing G10 currency year-to-date. The currency’s momentum underscores a broader shift in sentiment toward UK assets, with investors optimistic around the new Labour government drawing a line under years of turbulence in British politics that saw the pound hit a record low in September 2022. The UK has loftier interest rates than the US when adjusted for inflation. The growth outlook is brighter, and the real interest-rate differential is there, though the latter suggests GBP/USD might currently be stretched.

Hawkish comments from Bank of England (BoE) policymakers set the bullish tone at the start of last week, particularly from Huw Pill. The Chief Economist is seen as a bellwether voter with regards to the internal consensus for the BoE that may define the timing and extent of interest rate cuts. As a result of Pill’s comments, expectations for an August cut were scaled back to around 13 basis points, having reached 17 basis points prior. Moreover, data showed the UK economy grew at double the expected rate in May and permanent wage growth accelerated somewhat last month, all of which supported GBP/USD to break above its 200-week moving average resistance level. Sterling then got a shot in the arm at the end of last week after the US inflation report, spiking to the highest level ($1.2974) in a year against the US dollar and its highest level (€1.1913) versus the euro in almost two years.

All eyes are on the crucial $1.30 handle now, a level sterling has only been above for six days out of the last two years. With bullish short-term cyclical and political dynamics holding for now, the case for further upside in GBP/USD remains compelling, but this week’s UK inflation and labour market data could test appetite for more gains. Signs of a significant inflation slowdown would rein sterling in.

Euro holds below $1.09 amid US political violence

Ruta Prieskienyte – Lead FX Strategist

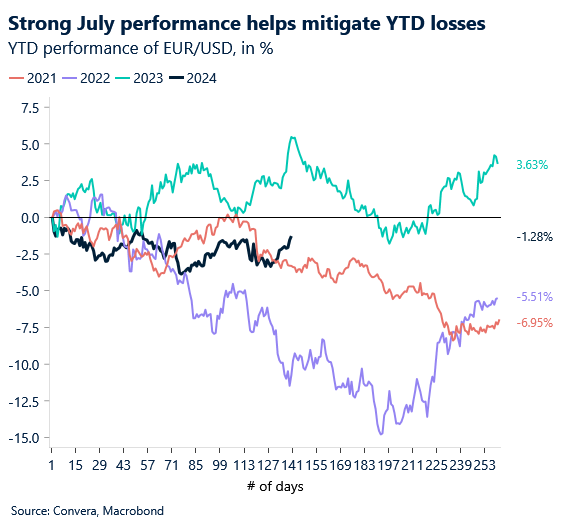

The euro rallied to a five-week high against the US dollar as sharp rate moves on the back of a soft US CPI print eroded the dollar’s yield advantage over the euro. The DE-US two-year spreads broke resistance near -170 basis points, hitting their tightest since early March. EUR/USD clenched its third consecutive weekly gain, relishing on the dollar leg-based weakness. Over the past two weeks the pair mitigated its YTD losses to 1.3%, down from as much as -3.8% registered in April.

One of the main domestic events this week is the ECB rate decision on Thursday. The central bank is almost certainly going to leave the policy rates unchanged as the disinflationary signals have not been strong enough to spur the council into action and the consensus among the Governing Council is against the back-to-back rate cuts. The money markets are pricing in 45bps cumulative rate cuts by year-end, largely unchanged from the start of the last week, with an 81% probability of a 25bps cut in September.

Market participants will continue to monitor the fallout of the French parliamentary elections. The new president of the National Assembly will be announced on July 18th, offering the first glimpse into the new political equilibrium. Due to the ongoing political uncertainty, we expect the spreads between the OAT-Bund 10-year government bonds to remain structurally elevated, thus dampening the euro’s potential. Having said that, further direct impact in the FX spot market is likely to be limited from here on.

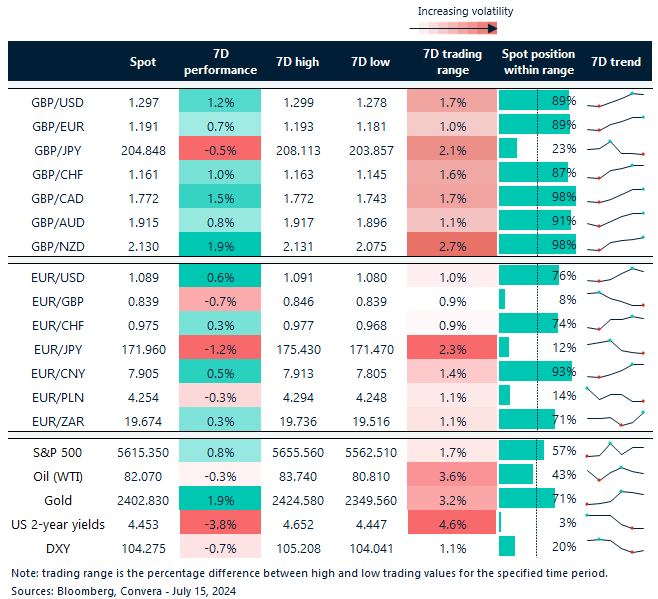

GBP still best-performing G10 currency YTD

Table: 7-day currency trends and trading ranges

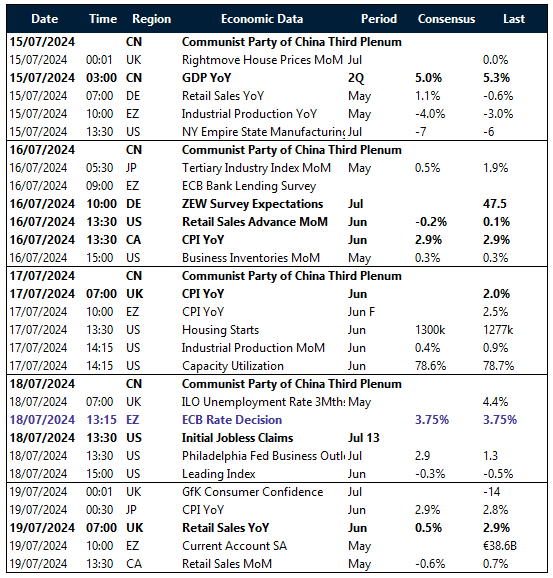

Key global risk events

Calendar: July 15-29

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.