Written by Convera’s Market Insights team

Betting on lower volatility and rates

Boris Kovacevic – Global Macro Strategist

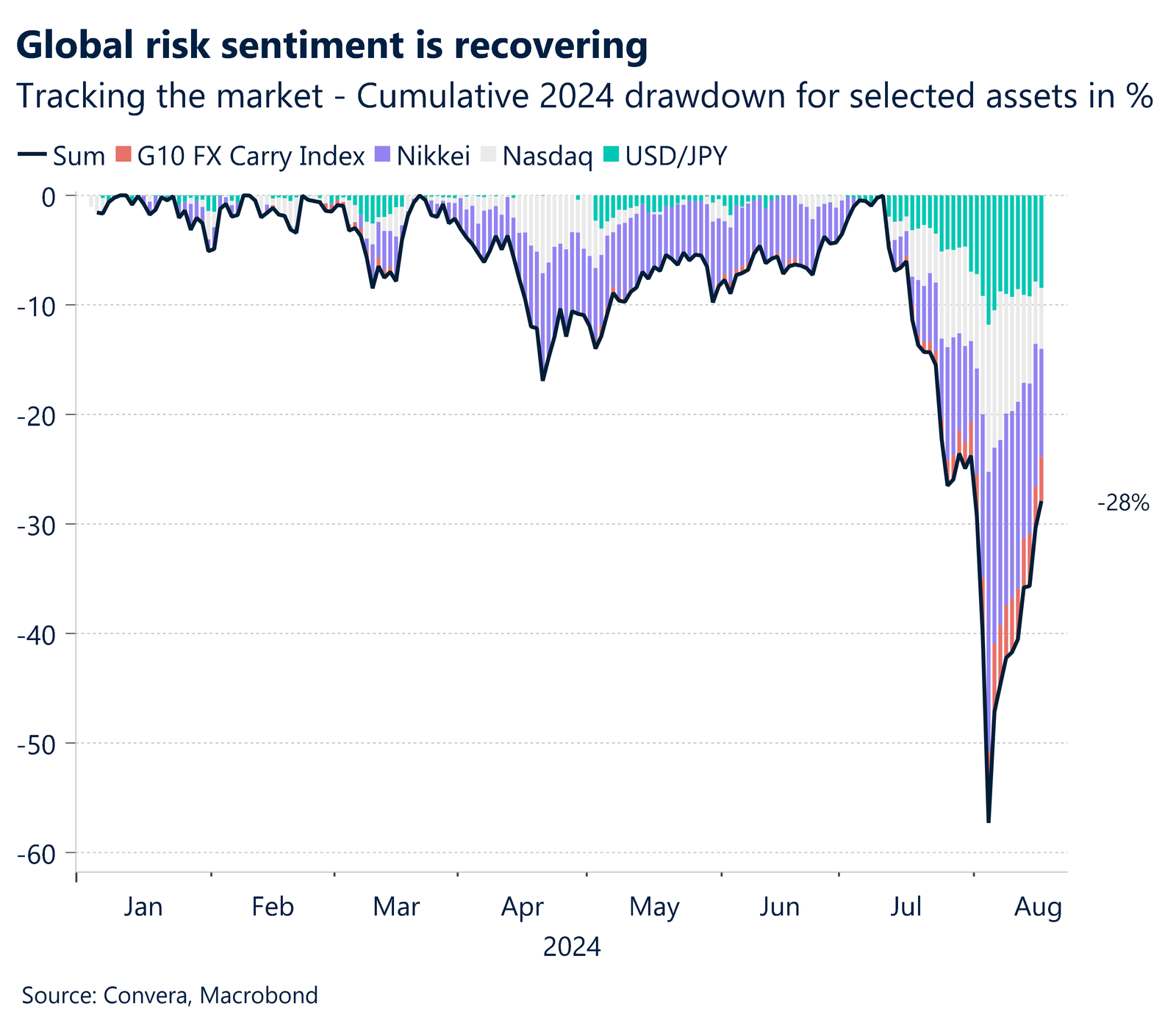

US equities just had their best week of the year and are now about 5% away from their previous record reached in July. The 11% rally of the Nasdaq index has been fueled by a positive macro news flow calming recession fears and the unwinding of the FX carry trade of shorting the yen seemingly exhausting itself. This has helped stabilize risk sentiment and bond yields across the developed world and has given investors another chance to buy the dip. The positive risk sentiment pushed the Greenback to its fourth consecutive weekly decline as the US Dollar Index has now lost 3.5% of its value since the beginning of the second half of 2024.

US inflation continues to moderate, initial jobless claims came in lower than expected, retail sales had their best month so far this year in July and consumer confidence rose for the first time in five months. All these positive headlines contributed to the upbeat risk sentiment last week. Investors chose to focus on the disinflation story and risk on rally and sold the dollar, disregarding lower recession probabilities usually favoring the Greenback. One way to make sense of this development is through the lens of Fed funds futures. While stronger macro data tilted the probabilities in favor of a 25 basis point cut in September (vs. 50bp), around 175 basis points of cuts are priced over the next 12 months. This significant expectation of easier monetary policy has weighed on the dollar.

Jerome Powell’s speech at the important Jackson Hole Symposium at the end of this week will shed some more light on the Fed’s thinking in regard to the recent data. Options markets are pricing in an above 1% swing of the US equity benchmark (S&P 500) on Friday due to the scheduled talk. The question has recently shifted from will the Fed cut rates in September to how much they will cut. Powell needs to reinforce this message for risk assets to continue rising. Investors have bought into the idea of imminent rate cuts and are betting on falling volatility. The data dependency of central banks is putting the spotlight on the incoming macro data.

