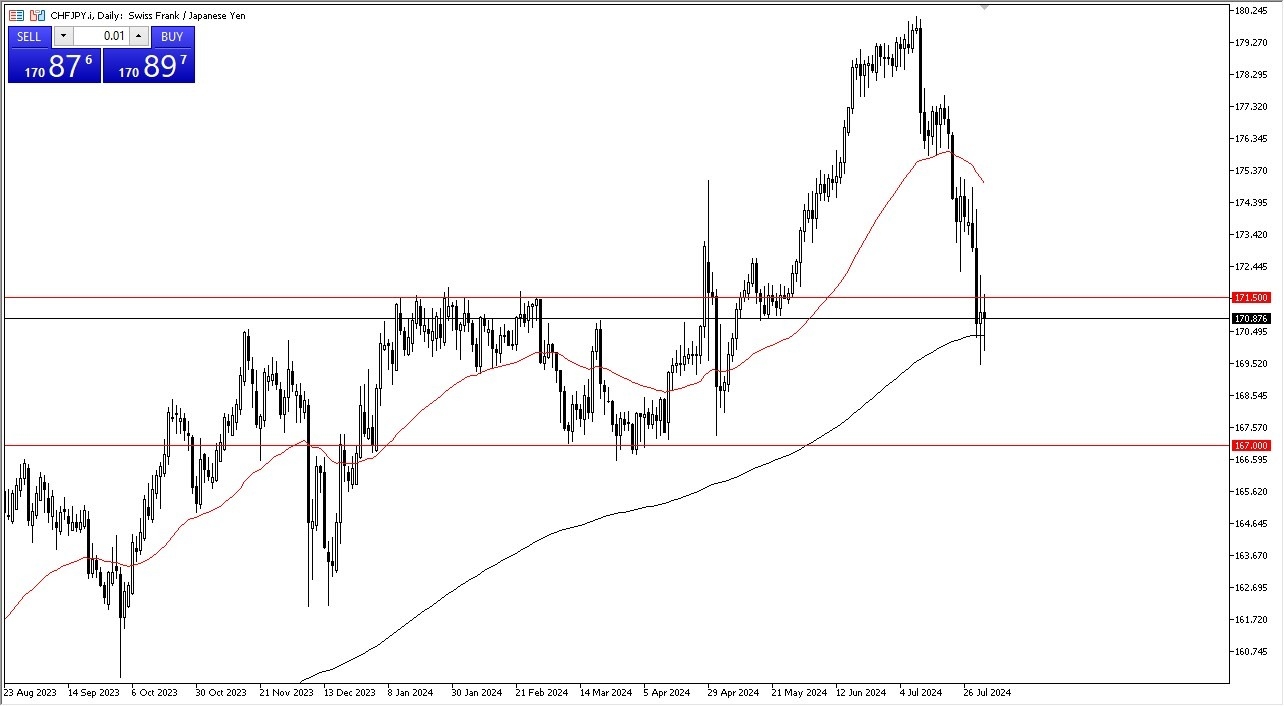

- As you can see, the Swiss franc has been all over the place against the Japanese yen, but unlike so many other currencies, it looks as if it is at least trying to show signs of strength.

- It is because of this that I will be watching this market very closely, because it gives you an idea as to which currency you actually want to own.

- Obviously, the Japanese yen has been extraordinarily strong over the last couple of weeks but now we are starting to see people run to the safety of the Swiss franc as well.

We are currently hovering around the 200 day EMA which in and of itself will attract a lot of attention. It’s also worth noting that the 171.50 yen level is offering a little bit of resistance at the moment as it has in the past.

On a Break Above…

If we can break above that level, then I think the market could start to take off to the upside. This would be a very strong sign for the Swiss franc, but it could also signify that perhaps the Japanese yen will lose some of its strength. After all we’ve recently seen the Bank of Japan raise interest rates and we’ve also seen the Bank of Japan intervene. They have done everything they can to save their own currency, but there’s only so much they can do. I would not be surprised at all to see this market turn around, especially if we end up forming a relatively neutral candlestick.

If we start to see the buyers come into this market, you may start to see other yen-related pairs recover as well. Alternatively, if we were to break down below the 169.50 yen level, then we could see this pair drop down to the 167 yen level, where we had seen a lot of support in the past. That would be a major breach of support, and therefore would probably also be felt in other Yen-denominated pairs around the world.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading platforms for beginners worth trading with.