Written by Convera’s Market Insights team

Dollar vulnerable as sentiment brightens

George Vessey – Lead FX Strategist

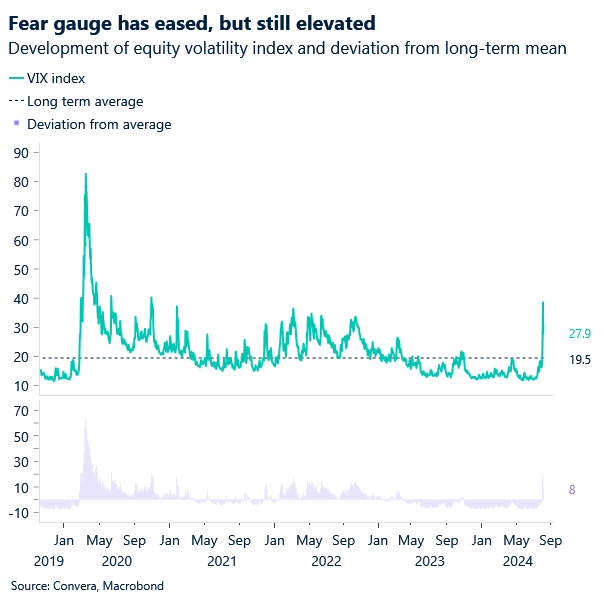

Equities have extended their rebound, cryptocurrencies have bounced higher, and the US dollar is battling against pro-cyclical FX as the panic that recently roiled the financial world continues to abate. The rebound in risk appetite has been helped by a modest easing in volatility, however the VIX “fear index” is still well beyond its long-term average. Today, the macro spotlight is squarely on the weekly jobless claims figures out of the US after last week’s sharp slowdown in payrolls and rise in unemployment exacerbated recession worries.

In addition, our financial sentiment index turned negative for the first time this year on Monday amid the flight to safety, increased demand for downside protection and spike in market volatility. This helped the US dollar somewhat against its procyclical peers. However, with US growth weakening and the Federal Reserve (Fed) commencing its easing cycle in September, we think there will be more room for dollar losses in the medium term. How much depreciation is in the pipeline will depend on the global growth outlook and US politics.

Traders are betting the Fed is more likely to start its loosening with a bigger-than-average 50-basis point move in September, but a lot will have to go wrong with the labour market for the US central bank to start with a big bang. Still, barring a US CPI surprise next week, the USD rate appeal appears compromised, and if the dollar index breaks below 102, the psychological 100 threshold comes firmly into view.

Pound needs a new positive trigger

George Vessey – Lead FX Strategist

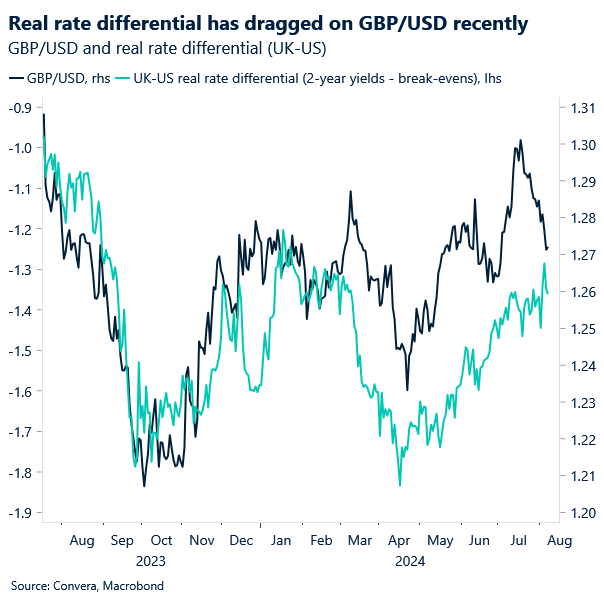

Despite the dust settling after the market turmoil at the start of the week, sterling continues to struggle against its major peers. GBP/USD is flirting near key moving average support levels on the daily chart, around $1.27, whilst GBP/EUR is edging closer to €1.16, primed for another 1% weekly decline. It’s clear sterling needs a fresh positive catalyst to resume its climb from the first half of 2024.

Revised UK GDP data wasn’t to be such a catalyst. It turns out that 2022 was better than statisticians thought, as UK GDP jumped 4.8%, instead of the 4.3% previously estimated, according to annual revisions. The data suggest the economy was showing underlying resilience even as it began to be roiled by Russia’s invasion of Ukraine, which sent inflation in Britain surging to a peak of 11.1% in October 2022. The impact of the cost-of-living crisis later triggered a recession and slowed annual GDP growth to just 0.1% in 2023. However, the economy has bounced back more quickly than many forecasters had expected this year as the surge in inflation fades.

