This is an opinion piece I’ve written after publishing my morning email, which includes many of the details informing it, as have the dozens I’ve written in recent weeks detailing the policies mentioned. This piece is being sent to all subscribers in full immediately and is fully open to the public immediately. Thanks to our paying subscribers for supporting us to do this work in public.

Are you ok with this being done to lift your after-tax income by about $38 per week, and to win your vote?

Just FYI, if you are ok with it…

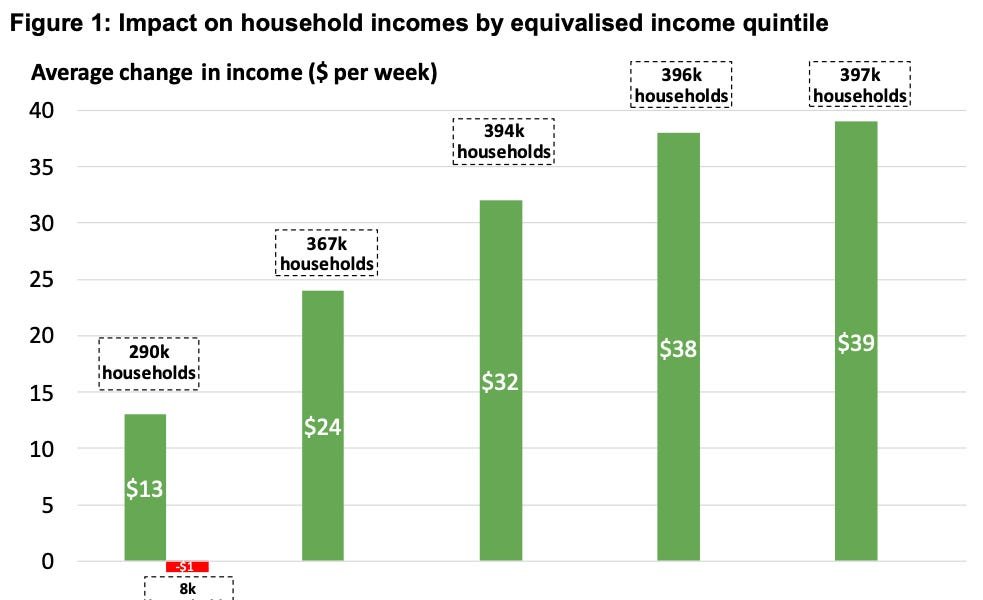

Treasury and IRD have advised the Government at least 64% of the NZ$15 billion of tax cuts being delivered to landlords and PAYE earners over the next four years will go to the top 40% of earners. That top 40% includes the two quintiles earning more than $57,400 per year after tax. These tax cuts are being paid for by some Government borrowing, some outright spending cuts and by slowing growth in spending in health, education, transport and infrastructure to rates less than inflation and population growth (ie real per-capita cuts). The Government says it’s finding fat in ‘back offices’ to remove so that ‘front line’ services aren’t and won’t be affected. It may sound and feel painless and like magic.

After all, it feels as if back offices can be easily separated from ‘front line services’ and that back offices aren’t really people who earn and spend money and have families and mortgages or rent due. These ‘back offices’ feel more like the stationary cupboard and a photocopier that never seems to work. You may think you need and/or deserve that cash more – especially these days when it’s tough to make even a decent income go far.

But here’s what’s actually happening:

-

over 60% of GPs have stopped taking new patients, while people in Northland, Gisborne and the West Coast can no longer either see a doctor and/or get into a hospital after hours or on weekends;

-

waiting lists for elective surgeries and to get into A&Es are blowing out, while staff who are burnt-out and chronically underpaid because of 30 years of real-per capita funding cuts in education & health are jumping on planes to Australia and elsewhere at a rate of two A320-loads per day;

-

now we learn those tax cuts are also being paid for by kicking 1,000 kids out of motels, with the minister not knowing where 200 went or trying to work out where they are now;

-

and by freezing funding for disabled people, including banning net new additional residential care places or spending, which means only disabled people who committed crimes, are insane or are stuck in a hospital bed can get in, and even then they’re not guaranteed a place; and,

-

despite a social housing shortage estimated in the hundreds of thousands and the most expensive rents in the world, the Government has chosen to stop building new social homes itself, and has yet to say how or when or how much it will provide Community Housing Providers (CHPs) to build only half the amount being previously built per year by the state house builder…maybe.

