The Central Bank of the Republic of Türkiye (CBRT) has announced its anticipated interest rate decision for the month of August, maintaining the policy rate unchanged at 50% for the fifth consecutive month.

In an exclusive interview with Türkiye Today, a Turkish chief economist of a private bank shared key insights into Turkish central bank’s interest rate policy, emphasizing that the timing of interest rate cuts is more critical than the cuts themselves. The chief economist argues that the possibility of an interest rate reduction in Türkiye reflects broader economic challenges faced globally, where governments must balance growth and inflation control.

Why Türkiye raised interest rate?

One of the main reasons for Türkiye’s policy shift towards higher interest rates is to reduce its reliance on imports. This change is aimed at cooling down the overheated real estate and automobile markets, which experienced returns far beyond expectations following the pandemic.

The chief economist outlines the two key policies to reduce import regime and cooling down prices implemented by Finance Minister Mehmet Simsek and his team:

- High-interest rate policy: By narrowing the gap between high interest rates and inflation, the government aims to curb consumer, commercial, and SME unnecessary spending, making borrowing more expensive and thereby reducing consumption to put pressure on inflation.

- Restriction on KKM (Currency Protected Deposits): The ban on the use of foreign currencies by banks is designed to increase the use of the Turkish lira. The decision to maintain the interest rate at 50% is aimed at reducing imports and keeping money within the country to bolster reserves. It also seeks to restrict access to consumer and commercial financing, thereby pressuring inflation by curbing unnecessary spending.

- Does it work: In the past six months, the transition from foreign currency deposits to Turkish Lira has accelerated. Yet, Turkish household struggles to feel the positive impacts of the monetary policies.

How did Turkish economy react to 50% interest rate?

The chief economist mentions how the state’s policies have introduced significant challenges, impacting both business growth and inflation:

Zoom in: Historically, Türkiye has seen annual growth rates of 5% or more when interest rates were below 1%, a period marked by low mortgage and vehicle loan rates. Currently, with interest rates remaining high, growth is stuck in the 2.5-3% range. Given that 30% of Türkiye’s growth is driven by the construction sector, 30% by retail, and the remaining 40% by tourism and other activities, the slowing down in construction sector and its more than 40 related sector doubled with high mortgage rates present a significant barrier to growth.

- Persistent price stickiness: Despite a decline in monthly inflation from 4.5-6.5% to around 2.5%, price stickiness remains an issue. The policies aimed at reducing inflation have not yet fully succeeded in lowering prices across the board, leading to concerns about prolonged economic stagnation.

Between the lines: These challenges have sparked fears of stagflation, where high-interest rates are slowing economic growth while inflation persists. Businesses, particularly in manufacturing, are struggling to obtain the working capital needed to maintain operations. This could lead to increased unemployment and stunted economic growth, as companies may be forced to reduce their workforce due to a lack of access to affordable financing.

Tug-of-war: Even though high-interest rates help curb individual and consumer financing in the fight against inflation, there is a problem on the producer side—businesses struggle to meet their working capital needs due to high-interest rates. This is why there is always a tug-of-war between governments and central banks; while central banks raise interest rates to curb inflation or consumption, this also slows down the country’s growth and leads to issues like unemployment, which is the biggest challenge governments face with their citizens

What if Türkiye cut interest rate right away?

The global context also plays a critical role in Türkiye’s economic strategy. High-interest rates are not unique to Türkiye but are a global phenomenon, particularly in response to demand-pull inflation, in which low-interest rates spur consumption, they also fuel inflation.

- Impact of U.S. Federal Reserve policies: The U.S. Federal Reserve has raised interest rates from 1% to to 4.5-5.0%, the highest levels in 50 years, which affects global markets, including Türkiye. Given Türkiye’s reliance on imports and foreign currency, maintaining low-interest rates in this environment would be challenging and could exacerbate existing economic problems.

- Shift from low-interest to high-interest regimes: Türkiye’s transition from a low-interest, low-inflation policy to the current high-interest regime is a significant shift. A premature interest rate cut could lead to a sharp rise in exchange rates and negate recent gains in stabilizing the economy. The fragile situation of Türkiye’s economy, despite growing central bank reserves, makes it vulnerable to such shifts.

Zoom in: Although the central bank’s reserves have reached approximately 152.2 billion dollars, the sudden increase in exchange rate would not be the best scenerio given that there is still a significant deficit in the budget, the country has short-term foreign currency debt, and the private sector’s fragility continues. Even though exporters currently find the exchange rate insufficient, the increase in the exchange rate would not benefit Türkiye in the absence of demand.

