Without a doubt, travelling abroad can be expensive, and that’s without mentioning the cost of the trip itself! There are numerous bank fees, ATM fees, and hidden currency conversion fees to pay attention to.

Using the local currency of your destination will help you save the most money as you get ready for your international trip. This entails using a debit card to access local currency and using ATMs to access local cash. You will lose money if you use a debit card from a British bank to access your British pounds because hidden fees at ATMs and neighbourhood shops apply.

Best Travel Card All-Around

In general, we consider Revolut the best travel card all-around as its versatile account and card can be used to spend like a local pretty much anywhere in the world. Get 3 months of free Revolut Premium as a Monito reader with our exclusive link.

However, if you’re from the EU, UK, or US, here are a few more specific recommendations to explore:

- Best for travelling from the UK: Starling Bank

- Best for travelling from the US: Chime®

- Best for travelling from the Eurozone: N26

Spending in your home currency with a card that doesn’t have any hidden markups on the exchange rate from your bank (e.G., Visa or MasterCard) is an option if you can’t spend in the local currency while traveling abroad. G. For the majority of people, it’s still a smart move to only convert money using Visa or Mastercard exchange rates.

We examine cards that can hold multiple currencies and that don’t charge ATM fees below. After every tap and swipe, you can feel at ease while spending on your vacation like a local.

Currency Exchange Fees Eating My Lunch? What’s That?

You’re frequently hit with a surprise fee in the form of an unfavorable exchange rate. There is a so-called “mid-market exchange rate” at any given moment; this is the actual exchange rate you can view on Google.

To exchange currencies, however, you will infrequently receive this exchange rate from the bank or money transfer service you use. You will, however, receive a much worse exchange rate. They keep the difference between the real exchange rate and the subpar rate they use, which allows the bank or money transfer service to make money from the currency exchange.

In other words, for each unit of currency you exchange, you or your recipient will receive less foreign currency. The provider will maintain that they have no commission or other fees throughout.

Top Travel Money Tips

- Avoid bureaux de change. They charge between 2.15% and 16.60% of the money exchanged.

- Always pay in the local currency and never accept the dynamic currency conversion.

- Don’t use your bank card. It’ll cost you between 1.75% and 4.25% per transaction. Instead, use one of the innovative travel money cards below.

The Best Travel Money Cards in 2022

After researching and reviewing the top travel cards offered by some of the most well-known neobanks, Monito has found multi-currency cards by Wise, Revolut, N26, and Monese to be among the industry’s best. Here, we walk through their products and services and compare them to other options like the Travelex Money Card.

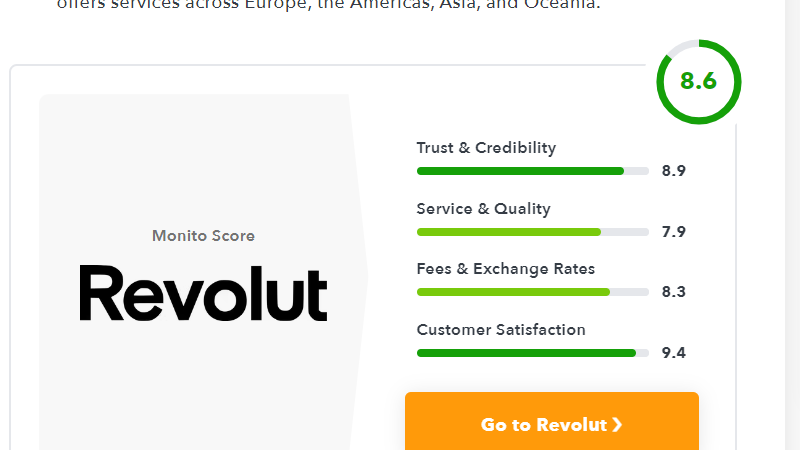

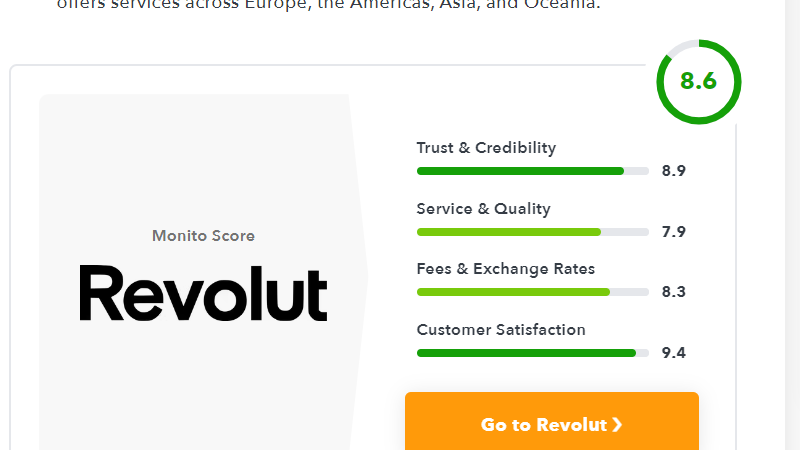

Revolut

Revolut is one of the most well-known neobanks in the world because it offers services across Europe, the Americas, Asia, and Oceania.

