Digital infrastructure company Equinix, Inc. (NASDAQ:EQIX) has reported its financial results for the quarter ended September 30, 2024.

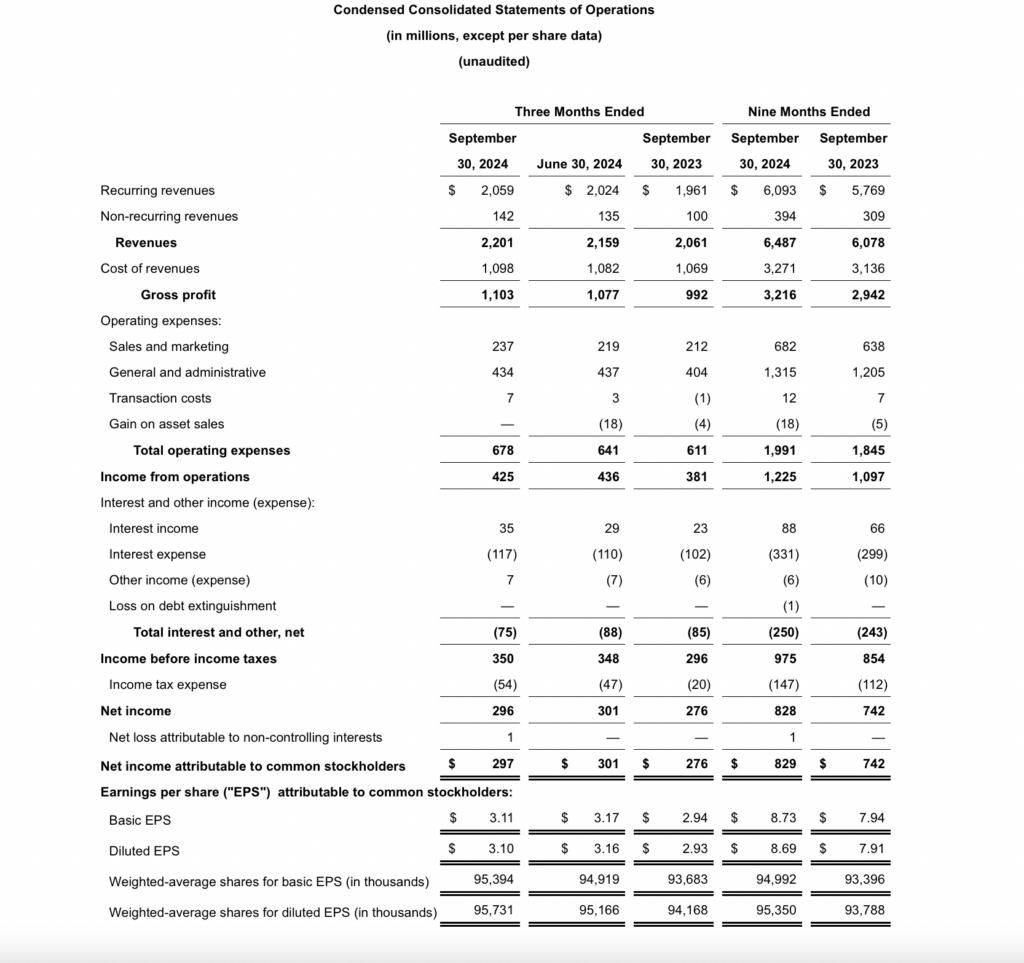

Revenues for the third quarter of 2024 amounted to $2.2 billion, a 2% increase over the previous quarter. The result includes a minimal negative foreign currency impact when compared to prior guidance rates,

Operating income for the third quarter of 2024 was $425 million, lower than the previous quarter due to the Q2 gain on sale of the Silicon Valley 12 xScale (SV12x) asset.

Net Income attributable to Common Stockholders was $297 million, lower than the previous quarter due to the Q2 gain on sale of the SV12x asset.

Adjusted EBITDA amounted to $1,048 million, a 1% increase over the previous quarter, and an adjusted EBITDA margin of 48%. The result reflects a minimal negative foreign currency impact when compared to prior guidance rates and $2 million of integration costs.

Adaire Fox-Martin, CEO and President, Equinix, commented:

“Our 87th consecutive quarter of revenue growth was also a record-breaking one for gross bookings, with strong results across our three regions. This performance is a testament to the trust our customers place in Equinix and the value they realize partnering strategically with us. We see continued robust demand for AI-enabling digital infrastructure from a highly diverse set of customers of varying sizes, industries, and regions. This, coupled with significant expansion of our xScale capability, further strengthens our value proposition with customers and our leading position in the market.”

For the fourth quarter of 2024, the company expects revenues to range between $2.262 and $2.302 billion, an as-reported increase of 3 – 5% over the previous quarter, or a normalized and constant currency increase of 2 – 4% excluding the quarter-over-quarter impact of the power pass-through. This guidance includes a $26 million foreign currency benefit when compared to the average FX rates in Q3 2024.