So, here is the Türkiye’s dilemma with timing interest rate cuts

When we considers current economic landscape of Türkiye when it comes to effect of 50% interest rate, the dilemma reveal itself as as such:

- Risk of premature rate cuts: If the central bank announces a rate cut too early, during the September, or October Monetary Policy Committee meetings, it’s almost certain that exchange rates will rise and harms the Turkish economy due to ongoing vulnerabilities, not even mentioning all the efforts made over the past year would have been in vain.

- Risk of delayed rate cuts: If the interest rate cut decision is postponed until April or May 2025, Türkiye will enter a recession, leading to gradual bankruptcy of business, who already start reducing their workforce to cut costs, leading to increased unemployment and economic stagnation.

At this point, the chief economist highlights that the main topic is not just the interest rate cut but the timing, magnitude, and purpose of the cut.

- Expert’s suggestion: To resolve this dilemma, the Turkish economist advices against reducing rates in September. If the Fed or the European Central Bank also reduces rates in the October-November period, the central bank may decide on a downward rate adjustment of 250-330 basis points, considering the partial decline in inflation, the increase in the bank’s reserves, and the improvement in the external market outlook. The bank may announce this policy can be successfully sustained with an inflation rate of 25% and an interest rate range of 30-35% until June 2025. The chief economist highlights that central bank should clearly communicate its rationale and objectives in its policy statement to avoid further market instability. This approach, he argues, would avoid derailing the progress made so far and ensure a more stable economic environment in the long term.

The central bank’s “only bullet” is interest rate, what about rest?

Interest rates alone cannot solve Türkiye’s inflation problems. According to chief economist, the primary issue is the persistent high inflation in country, driven by speculative practices and insufficient structural reforms.

- Supply-demand relations: Lowering interest rates can lead to increased commercial activity if banks reduce loan rates. However, if production does not meet this demand, it can result in hoarding and price distortions. The economist also mentions how increasing the supply more than demand will end up with throwing away of tomatoes or lemons instead falling prices in bazaar. In the lack of necessary regulation, sellers might avoid lowering the prices of their product in the face of surplus by destroying it thereby keeping the prices high. In the end, increasing supply reaching the end consumer, as the economist argues, requires serious regulation and inspection by government.

- Supply chain manipulations: Supply chain manipulations by companies, who refuse to reduce their profit margins, exacerbate price imbalances. Businesses, especially those accustomed to high profit margins, are reluctant to lower prices, even when economic conditions improve. This resistance can keep inflation elevated, despite efforts to control it through monetary policy.

Zoom in: Previously, a cafe in Cekmekoy, Istanbul faced criticism for selling a basic dessert at ₺100. While 90% of Istanbul’s population isn’t buying it, the city’s mix of 2.5 million Syrians, 600-700 thousand tourists and even if only 10% of the population is wealthy means that around 6,000 wealth customers are enough to create demand. The real issue isn’t that most people avoid it—it’s that the dessert still sells at ₺100.