The Bank of England’s (BoE) interest rate cut, coupled with the fall in inflation has reduced the pound’s real yield appeal though. Plus, speculative positioning was heavily stretched in favour of sterling bulls coming into the second half of the year. Hence, the bullish drivers of sterling strength have weakened of late, but we think a sustained improvement in global market risk appetite should act as a welcome relief for the UK currency alongside the brighter UK growth outlook.

Euro stabalises above key technical level

Ruta Prieskienyte – Lead FX Strategist

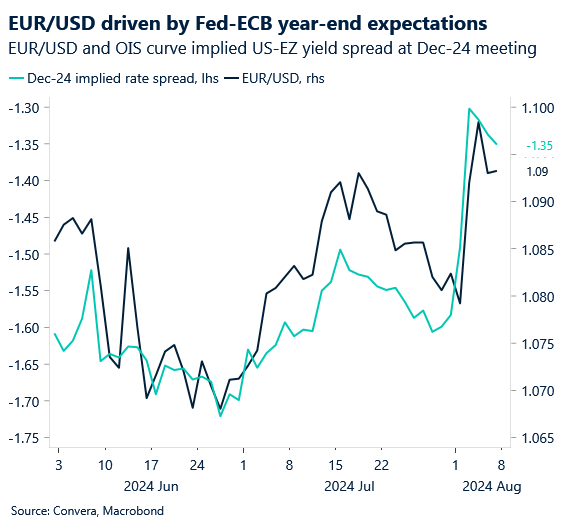

Market sentiment improved further on Wednesday, with European equities climbing higher and Bund yields recovering to pre-NFP levels. Bunds edged lower for a third day as investors continued to unwind haven buying, and the EUR/USD spot rate remained largely stable around the Wednesday’s open rate of $1.083.

Bund yields are likely to continue trading in lower ranges as European Central Bank (ECB) and Federal Reserve (Fed) rate cuts are anticipated. In the Eurozone, the market’s assessment of recession risk remains elevated, as incoming data does not show a marked improvement. Yesterday’s macro data from Germany showed a sharp fall in exports, which was counteracted by better-than-expected industrial production growth in June. This suggests that while the export-oriented growth model is fundamentally struggling, there could still be a small cyclical improvement in the second half of the year.

With assistance from soothing comments by the Bank of Japan, the euro rallied against the safe haven currencies JPY and CHF by more than 1.4% but continues to trade lower compared to a week ago. Having rallied close to 2% over the past five days, EUR/GBP has eased from near three-month highs and is now below the £0.86 level. Money markets continue to trim ECB rate-cut bets, pricing in 68bps of easing by year-end compared to 71bps the day prior. Investors are more hesitant to price out Fed easing at the same pace, thus maintaining EUR/USD relatively supported for now.

With the domestic calendar empty, the only key risk event is the US initial jobless claims. We can expect volatility following the release of this report, as market participants will be looking for data to support or disprove the belief that the US labour market is slowing faster than the Fed expects, thereby justifying the current OIS curve pricing.

Pound struggles across the board

Table: 7-day currency trends and trading ranges

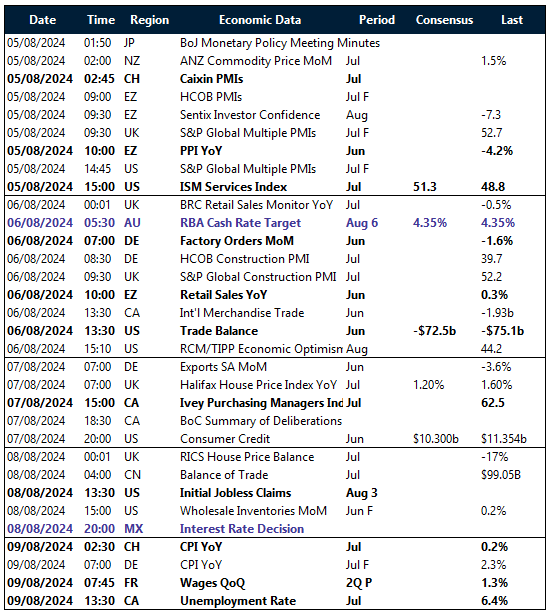

Key global risk events

Calendar: August 05-09

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.