I could detail many, many more examples, but this email is already long enough.

Finance Minister Nicola Willis and Social Development Minister Louise Upston are quickly becoming a double-act resembling Finance Minister Ruth Richardson and Social Welfare Minister Jenny Shipley at their welfare-net-shredding-worst from 1990 to 1993, or Finance Minister Roger Douglas and Railways & SOE Minister Richard Prebble arguing the economy and society had to change radically to avoid bankruptcy.

Back then, both sets of job-shedding and cost cutting ministers could credibly argue the Government had to cut to ensure it could avoid bankruptcy on its foreign debts and New Zealanders could afford to buy what they needed from overseas. The Government’s foreign debts back then forced the Government to find foreign exchange worth up to 25% of total Government revenue to service the debt.

But that was then and this is now.

That debt servicing cost is now barely 5% of revenues and paid in NZ dollars, which, push comes to shove, which it did just four years ago, the Reserve Bank can print the money to pay the interest bill.

Back in 1984, we had to earn foreign currency to pay the interest on the Government’s massive foreign-currency denominated debts built up during the Muldoon era. We had a fixed exchange rate and the interest rates on that debt often rose fast. If interest rates rose and our currency was devalued because of some sort of slump in commodity prices or oil supply crisis, then New Zealand’s Government was immediately broke, or at least felt that way. But then we floated our currency and paid our way, albeit with immense economic and social pain.

Back in 1990, New Zealand was again in mortal danger of a double-downgrade from a ratings agency after another oil shock and because the BNZ had to be bailed out and then sold off. Richardson and Shipley slashed benefits and hacked into the core of our welfare state, but at least there was some sort of economic justification. Our Government still had a lot of foreign currency debt and had a very volatile currency. Unemployment approached 11% and interest rates were in double-digits. That is an economic crisis that requires some sort of major response. You can argue about the lethality and the response back then, but there were genuine crises in 1984 and 1990/91.

Now, the New Zealand Government has no major foreign currency debt and has not issued bonds in foreign currencies for 20 years. All the Government’s borrowing is with fixed interest rates in New Zealand dollars. All the risks from any currency slump or interest rates blowing out are borne by private lenders and funds, not the Government. Unemployment is very low. Household debt is actually lower relative to incomes than a decade ago.

In the days of ‘Ruthanasia’ and ‘Rogernomics’, politicians argued New Zealanders had to ‘take the pain’ for avoiding bankruptcy and a national economic collapse. That pain was heaped on the poorest and the sickest and on tangata whenua in particular, but at least there was some sort of national purpose.

These latest real-per-capita cuts that are making the poorest, sickest and most disabled even sicker and poorer are justified on the grounds that ‘taxpayers need tax relief’ after a ‘cost of living crisis’. The trouble is most of those tax cuts are going to people who are the wealthiest, healthiest and least in need.

Their savings and term deposits have risen by $62 billion or a third to $264 billion since the first Covid lockdowns. Household net worth, which includes homes, land, shares and deposits, rose by NZ$560 billion just over 30% to NZ$2.34 trillion in the four years since Covid.

Neither rich households nor the Government, are ‘broke’. The only people who are ‘broke’ are paying the price to ensure the top 40% of income earners get $10 billion in extra cash. Much of which will end up being invested with bank loans in existing land and homes, or put into term deposits.

If you are in that 40% and live in your own home, are you happy to get that extra cash knowing poor and disabled kids were forced to live in tents and sick tamariki and kuia have had to drive for hours (if they can pay for the petrol) to sit in an A&E waiting room for days?

Seriously. Are you personally ok with that? Was that what you voted for? Was that vote satisfying?

Kind regards

Bernard

PS: Here’s the IRD/Treasury analysis showing the 64% of income threshold tax cuts going to the top 40%. That’s actually before the effects of lower taxes on landlords.