Betting on lower volatility and rates

Boris Kovacevic – Global Macro Strategist

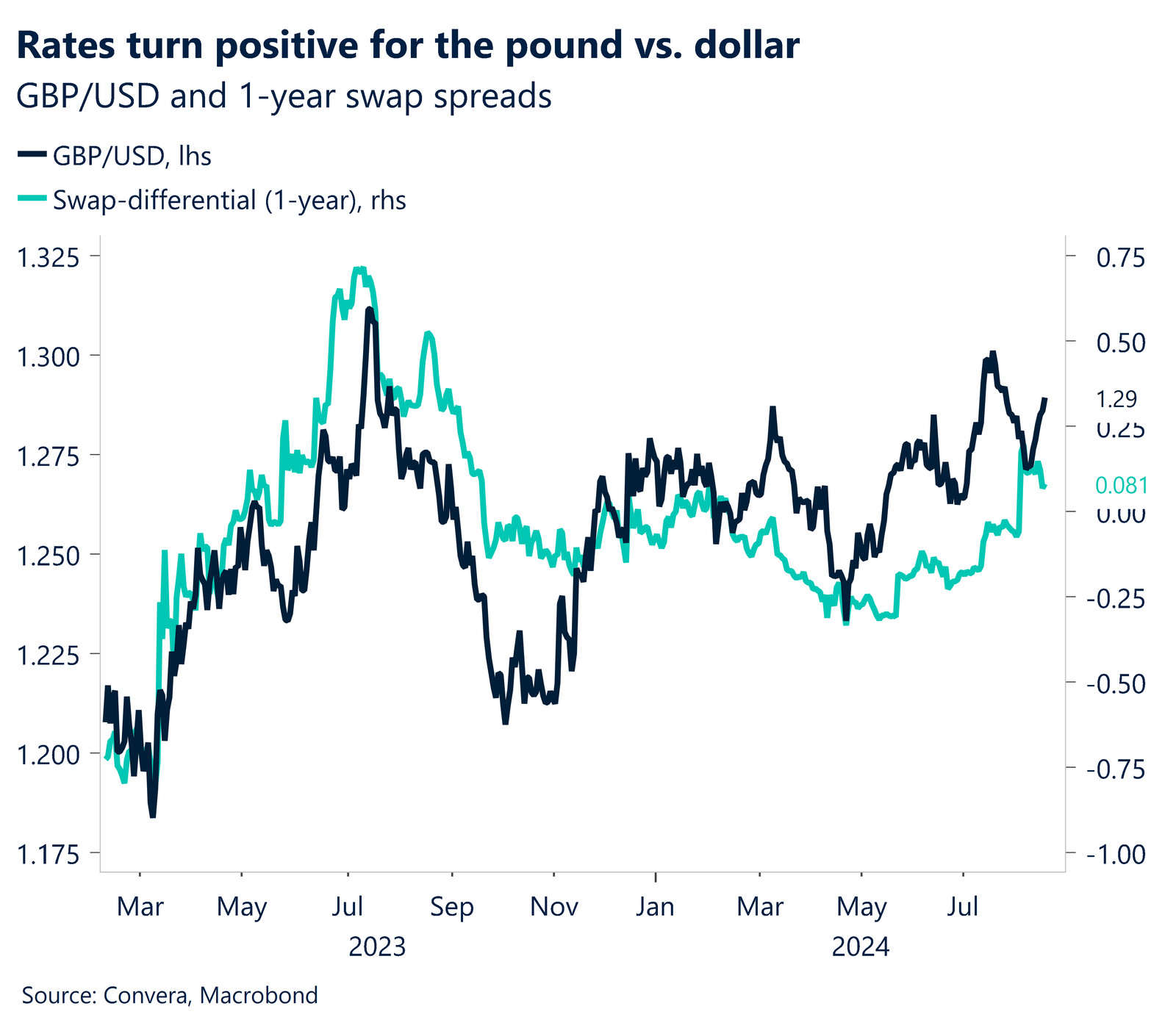

The British pound only needed one week to recover its losses from the previous three as GBP/USD surged by 1.4% last week. The fourth best session of the currency pair so far this year had been driven by inflation in the United States continuing to ease and the UK economy outperforming expectations.

Bond yields in the US are falling more quickly and are leading to the rate differential moving in the pounds favor. Investors now receive a higher yield investing in British 10-year government bonds that they do holding US Treasuries for the first time since last September. This is seen as one reason for GBP/USD moving back to the high $1.29 level with $1.30 clearly in sight.

August has already concluded for the UK from a macro perspective as all data has been released last week. Retail sales, GDP and labor market data all surprised to the upside, while inflation rose slower than expected. This will be welcomed news for the Bank of England trying to engineer a soft-landing and puts the next rate decision in a limbo. The positive news flows will likely linger around for some time and support the pound. However, it will be up to US data to move the currency pair in one or the other direction.

Euro hovers near 2024 high

Ruta Prieskienyte – Lead FX Strategist

The euro has recently benefited from a resurgence of risk-on sentiment, even as investors recalibrate their expectations for significant Federal Reserve easing in 2024. Positive US economic data have alleviated concerns about a rapidly deteriorating US outlook, which along with renewed risk on sentiment and improved market stability lifted EUR/USD near the 2024 highs.

Domestic growth remains predominantly propped up by the services sector, while manufacturing continues to struggle, with industrial production falling sharply. Recent indicators, like Germany’s ZEW survey, have worsened, reflecting increasing uncertainty and concerns about global events. Despite these issues, investors are focusing more on US developments and Fed expectations

This week’s negotiated wages data could shift focus to the ECB, as the metric is critical for the Governing Council when considering future rate cuts. Recent data from Italy has shown persistent upward wage pressures, and if this trend is echoed in the broader Eurozone figures, it could challenge expectations of an ECB rate cut in September, potentially boosting the euro. Flash August PMIs due later this week will also be important to gauge the growth momentum. Further signs on worsening may take out some of the shine from the euro.

JPY extends losses as US beats expectations

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: August 19-23

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.