Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

USD gains early on Monday

The US dollar jumped higher in early trading in an initial “flight-to-safety” move as markets reacted to the assassination attempt on former US president Donald Trump over the weekend.

However, the move was short-lived, and most markets regained early losses versus the US dollar.

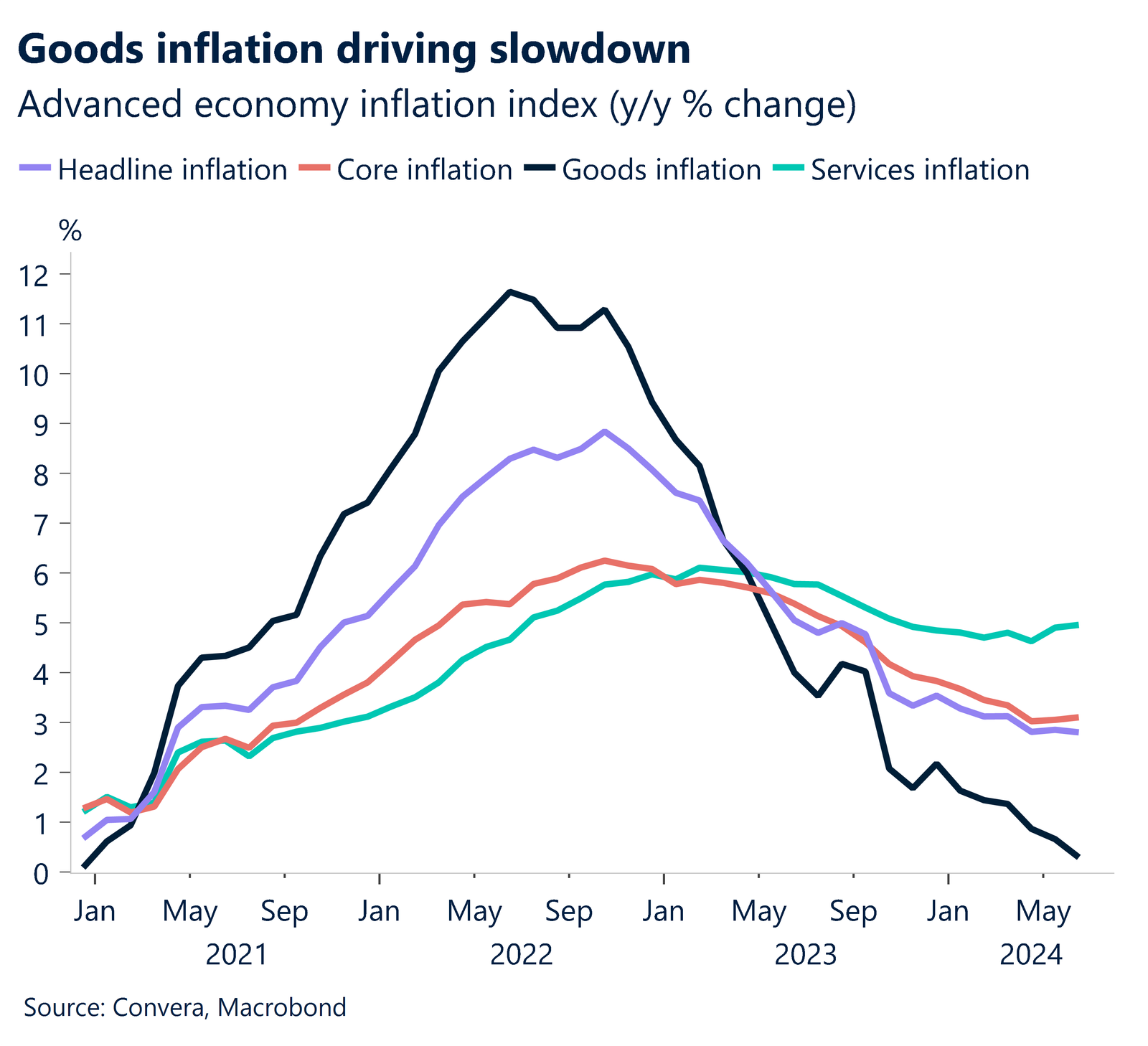

Observers believe that markets will likely remain more focused on the impact of future moves from the US Federal Reserve after last week’s drop in inflation caused money markets to look for two 25bps rate cuts by the end of the year.