Revolut converts your currency at the mid-market rate to the local currency of your travel destination, just like Wise does. In fact, we believe it to be the best method for acquiring foreign currency.

Free exchanges are available only for transfers totaling £1,000 per month under their Standard Plan. Additionally, the initial €200 in ATM withdrawals are free. By upgrading memberships, these allowances are refundable.

N26

N26, one of the most well-known neobanks in Europe, and its debit card only accept Euros as payment. To ensure that you never pay foreign transaction fees on purchases made outside of the eurozone, N26 is a partner of Wise and has fully integrated Wise’s technology.

N26’s card is a useful tool for EU/EEA residents who travel abroad even though it lacks multi-currency functionality because it will always use the real exchange rate and never impose a commission fee.

For travelers who frequently travel to the Eurozone but do not have a European bank account, this low-cost banking option is ideal. For instance, N26 is available to residents and citizens of Switzerland, Norway, and other European Economic Area nations that do not use the Euro.

These residents will save money each time they use an N26 card to make a purchase in Europe because they are so close to the Eurozone. Although N26 offers three free ATM withdrawals each month in euros, it does levy a 1.7% fee for each withdrawal made outside of Europe.

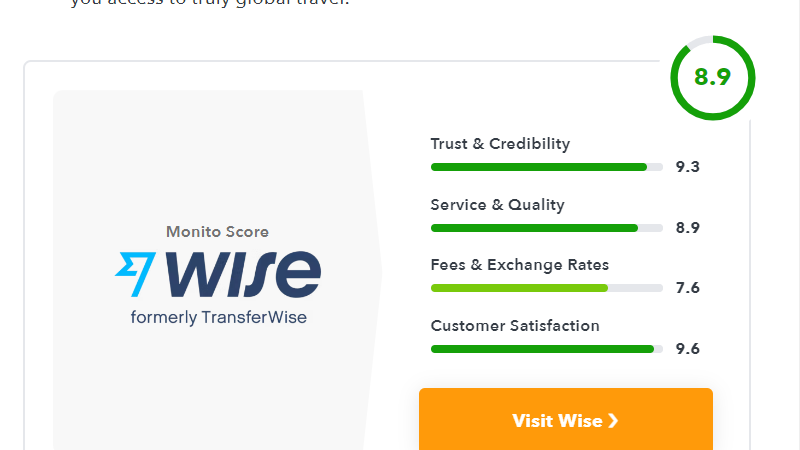

Wise multi-currency card

With this card, you can travel internationally by loading up to 54 different currencies at the real exchange rate.

When you convert your home currency into up to 54 different currencies, Wise is open about never charging a hidden exchange rate margin, unlike banks, credit unions, airport kiosks, and foreign ATMs. With Wise, you receive the live rate that is displayed on Google or XE.Com.

Depending on the currency, a transaction’s industry-low commission fee will be between 0 and 2 points.

Starling Bank

One of the top neobanks in the UK is Starling Bank. Due to its multi-currency capabilities, we strongly advise it to UK residents who frequently make purchases in British pounds and euros.

For UK citizens and residents, opening a Starling Bank account is free. The Starling Bank card has no transaction fees for purchases made abroad. It is a practical and economical choice for frequent travelers just based on this feature. Even all ATM fees for machines abroad and in the UK are waived.

The alternative is to exchange your British pounds for euros. You can hold, send, and receive euros for no cost by opening an account with them in that currency. Your Starling Bank card will use your Euro balances (instead of your British pounds) when you make purchases within the Eurozone.

Which Multi-Currency Card is the Best?

There are many different kinds of travel cards, including credit cards with no foreign transaction fees and cards with no foreign ATM withdrawal fees.

What is a Multi-Currency Card?

When you use your multi-currency card to make a purchase abroad, you can instantly access all of the different foreign currencies that you actually own. You avoid bad foreign exchange rates by using local currency where you are traveling. Your card will be accepted by cashless payment devices and ATMs just like a local’s card.

In this review, we’ve already mentioned a few multi-currency cards, but we’ll also talk about Travelex. Additionally, you can top up a variety of foreign currencies with Travelex’s Money Card, though at exchange rates that are marginally inferior to the actual mid-market rate.

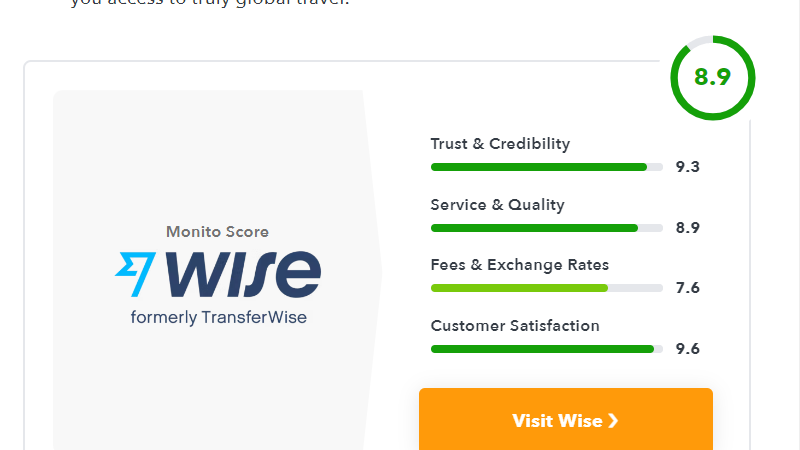

Wise Multi-Currency Account

One of the top multi-currency cards on the market is offered by Wise.

