Written by Convera’s Market Insights team

Dollar rebounds after strong retail sales

George Vessey – Lead FX Strategist

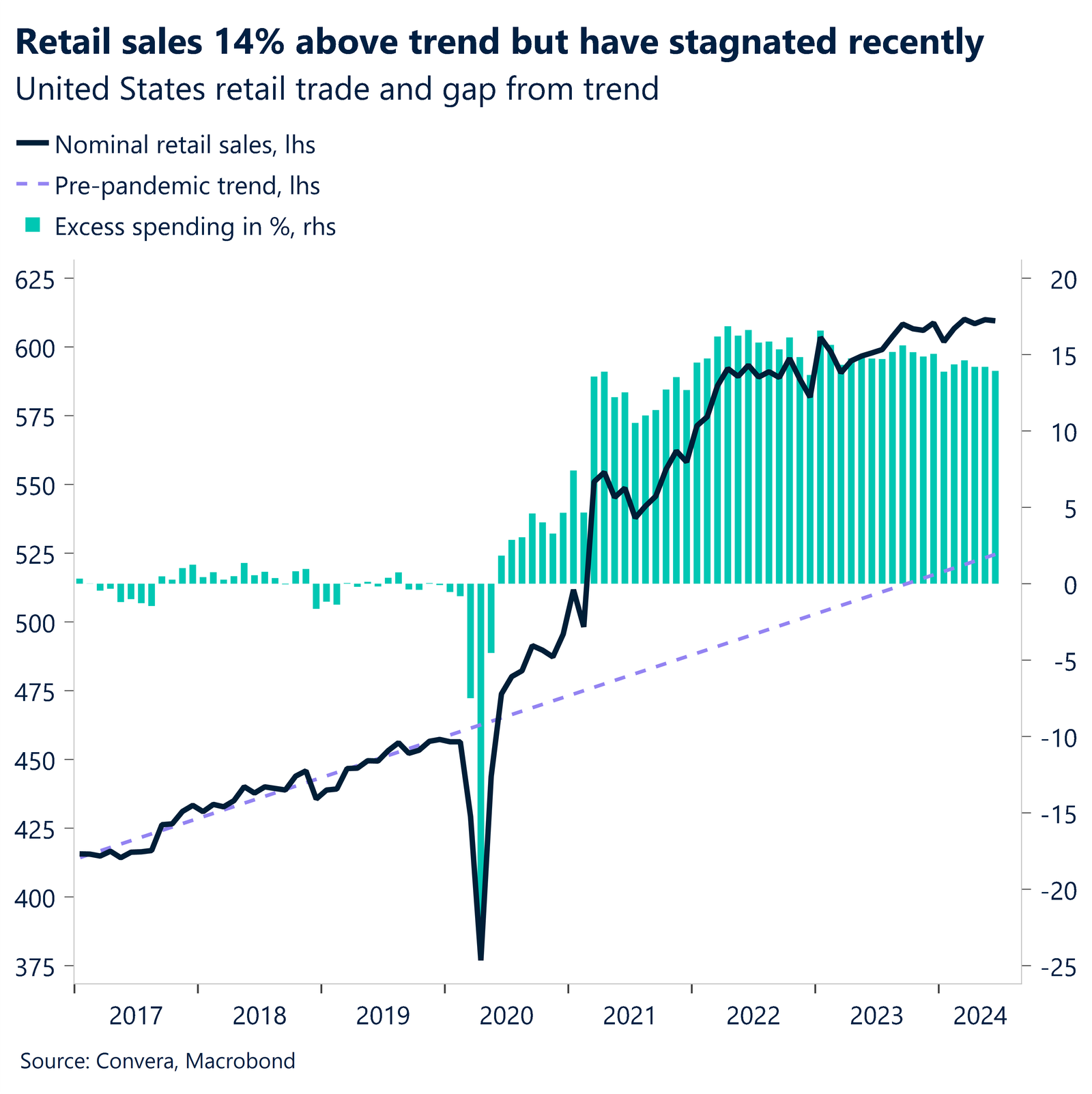

Headline US retail sales printed flat in June compared with May’s upwardly revised 0.3%, beating the consensus expectation for a 0.3% decline. Plus, the core metric rose the most since April last year, suggesting consumer spending remains robust, which gave equity and USD bulls something to cheer about.