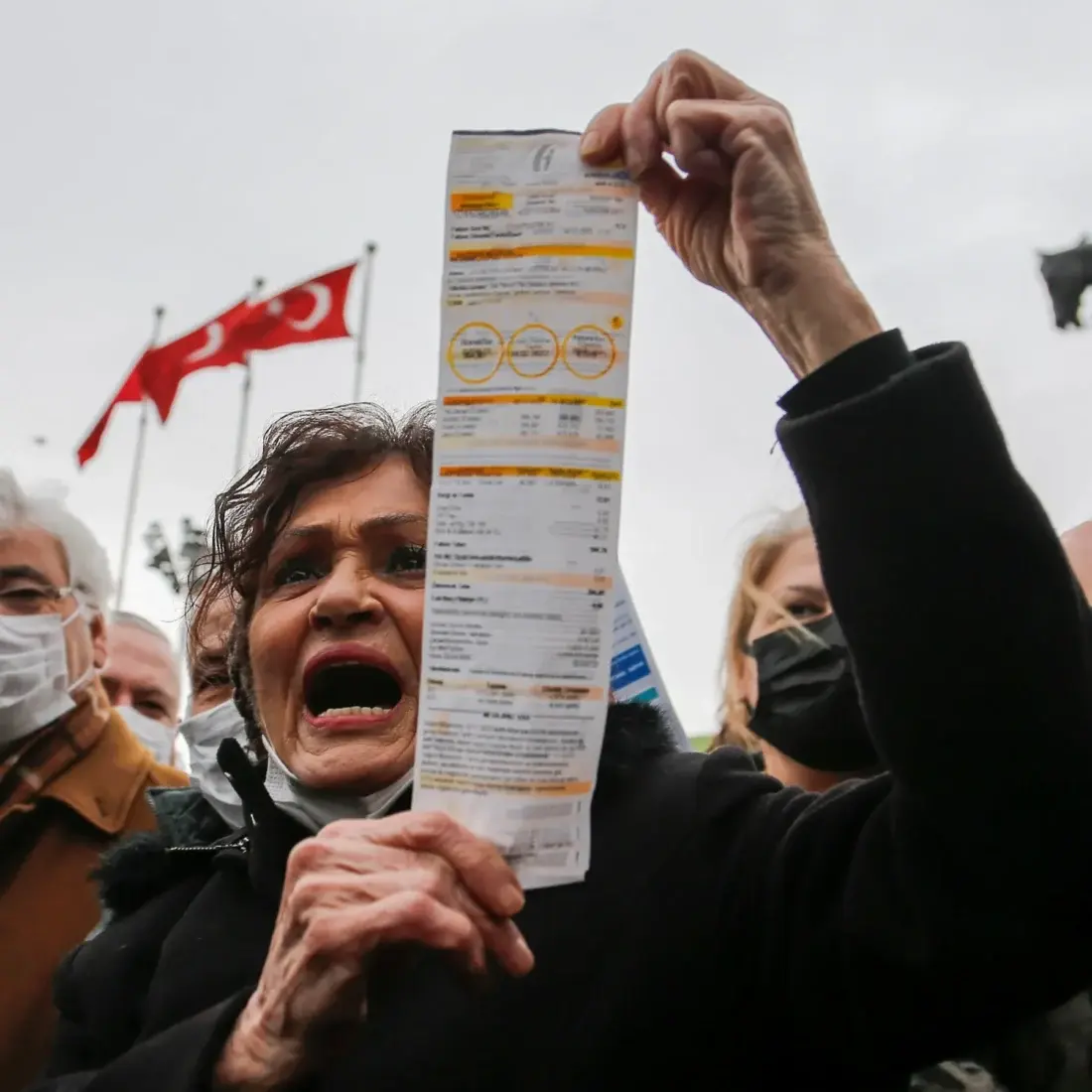

- Financial burden on middle class: High prices are maintained not because of actual supply shortages but due to perceived scarcity created by companies to sustain high-profit margins. This situation leads to an increase in indirect taxes, particularly burdening the middle class, civil servants, and retirees.

- Increasing public wage: Increasing the public’s income levels within an inflation-free environment to improve their welfare takes a long time for citizens to feel financial relief. The chief economist argues if interest rates drop to 20% today or tomorrow, it will take at least 20 months for the public to feel the effects because as incomes rise, so will the prices in the service sector, such as rents. Therefore, if inflation rises to 40% by the end of the year and employees, including civil servant raises, receive a 35% raise, the public won’t feel the effect regardless of interest rates due to price stickiness.

When will Turkish household feel the effects of monetary policies?

Structural reforms and policy coordination are essential to the success of Türkiye’s economic strategy in combatting inflation, beyond just managing interest rates.

- Accelerate structural reforms: Structural reforms, such as regulatory changes and tax policy adjustments, are necessary to complement the central bank’s interest rate cut. These reforms could include streamlining regulations, particularly those related to essential goods and services, to reduce inflationary pressures. Therefore, the economist strongly suggests introducing the hall law to prevent hoarding and ensure access to essential goods, especially in the food sector.

Behind the scene: Despite global food prices falling by 23% over the past 35 months, the economist pointed out that this trend has not been reflected in Türkiye due to the lack of a hall law and the continued high profits of intermediaries. As a result, the prices of basic food items remain high, creating significant difficulties for consumers in accessing essential goods.

- Enhance policy coordination: Effective coordination between different branches of government is crucial. For example, tax policies that align with monetary policy can help stabilize the economy and reduce inflation. Ensuring that all policies work together will create a more resilient economic environment.

- Increase government scrutiny: Intensifying tax audits on companies to address tax evasion and reduce the indirect tax burden on the public, particularly on the middle class, civil servants, and retirees.

- Eliminate inflationary brokers: Targeting and eliminating brokers and intermediaries who contribute to inflationary bubbles, particularly in the food industry. Ensure that the benefits of global food price reductions are passed on to consumers in Türkiye.