Hopes for Fed cuts saw US sharemarkets reach new highs on Friday. The Dow Jones, S&P 500 and Nasdaq each gained 0.6%.

The US dollar ended the week at three-month lows.

Inflation, central bank decisions in focus

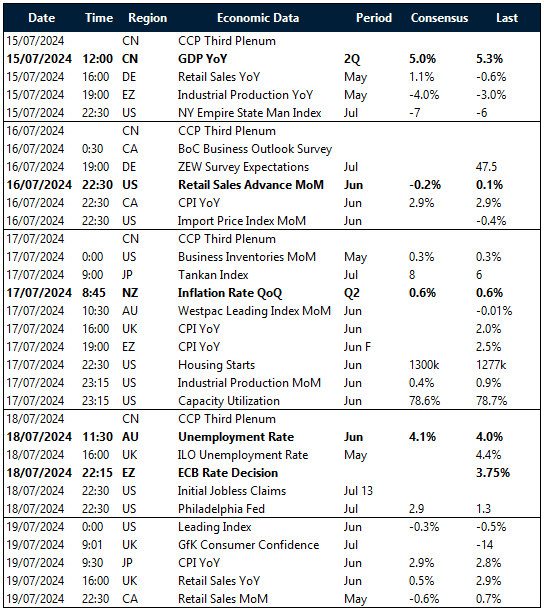

FX markets will be driven by key economic data releases this week, with particular attention on inflation figures from various countries.

In the United States, retail sales data and industrial production figures will be closely watched for insights into economic health and potential implications for Federal Reserve policy.

European inflation data and the ECB’s rate announcement will be key events for euro traders, while UK inflation and retail sales figures will be important for sterling.

Around the region, NZ inflation on Wednesday and Australian jobs on Thursday are the main events.

Yuan under pressure as China’s GDP growth slows

China GDP, retail sales and industrial production numbers are due today. Chinese real GDP growth looks likely to slow down to 4.6% y-o-y in Q2 from 5.3% in Q1, which is less than the 5.0% consensus estimate.

We believe that the drag from weak domestic demand cannot be entirely compensated by the robust overseas demand, and we see drags from rise in investment and consumption.