Revolut

Revolut is impressive for its wide range of currency options as well as its extra services, like stock trading, access to cryptocurrencies, and a money management interface.

Use a Travelex Money Card

A prepaid travel money card from Travelex is available; it accepts ten different currencies and has no ATM fees when used abroad.

To convert your home currency into one of the supported currencies, Travelex levies fees, which change daily based on the rate of exchange. But once the money is loaded onto the card, you can make purchases just like a local.

Best Travel Money Card Tips

Foreign exchange service providers will charge you two types of fees when you exchange your local currency for a foreign currency:

Providers use an exchange rate that is less favorable than the actual “mid-market” exchange rate. The difference, also known as an exchange rate margin, is kept by them.

Commission Fee: This fee, which is assessed for the service rendered, is typically calculated as a percentage of the amount converted.

With these details in mind, let’s look at some strategies for avoiding ATM fees, foreign transaction fees, and other fees you might run into while traveling.

Tip 1: Steer clear of bureaus de change at all costs when traveling.

It’s simple: bureaus de change and currency exchange desks make (plenty of) money through hidden fees on the exchange rates they’re giving you.

According to research, Bureaux de Change in Paris charge a margin when converting, for instance, $500 USD into EUR that ranges from 21%5% at CEN Change Dollar Boulevard de Strasbourg to 166% (! ) at Travelex Champs-Élysées.

Ordering currencies online prior to your trip is typically less expensive than exchanging currencies at a bureau de change, but it is still a very expensive method of getting foreign currency that we do not advise if you really need cash and can’t wait to withdraw it with a card at an ATM at your destination.

Tip 2: Always Choose To Pay In the Local Currency

You’ve probably been prompted to choose between paying in your home currency and the local currency of the foreign country when using your card to make purchases or withdraw cash from an ATM while traveling abroad. The right response to this cunning question will enable you to significantly reduce currency exchange fees. This little trick is known as dynamic currency conversion.

Generally speaking, you should always use the local currency (such as Euros in Europe, GBP in the UK, DKK in Denmark, THB in Thailand, etc.). (Instead of using the currency exchange and paying in your local currency when using your credit card outside of the country.

Why not choose to pay in your home currency instead? On the plus side, you would know exactly how much you would be paying in your home currency rather than having to accept the unknowable exchange rate decided by your card issuer a few days later.

Dynamic Currency Conversion, explained

However, if you decide to pay in your home currency rather than the local currency, you will engage in a process known as a “dynamic currency conversion.”. This is just a fancy way of saying that when you use your card to make a purchase or withdraw cash in a foreign currency, and not a few days later, you’re actually exchanging between the foreign currency and your home currency at that very moment. For this privilege, the local payment terminal or ATM will apply an exchange rate that is frequently significantly worse than even a traditional bank’s exchange rate (we’ve seen margins of up to 8%! ), and of course, much worse than the exchange rate you would get by using an innovative multi-currency card (see tip 3).

Choosing to pay in the local currency is always advised because, in the vast majority of cases, knowing exactly how much you will pay in your home currency is not worth the additional high cost of the dynamic currency conversion.

Tip 3: Don’t Use a Traditional Card To Pay in Foreign Currency/Withdraw Cash Abroad

As mentioned before, providers make money on foreign currency conversions by charging poor exchange rates — and pocketing the difference between that and the true mid-market rate. They also make money by charging commission fees, which can either come as flat fees or as a percentage of the transaction.

Have a look at traditional bank cards compared to see how much you can be charged in fees for spending or withdrawing $500 while on your holiday.

| Card provider | Foreign transaction | Foreign ATM | Cost to spend $500 |

| Barclays | 2.75% | 2.75%£1.50¹ | ≈ $15.65 |

| HSBC | 2.75% | 2.75%£1.75 | ≈ $15.95 |

| La Banque Postale | 2.30% | 2.30%€3.30 | ≈ $15.2 |

| Deutsche Bank | 1.75%Min €1.50 | 4.25%€7.25¹ | ≈ $21.25 |

| UBS | 2% fee1-2% margin | 4% | ≈ $20 |

These charges can add up very fast. Consider a family traveling to the US for a two-week midrange vacation, for instance. This study estimates that the total cost of their vacation would be around $4200.

Withdrawing $200 cash four times and using your card for the remaining $100 would cost you $123 in hidden currency exchange and ATM fees with HSBC and $110 with La Banque Postale. Our travelers could purchase a nice meal, Yosemite Park admission, or many other priceless memories with this cash.

Fortunately, cutting costs significantly while traveling is now possible thanks to new, cutting-edge multi-currency cards. It would only cost $13.60 to open an N26 Classic account and use an N26 card on the same US holidays.