(Bloomberg) — The yen was volatile Friday as the Bank of Japan conducted so-called rate checks with traders, reinforcing perceptions that authorities intervened in the market on Thursday to prop up the currency.

It whipsawed during morning trading in Tokyo, with several market participants saying that the central bank had called and asked for indicative exchange rates against the euro.

This followed a surge of as much as four yen to 157.44 per dollar on Thursday in the minutes after a softer-than-expected reading of US inflation. The move came with a spike in volumes reminiscent of past intervention by Japanese authorities.

Japan’s top currency official, Masato Kanda, told reporters in Tokyo on Thursday night that he wasn’t in a position to say if the move was intervention. He followed up with comments early Friday, saying that given the yield gap between the US and Japan, speculation was probably behind the moves.

“Right now we are seeing two-way activity in the market but no clear directional bias,” said Ruchir Sharma, London-based global head of FX option trading at Nomura International Plc. Sharma added that there was “palpable nervousness in the market” in recent sessions from hedge funds looking to protect carry trades for scenarios like the one that just played out.

TV Asahi, a Japanese broadcaster, reported officials had stepped into the currency market. Daily newspaper Mainichi Shimbun also reported an intervention, citing an unidentified Japan government official. US Treasury spokesperson Megan Apper declined to comment.

The yen was down 0.2% at 159.22 to the dollar in choppy trading at 10:37 a.m. in Tokyo on Friday. It was 0.2% weaker at 173.06 versus the euro.

Rate checks typically happen when volatility increases and verbal intervention appears insufficient to tame currency moves. The market participants who commented on rate checks Friday asked for anonymity because the communications are confidential.

Previous to this, the BOJ was last reported to have conducted such checks in September 2022, which were followed a few days later by intervention.

The yen has slumped over the past year, making it the worst-performing Group-of-10 currency. It touched its weakest since 1986 just last week, fueling a new wave of jawboning from Japanese authorities about their willingness to act to bolster the currency if necessary.

The spike on Thursday shared similarities with this year’s previous interventions, in which the Ministry of Finance bought ¥9.8 trillion to stem losses in apparent moves on April 29 and May 1. The yen’s Thursday rally was the biggest on a one-day basis since May 1.

Foreign-exchange brokers saw volumes in the hour after inflation data that were comparable to the year’s earlier interventions, according to traders who asked not to be identified.

“Certainly the extent of the move does suggest it could well have been intervention,” said Jane Foley, head of currency strategy at Rabobank. “It’s quite exciting and does cause ripples on our trading desk.”

Kanda, Japan’s vice finance minister for international affairs, stuck with a strategy of trying to keep market players guessing.

“Our practice is basically not to say whether we have intervened or not,” he said Thursday. “While some believe the move was a reaction to the CPI results, others say that other forces may have been at work.”

On Friday morning he said that the number of people who know about intervention is limited, adding that he won’t comment on if the action took place.

Yusuke Miyairi, a currency strategist at Nomura International Plc., said the fact that Kanda was able to speak in front of the media so late in the Tokyo evening is “quite telling.”

In the week leading up to July 10, foreign central bank usage of a key Federal Reserve facility rose to an all-time high, an indication policymakers around the world built up their cash positions.

Here’s what Bloomberg strategists say…

USD/JPY’s plunge overnight was a victory for Japanese authorities, even if they are being coy about FX intervention. But there will need to be a forceful follow up for the yen to sustain any gains. The next Bank of Japan meeting is almost three weeks away — a gap into which the MOF should ram home its advantage or risk it being seen as yet another USD/JPY buy-the-dip window for dollar bulls.

— Mark Cranfield, strategist. Read more on MLIV.

Regardless, sustained strength in the yen is unlikely without shifts in US and Japanese policy, said Leah Traub, a portfolio manager at Lord Abbett & Co. While US yields have fallen in recent weeks, the rate differential between 10-year Treasuries and Japanese government bonds remains well above its long-term average over the past decade.

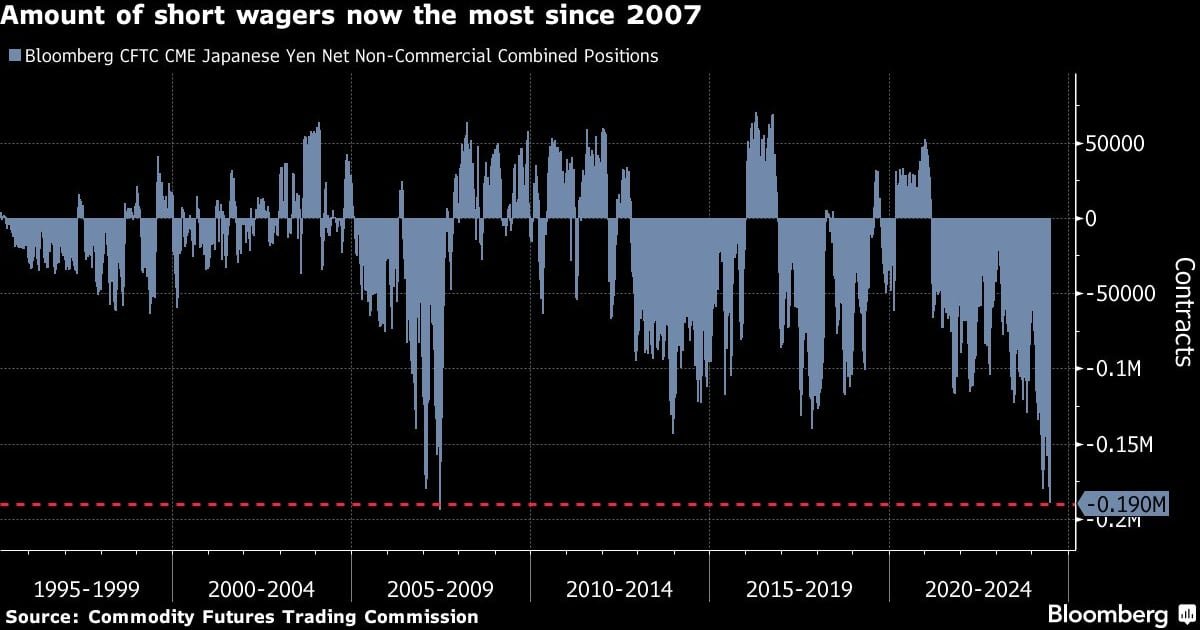

Sentiment has been so poor on the yen that bearish wagers have dominated the market, even after the Bank of Japan in March raised its short-term policy rate for the first time since 2007.

Speculative traders have accumulated a massive bearish bet against the Japanese currency. Non-commercial traders now hold some 189,560 contracts (worth about $14.7 billion) tied to wagers the yen will fall in the weeks to come, the most since 2007, according to Commodity Futures Trading Commission data for the week ended July 2.

“I would expect more movement in the yen as a result of any data surprises just based on that positioning profile alone,” said Ed Al-Hussainy, global rates strategist at Columbia Threadneedle Investment.

–With assistance from Carter Johnson, George Leiva, Alexandra Harris, Garfield Reynolds, David Finnerty, Masaki Kondo, Robert Fullem, Christopher Condon, Takashi Umekawa and Erica Yokoyama.

(Recasts information on rate check)

©2024 Bloomberg L.P.