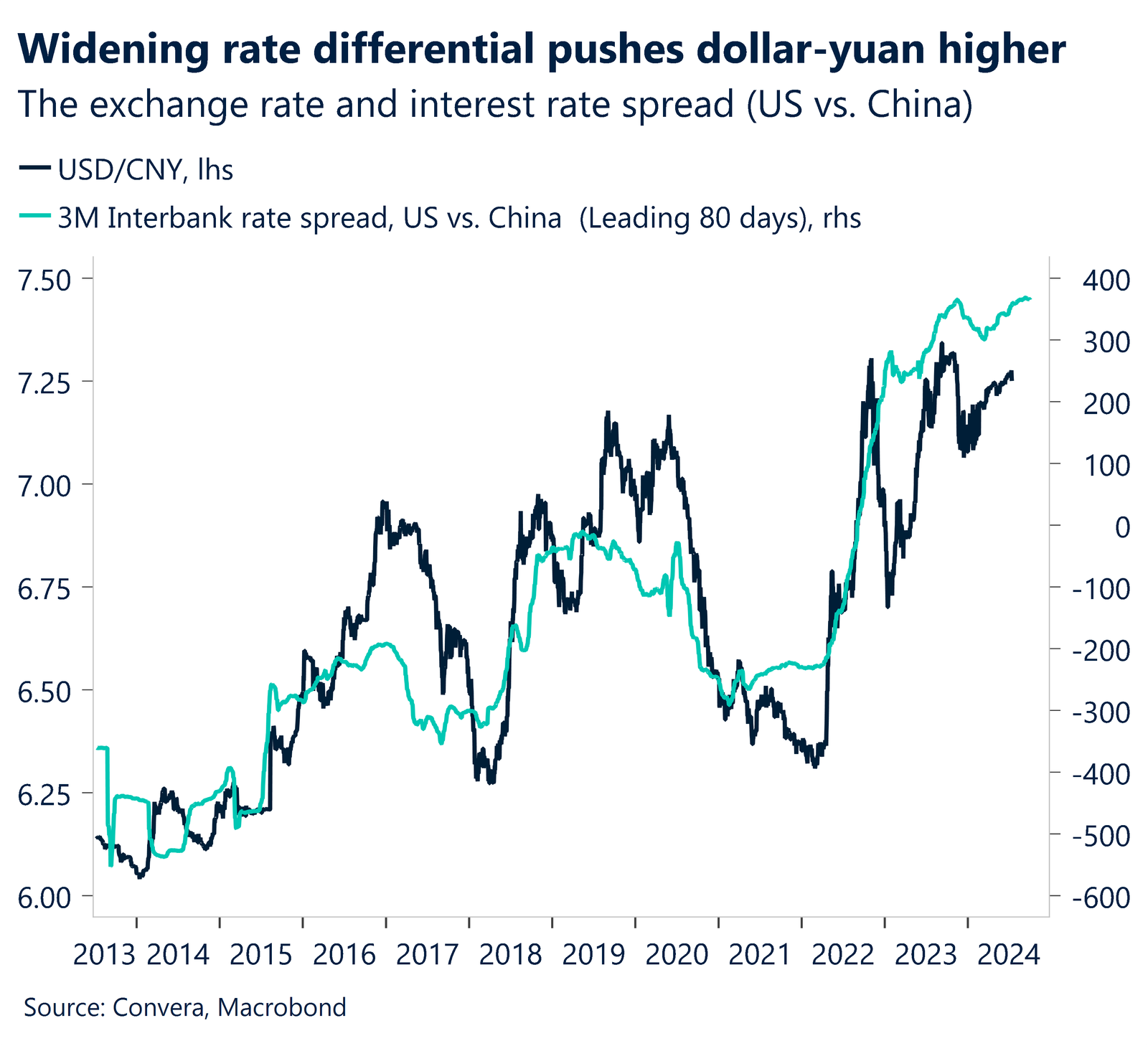

We continue to believe that more deterioration is probable given the growing interest rate gap between the US and China.

Aussie remains near highs

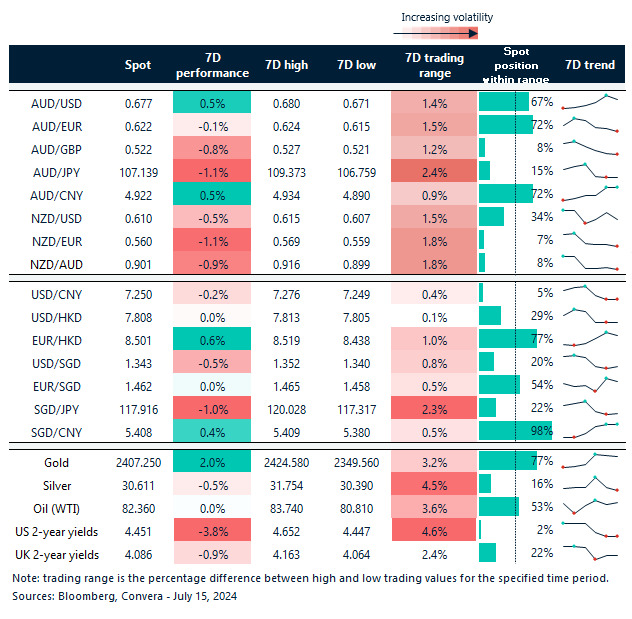

Table: seven-day rolling currency trends and trading ranges

Key global risk events

Calendar: 15 – 19 July

All times AEST

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Have a question? [email protected]