The S&P 500 and Dow Jones hit new record levels yesterday as investors continue to digest key macro data, the monetary policy outlook, and earnings. Money markets are currently pricing in two Fed rate cuts before year-end, starting in September and likely again in December, but there’s a 65% probability of a November cut too. Therefore, the degree to which the weak dollar move of late extends in the short run seems limited. This is because the bar is now higher for more easing to be priced in, given the repricing, as well as several still-resilient activity indicators like yesterday’s retail sales. However, we do think that given the cooling labour market and slower income growth, consumer spending will likely remain tepid through year-end.

Meanwhile, rising odds of a second Trump presidency following a failed assassination attempt might continue giving some support to Treasury yields and the dollar. Trump’s policies are seen as inflationary, meaning the pace of Fed rate cuts could be hampered in 2025.

UK inflation remains at 2%

George Vessey – Lead FX Strategist

The highly anticipated UK inflation report was published this morning and showed headline unchanged at 2% YoY for a second consecutive month. The core print came in at 3.5% YoY and the Bank of England’s (BoE) closely watched services inflation at 5.7% YoY, also unchanged from the month prior. The market implied odds of an August rate cut have decreased to 49%, which has seen the pound strengthen in early European hours.

The star performer in the FX space this year has been the British pound, which has appreciated against over 70% of 50 global currencies we’re tracking. It’s up almost 3% versus the USD year-to-date and at almost 2-year highs against the euro. High real yields, and a stronger economic recovery have helped sterling, but also the optimism around the new Labour government, providing some welcome stability, which contrasts with the political uncertainty in France and the US.

Given the recent hawkish comments by BoE officials, including Chief Economist Huw Pill, today’s inflation report will support their cautiousness about moving too soon with rate cuts. As the UK core and service inflation failed to decelerate, we are unlikely to see the BoE cutting rates in the following month, which should keep the high yielding pound supported.

Given that no BoE speakers are scheduled before the 1 August meeting, there are no strong reasons to expect a major loss of momentum for the pound this week, unless CPI data surprises on the downside.

Euro falls short of recent bullish momentum

Ruta Prieskienyte – Lead FX Strategist

The euro enjoyed gains against the high-beta APAC and Scandi G10 currencies amid cooling risk-on sentiment but was weighed down by a resurgence in the US dollar given the upside surprise in the US retail sales print. European equities retreated for the second consecutive day, while European bond yields dropped to a multi-week low, following a decline in US Treasury yields after Federal Reserve Chair Powell’s dovish remarks earlier this week.

The Eurozone ZEW Indicator of Economic Sentiment declined by more than expected, falling to 43.7 in July versus market expectations of 48.1. Despite marking the tenth consecutive improvement in the morale gauge, the softening of optimism was in line with recent concerns about slowing recovery momentum across the bloc. The German equivalent measure also slumped, marking the first such instance in 2024. The economic outlook is worsening amid falling exports, political uncertainty in France, and the lack of clarity regarding future monetary policy by the ECB. On the bright side, the current conditions index increased to the highest level in a year.

The European Central Bank’s 2Q24 Bank Lending Survey revealed a modest improvement in lending conditions, led by the demand for credit. The survey indicates that the impact of the general level of interest rates on loan demand is becoming smaller. Overall, the report confirmed an environment in which bank credit standards remain relatively tight, and loan demand is sluggish and likely to remain so throughout this year, as policy rates are still in restrictive territory.

EUR/USD retreated for the second consecutive day as the $1.09 barrier proved yet again unsustainable, given weakening domestic investor sentiment, a post-French parliamentary election relic. We expect the euro to remain supported in the upper $1.08 area amid the recent compression in short-term yield spreads. Curiously the euro also fell against the Canadian dollar as markets appear to be more preoccupied with disappointing Eurozone indicators rather than signs of cooling Canadian inflation, which has increased the likelihood of a BoC rate cut next week.

The final Eurozone CPI is due later today. As we are not expecting a revision, the data release should largely go unnoticed.

Pound remains strong across the board

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: July 15-19

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.