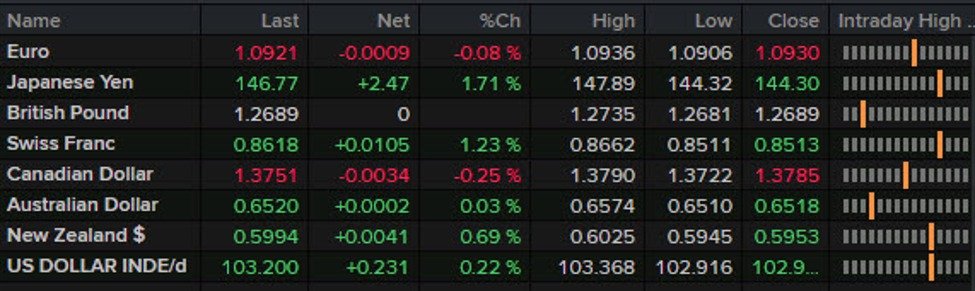

Markets:

- NZD leads, JPY lags

- US 10-year yields up 6.6 bps to 3.95%

- WTI crude oil up $2.16 to $75.36

- S&P 500 down 40 points to 5199

- Gold down $7 to $2382

The early mood was positive as the Bank of Japan signalled that it wouldn’t be making any more waves in markets, in a policy climb-down. That was enough to send USD/JPY 200 pips higher and boost stocks in Europe.

But in the back half of US trading it all came apart. The seeds for pain were planted earlier with SMCI falling sharply and hurting the AI trade. Disney also warned on theme park softness and the market took that as a poor signal for consumers.

Bitcoin fell early and it was a sign that the risk mood wasn’t great and then it slowly fell apart in equities as a +1% gain turned into a more than 1% loss along with a 8% swing lower in Nvidia shares in what’s been an incredibly volatile period for the standard-bearer of the AI rally.

The further tipping point came after a 3 basis point tail in the 10-year Treasury auction. That miss wasn’t a huge shock given the volatility in bonds and it was still below 4% but it shows that real money isn’t nearly as panicky as the 3.67% low at the start of the week. In turn, that lifted the dollar on most fronts 30-40 pips higher.

Aside from the auction, news flow was very light but the EIA data did help to boost oil.

The euro tried to climb above 19.30 but was reeled back in by the US dollar in a lackluster session.

All eyes will stay on USD/JPY in Asian trade as it consolidates in a 146.40-147.80 range following one of the wildest rides in the FX market in years.